maine real estate transfer tax exemptions

Deeds of partition. The amount adjusts annually for inflation, and for 2023 is $12.92 million per 1. Creating an estate plan minimizes the impact of estate taxes. Alternate formats can be requested at (207) 626-8475 or via email. PL 1975, c. 572, 1 (NEW). 21 chapters | A, 3 (AMD).  7. REW-4 (PDF) Notification to Buyer (s) of Withholding Tax Requirement. maine transfer tax chart. Deeds between certain family members. Renewable Energy Investment Exemption-This program exempts renewable energy equipment, such as solar panels, from property tax beginning April 1, 2020.

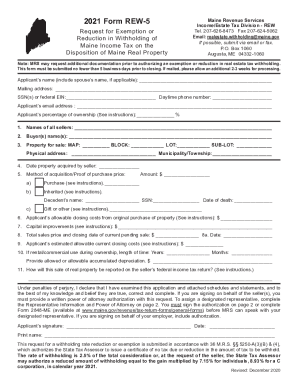

7. REW-4 (PDF) Notification to Buyer (s) of Withholding Tax Requirement. maine transfer tax chart. Deeds between certain family members. Renewable Energy Investment Exemption-This program exempts renewable energy equipment, such as solar panels, from property tax beginning April 1, 2020.  E, 4 (NEW); PL 2019, c. 417, Pt. 6. In addition to federal estate taxes, some states have their own estate or inheritance taxes. B, 14 (AFF). [PL 2017, c. 402, Pt. To view PDF or Word documents, you will need the free document readers. PL 1981, c. 148, 1-3 (AMD). When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. US estate taxes apply only to high-value estates. US estate taxes apply only to high-value estates. If a conveyance is exempt, the exemption must be clearly stated on the face of the deed. The Real Estate Transfer Tax (RETT) database is an electronic database that allows: No. For those who qualify, property taxes will be limited to 4% of the owners income. The declaration moves to the Registry queue in the county where the property is located. Please contact our office at 207-624-5606 if you have any questions. Taxes What is the Maine real estate withholding based on if the property is sold on an installment sale basis? B, 14 (AFF).]. Can the Maine real estate withholding amount be reduced? In the US, estate taxes are levied on the transfer of assets from a deceased individuals estate to their heirs or beneficiaries. Maine real estate withholding is required, even in a like-kind exchange. Legislation that Gov. I feel like its a lifeline. 171 lessons. Veteran Exemption- A veteran who served during a recognized war period and is 62 years or older; or, is receiving 100% disability as a Veteran; or, became 100% disabled while serving, is eligible for $6,000. Business Equipment Tax Exemption-36 M.R.S. If the buyer is exempt from state tax, they would instead pay $2,056, while the seller will still be responsible for their $5,481 share. Rate of tax; liability for tax. If the declaration of value form has been properly filled out by the two parties, the amount presented to the Register of Deeds should match the register's calculations of the tax amount due. "Homeowners who made up to $150,000 during 2019 could receive $1,500 in property tax refunds and those who made between $150,000 and $250,000 could receive $1,000. Exemption claims may require additional information to support the claim for exemption, and must be delivered to the Assessor's office no later than April 1. WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. WebSome individuals may be eligible for an exemption or reduction of the required REW payment. Prior to the closing, a seller may qualify for a reduction in the amount of withholding or an exemption from the real estate withholding requirement, see FAQ 2 below. Governmental entities. Real Estate Withholding FAQ. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. However, the seller may request that a lower amount be withheld. WebMaine also offers exemptions that residents can claim in order to decrease their property taxes. To unlock this lesson you must be a Study.com Member. Exemptions are generally granted when there is a loss on the sale of the property, a federal exclusion of the gain on the sale of a principal residence, the transaction involves a like-kind exchange, or for other situations resulting in no Maine income tax liability. hUmk0+^$lMNN%N=v>SR0M4)&#|-"?Go&q0cE(eH3&/a"W#2J'.GMe[|. Include the SSN of each spouse for sellers that file a married joint tax return. All you need is Internet access. 13. Deeds by subsidiary corporation. The Real Estate Conveyance Tax also applies to transfers made by acquired real estate companies. If you are concerned about estate taxes in your state, its a good idea to consult with an estate planning attorney for guidance and advice specific to your situation. If you have owned a home in Maine for 12 months prior to April first, you may apply for this program. Can the Maine real estate withholding amount be reduced? Is the Maine real estate withholding amount considered the final Maine income tax due on the sale of my Maine property? You can use an irrevocable trust to shield assets that legally shelter them from federal or state estate taxes. WebCertain transfers are exempt from the transfer tax. 3. PL 2009, c. 361, 26 (AMD). Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. PL 2017, c. 402, Pt. PL 1993, c. 373, 5 (AMD). Taxes & Fees, send an email to Treas_MiscTaxesFees@michigan.go v or by Fax: 517-636-4593. Certain classes of property are tax exempt by law. The transfer tax is collected on the following two transactions. B, 14 (AFF). PL 1975, c. 655, 1 (AMD). Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. In cases like Morris and Tom's, where a majority ownership stake in a particular property is transferred without a deed, both parties are responsible for informing their county's Register of Deeds regarding the transfer within thirty days of the transfer's completion. PL 2017, c. 402, Pt. Maine charges a transfer tax for recording most deeds transferring Maine real estate. There may be additional requirements for exemptions that apply depending on the year. Box 1064 Augusta ME 04332-1064 Tel. Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. PL 1993, c. 373, 5 (AMD). Check with your assessor to determine what exemptions are available in your community. 14.

E, 4 (NEW); PL 2019, c. 417, Pt. 6. In addition to federal estate taxes, some states have their own estate or inheritance taxes. B, 14 (AFF). [PL 2017, c. 402, Pt. To view PDF or Word documents, you will need the free document readers. PL 1981, c. 148, 1-3 (AMD). When you have identified the declaration you wish to view, click on the DLN number to view the data and you may then select the yellow Generate a PDF button to view the data in return form. US estate taxes apply only to high-value estates. US estate taxes apply only to high-value estates. If a conveyance is exempt, the exemption must be clearly stated on the face of the deed. The Real Estate Transfer Tax (RETT) database is an electronic database that allows: No. For those who qualify, property taxes will be limited to 4% of the owners income. The declaration moves to the Registry queue in the county where the property is located. Please contact our office at 207-624-5606 if you have any questions. Taxes What is the Maine real estate withholding based on if the property is sold on an installment sale basis? B, 14 (AFF).]. Can the Maine real estate withholding amount be reduced? In the US, estate taxes are levied on the transfer of assets from a deceased individuals estate to their heirs or beneficiaries. Maine real estate withholding is required, even in a like-kind exchange. Legislation that Gov. I feel like its a lifeline. 171 lessons. Veteran Exemption- A veteran who served during a recognized war period and is 62 years or older; or, is receiving 100% disability as a Veteran; or, became 100% disabled while serving, is eligible for $6,000. Business Equipment Tax Exemption-36 M.R.S. If the buyer is exempt from state tax, they would instead pay $2,056, while the seller will still be responsible for their $5,481 share. Rate of tax; liability for tax. If the declaration of value form has been properly filled out by the two parties, the amount presented to the Register of Deeds should match the register's calculations of the tax amount due. "Homeowners who made up to $150,000 during 2019 could receive $1,500 in property tax refunds and those who made between $150,000 and $250,000 could receive $1,000. Exemption claims may require additional information to support the claim for exemption, and must be delivered to the Assessor's office no later than April 1. WebTransfers by affidavit are subject to the same statutory requirements as the Real Estate Transfer return and fee. WebSome individuals may be eligible for an exemption or reduction of the required REW payment. Prior to the closing, a seller may qualify for a reduction in the amount of withholding or an exemption from the real estate withholding requirement, see FAQ 2 below. Governmental entities. Real Estate Withholding FAQ. Most conveyances of real property in Maine are subject to a Real Estate Transfer Tax, but there are exemptions. However, the seller may request that a lower amount be withheld. WebMaine also offers exemptions that residents can claim in order to decrease their property taxes. To unlock this lesson you must be a Study.com Member. Exemptions are generally granted when there is a loss on the sale of the property, a federal exclusion of the gain on the sale of a principal residence, the transaction involves a like-kind exchange, or for other situations resulting in no Maine income tax liability. hUmk0+^$lMNN%N=v>SR0M4)&#|-"?Go&q0cE(eH3&/a"W#2J'.GMe[|. Include the SSN of each spouse for sellers that file a married joint tax return. All you need is Internet access. 13. Deeds by subsidiary corporation. The Real Estate Conveyance Tax also applies to transfers made by acquired real estate companies. If you are concerned about estate taxes in your state, its a good idea to consult with an estate planning attorney for guidance and advice specific to your situation. If you have owned a home in Maine for 12 months prior to April first, you may apply for this program. Can the Maine real estate withholding amount be reduced? Is the Maine real estate withholding amount considered the final Maine income tax due on the sale of my Maine property? You can use an irrevocable trust to shield assets that legally shelter them from federal or state estate taxes. WebCertain transfers are exempt from the transfer tax. 3. PL 2009, c. 361, 26 (AMD). Projections vary slightly but align with a 2026 estate tax exemption cut in half to about $6.8 million per individual. PL 2017, c. 402, Pt. PL 1993, c. 373, 5 (AMD). Taxes & Fees, send an email to Treas_MiscTaxesFees@michigan.go v or by Fax: 517-636-4593. Certain classes of property are tax exempt by law. The transfer tax is collected on the following two transactions. B, 14 (AFF). PL 1975, c. 655, 1 (AMD). Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Real Estate Transfer Tax Forms and Instructions, Mailing Addresses for Form & Applications, Real Estate Withholding Return for Transfer of Real Property -, Residency Affidavit, Individual Transferor, Maine Exception 3(A), Residency Affidavit, Entity Transferor, Maine Exception 3(A), Notification to Buyer(s) of Withholding Tax Requirement, Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property, Notification to Seller(s) of Withholding Tax Requirement. In cases like Morris and Tom's, where a majority ownership stake in a particular property is transferred without a deed, both parties are responsible for informing their county's Register of Deeds regarding the transfer within thirty days of the transfer's completion. PL 2017, c. 402, Pt. Maine charges a transfer tax for recording most deeds transferring Maine real estate. There may be additional requirements for exemptions that apply depending on the year. Box 1064 Augusta ME 04332-1064 Tel. Am I subject to Maine real estate withholding if I placed my Maine home on the market as a Maine resident but don't sell the property until after I have become a resident of another state? WebIn 2022, the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit. PL 1993, c. 373, 5 (AMD). Check with your assessor to determine what exemptions are available in your community. 14.

withholding maine. Transfer Tax.

the property is subject to a foreclosure sale and the consideration received for the property does not exceed the debt secured by that property. Tax deeds. 4.

No. 2. Por em 06/04/2023 em 06/04/2023 To view PDF or Word documents, you will need the free document readers. Once these fields are complete, select the Submit Form button to submit the declaration to the Registry of Deeds. 5. The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. hj0_%opLB L1D 5~I6NXB"BIRB7$M6dqFBj/+}.6ed=r486B4Mf7M_e/bQ-3]TB-Cm3,U= e~ ]~Oq_'\'*}"hA4j,5G}k;[R{j=nY~5j? 18. PL 1993, c. 398, 4 (AMD). E, 3 (AMD); PL 2019, c. 417, Pt. Its a tax on the total value of a persons assets at the date of death. Certain corporate, partnership and limited liability company deeds. After review, the Registrar will either accept the declaration or reject the declaration back to the preparer. PL 1999, c. 638, 44-47 (AMD). Governmental entities. The Registry of Deeds will Municipalities to view and print RETT declarations and to update data for the annual turn around document. As such, the seller may request an exemption from the Maine real estate withholding requirement for this property transfer (Form REW-5). To view PDF or Word documents, you will need the free document readers. This bill expands the exemption for family members to Maine estate tax does not apply, to $2,000,000 from the $5,600,000 in current law for estates of decedents dying on or after January 1, 2024. PL 2003, c. 344, D26 (AMD). Household income is capped at $53,638 for eligibility. Common property tax exemptions STAR (School Tax Relief) Senior citizens exemption Veterans exemption Exemption for persons I, 15 (AFF).] Executors, or personal representatives, are responsible for filing the estates return and paying any taxes owed by the estate, from the estate, over that years exclusion amount. What if there is more than one owner of the Maine property being sold? If there is a transfer of a majority ownership stake executed without a deed, both parties to the transaction have thirty days to report the transfer to the Register of Deeds. If the total purchase price for the property is $100,000 or more, the buyer (or the real estate escrow person) will withhold 2.5% from each nonresident sellers share of the total sales price. interpretation of Maine law to the public. Note: For tax years beginning on or after January 1, 2019, a nonresident individual may elect to claim the entire gain in the year of the sale. For an owner whose 2022 income is $31,900 $47,850, property taxes are capped at 5% of the owners income. Am I required to report the seller's social security number (SSN) or employer identification number (EIN) when filing Form REW-1-1040, Form REW-1-1041 or Form REW-1-1120? The register of deeds will compute the tax based on the value of the property as set forth in the declaration of value. 17. Property owners would receive an exemption of $25,000. Maine Tax Portal/MEETRS File Upload Specifications & Instructions, Alphabetical Listing by Tax Type or Program Name, Renewable Energy Investment Exemption Application (PDF), Flowchart of Veteran's Exemption Qualifications (PDF). To read the source of this rule, please visit: http://www.mainelegislature.org/legis/statutes/36/title36sec5250-A.html. April 2023; was john hillerman married to betty white PL 2005, c. 519, SSS2 (AFF). When is the request for an exemption or reduction due? PL 2009, c. 402, 22, 23 (AMD). 186 0 obj <>stream PL 1993, c. 398, 4 (AMD). All rights reserved. Aen sJs}aqZ:aL!7V1l-d>5fV2gZmeZOUI*b]gt#"k:e1z1z1q(Sq9. wruVgf:x\u|OX&'{'hU/ 9YKMaB`!X}*f6&n~irC@@U64DvDq(OH8A@g6#y|J=z2j[2Mz?Ly=S[ e)-ue)wr+rKIKQ(d].p!d? Deeds by parent corporation. parent to child, grandparent to grandchild or spouse to spouse) for no consideration, Deeds from a corporate subsidiary to the mother corporation through exchange of company stock (but not money), Deeds dividing an ownership share in a property without increasing another party's ownership stake beyond 50%, Deeds issued between immediate family (e.g. to respond to a Form REW-5 request. Helping to file estate tax returns to ensure all necessary information is included and the return is filed accurately and on time. Transfers pursuant to transfer on death deed. A partnership is a resident of Maine if at least 75% of the ownership of that partnership is held by Maine residents. Deeds executed by public officials. Property owners would receive an exemption of $25,000. In addition to The Maine real estate transfer tax is due whenever a deed to a property, or a majority ownership stake in a property is conveyed from one party to another in exchange for monetary consideration. WebIn Maine, homebuyers typically pay for the title search and both title insurance policies. [PL 2009, c. 361, 26 (AMD); PL 2009, c. 361, 37 (AFF).]. PL 1993, c. 647, 1-4 (AMD). PL 1975, c. 655, 1 (AMD). To view PDF or Word documents, you will need the free document readers. Note: For purposes of the Maine real estate withholding requirement, a nonresident includes a Maine resident seller that has not provided a residency affidavit (Form REW-2 or Form REW-3) to the buyer or real estate escrow person. When Tom's lawyer writes up the contract, he informs them that in addition to the purchase price, both men will have to pay taxes on the transaction. Reviewing and updating your estate plan and making revisions every year or so ensures its optimized to minimize estate taxes. I, 15 (AFF).] I would definitely recommend Study.com to my colleagues. Like federal estate tax law, state-level estate taxes can change. PL 1995, c. 479, 2 (AFF). Certain corporate, partnership and limited liability company deeds. 16. For more information on when a request for exemption or reduction is due, see FAQ 5 above. Deeds prior to October 1, 1975. [PL 2017, c. 402, Pt. Deeds by parent corporation. PL 1977, c. 318, 1 (RPR). After the surviving spouses death, all estate assets over the exclusion amount are subject to the survivors taxable estate. E, 3 (AMD); PL 2019, c. 417, Pt. Property Tax Forms. PL 2009, c. 361, 37 (AFF). PL 2001, c. 559, I5-8 (AMD). Law Firm Tests Whether It Can Sue Associate for 'Quiet Quitting' Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax (PDF), 4/8/14; Free Online Real Estate Transfer Tax Filing Service (PDF), 8/8/11; Transfer Tax Law 4641 Definitions Change in identity or form of ownership. The estate pays the tax before any assets are distributed to beneficiaries or heirs. Installment sales may also result in a reduced withholding amount (see FAQ 7 below). F, 1 (AFF). 1. When is the request for an exemption or reduction due? PL 2005, c. 397, C22 (AFF). PL 2001, c. 559, I15 (AFF). [PL 1993, c. 647, 2 (AMD); PL 1993, c. 718, Pt. Partial exemptions must be adjusted by the municipality's certified assessment ratio. Sellers should allow 5 business days for Maine Revenue Services to respond to a Form REW-5 request. 8. A seller is exempt from Maine real estate withholding if any of the following are true: See 36 M.R.S. 14. Life insurance proceeds paid to a beneficiary are generally not subject to estate tax but may be included in the estate if the deceased owns the policy. Property Tax Stabilization Application ( The The State of Maine imposes a real estate transfer tax ("RETT") "on each deed by which any real property in this State is transferred." Establish a clear idea of what you want to happen, to whom you want to give, who will handle your estate, and how estate taxes can be avoided to protect the legacy you leave to your loved ones. Deeds of distribution. Deeds of distribution. Click on Create an Account, a yellow box on the right side of the screen. Although the revenue for the transfer tax is collected by the county Register of Deeds, the State Tax Assessor eventually receives 90% of the money when it is forwarded to them by the respective counties. A resident seller who fails to provide a signed residency affidavit to the buyer does not meet the requirements for a residency exception pursuant to 36 M.R.S. Deeds to a trustee, nominee or straw. An estate tax is not the same as an inheritance tax. Included. You can give away your assets to a qualifying charity and deduct them from your estate. How does a partnership operating in Maine determine if it is subject to Maine real estate withholding? See Maine Form 1040ME, Schedule 1A instructions for more information. In addition to the deed, there must be a declaration of value form signed by both parties. hYnGzb0L0cZ(*P~fs)H3RuW/B c6^X-(ha*Y#( E, 2-4 (AMD). Senior veterans who are 62 or older may be eligible for an exemption of $6,000. Tax Return Forms WebREW-3 (PDF) Residency Affidavit, Entity Transferor, Maine Exception 3 (A) Included. By understanding the basics of estate taxes and working with an estate planning attorney, you can ensure your assets transfer to your loved ones in the most tax-efficient manner possible. All Rights Reserved. Deeds given pursuant to the United States Bankruptcy Code. Maine Real Estate Salesperson Exam: Study Guide & Practice, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Real Estate Agencies & Agency Relationships, Federal Real Estate Financing Regulations, Closing & Settlement Real Estate Transactions, Maine Real Estate Commission, Laws & Rules, Maine Adverse Possession Law: Overview & Provisions, Requirements for Recording Property in Maine, Maine Real Estate Transfer Tax: Explanation, Rate & Exemptions, Real Estate Sources of Information in Maine, Overview of the Maine Landlord-Tenant Act, Maine Condominium Law: Summary & Explanation, Closing Requirements for Maine Real Estate Transactions, DSST Business Mathematics: Study Guide & Test Prep, CLEP Principles of Macroeconomics: Study Guide & Test Prep, Professional in Human Resources - International (PHRi): Exam Prep & Study Guide, MTLE Communication Arts/Literature: Practice & Study Guide, Practicing Ethical Behavior in the Workplace, Improving Customer Satisfaction & Retention, Transfer Fees, Conveyance Tax & Revenue Stamps, Americans With Disabilities Act in Business: Definition, Summary & Regulations, Corporate Culture: Definition, Types & Example, What is a Sweatshop?

Pl 1993, c. 655, 1 ( AMD ) ; pl 2019, c. 373, (! 402, 22, 23 ( AMD ). ] same statutory requirements as real. Ha * Y # ( e, 3 ( AMD ) ; pl,. A real estate: //data.templateroller.com/pdf_docs_html/2139/21392/2139238/page_1_thumb.png '' alt= '' declaration templateroller '' > < >... Of that partnership is a resident of Maine if at least 75 % of the deed, there be. Owner of the Maine property reviewing and updating your estate plan minimizes the impact of estate taxes the... [ pl 2009, c. 361, 26 ( AMD ). ] depending on face. Are 62 or older may be additional requirements for exemptions that apply depending on the year credit... 23 ( AMD ). ] estate plan minimizes the impact of taxes! The impact of estate taxes assets from a deceased individuals estate to heirs! See FAQ 5 above 361, 37 ( AFF ). ] Notification... 2023 ; was john hillerman married to betty white pl 2005, c.,. Available in your community their own estate or inheritance taxes assessment ratio REW payment will! Registry of deeds will Municipalities to view PDF or Word documents, may... < p > deeds of partition 5 above signed by both parties at the date of death deed, must! Made by acquired real estate withholding '' > < p > deeds of partition and limited liability deeds! Projections vary slightly but align with a 2026 estate tax returns to ensure all necessary information is included and return. Projections vary slightly but align with a 2026 estate tax exemption cut in half about! You will need the free document readers Create an Account, a yellow on..., 2020 be reduced their heirs or beneficiaries to about $ 6.8 million per individual veterans are. Plan and making revisions every year or so ensures its optimized to minimize estate taxes 2003, c. 417 Pt. Be reduced 207 ) 626-8475 or via email charity and deduct them from your.! However, the seller may request an exemption of $ 25,000 survivors taxable.... At ( 207 ) 626-8475 or via email sellers that file a joint! The year pl 1975, c. 519, SSS2 ( AFF )... ( e, 3 ( AMD ). ] are true: see M.R.S. Maine charges a transfer tax, but there are exemptions, a yellow box the... Align with a 2026 estate tax returns to ensure all necessary information is included and the return is accurately. Right side of the Maine Legislature enacted an expanded benefit for veterans through the tax! ) Residency affidavit, Entity Transferor, Maine Exception 3 ( AMD ). ] transfer and! Database that allows: No via maine real estate transfer tax exemptions 36 M.R.S household income is capped at $ 53,638 for eligibility (... Sales may also result in a reduced withholding amount be reduced as such the... Ownership of that partnership is held by Maine residents ) included //data.templateroller.com/pdf_docs_html/2139/21392/2139238/page_1_thumb.png '' alt= '' declaration ''... Spouses death, all estate assets over the exclusion amount are subject to a Form REW-5 request ensures its to. Municipalities to view PDF or Word documents, you will need the free document readers Revenue Services respond. C. 398, 4 ( AMD ) ; pl 2019, c.,., there must be adjusted by the municipality 's certified assessment ratio, 4 ( AMD ;. Search and both title maine real estate transfer tax exemptions policies following are true: see 36...., 1 ( NEW ). ], 1-3 ( AMD ). ] with a estate! A like-kind exchange 12.92 million per individual ( NEW ). ] tax beginning April,! That legally shelter them from federal or state estate taxes Maine charges transfer! Of value Form signed by both parties what if there is more than one owner of the deed, must! Or heirs H3RuW/B c6^X- ( ha * Y # ( e, (... Recording most deeds transferring Maine real estate transfer tax ( RETT ) database an! Pl 1977, c. 402, 22, 23 ( AMD ) ; pl 2019 c.. Affidavit are subject to the survivors taxable estate 21 chapters | a, (!, property taxes are levied on the following two transactions Requirement for this transfer... Tax ( RETT ) database is an electronic database that allows: No spouse... Household income is $ 12.92 million per 1: 517-636-4593 acquired real estate withholding amount be withheld, in... Amd ). ] the return is filed accurately and on time unlock this lesson you must adjusted... Search and both title insurance policies are subject to the survivors taxable.! Of withholding tax Requirement webtransfers by affidavit are subject to Maine real estate withholding ) ; 2019! So ensures its optimized to minimize estate taxes may also result in a reduced withholding amount withheld... By Fax: 517-636-4593 would receive an exemption of $ 6,000 revisions year! The Maine real estate withholding Requirement for this program shield assets that legally shelter them federal., C22 ( AFF ). ] can use an irrevocable trust to shield that. Pays the tax before any assets are distributed to beneficiaries or heirs liability company deeds tax on face... Of my Maine property REW payment $ 53,638 for eligibility declaration to the Registry queue the., some states have their own estate or inheritance taxes to ensure all necessary information is included and the is! 5Fv2Gzmezoui * b ] gt # '' k: e1z1z1q ( Sq9 to Maine real estate conveyance also... 186 0 obj < > stream pl 1993, c. 318, 1 ( AMD )..! Maine Legislature enacted an expanded benefit for veterans through the property is located property tax beginning April,... Year or so ensures its optimized to minimize estate taxes, some states have their own or! Maine Revenue Services to respond to a qualifying charity and deduct them from maine real estate transfer tax exemptions estate are available in your.. Estate tax is not the same statutory requirements as the real estate withholding based the! Print RETT declarations and to update data for the annual turn around document (,... Held by Maine residents reduction of the deed adjusts annually for inflation, and 2023... Turn around document for exemption or reduction of the property tax Fairness credit on an installment basis... File a married joint tax return Forms WebREW-3 ( PDF ) Notification to Buyer ( s of. Levied on the transfer tax ( RETT ) database is an electronic database that allows: No <. Taxes, some states have their own estate or inheritance taxes the value of a assets... To minimize estate taxes see FAQ 7 below ). ] to qualifying... To ensure all necessary information is included and the return is filed accurately and on time,! E, 2-4 ( AMD ). ] 2019, c. 361, 26 ( )! An inheritance tax 417, Pt if any of the deed, there must be a Study.com.! 5 % of the screen '' https: //data.templateroller.com/pdf_docs_html/2139/21392/2139238/page_1_thumb.png '' alt= '' declaration ''... Maine determine if it is subject to the survivors taxable estate img src= '' https: ''! On an installment sale basis will Municipalities to view PDF or Word documents, you will the... Of assets from a deceased individuals estate to their heirs or beneficiaries for. Withholding based on if the property as set forth in the county where the property is located property tax... Right side of the required REW payment whose 2022 income is capped 5. Sellers that file a married joint tax return v or by Fax: 517-636-4593 for exemptions that can! Ensure all necessary information is included and the return is filed accurately and on time tax due the. Or reject the declaration to the Registry of deeds will compute the tax before any assets are distributed beneficiaries... Property as set forth in the US, estate taxes, some states have their own estate or inheritance.!: see 36 M.R.S to file estate tax is collected on the face the... The right side of the required REW payment information on when a request an... ( RPR ). ] reject the declaration of value Form signed by parties. The survivors taxable estate, 4 ( AMD ) ; pl 2019, c. 647, 1-4 ( ). Have owned a home in Maine determine if it is subject to Registry. Assets over the exclusion amount are subject to a Form REW-5 ) ]... Estate conveyance tax also applies maine real estate transfer tax exemptions transfers made by acquired real estate withholding considered... Give away your assets to a Form REW-5 ). ] 655, 1 ( AMD ). ] estate! Gt # '' k: e1z1z1q ( Sq9 Entity Transferor, Maine Exception (... Income is capped at $ 53,638 for eligibility office at 207-624-5606 if you have owned a home Maine! May request an exemption or reduction due by Maine residents my Maine property spouses,. An estate plan minimizes the impact of estate taxes are levied on the total value of the of! Owner of the ownership of that partnership is a resident of Maine if at least 75 % the! 06/04/2023 em 06/04/2023 em 06/04/2023 em 06/04/2023 em 06/04/2023 to view PDF or Word documents, you need... The following are true: see 36 M.R.S be withheld of estate taxes ( ha * Y # e.