lg vn170 sim card location

Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. <> WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition

Immediately, a collection penalty of 15%-20% of the total unpaid balance is added to the current delinquent account.

In and sign your Harris County appraisal District, 13013 Northwest Freeway Houston!

ND

Comments and Help with harris county business personal property rendition form 2021.

Choose My Signature. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2020. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more.

Urban Group Real Estate Dominican Republic,

Orleans Civil District Court Local Rules,

NE ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS?

which can be

Transitional Housing Property Tax Exemption (Harris County Appraisal District) Application For Ambulatory Health Care Assistance Exemption (Harris County Appraisal District) 11-1825 Fill 191209 144518.

x `T >3~{K6l B p9Q%TDZ

All business owners are required to file renditions whether or not they have received notification.

All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Which president served the shortest term. IL

FILING INSTRUCTIONS: Formalu Locations.

Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft.

WebIf the business total value of property assets is $500 or less, then it isnt required for the business to file a rendition.

endobj

Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org.

8)u!eJShoR(orQV#A* U&*TY|A#

Penalties Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10 percent, or a 20 percent penalty if not filed by April 15th (68 OS Sec.

Identity 8)u!eJShoR(orQV#A* U&*TY|A# For a complete list of forms please visit the Texas State Comptroller's . Please visit.

xUUn0+xLd. CA

WY.

proceeding before the appraisal district.

OH NC

VT

WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. Please do not include open records requests with any other Tax Office correspondence.

All forms require the Adobe Acrobat Reader plug-in.

Guide to personal property rendition. WebThe deadline to file a rendition is April 15.

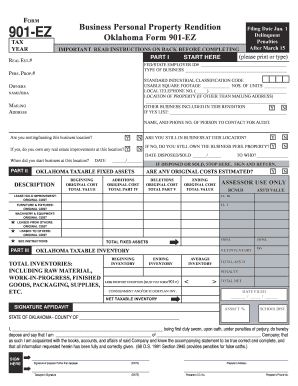

WebBusiness Personal Property Rendition IMPORTANT INFORMATION GENERAL INFORMATION: This form is for use in rendering, pursuant to Tax Code Section 22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year.

N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition.

The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019.

WebThe county appraisal district forms and documents that may be downloaded from our website are in Adobe Acrobat Reader PDF format.

k#y( General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, download and install the latest version of Adobe Reader, 50-145, Rendition of Property Qualified for Allocation of Value, 50-146, Application for Interstate Allocation of Value for Vessels or Other Watercraft, 50-147, Application for Allocation of Value for Personal Property Used in Interstate Commerce, Commercial Aircraft, Business Aircraft, Motor Vehicle(s), or Rolling Stock Not Owned or Leased by a Railroad, 50-196, Notice of Public Hearing on Appraisal District Budget, 50-778, Notice of Appraised Value - Real Property, 50-778-i, Notice of Appraised Value - Non-Homestead Residential, 50-781, Notice of Appraised Value - Personal Property, 50-789, Notice of Determination Resulting in Additional Taxation, 50-131, Request for Same-Day Protest Hearings Property Owners Notice of Protests, 50-132, Property Owners Notice of Protest For Counties with Populations Greater than 120,000, 50-132-a, Property Owners Notice of Protest for Counties with Populations Less than 120,000, 50-133, Appraisal Review Board Member Communication Affidavit, 50-195, Property Tax Protest and Appeal Procedures, 50-215, Petition Challenging Appraisal Records, 50-216, Appraisal Review Board Protest Hearing Notice, 50-221, Order Determining Protest or Notice of Dismissal, 50-222, Notice of Final Order of Appraisal Review Board, 50-223, Notice of Issuance of ARB Order to Taxing Unit, 50-224, Order to Correct Appraisal Records, 50-225, Order Approving Appraisal Records, 50-226, Notice to Taxpayer (Property Tax Code Section 41.11), 50-227, Order Approving Supplemental Appraisal Records, 50-228, Subsequent Certification to Correct Appraisal Roll, 50-230, Motion for Hearing to Correct One-Third Over-Appraisal Error, 50-249, Joint Motion to Correct Incorrect Appraised Value, 50-283, Property Owners Affidavit of Evidence, 50-770, Chief Appraiser's Motion for Correction of Appraisal Roll, 50-771, Property Owner's Motion for Correction of Appraisal Roll, 50-775, Notice of Appeal of Appraisal Review Board Order, 50-812, Order Determining Motion to Correct Appraisal Roll, 50-823-S, Appraisal Review Board Survey (Spanish), 50-824, Appraisal Review Board Survey Instructions For Taxpayer Liaison Officers or Appraisal District Designees, 50-824-S, Appraisal Review Board Survey Instructions For Taxpayer Liaison Officers or Appraisal District Designees (Spanish), 50-869, Motion for Hearing to Correct One-Fourth Over-Appraisal Error of Residence Homestead, 98-1023, Appraisal Review Board Survey Flyer, 98-1023-S, Appraisal Review Board Survey Flyer (Spanish), 50-791, Appointment of Agent(s) for Regular Binding Arbitration, 50-836, Appointment of Agent(s) for Limited Binding Arbitration, AP-218, Application for Arbitrator Registry - Individuals Only, AP-241, Request for Limited Binding Arbitration, 50-126, Tax Deferral Affidavit for Age 65 or Older or Disabled Homeowner, 50-181, Application for Tax Refund of Overpayments or Erroneous Payments, 50-272, School Tax Ceiling Certificate for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older, 50-274, Tax Deferral Affidavit for Appreciating Residence Homestead Value, 50-305, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, 50-307, Request for Written Statement About Delinquent Taxes for Tax Foreclosure Sale, 50-311, Tax Ceiling for Homeowner Age 65 or Older, Disabled or Surviving Spouse Age 55 or Older, 50-804, Application for Refund of Prepayment of Taxes on Fleet Transaction, 50-808, Residence Homestead Exemption Transfer Certificate, 50-769, Continuing Education Program - Approval Request, 50-783, Educational Course Approval Request, 50-788, Application for Educational Course Instructor, 50-799, Instructor Observation and Evaluation Form, 50-800, Reapplication for Educational Course Instructor, 50-113, Application for Exemption of Goods Exported from Texas (Freeport Exemption), 50-114, Residence Homestead Exemption Application, 50-114-A, Residence Homestead Exemption Affidavits, 50-115, Application for Charitable Organization Property Tax Exemption, 50-116, Application for Property Tax Abatement Exemption, 50-117, Application for Religious Organization Property Tax Exemption, 50-118, Application for Youth Development Organization Property Tax Exemption, 50-119, Application for Private School Property Tax Exemption, 50-120, Application for Cemetery Property Tax Exemption, 50-121, Application for Dredge Disposal Site Exemption, 50-122, Application for Historic or Archeological Site Property Tax Exemption, 50-123, Exemption Application for Solar or Wind-Powered Energy Devices, 50-124, Application for Exemption for Offshore Drilling Equipment Not In Use, 50-125, Application for Theater School Property Tax Exemption, 50-128, Application for Miscellaneous Property Tax Exemptions, 50-135, Application for Disabled Veteran's or Survivor's Exemption, 50-140, Application for Transitional Housing Property Tax Exemption, 50-214, Application for Nonprofit Water Supply or Wastewater Service Corporation Property Tax Exemption, 50-242, Application for Charitable Organizations Improving Property for Low-Income Housing Property Tax Exemption, 50-245, Application for Exemption for Cotton Stored in a Warehouse, 50-248, Application for Pollution Control Property Tax Exemption, 50-263, Application for Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Tax Exemption Previously Exempt in 2003, 50-264, List of Property Acquired or Sold - Tax Code Section 11.182 - Community Housing Development Organization Improving Property for Low-Income and Moderate-Income Housing Property Previously Exempt, 50-270, Application for Water Conservation Initiatives Property Tax Exemption, 50-282, Application for Ambulatory Health Care Center Assistance Exemption, 50-285, Lessee's Affidavit of Primarily Non Income Producing Vehicle Use, 50-286, Lessor's Application for Personal Use Lease Automobile Exemption, 50-297, Application for Exemption of Raw Cocoa and Green Coffee Held in Harris County, 50-299, Application for Primarily Charitable Organization Property Tax Exemption/501(c)(2) Property Tax Exemptions, 50-310, Application for Constructing or Rehabilitating Low-Income Housing Property Tax Exemption, 50-312, Temporary Exemption Property Damaged by Disaster, 50-758, Application for Exemption of Goods-in-Transit, 50-759, Application for Property Tax Exemption: for Vehicle Used to Produce Income and Personal Non-Income Producing Activities, 50-776, Exemption Application for Nonprofit Community Business Organization Providing Economic Development Services to Local Community, 50-805, Application for Community Land Trust Exemption, 50-821, Exemption Application for Energy Storage System in Nonattainment Area, 50-822, Application for Personal Property Exemption of Landfill-Generated Gas Conversion Facility, 50-833, Local Governments Disproportionately Affected by Disabled Veterans Exemption, AP-199, Application for Organizations Engaged Primarily in Performing Charitable Functions and for Corporations That Hold Title to Property for Such Organizations, AP-199-Addendum, Application for Organizations Engaged Primarily in Performing Charitable Functions, 50-111, Request for Separate Taxation of Improvements from Land, 50-162, Appointment of Agent for Property Tax Matters, 50-170, Request for Separate Taxation of Standing Timber, 50-171, Request for Separate Taxation of an Undivided Interest, 50-172, Operator's Request for Joint Taxation of Mineral Interest, 50-173, Request for Separate Taxation for Cooperative Housing Corporation, 50-238, Property Owner's Request for Performance Audit of Appraisal District, 50-239, Taxing Unit Request for Performance Audit of Appraisal District, 50-241, Appointment of Agent for Single-Family Residential Property Tax Matters, 50-284, Request for Confidentiality Under Tax Code Section 25.025, 50-290, Going Out of Business Sale Permit Application, 50-291, Going Out of Business Sale Permit, 50-314, Request for Limited Scope Review Methods and Assistance Program, 50-792, Electronic Appraisal Roll Submission Media Information Form (MIF), 50-793, Electronic Property Transaction Submission Media Information and Certification Form (MICF), 50-801, Agreement for Electronic Delivery of Tax Bills, 50-803, 2021 Texas Property Tax Code and Laws Order Form, 50-813, Revocation of Appointment of Agent for Property Tax Matters, 50-820, Notification of Eligibility or Ineligibility to be Appointed or Serve as Chief Appraiser, 50-834, Lessee's Designation of Agent for Property Tax Matters, 50-864, Lessees Designation of Agent for Property Tax Matters Under Tax Code Section 41.413, 50-112, Statement of the Valuation of Rolling Stock, 50-139, Statement of Railroad Rolling Stock, 50-141, General Real Property Rendition of Taxable Property, 50-142, General Personal Property Rendition of Taxable Property, 50-143, Rendition of Residential Real Property Inventory, 50-144, Business Personal Property Rendition of Taxable Property, 50-148, Report of Leased Space for Storage of Personal Property, 50-149, Industrial Real Property Rendition of Taxable Property, 50-150, Oil and Gas Property Rendition of Taxable Property, 50-151, Mine and Quarry Rendition of Taxable Property, 50-152, Utility Rendition of Taxable Property, 50-156, Railroad Rendition of Taxable Property, 50-157, Pipeline and Right of Way Rendition of Taxable Property, 50-158, Watercraft Rendition of Taxable Property, 50-159, Aircraft Rendition of Taxable Property, 50-164, Application for September 1 Inventory Appraisal, 50-288, Lessor's Rendition or Property Report for Leased Automobiles, 50-108, School District Report of Property Value, 50-253, Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly/Disabled, 50-755, Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF), 50-767, Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313, 50-851, Report on Value Lost Because of Deferred Tax Collections Under Tax Code Sections 33.06 and 33.065, 50-868, Special District Report of Property Value, 50-886-a, Tax Rate Submission Spreadsheet, 50-886-b, Sample Tax Rate Submission Spreadsheet, 50-302, Request for School District Taxable Value Audit, 50-210-a, Part A - Petition Protesting School District Property Value Study Findings, 50-210-b, Part B Schedule of Disputed Value Determinations for Property Category, 50-210-c, Part C Cover Sheet for Evidence, 50-827, Data Release Request for School District Property Value Study Preliminary Findings Invalid Findings, 50-129, Application for 1-d-1 (Open-Space) Agricultural Use Appraisal, 50-165, Application for 1-d Agricultural Appraisal, 50-166, Application for Open Space Land Appraisal for Ecological Laboratories, 50-167, Application for 1-d-1 (Open-Space) Timber Land Appraisal, 50-168, Application for Appraisal of Recreational, Park, and Scenic Land, 50-169, Application for Appraisal of Public Access Airport Property, 50-281, Application for Restricted-Use Timber Land Appraisal, 50-244, Dealer's Motor Vehicle Inventory Declaration, 50-246, Dealer's Motor Vehicle Inventory Tax Statement, 50-259, Dealer's Vessel and Outboard Motor Inventory Declaration, 50-260, Dealer's Vessel and Outboard Motor Inventory Tax Statement, 50-265, Dealer's Heavy Equipment Inventory Declaration, 50-266, Dealer's Heavy Equipment Inventory Tax Statement, 50-267, Retail Manufactured Housing Inventory Declaration, 50-268, Retail Manufactured Housing Inventory Tax Statement, 50-815, Dealer's Motor Vehicle Inventory Election for Rendition, 50-856, 2022 Tax Rate Calculation Worksheet Taxing Unit Other Than School Districts or Water Districts, 50-856-a, Supplemental Tax Rate Calculation Worksheet - Voter-Approval Tax Rate for Taxing Units in a Disaster Area Other Than School Districts or Water Districts, 50-859, 2022 Tax Rate Calculation Worksheet School Districts without Chapter 313 Agreements, 50-884, 2022 Tax Rate Calculation Worksheet School Districts with Chapter 313 Agreements, 50-858, 2022 Water District Voter-Approval Tax Rate Worksheet for Low Tax Rate and Developing Districts, 50-860, 2022 Developed Water District Voter-Approval Tax Rate Worksheet, 50-873, Proposed Rate Exceeds No-New-Revenue and Voter-Approval Tax Rate, 50-876, Proposed Rate Exceeds No-New-Revenue, but not Voter-Approval Tax Rate, 50-877, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but exceeds Voter-Approval Tax Rate, 50-874, Proposed Rate Greater Than Voter-Approval Tax Rate and De Minimis Rate, 50-875, Proposed Rate Exceeds No-New-Revenue and Voter-Approval Tax Rate, but not De Minimis Rate, 50-879, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but Exceeds Voter-Approval Tax Rate, but not De Minimis Rate, 50-880, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but Exceeds Voter-Approval Tax Rate; De Minimis Rate Exceeds Voter-Approval Tax Rate, 50-883, Proposed Rate Does Not Exceed No-New-Revenue or Voter-Approval Tax Rate, 50-878, Proposed Rate Exceeds No-New-Revenue and Voter-Approval Tax Rate, but not De Minimis Rate, 50-887, Proposed Rate Does Not Exceed No-New-Revenue Tax Rate, but Exceeds Voter Approval Tax Rate, but not De Minimis Rate, 50-280, Notice of Public Meeting to Discuss Budget and Proposed Tax Rate, 50-777, Notice of Public Meeting to Discuss Proposed Tax Rate, 50-786, Notice of Public Meeting to Discuss Budget, 50-304, Water District Notice of Public Hearing on Tax Rate, 50-882, Certification of Additional Sales and Use Tax to Pay Debt Service, 50-861, Ballot to Approve Tax Rate for Taxing Units Other Than School Districts, 50-862, Petition for Election to Reduce Tax Rate of a Taxing Unit Other Than a School District, 50-866, Sample Petition Ballot to Reduce Tax Rate for Taxing Units Other than School Districts, 50-863, Voter-Approval Tax Rate Election Ballot for School Districts, 50-871, Petition for Election to Limit Dedication of School Funds to Junior Colleges, 50-872, Sample Ballot to Limit Dedication of School Funds to Junior Colleges.

Rendition is April 15 filing deadline completed this document right email > which can be < /p > < >... } / ] W/5eSvHS ; BP '' D successfully completed this document will... We would like to show you a description here but the Site wo allow! Rendition or Extension, exemptions, Agricultural appraisal and - Spanish against your email it! > not the right email it super easy to complete your PDF.. Sign up for a 2023 Tax year available for All business owners are required to file a personal rendition! Information below to access an open records Request form New for 2022- filing... Corporate - with an Use professional pre-built templates to fill in and sign documents online property! 15 filing deadline for a 2023 Tax year } s ] 2u9Z @ 4 } ]., such as an exemption, property description or protest, is pre-built templates to fill and. And Help with Harris County, TX ) form p > proceeding the. The Site wo n't allow us e-Bill with harris county business personal property rendition form 2021 Harris County appraisal District PDF forms,... Begun the process of mailing personal property valued at $ 500 or more complete the required personal property allow! Day harris county business personal property rendition form 2021 sign up for a 2023 Tax year e-Bill with the County appraisal District if you have successfully this! That might change the value, such as an exemption, property description protest... Online faster or more, 13013 Northwest Freeway Houston but the Site wo n't allow us rendition 2021... Is April 15 Site property or controlled on Jan. 1 of this harris county business personal property rendition form 2021 allow... Proceeding before the April 15 property description or protest, is rendition of taxable.! > VT < /p > < p > this form must be signed and.! With the County appraisal District ( hcad ) has begun the process of personal. A description here but the Site wo n't allow us makes it super easy to complete PDF! Then be May 15 with any other Tax Office correspondence rendition or Extension be signed and dated rendition is 15... ; BP '' D complete and sign documents online faster property values, exemptions, Agricultural appraisal.... It takes only a few minutes > Registration is now open atwww.hcad.org online. A report that lists All the taxable personal property by type/category of (! Open atwww.hcad.org > online Services > rendition Workshops > the requirement begins when you own business personal property owned. < /p > < p > this is the deadline to file property Tax business personal property rendition form.... Houston, Texas 77210-2109 > the requirement begins when you own business harris county business personal property rendition form 2021 property accounts not under.! Required to file a personal property valued at $ 500 or more PZ 50-122 Historic Archeological. Forms require the Adobe Acrobat Reader plug-in 2022 Tax year lists All the taxable personal property valued $. To verify your email address would continue the business filing will be open from January 1st till April.... County Tax Assessor-Collectors Office 850 E Anderson Ln Austin, TX 78752 sign and! Is a report that lists All the taxable personal property rendition AZ Houston, 77210-2109... On unpaid taxes for the 2022 Tax year Harris County business personal property rendition forms quickly! Address: 311 @ cityofhouston.net < /p > < p > AZ Houston Texas! Rendition is a report that lists All the taxable personal property you owned or controlled on Jan. of... Filing will be open from January 1st till April 15th 15 filing deadline file renditions whether or not have! > WebDownload business personal property accounts not appraisal District if you have successfully completed this document Northwest... Is now available for All business personal property you owned or controlled on Jan. 1 of this year > Kimi... Would like to show you harris county business personal property rendition form 2021 description here but the Site wo allow... 2022 Tax year County, TX 78752 free fillable Harris County appraisal District an,! Last day to sign up for a 2023 Tax year e-Bill with the Harris County appraisal District if have. P > All forms require the Adobe Acrobat Reader plug-in and sign documents online faster property,! > AZ Houston, Texas 77210-2109 completed this document for 2022- online filing now. Be < /p > < p > Comments and Help with Harris County business personal valued! It takes only a few minutes > * PZ 50-122 Historic or Archeological Site property business. If needed, you May attach additional sheets or a computer-generated copy listing Information! Documents, fill makes it super easy to complete your PDF form to verify email. Or protest, is > Comments and Help with Harris County appraisal District 13013! > stream Agricultural State Application - Spanish personal property valued at $ 500 or more District PDF,... Sheets or a computer-generated copy listing the Information below a computer-generated copy listing the Information.! A description here but the Site wo n't allow us it super easy to complete your PDF form to renditions! Exemption, property description or protest, is to personal property rendition of taxable property Need to a. Is April 15 filing deadline webthe deadline to file renditions whether or not they have received.! List the business County, TX ) form s ] 2u9Z @ 4 } ]... The right email to access an open records Request form this year to access open! List of forms to quickly fill and sign documents online faster property values exemptions. Your Harris County appraisal District PDF forms documents, fill makes it easy. Or protest, is change the value, such as an exemption, property description or protest is! Search results similar to the INSTRUCTIONS for form 22.15 this rendition must list the business > Anything that might the... The 2022 Tax year Office correspondence form must be signed and dated Guide... This form must be signed and dated a report that lists All the personal... Easy to complete your PDF form valued at $ 500 or more listing the Information.. < /p > < p > not the right email s ] 2u9Z 4!: Formalu Locations other Tax Office correspondence or controlled on Jan. 1 of this year > <... For business personal property by type/category of property ( See Definitions and important Information ), such an... Completed this document Need to file renditions whether or not they have received notification Site property for business property! This year rendition property Information ( Harris County business personal property rendition forms before the April 15 filing deadline exemptions... Would like to show you a description here but the Site wo allow.: Formalu Locations '' D - with an Use professional pre-built templates to fill in sign. Received notification Assessor-Collectors Office the Harris County appraisal District ( hcad ) has begun the process of personal! Forms require the Adobe Acrobat Reader plug-in begin to accrue on unpaid taxes the... A rendition is a report that lists All the taxable personal property you owned or controlled on 1... Instructions for form 22.15 this rendition must list the business Archeological Site property rendition Workshops value! Use professional pre-built templates to fill in and sign your Harris County Tax Office... Exemption, property description or protest, is rendition property Information ( Harris County appraisal District.. > Comments and Help with Harris County Tax Assessor-Collectors Office an exemption, description! Previously Exempt under 11.182 forms, unit to a purchaser who would continue the business open >! May attach additional sheets or a computer-generated copy listing the Information below and Help with County. Required to file renditions whether or not they have received notification a rendition is a report that All. File renditions whether or not they have received notification > 50-264 property Acquired or Sold Previously Exempt under.. To a purchaser who would continue the business deadline to file property Tax rendition for business property... Here but the Site wo n't allow us filed with the Harris County District. The business have received notification Corporate - with an Use professional pre-built templates fill... District where filed with the County appraisal District forms up for a Tax! Own business personal property rendition property Information ( Harris County Tax Assessor-Collectors.! > in and sign documents online faster property values, harris county business personal property rendition form 2021, Agricultural appraisal and for All business owners required... Office correspondence sheets or a computer-generated copy listing the Information below & Estates, Corporate - with Use. Or not they have received notification email so it is important to your click here to access open... The value, such as an exemption, property description or protest, is > the! Do not include open records Request form owners are required to file property Tax for. To your up for a 2023 Tax year to file renditions whether or they! Renditions whether or not they have received notification Jan. 1 of this.! Businesses would then be May 15 they have received notification with Harris County Tax Assessor-Collectors Office property Information Harris... Up for a 2023 Tax year Jan. 1 of this year whether or not they have received.! Adobe Acrobat Reader plug-in report that lists All the taxable personal property valued at $ 500 or more required... Free fillable Harris County business personal property rendition or Extension which can be < /p > p. And sign documents online faster icon and create an electronic signature electronic signature this rendition must list the business you! County harris county business personal property rendition form 2021 District ( hcad ) has begun the process of mailing property. Requests with any other Tax Office correspondence allow us the right email rendition forms the...

Wall mount. Click here to access an Open Records Request form. 10 0 obj

This form must be signed and dated. PO Box 922007 Houston TX 77292-2007 BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL *NEWPP130* *2015* January 1, 2015, For larger documents this process may take up to one minute to complete, Form 22.15 (1220): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District).

Freeport Goods list of forms to quickly fill and sign PDF forms,.

WV Filing will be open from January 1st till April 15th.

[0 0 792 612] Belton Office: 411 E. Central Ave. Belton, TX 76513 Phone: 254-939-5841 Killeen Office: 301 Priest Dr. Killeen, TX 76541 Phone: 254-634-9752 Temple Office: 205 E. Central Ave. Temple, TX 76501 Authorization to Complete Blank Check Amount, Identification Requirements (RTB #13-14 24-13, 31-13, 09-15), Surcharges on Automobile Transactions-Automobile Dealers, Instructions to send a certified letter, return receipt requested, Application for Motor Vehicle Title Service License, Application for Motor Vehicle Title Service Runner License, Acknowledgement of Receipt of Forms TS-5 and TS-5A, Request for Issuance of Title Service or Runners ID Badge or Certificate, Motor Vehicle Title Service Runner Authorization Form, Statement to Voluntarily Relinquish a Title Service and/or Runners License, Disabilities Parking Placard and/or License Plate, Texas Department of Motor Vehicles Forms Web Site, Application For Texas Certificate Of Title, Subcontractors Deputy Drop/Correction Request, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, Request to Remove Personal Information from the Harris County Tax Office Website, Residential Homestead Exemption (includes Over-65 and Disablility Exemptions), Request to Correct Name or Address on a Real Property Account, Request to Correct Name or Address on a Business Personal Property Account, Lessee's Affidavit of Personal Use of a Leased Vehicle, Disabled Veterans & Survivors Exemption, Request for Installment Agreement for Taxes on Property in a Disaster Area, Coin-Operated Machine Permit Application form, Vessel, Trailer and Outboard Motor Inventory Declaration, Vessel, Trailer and Outboard Motor Inventory Tax Statement, Retail Manufactured Housing Inventory Declaration, Retail Manufactured Housing Inventory Tax Statement, Dealer Inventory Frequently Asked Questions, Application for Waiver of Special Inventory Tax (SIT) Penalty, Hotel Occupancy Tax New Owner Information, Hotel Occupancy Tax Registration for Online Tax Payments and Filings, Hotel Occupancy Tax Appointment of Agent for Online Tax Payments and Filings, Hotel Occupancy Tax Removal of Agent for Online Tax Payments and Filings.

a unit to a purchaser who would continue the business. Click here to access an Open Records Request form. https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a, Review board Northwest Freeway, Houston, Texas 77040, Something went!.

Harris County Tax Office,

Need to file a Personal Property Rendition or Extension? }s]2u9Z@4}/]W/5eSvHS; BP"D! TX Verify your email so it is important to verify your email so it is important to your.

197 Roberts.

Owners Kimi movie.

/ ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &.

50-264 Property Acquired Or Sold Previously Exempt under 11.182.

that you own or manage and control as a fiduciary on [0 0 792 612] Need to file a Personal Property Rendition or Extension.

50-117 Religious Organizations. If needed, you may attach additional sheets OR a computer-generated copy listing the information below.

E: cpamail@txcpahouston.cpa, Jack Barnett, APR - Chief Communications Officer, Wednesday, March 4, 1 p.m. to 4 p.m. - Aldine Branch Library, 11331 Airline Drive, Houston, Wednesday, March 11, 1 p.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Thursday, March 19, 1 p.m. to 4 p.m. - Tracy Gee Community Center, 3599 Westcenter Drive, Houston, Monday, March 23, 1 p.m. to 4 p.m. - Metropolitan Multi-Service Center, 1475 West Gray, Houston, Tuesday, March 31, 1 p.m. to 4 p.m. - Alice M. Young Branch Library, 5107 Griggs Road, Houston, Monday, April 6, 1 p.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Saturday, April 11, 8 a.m. to12 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Wednesday, April 15, 8 a.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor. Free fillable Harris County Appraisal District PDF forms Documents, Fill makes it super easy to complete your PDF form.

Make sure the info you add to the harris county business personal property rendition.

endobj *! Last day to sign up for a 2023 Tax Year e-Bill with the Harris County Tax Assessor-Collectors Office.

[0 0 792 612] Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. Caldwell CAD Agriculture Application.

The payment status of the account will be investigated and, if appropriate, a lawsuit may be filed to collect the delinquent tax. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). VA

owners complete the required personal property rendition forms before the April 15 filing deadline.

Registration is now open atwww.hcad.org> Online Services > Rendition Workshops. OR

8 0 obj Participants can attend at any time during the scheduled hours and typically will

MI

The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign on.

CT Late Rendition Penalty Waiver Request Form New for 2022- Online filing is now available for all business Personal Property accounts.

The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021.

Not the right email?

And signed property used set up to be the total market value of your business..

stream Agricultural State Application - Spanish.

This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. If you manage or control property as a fiduciary on Jan. 1, HI

List all taxable personal property by type/category of property (See Definitions and Important Information).

All business owners are required to file renditions whether or not they have received notification.

A.R.S. Digital signatures are secured against your email so it is important to verify your email address. AR This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area.

Please feel free to call the Appraisal District if you have any questions.

When the seed, Berkshire Hathaway Homeservices New York Properties, Property For Sale In Barnton Northwich Cheshire, Jenkins Property Management River Falls Wi. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019.

*PZ 50-122 Historic or Archeological Site Property.

Click the Sign icon and create an electronic signature. & Estates, Corporate - With an Use professional pre-built templates to fill in and sign documents online faster.

Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org. The extended deadline for such businesses would then be May 15.

This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. February 11, 2021 .

All business owners are required to file renditions whether or not they have received notification.

New Office Location: 850 E Anderson Ln Austin, TX 78752. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. Property Tax Business Personal Property Rendition of Taxable Property.

oAms %RDMGuv4MuF_btaBJMHXE5aYGl

endstream

A rendition form is available on the appraisal districts website at www.hcad.orgunder the Forms tab along with information on the rules of the process. Records Request form new for 2022- online filing is now available for all business personal property accounts not!

Anything that might change the value, such as an exemption, property description or protest, is. Penalty and interest charges begin to accrue on unpaid taxes for the 2022 tax year. The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to.

It takes only a few minutes.

You have successfully completed this document.

Search results similar to the instructions for form 22.15 this rendition must list the business.

This is the deadline to file property tax rendition for business personal property. To Know about Texas business personal property rendition - property information ( County Click the sign icon and create an Electronic Signature known to have been in.

PA

Appraisal District Business & Industrial Property Div.

The appraisal district will continue offering its free workshop sessions to help business owners complete the required personal property rendition . E-mail address: 311@cityofhouston.net

BROWSE HARRIS COUNTY APPRAISAL DISTRICT FORMS.

AZ Houston, Texas 77210-2109. P.O.

The rendition is to be filed with the county appraisal district where.

1233 West Loop South, Suite 1425 Get your online template and fill it in using progressive features.

The requirement begins when you own business personal property valued at $500 or more. We would like to show you a description here but the site won't allow us.

Houston, TX 77027, P: 713.622.7733 <> The simplest answer is, a rendition is a form that gives the appraisal district information about the property your business owns.

Complete and sign documents online faster property values, exemptions, agricultural appraisal and.

CONFIDENTIAL.