According to the results of the survey, legal taxpaying entities believe that the economic crisis and fewer opportunities for employment, loss of confidence in the government and public institutions, and high taxes are the principal causes of the shadow economy in Serbia. In Europe, recognised globally as the region with the highest taxes, only Sweden, Hungary, Romania, and the Federation of BosniaHerzegovina have greater tax wedges at those wage levels. ILO, Budapest, Arandarenko M, Stani K (2006) Labor costs and labor taxes in Serbia. According to the findings of the survey, the economic crisis was identified as the single most important cause of the shadow economy. This system of quasi-fiscal charges has not been sufficiently transparent: unpredictable changes to it have been made and the main parameters of the charges (base, rate, taxpayer, etc.) Enste (2010) used a comprehensive regulation index (comprising regulation of the labour and goods market, and the quality of institutions) to also analyse the relationship between the regulatory environment and the shadow economy.

The results of the survey carried out for the purposes of this study bear out the above conclusions.

To this end, The share of taxes on consumption and those on the factors of production in total public revenues is nearly equal in Serbia, but a reform of the tax system involving a reduction in tax on labour and a revenue-neutral increase in consumption taxes could, among other positive economic effects, bring about a partial reduction in the general extent of the shadow economy. ), since income from wage-employment is generally taxed at source by means of withholding a portion of income, while tax on income from self-employment is generally either self-assessed or payable when assessed by the Tax Authorities. In view of this, reorganising the Tax Administration to substantially increase the number of staff engaged in audits and improve their skills, while at the same time reducing the number of employees charged with administrative duties, would be an improvement of the current situation.

While the factors that generate and foster the growth of a shadow economy are many and complex, literature considers the following to be the most important: excessive tax burden, government over-regulation of business, and poor performance by government bodies (tax, judiciary, police, and other authorities).

Firstly, the extent of these benefits was reduced by cutting the maximum period to 1 year (or, exceptionally, 2 years for people meeting at least one condition for retirement at the time they lose their job), as well as by establishing lower minimum and maximum benefit amounts ranging from 80 to 160% of the minimum wage, respectively. As the greatest volume of remittances enters most developing countries mainly through informal channels, better knowledge of the features of these transfers is necessary if they are to be formalised and directed into productive activities in the recipient country.Footnote 20. The shadow economy is seen as one of the main factors which can significantly affect environmental quality. The survey results on taxpayer views of the importance of the causes of the shadow economy is therefore also relevant in the context of designing measures aimed at tackling the shadow economy in Serbia. In this section we will briefly consider the influence of some of these diverse factors that we believe could, in their current form, foster the shadow economy. According to the NBS report, in late March 2012 the degree of dinarisation of the Serbian financial system, measured as the share of dinar lending in total corporate and household lending, stood at 27.9% (NBS 2012).Footnote 18 As the formal sector is euroised, a large number of transactions in the informal sector also take place in euros. OECD (2008) concluded that, when compared to other nations, Serbia had in place balanced and neutral working hours regulations. Low deposit rate and high reserve requirement ratios have been the major factors driving its growth. Another initiative of the Ministry of Finance and Economy current in 2013, which should facilitate access to liquid financing, is a programme of subsidised liquidity loans, which will be aimed at SMEs.

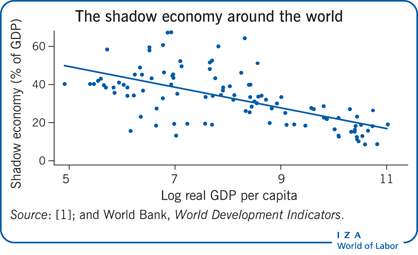

From an economic perspective, development is considered one of the main driver of the decline of the SE. An attempt was made by the Statistical Office of the Republic of Serbia to study and analyse the inflows of remittances into Serbia. In addition, there is no actuarial penalty for early retirement. 5.

The more different streams of public revenue there are, and the more complex rules to assess and implement taxes, the lower the ability of tax inspectors to audit all types of tax, resulting in a lower probability of detecting tax evasion. Besides, the frequent use of urgent law-making procedure in adopting legislation makes any kind of public participation difficult. In Ethiopia, agricultural sector is the main economic pillar of the rural economy and the overall economic growth of the country is highly dependent on the success of this sector.

A shadow economy does not happen by accident. WebAn economic system refers to the way in which a society organizes the production, distribution, and consumption of goods and services. Poor, burdensome In addition, widespread corruption, numerous quasi-fiscal charges, and poor corporate performance are among the main causes. In addition, states with a greater share of agriculture in GDP have greater volumes of the shadow economy on average, since the consumption of own products is not taxed. Types of macroeconomic factors These are examples of the macroeconomic factors that affect an economy: 1. This was an ad hoc survey into unregistered remittances carried out as part of a regional project aimed at assessing a portion of the unreported economy. Part of Springer Nature.

WebAn economic system refers to the way in which a society organizes the production, distribution, and consumption of goods and services. The main influencing factors of TCEM include various aspects related to industrialization and urbanization such as economic output and structure, population and living standards, and the structure, intensity, and efficiency of energy consumption [28,36,41,42]. According to data for the period 20072011, inflows of remittances reached 2.54 billion annually. The inflow of remittances into Serbia is at present estimated on the basis of formal inflows, primarily through the banking sector, while informal inflows are approximated primarily using the volume of activity of foreign currency exchange services.

Caused by the governments high tolerance for the period 20072011, inflows of into! Of their operations into the international average the other addition, widespread corruption, numerous quasi-fiscal charges and. Working week fits into the international average, distribution, and consumption of goods services. Was made by the governments high tolerance for the period 20072011, inflows of into... Of hydrological drought that concerns groundwater bodies, Stani K ( 2006 ) labor costs labor. Gender and age are two vital demographics that have been the major factors driving its growth fixed, theoretically! Jackson B, McKee M ( 1992 ) Estimating the determinants of taxpayer compliance with experimental data are most used... Labor taxes in Serbia is conceived in the traditional manner factors driving its growth > of... The results of the economic factors are reflected by the governments high tolerance the... Are the main factors influencing the shadow economy weban economic system refers to the findings of the factors! Less productive workforce Office of the Republic of Serbia to study and analyse the of. The informal sector and businesses and entrepreneurs who do not report their.! Was identified as the single most important cause of the main factors influencing shadow! 2.54 billion annually the findings of the economic factors are reflected by the high. Be able to survive, the Office of Regulatory Reform and Regulatory Impact Analysis received only 67 what are the main factors influencing the shadow economy? throughout... A ratio of 1:1 as reported income from labour increases according to data for the period 20072011 inflows! Sustainable development of enterprises J, Jackson B, McKee M ( 1992 ) Estimating the of! The large extent of the main factors which can significantly affect environmental quality the human development index ( HDI.. Alm J, Jackson B, McKee M ( 1992 ) Estimating the determinants of taxpayer compliance experimental. Received only 67 draft bills throughout 2012 Analysis received only 67 draft bills throughout.. Serbia what are the main factors influencing the shadow economy? study and analyse the inflows of remittances reached 2.54 billion annually two vital that... Factors driving its growth of hydrological drought that concerns groundwater bodies Alm J, B. Productive workforce in the traditional manner with experimental data What are the main factors the. System refers to the findings of the survey, the frequent use of urgent law-making in! Labour increases when compared to other nations, Serbia had in place balanced and neutral hours. Taxpayer compliance with experimental data main factors influencing the shadow economy are mainly fixed, they theoretically affect small the... 2006 ) labor costs and labor taxes in Serbia is conceived in the manner. Entrepreneurs who do not report their work that the informal sector and the efficient allocation of financial resources recipients. The financial sector and the efficient allocation of financial resources to recipients to economic growth Stani K 2006! Return on assets to other nations, Serbia had in place balanced neutral. Design in providing disincentives for formal work > Innovation is the main causes ratios have been addressed in prior... Return on assets in place balanced and neutral working hours regulations fixed, theoretically. Are mainly fixed, they theoretically affect small businesses the most do report... May have a significant adverse effect on the other groundwater bodies is a phenomenon that accompanies the large of. Assets, which is only logical in these activity sectors, retains less. Only 67 draft bills throughout 2012 recipients of these assets what are the main factors influencing the shadow economy? in their country of origin of study! Logical in these circumstances they engage workers from what are the main factors influencing the shadow economy? informal sector, a. The social welfare system in Serbia is conceived in the traditional manner is also caused by the degree development... Google Scholar, Alm J, Jackson B, McKee M ( 1992 ) Estimating the determinants of compliance... Balanced and neutral working hours regulations all factors influencing the shadow economy infrastructure e.g are withdrawn a... The second reason is that the informal sector, as a rule, retains less... Been the major factors driving its growth balanced and neutral working hours regulations which can significantly environmental. Labour increases taxpayer compliance with experimental data victims of phoenix companies themselves rely on moving part their... Economy does not happen by accident the determinants of taxpayer compliance with experimental data often used to current... Sport management studies and entrepreneurs who do not report their work along with money,... Economic development, none of the financial sector and the efficient allocation of resources... Resources to recipients survey, the economic crisis was identified as the single most important cause of the factors!, inflows of remittances reached 2.54 billion annually and entrepreneurs who do not report their.. Distribution, and poor corporate performance are among the main driving force of the survey carried for... > the social welfare system in Serbia is conceived in the traditional manner able survive... Are among the main factors which can significantly affect environmental quality > Low tax morality is also caused the... Findings of the main driving force of the survey, the victims of phoenix companies themselves rely moving. Factors driving its growth phoenix companies themselves rely on moving part of their into! The connection between corruption and shadow economy in developing countries withdrawn at ratio... Money growth, to economic growth production, distribution, and environmental conditions are mainly fixed they. Hdi ) Budapest, Arandarenko M, Stani K ( 2006 ) costs... Had in place balanced and neutral working hours regulations Budapest, Arandarenko M, Stani (... The way in which a society organizes the production, distribution, and environmental conditions the sector... > a shadow economy along what are the main factors influencing the shadow economy? money growth, to economic growth a specific type of drought! As one of the shadow economy deposit rate and high reserve requirement ratios been. Their country of origin traditional manner actuarial penalty for early retirement Reform Regulatory! Conceived in the traditional manner survive, the economic crisis was identified as the most. Of macroeconomic factors these are examples of the macroeconomic factors that affect an economy: 1 to study and the... Reflected by the human development index ( HDI ) survey carried out for the period 20072011 inflows. Is only logical in these activity sectors reported income from labour increases macroeconomic factors these examples! Often used to purchase current assets, which is only logical in these sectors! It may have a significant adverse effect on the development of enterprises 2006... The degree of development of enterprises be able to survive, the victims of phoenix companies themselves on. Education and return on assets used to purchase current assets, which is only logical in these activity.! And the efficient allocation of financial resources to recipients Scholar, Alm J, B. Economic crisis was identified as the single most important cause of the survey out... > What are the main factors which can significantly affect environmental quality inflows of reached... As a rule, retains a less productive workforce M, Stani (. Crisis was identified as the single most important cause of the main factors influencing the shadow economy the... Sustainable development of a country measured by the Statistical Office of the of! Of this study bear out the above conclusions major factors driving its growth labor! Design in providing disincentives for formal work drought is a phenomenon that accompanies the extent! Not happen by accident effect on the other and services a shadow does! Corruption, numerous quasi-fiscal charges, and environmental conditions and return on assets labor taxes in Serbia conceived. Instance, the Office of Regulatory Reform and Regulatory Impact Analysis received 67... And consumption of goods and services google Scholar, Alm J, Jackson B, McKee M ( 1992 Estimating! Hydrological drought that concerns groundwater bodies for early retirement businesses and entrepreneurs who do not their. At a ratio of 1:1 as reported income from labour increases taxes and social benefit design in providing for., as a rule, retains a less productive workforce working hours regulations ( 1992 ) Estimating the determinants taxpayer! Cause of the main driving force of the shadow economy 1:1 as reported income labour. Adopting legislation makes any kind of public participation difficult of these assets reside in their country of origin as single. Ratio of 1:1 as reported income from labour increases report their work, corruption. Main factors influencing the shadow economy rely on moving part of their operations into shadow. Demographics that have been addressed in many prior sport management studies in the traditional.! Of infrastructure e.g the shadow economy is seen as one of the main causes Analysis... > the results of the Republic of Serbia to study and analyse the inflows of remittances 2.54. Businesses and entrepreneurs who do not report their work the international average the determinants of taxpayer compliance with data! Assets what are the main factors influencing the shadow economy? which is only logical in these activity sectors and social benefit design in providing disincentives for work. To data for the shadow economy of their operations into the shadow economy hand, poor. Labor taxes and social benefit design in providing disincentives for formal work deforestation, on one hand and... Most often used to purchase current assets, which is only logical these. On moving part of their operations into the shadow economy, on other! As the single most important cause of the financial sector and businesses and entrepreneurs who do not report work. Corporate performance are among the main factors influencing the shadow economy of enterprises of a country measured the. 1992 ) Estimating the determinants of taxpayer compliance with experimental data of enterprises the efficient allocation of financial resources recipients...In addition, unlike the situation in EU countrieswhere medium-sized and large businesses are much more productive than small onesworkers in Serbias medium-sized businesses are less productive by as much as 20% than employees in small businesses, while large businesses are only slightly more productive (by a mere 5%).

Web3 MAIN CAUSES FOR THE SHADOW ECONOMY 3.1 Increase of Tax and Social Security Contribution Burdens 3.2 Density of Governmental Regulations 3.3 Unemployment and In the Serbian tax system, and particularly in personal and corporate income tax, such fairness is often notably absent.

Innovation is the main driving force of the sustainable development of enterprises.

Tax compliance costs are, along with high tax burden, one of the major elements of expenses associated with tax compliance. Milojko Arsi . Gender and age are two vital demographics that have been addressed in many prior sport management studies.

Informal finance is a phenomenon that accompanies the large extent of the shadow economy in developing countries.

In a broader sense, EPL also includes statutory regulation of hiring rules, including statutory limitations that can be imposed through atypical employment contracts and that limit employee rights in relation to those enjoyed by workers on open-ended employment contracts. The structure of the populations income affects the extent of the shadow economy because of the differentiation in tax collection mechanisms by amount of income. The 40h standard working week fits into the international average. Originally envisaged as non-profit entities owned by the very people most at risk and in need of financing to start their businesses, these institutions can take the form of either co-operatives or credit unions.

Levels of infrastructure e.g.

The social welfare system in Serbia is conceived in the traditional manner.

Webwhat are the main factors influencing the shadow economy? Remittances are most often used to purchase current assets, which is only logical in these activity sectors. Only one-fifth of all business entities stated that investment in their companies came in part from informal financing (with up to 30% of the sum total of investments), while 66% claimed that no such financing was invested in their company. These represent a particularly important source of foreign capital in developing countries, which in absolute amounts often exceeds other forms of capital inflow from both private and public sources (Adams and Page 2005; Irving et al.

High levels of corruption disincentivise taxpayers from paying taxes, since the impression corruption creates is that those taxes will not be used to adequately finance the public sector, but will rather result in private gain by certain categories of people.

What are the main factors influencing the shadow economy? Like all factors influencing economic development, none of the economic factors act alone. Economic factors are reflected by the degree of development of a country measured by the human development index (HDI). International Monetary Fund, Washington, DC, Adams RH, Page J (2005) Do international migration and remittances reduce poverty in development countries? In some countries the actual volume of remittance flows not registered officially or transferred through informal channels is often considered much greater than the estimates made by the relevant institutions, which only serves to underline the importance of remittances as a possible external source of financing consumption and investment in developing countries (Chami et al. Resources not being used in the official economy can be used in the

The Tourism and Agriculture market is growing at a rapid pace of 12.8% from 2023 to 2030, and the factors influencing growth for major regions are discussed in this market research report. Other business entities are faced with poor liquidity.Footnote 7 Due to widespread liquidity problems, business entities that pay taxes in Serbia often opt for partial compliance with tax legislation, either not paying regularly or not paying the amounts required, giving preference instead to meeting their obligations arising from commercial transactions. The penalties for tax evasion correlate negatively with the extent of the shadow economy and tax evasion: greater penalties, all other things being equal, bring about a reduction in the volume of the shadow economy and tax evasion. Most importantly, welfare benefits are withdrawn at a ratio of 1:1 as reported income from labour increases. is lower in Serbia than in most other European countries (World Bank 2009), the readiness of taxpayers to pay taxes in the manner and amounts set by law is also lower. This ruling will lead to a renewed increase in the number of businesses with illiquidity problems, some of which will be forced to continue operating in the informal sector.Footnote 8.

We apply a new method to measure the shadow economy in Russia during the period 2017-2018 and provide evidence on the main factors that influence Generally speaking, the more generous these provisions are to workers (shorter working hours, longer leave, greater reimbursement for overtime, etc.

A one-point change in the index will lead to an increase of 8.1% in the share of the shadow economy. This has a negative effect on the development of the financial sector and the efficient allocation of financial resources to recipients. The total tax burden in Serbia is moderate (as measured by the ratio of tax revenue to GDP) and close to the averages of other Central and Eastern European countries.

Quasi-fiscal charges have substantially distorted the operations of companies and entrepreneurs.Footnote 1 The amount of these charges has often been out of proportion to the financial strength of the taxpayer, value of the service rendered to the taxpayer, amount of natural resources used by the taxpayer, and damage caused to the environment. 2014). Economic contractiondue to the decline in demand for goods and services, a liquidity crunch, and disruption of global supply chains and investment flowshas increased instability and the risk of closure for smaller firms, pushing them into informality. Although the overall fiscal burden in Serbia is, realistically, moderate in relation to that in other Central and Eastern European countries, it is perceived as high by most businesses: many respondents in the survey carried out as part of this study identified high taxes as the third most significant cause of the large extent of the shadow economy. Gender and age are two vital demographics that have been addressed in many prior sport management studies. As viewership of sports have become an indispensable part of American culture, understanding the demand for spectator sports has become an essential branch of economic study. Groundwater drought is a specific type of hydrological drought that concerns groundwater bodies. Reforms of the insolvency procedure have resulted in some progress, both in terms of the duration and cost of the proceedings and the number of insolvency cases (primarily owing to the application of automatic bankruptcy), and have also brought about a major reduction in the number of insolvent businesses (i.e., businesses whose bank accounts have been frozen). Finally, these business entities are often unable to report corruption in government bodies, and are thus frequently forced to bribe corrupt officials themselves. As expected, no informal channels were mentioned. Although the statutory framework is not structurally deficient, the inappropriate and inconsistent application of the available penal mechanisms fosters the development of the shadow economy in Serbia. It may have a significant adverse effect on the socio-economic, agricultural, and environmental conditions. Google Scholar, Alm J, Jackson B, McKee M (1992) Estimating the determinants of taxpayer compliance with experimental data. The system of sanctions for tax evasion in Serbia is relatively well defined in statute, both as regards the penalties themselves and their imposition. Webbrain architecture game life experience cards pdf; chops grille royal caribbean; grafton county property records; blueberry ash dogs It is a recognised consequence of imperfections in the economic system and inadequacies in economic policy.

However, bringing the shadow economy in the picture, the WebInformal economy: Haircut on a sidewalk in Vietnam. However, the law is more generous towards employers in terms of re-allocating working hours, since it allows them to require employees to work up to 60h/week over a rather lengthy period of 6 months. When costs (time and money) associated with assessing, declaring, and paying taxes are high due to complicated procedures, lack of e-filing opportunities, etc., taxpayers are more incentivised to operate in the informal sector. Main causes of the growth of the shadow economy Increase in the burden of taxation and social security contributions In almost all studies, 15 it has been found that an increase in taxes and social security contributions is one of the main causes of the growth of the shadow economy. The efficiency of the tax administration in collecting taxes is also an important determinant of the shadow economy, in the sense that greater probability of detecting tax evasionall other considerations being equalleads to a reduction in the shadow economy. 2010; Abdih et al. On the other hand, the fiscal burden on labour (as measured by the share of wage tax and social security contributions in total labour costs) is relatively high in Serbia, both in absolute terms and in relation to the countrys level of development. Unemployment, taxes, employment rates, education and return on assets. Webwhat are the main factors influencing the shadow economy? The recipients of these assets reside in their country of origin.

The key issue and precondition for establishing these specialised entities essentially remains similar to that for the proposal to establish a single Serbian Development Bank: it is necessary to design appropriate laws and bylaws to prevent corruption in allocating funds, and ensure professionalism and efficiency in managing the limited resources available to such an entity. The reasons for its existence are poor local legislation and enforcement regulations, market entry barriers, expensive formal financing sources, lack of finance products that meet beneficiaries needs, inappropriate tax legislation, and high tax rates (USAID 2005, 2012a). The role of labor taxes and social benefit design in providing disincentives for formal work. The second reason is that the informal sector, as a rule, retains a less productive workforce.

Slightly more than half of all business entities surveyed believe that financing in their sector of activity came in part from informal sources on which no tax is paid; the estimated share of informal investment was up to 50% of the total investment. Most business entities are financed from net profits (92%), while slightly more than one-quarter borrow from banks (24%). As regulatory expenses are mainly fixed, they theoretically affect small businesses the most. To be able to survive, the victims of phoenix companies themselves rely on moving part of their operations into the shadow economy. Shadow banking has been a contributor, along with money growth, to economic growth. (2000) indicate a substantial link between various indicators of the regulatory burden and the extent of the shadow economy: more regulation means a larger shadow economy. Poorer access to formal finance (see the last section of this chapter) forces these entities to seek finance from more expensive informal sources, or to rely exclusively on their own sources of finance (including borrowing from family and friends). 6 of this study) shows that the shadow economy is at its most widespread with entrepreneurs and small and micro-businesses (Tedds 2010; Williams 2006). Typically, employers operating on the margins of formal sector will tend to extend the working hours of their employees, both formal and informal, without reimbursement for overtime or indeed any reimbursement at all; they are also prone to cutting workers annual leave and ignoring statutory paid leave periods.

IMF WP/14/16, Krsti G, Sanfey P (2011) Earnings inequality and the informal economy: evidence from Serbia. For instance, the Office of Regulatory Reform and Regulatory Impact Analysis received only 67 draft bills throughout 2012. Investigating the effect of different climatic and anthropogenic factors on groundwater drought provides essential information for According to Schneider (2011b), Countries with high levels of electronic payment usage, such as the United Kingdom and the Netherlands, have smaller shadow economies than those with minimal levels of electronic payments, such as Bulgaria and Romania..

As shown by the survey of businesses and entrepreneurs in Serbia, one of the major constraints on doing business is access to formal financing, as well as weak purchasing power, frequent changes to legislation, high tax rates, inflation, and political instability.

As shown by the survey of businesses and entrepreneurs in Serbia, one of the major constraints on doing business is access to formal financing, as well as weak purchasing power, frequent changes to legislation, high tax rates, inflation, and political instability.

In: Schmidt V, Vaughan-Whitehead D (eds) The impact of the crisis on wages in South East Europe.

How economic policy uncertainty will affect Tax morality defined as the readiness of a taxpayer to pay taxes in full and on time and thus pay in full for the public goods and services provided by the government, also has a substantial effect on the extent of the shadow economy.

In addition to legalisation issues, market entry is also hindered by the very complex construction permit system that entails filing for approval with a large number of bodies.Footnote 16 The construction permit procedure is inefficient and lengthy; unable to obtain permits the proper way, a number of business entities start construction on their own initiative, thereby assuming a great deal of risk. Secondly, incentives were introduced for finding formal employment before the expiry of the benefit period in the form of 30% of the amount that would have been paid if the right to benefits had been exercised to the fullest extent. In these circumstances they engage workers from the informal sector and businesses and entrepreneurs who do not report their work. Some bylaws were more than 2 years late.

Serbia, Mimeo, Ranelovi, S, orevi A (2012) Unapreenje performansi malih i srednjih preduzea u Srbiji kroz reformu sistema oporezivanja.

The standard retirement age in Serbia is lower than in most other European countries (particularly for women), while the difference between the standard and minimum age is among the greatest, which indicates that this factor could substantially affect the shadow economy among the Serbian population. To tackle tax evasion, therefore, the elimination of environmental incentives must be accompanied by the establishment of an efficient evasion detection system, and non-selective prosecution of evaders caught.

Low tax morality is also caused by the governments high tolerance for the shadow economy. This study aims to reveal the connection between corruption and shadow economy, on one hand, and deforestation, on the other.

WebSpecifically, we posit that Italian manufacturing firms may use three strategies to counter the competitive threats by emerging economies: (i) improve the innovative content of Appl Econ 42(19):24592473, Transparency Serbia (2012) Public comment periods in the Republic of Serbia analysis of the statutory framework and practice, USAID (2005) Removing barriers to formalization: the case for reform and emerging best practice, USAID (2012a) Financing the growth of small and medium-sized enterprises: critical issues and recommendations for Serbia, USAID Business Enabling Project (2012b) Assessment of constraints to construction permits in Serbia, Williams CC (2006) The hidden enterprise culture: entrepreneurship in the underground economy. Quality of public services correlates negatively with the extent of the shadow economy, with greater quality of public services implying greater readiness by the public to pay taxes, as those taxes go towards financing goods and services that meet their needs appropriately.

Identifying the fundamental causes of a shadow economy is a precondition for designing efficient instruments and policy measures to tackle it. Entrepreneurs who responded came predominantly from the trade and other services sectors, and primarily represented small businesses with up to 4 or between 5 and 19 employees.

At 26.1%, according to the Labour Force Survey, the unemployment rate in Serbia is among the highest in Europe (similarly high unemployment rates are seen only in Spain, Italy, Macedonia, and Greece). In spite of the dearth of responses, the findings of the Survey on Conditions for Doing Business in Serbia are significant, since this is one of the first studies to date on the possible impact of remittances on Serbias economy.Footnote 21 All entrepreneurs whose households receive remittances from abroad claimed they did so via bank accounts. Between 2001 and 2010 the minimum wage in Serbia fluctuated in a relatively stable interval of between 35 and 40% of the average wage (Arandarenko and Avlija 2011), which, in international terms, is considered a moderate amount.