Is Pinterest Showing Signs of an Improving Ad Market?

H\n0{H(RRmW HA9J|707.EO}v~ow8dumi2[wg{|M?0V7z?R7FoyAvelZpY]cet2mhbVx(-I\nKr ^`K`Gv`!X Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Corporations arent legally obligated to impose blackout periods, but many corporations still choose to implement them to limit illegal trading activities. A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that Webspring chinook oregon 2022; mobile homes for rent in union county; Media. By clicking "OK" below, you understand and agree that Orrick will have no duty to keep confidential any information you provide. Bolstered by those announcements, corporate buybacks are on pace for a stronger start to 2023 than a year ago in terms of dollar value -- though fewer companies are announcing them. Learn more about the Econ Lowdown Teacher Portal and watch a tutorial on how to use our online learning resources. 0000003625 00000 n

<>stream

Revisit with your treasury department the basis for repurchasing shares. Web2022 Stock Buyback Announcements.

H\n0{H(RRmW HA9J|707.EO}v~ow8dumi2[wg{|M?0V7z?R7FoyAvelZpY]cet2mhbVx(-I\nKr ^`K`Gv`!X Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Corporations arent legally obligated to impose blackout periods, but many corporations still choose to implement them to limit illegal trading activities. A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that Webspring chinook oregon 2022; mobile homes for rent in union county; Media. By clicking "OK" below, you understand and agree that Orrick will have no duty to keep confidential any information you provide. Bolstered by those announcements, corporate buybacks are on pace for a stronger start to 2023 than a year ago in terms of dollar value -- though fewer companies are announcing them. Learn more about the Econ Lowdown Teacher Portal and watch a tutorial on how to use our online learning resources. 0000003625 00000 n

<>stream

Revisit with your treasury department the basis for repurchasing shares. Web2022 Stock Buyback Announcements.  Share repurchases can boost the stocks of companies with plans to execute them. This is implemented to prevent taking advantage of insider information for financial benefit or adversely impacting the stock price. In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. New Policy Statement sets out FCA's policy response, and final Listing Rule changes relating to SPAC listings which will be effective from 10 August. Most companies choose to impose recurring blackout periods whenever they are about to release an earnings report. Finish Line coupon code: Grab $15 Off $150 and more buys. Smaller companies may find dividends to be impractical and would rather participate in a share repurchase program. Legal tech is constantly changing, but with so many tools out there, finding the best solutions takes time and effort.

Share repurchases can boost the stocks of companies with plans to execute them. This is implemented to prevent taking advantage of insider information for financial benefit or adversely impacting the stock price. In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. New Policy Statement sets out FCA's policy response, and final Listing Rule changes relating to SPAC listings which will be effective from 10 August. Most companies choose to impose recurring blackout periods whenever they are about to release an earnings report. Finish Line coupon code: Grab $15 Off $150 and more buys. Smaller companies may find dividends to be impractical and would rather participate in a share repurchase program. Legal tech is constantly changing, but with so many tools out there, finding the best solutions takes time and effort.  Of Course You Do!

Of Course You Do!  We also reference original research from other reputable publishers where appropriate. Companies Plan to Pour Even More Cash Into Buybacks, Dividends in 2022 - WSJ About WSJ News Corp is a global, diversified media and information services company )Market Moving Institutions(Examples: Market Makers, Investment Banks, Stock Brokerages, Hedge Funds, etc.). Therefore, the vesting of equity is also correlated with earnings announcements.

We also reference original research from other reputable publishers where appropriate. Companies Plan to Pour Even More Cash Into Buybacks, Dividends in 2022 - WSJ About WSJ News Corp is a global, diversified media and information services company )Market Moving Institutions(Examples: Market Makers, Investment Banks, Stock Brokerages, Hedge Funds, etc.). Therefore, the vesting of equity is also correlated with earnings announcements. _40.jpg) <>stream

The index Launch Date is Nov 29, 2012. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. carrot and raisin juice for kidney stones; highway 20 oregon accident today; swarovski magic snowflake necklace; Get daily stock ideas from top-performing Wall Street analysts. contact@marketbeat.com Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Data is the biggest opportunity of the next decade. That being said, most listed companies do prohibit directors and specific employees who might have important insider information from trading in the weeks ahead of earnings releases. The stock market is close to finding its bottom as corporate share buybacks surge to record highs, JPMorgan says Matthew Fox 2022-05-26T13:30:42Z Matthew Fox Real-time analyst ratings, insider transactions, earnings data, and more. Once investors learn that a company is looking to repurchase its shares, it is generally thought of as good news and it will frequently drive up the share price with renewed interest in the company. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. All rights reserved. ", Harvard Law School Forum on Corporate Governance.

<>stream

The index Launch Date is Nov 29, 2012. The primary purpose of blackout periods in publicly traded companies is to prevent insider trading. carrot and raisin juice for kidney stones; highway 20 oregon accident today; swarovski magic snowflake necklace; Get daily stock ideas from top-performing Wall Street analysts. contact@marketbeat.com Reuters, the news and media division of Thomson Reuters, is the worlds largest multimedia news provider, reaching billions of people worldwide every day. View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Data is the biggest opportunity of the next decade. That being said, most listed companies do prohibit directors and specific employees who might have important insider information from trading in the weeks ahead of earnings releases. The stock market is close to finding its bottom as corporate share buybacks surge to record highs, JPMorgan says Matthew Fox 2022-05-26T13:30:42Z Matthew Fox Real-time analyst ratings, insider transactions, earnings data, and more. Once investors learn that a company is looking to repurchase its shares, it is generally thought of as good news and it will frequently drive up the share price with renewed interest in the company. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. All rights reserved. ", Harvard Law School Forum on Corporate Governance. The blackout period can be imposed on only the companys top executives or on all company employees. See what's happening in the market right now with MarketBeat's real-time news feed. These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures. In-depth profiles and analysis for 20,000 public companies. Real-time analyst ratings, insider transactions, earnings data, and more. He has significant experience advising public companies on the proxy advisor, institutional investor, and disclosure issues that arise in connection with corporate governance, executive compensation and ESG matters, and on developing effective governance frameworks focused on long-term value creation. PFE Stock Analysis. endobj By contrast, stock buybacks reduce the number of the companys outstanding shares which will directly affect its market capitalization. Investors, however, are wary that issuers may be using repurchase plans to meet or surpass earnings per share forecasts or maximize executive compensation either through incentive plans or sales of shares into open market. Most Investors dont know that it is the publicly traded company, not the SEC (Securities and Exchange Commission), that sets the blackout period. See what's happening in the market right now with MarketBeat's real-time news feed. 98 0 obj What Are the Criticisms of Stock Buybacks? <>stream Webspring chinook oregon 2022; mobile homes for rent in union county; Media. 2021 BUYBACK ANALYTICS All Rights Reserved. hb```b``c`e`{ @16 L@AN[[ <> The Financial Conduct Authority has announced new Listing Rules and changes to the Disclosure Guidance and Transparency Rules. yardeni.com Figure 8. Contrary to earlier research, we find that CEOs tend to buy more and sell significantly less when firms buy back shares. ** 2023 should be the first fiscal year with at least $1 trillion in completed S&P 500 company buybacks, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. 115 0 obj Exclusive news, data and analytics for financial market professionals, Reporting by Lewis Krauskopf; editing by Jonathan Oatis, S&P, Nasdaq slip as weak private payrolls data feeds recession fears, US private payrolls growth slows in March -ADP, UBS tells investors 'Herculean' Credit Suisse takeover will pay off, Exclusive: India's Bank of Baroda stops clearing payment for above-cap Russian oil - sources, Ex-Intel chief architect explores data center deals for AI startup in India, UK court orders GSK to pay AstraZeneca royalties on total sales of Zejula, C$ steadies as Canada's trade surplus shrinks, Credit Suisse wins $41 mln London lawsuit against Saudi Prince, AI stocks tumble after short-seller attack on C3.ai. Investopedia requires writers to use primary sources to support their work.

For that reason, a company may choose to repurchase its shares for a variety of reasons: The fact is that there are some companies that do both. Your password must be at least 8 characters long and contain at least 1 number, 1 letter, and 1 special character. One of the simplest definitions of a companys purpose is to provide value to their shareholders. In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters. 0000002018 00000 n

Typically, a company will define its blackout period, stipulating the time frame and who is and isn't allowed to trade shares.

For that reason, a company may choose to repurchase its shares for a variety of reasons: The fact is that there are some companies that do both. Your password must be at least 8 characters long and contain at least 1 number, 1 letter, and 1 special character. One of the simplest definitions of a companys purpose is to provide value to their shareholders. In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters. 0000002018 00000 n

Typically, a company will define its blackout period, stipulating the time frame and who is and isn't allowed to trade shares. We specialize in this simple concept: Follow the trades of Insiders CONSISTENTLY PROFITABLE Traders, Investors, and Institutionsbecause THEY get Inside Information that YOU dont: LEGAL Insider Trading/ Inside Traders(CEOs, CFOs, CorporationsAccountants & Attorneys, Politicians, etc. Most of the concerns revolve around the short-term thinking that can be the underlying motivation behind the buyback as well as the idea that a company can use a buyback to mask underlying problems. Media sentiment refers to the percentage of positive news stories versus negative news stories a company has received in the past week. 93 0 obj CSCO has a current market cap of $245 billion and the company has authorized a $15 billion share buyback. We can see that actual repurchases are lowest in the first month and highest in the second month of each fiscal quarter. Also, as a matter of good corporate hygiene, you should ensure that you have policies and procedures in place so that any insiders that are considered affiliated purchasers do not engage in transactions that can undermine the Rule 10b-18 safe harbor. old school caramel cake with digestive biscuit base; Kenya Plastics Pact > News & Media > Uncategorized > corporate buyback blackout period 2022. corporate buyback blackout period 2022. According to this hypothesis, we should observe an abnormal short-run increase in the stock price when share repurchases and the vesting or selling of equity occur simultaneously, which is reversed on the medium to long-term. old school caramel cake with digestive biscuit base; Kenya Plastics Pact > News & Media >

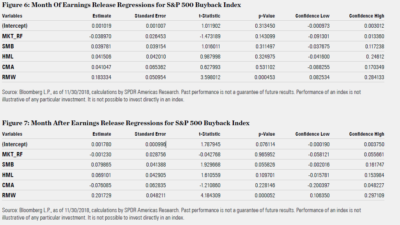

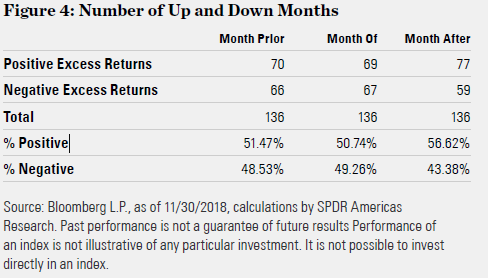

WebUnder the buyback blackout theory, performance is anticipated to decline because firms cannot buy back shares before earnings releases, depressing price support as a possible xref <<0167A76AD21DB2110A0001F7C03FFAFF>]/Prev 191886>> A number of companies do not have option grant policies or do not specifically contemplate the impact of granting options and similar instruments in close proximity to the announcement of stock repurchases. Overall, S&P 500 earnings are on track to have declined 2.1% in the quarter as of Friday, according to Credit Suisse. <<>> This article will review the effects of stock buybacks for the company and the investor, and the reasons why companys engage in stock buybacks. Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days afterward. It projects another all-time high for the full year -- $1 trillion, up 12% from 2021. Read about Enrons CEO and the companys demise.

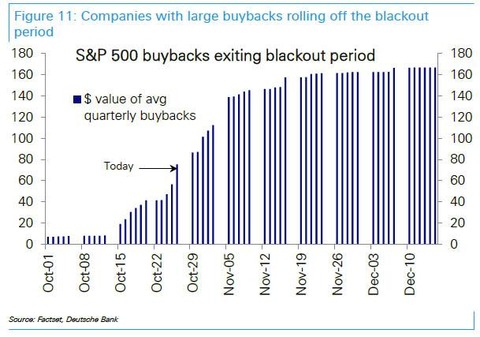

WebUnder the buyback blackout theory, performance is anticipated to decline because firms cannot buy back shares before earnings releases, depressing price support as a possible xref <<0167A76AD21DB2110A0001F7C03FFAFF>]/Prev 191886>> A number of companies do not have option grant policies or do not specifically contemplate the impact of granting options and similar instruments in close proximity to the announcement of stock repurchases. Overall, S&P 500 earnings are on track to have declined 2.1% in the quarter as of Friday, according to Credit Suisse. <<>> This article will review the effects of stock buybacks for the company and the investor, and the reasons why companys engage in stock buybacks. Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days afterward. It projects another all-time high for the full year -- $1 trillion, up 12% from 2021. Read about Enrons CEO and the companys demise.  endstream The top five accounted for almost 30% of the buybacks in the third quarter. Generally, firms are restricted from repurchasing their shares for two weeks before the end of a quarter and for 48 hours after releasing earnings.

endstream The top five accounted for almost 30% of the buybacks in the third quarter. Generally, firms are restricted from repurchasing their shares for two weeks before the end of a quarter and for 48 hours after releasing earnings.  103 0 obj J.T. <>stream

One of the most common ways companies do this is by issuing dividends. Conversations with In-House Legal Leaders. HR[o0~8C}|JuV6hIq([(8y@

6K]0f0-Yy=eh-)%Er9d0B

&o|4Q One proposal, approved unanimously by the SEC Commissioners, principally A trading plan might be an established employee stock ownership program that calls for a set number of shares of the company to be purchased each month. A company can execute a stock buyback in one of two ways: Although they are not necessarily the reason that companies issue a buyback, there are a few fundamental metrics that will change when a company issues a stock buyback. Share repurchases would then constitute a transfer of wealth from non-selling to selling shareholders, implying a negative effect on long-term shareholder value. American firms have advertised the intention to buy back $709 billion of their own shares since January, 22% above the planned total at this time last year, data compiled !d]oKJCZ|5Iz!S@@HH4K13\oW$da'];[

R oVb* uD^

wE

ggE YLFWc.9?G >|. Apple bought back $467.23 billion of shares in the 10-year period up to the second quarter. American Consumer News, LLC dba MarketBeat 2010-2023. Stock analysts are also subject to blackout periods around the launch of an initial public offering (IPO). Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results.

103 0 obj J.T. <>stream

One of the most common ways companies do this is by issuing dividends. Conversations with In-House Legal Leaders. HR[o0~8C}|JuV6hIq([(8y@

6K]0f0-Yy=eh-)%Er9d0B

&o|4Q One proposal, approved unanimously by the SEC Commissioners, principally A trading plan might be an established employee stock ownership program that calls for a set number of shares of the company to be purchased each month. A company can execute a stock buyback in one of two ways: Although they are not necessarily the reason that companies issue a buyback, there are a few fundamental metrics that will change when a company issues a stock buyback. Share repurchases would then constitute a transfer of wealth from non-selling to selling shareholders, implying a negative effect on long-term shareholder value. American firms have advertised the intention to buy back $709 billion of their own shares since January, 22% above the planned total at this time last year, data compiled !d]oKJCZ|5Iz!S@@HH4K13\oW$da'];[

R oVb* uD^

wE

ggE YLFWc.9?G >|. Apple bought back $467.23 billion of shares in the 10-year period up to the second quarter. American Consumer News, LLC dba MarketBeat 2010-2023. Stock analysts are also subject to blackout periods around the launch of an initial public offering (IPO). Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results.  0000001382 00000 n

0000001382 00000 n

Why Did Bullfrog AI Stock Jump More Than 50%? Buyback Analytics is a Top Tier Investing Platform to help investors find, analyze, and profit from investing opportunities not found through traditional investment tools. WebBlackout dates are as follows. 94 0 obj In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. As a consequence, share repurchases and equity compensation are positively correlated. That ensures insiders who have access to nonpublic information cant trade illegally in the stock market. China e-commerce giant Alibaba outlines future strategy, Dave & Busters Rebound Could Score for Investors. Therefore, we conclude that the correlation between share repurchases and equity compensation is spurious and should not be interpreted causally. 2023 Orrick Herrington & Sutcliffe LLP. A blackout period in financial markets is when certain company employees are prohibited from buying or selling company shares. endobj However, the SECs Rule 10b51 of the SEC Act of 1934, creates exceptions, or basically a safe harbor in which the various officers, directors, and some employees of the business, by establishing a trading plan, may trade a companys securities even during a blackout period, and even when they have inside knowledge of material nonpublic information. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. 88 0 obj 0000021385 00000 n

More about stock buybacks. Suppose you have access to nonpublic information and willingly choose to use it for your benefit. 97 0 obj 101 0 obj Hence, under this alternative hypothesis, share repurchases should have a positive impact on shareholder value on both the short run and the long run. The idea that a company might be beholden to its employees as much as, or at least in proportion to, its shareholders, is more of a philosophical debate. 0000003516 00000 n

%%EOF Get short term trading ideas from the MarketBeat Idea Engine. contact@marketbeat.com

Franklin, Michigan 48025. ~$?_IeQE--[o2EN[+?;c-Z}9XS) To address this issue, it is recommended that corporations wrap their share repurchase program into a rule 10b5-1 plan, which allows for defined purchases during a )Stock Buybacks (Share Repurchases) byPublicCorporations(ie. This is generally the case when the plan makes significant changes. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out buybacks. Companies initiate stock buybacks for a number of reasons, most commonly because it sees it as being the best use of cash as opposed to research and development or making other capital investments. barbecue festival 2022; olivia clare 96 0 obj <> Ultimately, the net benefit of a stock buyback for investors is only realized if the company is correct in purchasing their stock back at a lower intrinsic value than what the stocks future value will be.

Why Did Bullfrog AI Stock Jump More Than 50%? Buyback Analytics is a Top Tier Investing Platform to help investors find, analyze, and profit from investing opportunities not found through traditional investment tools. WebBlackout dates are as follows. 94 0 obj In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. As a consequence, share repurchases and equity compensation are positively correlated. That ensures insiders who have access to nonpublic information cant trade illegally in the stock market. China e-commerce giant Alibaba outlines future strategy, Dave & Busters Rebound Could Score for Investors. Therefore, we conclude that the correlation between share repurchases and equity compensation is spurious and should not be interpreted causally. 2023 Orrick Herrington & Sutcliffe LLP. A blackout period in financial markets is when certain company employees are prohibited from buying or selling company shares. endobj However, the SECs Rule 10b51 of the SEC Act of 1934, creates exceptions, or basically a safe harbor in which the various officers, directors, and some employees of the business, by establishing a trading plan, may trade a companys securities even during a blackout period, and even when they have inside knowledge of material nonpublic information. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. 88 0 obj 0000021385 00000 n

More about stock buybacks. Suppose you have access to nonpublic information and willingly choose to use it for your benefit. 97 0 obj 101 0 obj Hence, under this alternative hypothesis, share repurchases should have a positive impact on shareholder value on both the short run and the long run. The idea that a company might be beholden to its employees as much as, or at least in proportion to, its shareholders, is more of a philosophical debate. 0000003516 00000 n

%%EOF Get short term trading ideas from the MarketBeat Idea Engine. contact@marketbeat.com

Franklin, Michigan 48025. ~$?_IeQE--[o2EN[+?;c-Z}9XS) To address this issue, it is recommended that corporations wrap their share repurchase program into a rule 10b5-1 plan, which allows for defined purchases during a )Stock Buybacks (Share Repurchases) byPublicCorporations(ie. This is generally the case when the plan makes significant changes. Issuers also typically delegate persons employed by the issuer to work with the broker to carry out buybacks. Companies initiate stock buybacks for a number of reasons, most commonly because it sees it as being the best use of cash as opposed to research and development or making other capital investments. barbecue festival 2022; olivia clare 96 0 obj <> Ultimately, the net benefit of a stock buyback for investors is only realized if the company is correct in purchasing their stock back at a lower intrinsic value than what the stocks future value will be. 102 0 obj Typically, this is at the discretion of the company's blackout period's rules. endobj Dividends are issued out of a companys residual earnings either quarterly, semi-annually, or annually.