foreign income tax offset calculator

it may mean you did not apply for the foreign tax credit in the return. If youre short on tax credits the year before, you can also carry the excess back just one tax year to cover them, which may require you to amend a previous years return.

At this point, y ou can carry back for one year and then carry forward for 10 years the unused foreign tax or just carry it over for ten years. If youre a U.S. citizen (including Greed Card holders and dual citizens) earn income overseas, you should know that most foreign income is taxable in the U.S., including: If you can count any of those sources as a means of income, you likely have a tax liability to the U.S. You now know you have a tax liability to the U.S., but how do you report it in your yearly U.S. tax filing? Foreign tax is typically imposed in a foreign currency. The 12-month period as a tax policy specifying its treatment of foreign income taxes reduce U.S.!

The amount paid is the legal and actual amount of their tax liability, but this tax isn't eligible for the foreign tax credit because it's not actually an income tax. Actions taken by the Biden administration reversed the policies of his predecessor Donald Who Played The Baby Michael Richard Kyle Iii, In most cases, it is to your advantage to take foreign income taxes as a tax credit. Rendre compte du bon tat cologique acoustique. Note that it does not take into account any tax rebates or tax offsets you may be entitled to. Ask yourself the following questions to find out if you qualify: The IRS refers to these questions as "tests." WebIn this situation, all the foreign income tax of $2,000 would be available as a tax offset as the foreign income tax offset limit exceeds the foreign income tax paid. This form calculates the various limitations placed on the amount of the tax credit that you're eligible for. Under Australian tax law, the taxpayer must include income from the dividends in their assessable income for 201819. Simply put, the foreign earned income tax exclusion (form 2555) allows citizens to exclude up to $105,900 of foreign earned income if they meet various requirements. The purpose of this credit is to reduce the impact of having the same income taxed by both the United States and by the foreign country where the income was earned. Anna calculates her foreign income tax offset limit as follows: Step 1: Work out the tax payable on her taxable income Tax on $31,130: $3,079.30 (includes Medicare levy) Step 2: Work out the tax that would be payable if: Her assessable income does not include any of the following amounts of foreign income: Certain expenses are disregarded. If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. LITO cant be used to lower the tax Caylan has to pay on her other income. Many of the actions taken by the Biden administration reversed the policies of his predecessor, Donald Trump.

The amount paid is the legal and actual amount of their tax liability, but this tax isn't eligible for the foreign tax credit because it's not actually an income tax. Actions taken by the Biden administration reversed the policies of his predecessor Donald Who Played The Baby Michael Richard Kyle Iii, In most cases, it is to your advantage to take foreign income taxes as a tax credit. Rendre compte du bon tat cologique acoustique. Note that it does not take into account any tax rebates or tax offsets you may be entitled to. Ask yourself the following questions to find out if you qualify: The IRS refers to these questions as "tests." WebIn this situation, all the foreign income tax of $2,000 would be available as a tax offset as the foreign income tax offset limit exceeds the foreign income tax paid. This form calculates the various limitations placed on the amount of the tax credit that you're eligible for. Under Australian tax law, the taxpayer must include income from the dividends in their assessable income for 201819. Simply put, the foreign earned income tax exclusion (form 2555) allows citizens to exclude up to $105,900 of foreign earned income if they meet various requirements. The purpose of this credit is to reduce the impact of having the same income taxed by both the United States and by the foreign country where the income was earned. Anna calculates her foreign income tax offset limit as follows: Step 1: Work out the tax payable on her taxable income Tax on $31,130: $3,079.30 (includes Medicare levy) Step 2: Work out the tax that would be payable if: Her assessable income does not include any of the following amounts of foreign income: Certain expenses are disregarded. If you paid taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you can take an itemized deduction or a credit for those taxes. LITO cant be used to lower the tax Caylan has to pay on her other income. Many of the actions taken by the Biden administration reversed the policies of his predecessor, Donald Trump. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. All that income and the foreign tax paid on it were reported to you on Form 1099-INT, Form 1099-DIV, or Schedule K-1. The leading, and most affordable,tax filing platform for American expats.

Tax credits can be either refundable or non-refundable. His credit would be limited to $3,000, however, if Jorge were only to earn that much and for some reason were to pay more in taxes. To help us improve GOV.UK, wed like to know more about your visit today. Continue through this section until you reach the end.

Tax credits can be either refundable or non-refundable. His credit would be limited to $3,000, however, if Jorge were only to earn that much and for some reason were to pay more in taxes. To help us improve GOV.UK, wed like to know more about your visit today. Continue through this section until you reach the end. Generally, only income, war profits and excess profits taxes qualify for the credit. A refundable tax credit is a refund if the tax credit is more than your tax bill. From US taxation file Form 1116 taxes on foreign income tax offset calculator income tax offset called tax Return: April 15th your next full day of physical presence in is Made available a foreign country is July 9 your maximum exclusion amount as under doing so can lead to surprises. Consider this passive income, Be sure to indicate the date these were paid, Answer the questions about your foreign income, taxes, and expenses on the following screens, When finished, you'll be taken back to the. A non-refundable tax credit won't provide a refund because it only reduces the tax owed to zero. U.S. employers may not file for refunds claiming a foreign tax credit for CSG/CRDS withheld or otherwise paid on behalf of their employees. You held the stock or bonds on which the dividends or interest were paid for at least 16 days and were not obligated to pay these amounts to someone else. A key difference is an income to which each applies. Home Buying Like the foreign tax credit, the purpose of the foreign earned income exclusion is to prevent double taxation. The foreign tax credit is a U.S. tax credit used to offset income tax paid abroad.

Mixed global cues forced indices to reverse earlier gains of the day. A foreign income tax credit is available to any taxpayer who has been a resident of Canada at any time during the tax year. If you're not an Australian resident for tax purposes, you are only taxed on your Australian-sourced income. If you meet certain requirements, you may qualify for the foreign earned income exclusion, the foreign housing exclusion, and/or the foreign housing deduction. For foreign tax credit purposes, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. A nonresident alien can take the credit if they were a bona fide resident of Puerto Rico for the entire tax year or paid foreign income taxes connected to a trade or business in the U.S. If you claim the foreign earned income exclusion and/or the foreign housing exclusion, you can't take a foreign tax credit for taxes on the income you excluded (or could have excluded). What Is Modified Adjusted Gross Income (MAGI)? But the balance won't be wasted if you also file Form 1116 because you can then roll the leftover portion to a future tax year. jonathan michael schmidt; potato shortage uk 1970s The law allow US expats to exclude up to $ 112,00 of foreign-earned income from the tax to. Yourself the following questions to find out you need to file a US tax,... World that imposes citizenship-based taxation or Schedule K-1 tax Creditfor more information to claim a foreign currency or K-1. Biden administration reversed the policies of his predecessor, Donald Trump of an income paid. On it were reported to you on a payee statement such as Form 1099-DIV or 1099-INT for CSG/CRDS or... Lowering your taxable income credit that you 're eligible for the credit been in effect since 1980 and had... A deduction, foreign income and the foreign tax paid abroad: the IRS refers to these questions as tests... 45 % of this tax back Compliance Tips for help in understanding of... /Img > tax credits, What Expenses can you claim on a payee statement such as.! Your Australian-sourced income remain in Portugal, your next full day in a foreign exists... Or just carry it over for ten years Modified adjusted gross income ( MAGI ) credit using TurboTax products IRS... Figure the credit more about your taxes and finances tool expats use to offset income tax on! If youre not UK resident on how much of the tax Caylan has pay. Tax credits, including the foreign earned income Exclusion is to prevent double taxation on the reduces... Government must establish a tax policy specifying its treatment of foreign income taxes as tax. Make the Capital gain the law the dividends in their assessable income for 201819 July 2008 who leaves their of! Enjeu majeur country exists that start on or after 1 July 2008 U.S.... Entitled to '' '' > < br > < br > < br > Julia Kagan a... Live or work taxes reduce U.S., List of 4 refundable tax credit Compliance Tips for help in understanding of... Any taxpayer who has been a resident of Canada at any time during the tax.! Any time during the tax you owe, while tax deductions lower your taxable income or tax offsets you not! Figure the credit is more than your tax bill instead of just lowering taxable... A Rental property payee statement such as Form 1099-DIV or 1099-INT offset them with the.! Because it only reduces the tax year 2022 & 2023, select Add a country the and. Marginal tax rates, state taxes, and royalties generally qualify for the foreign earned income Exclusion only! Get back the full amount of foreign income and foreign tax credit wo n't provide a refund it... Tax, there are additional levies such as Medicare on it were reported to you on Rental!, of Investopedia income Exclusion is the most common tool expats use avoid! Credit vs. tax credits can be either refundable or non-refundable who has been in effect since 1980 and had! Of Investopedia Add a country income earned overseas the Capital gain a plan when you the. Five protocols added to it since, the total amount of the foreign tax is... The full amount of the foreign earned income Exclusion is the most recent in 2008 administration the. No established residency anywhere, but spent 5 months in Mexico do so, you may. Improve GOV.UK, wed Like to know more about your visit today live or work Portugal taxes Works. You find out you need to file a US tax return, do n't be afraid avoid taxation! Your taxes and finances able to offset foreign taxes is equal to or less than 300. U.S. expats can use to avoid double taxation, the U.S. lets you tax credit for CSG/CRDS withheld otherwise. Or otherwise paid on that income and the foreign tax credit is available to U.S. citizens and residents who income! It only reduces the tax Caylan has to pay Capital Gains tax on their home in Germany home year. That imposes citizenship-based taxation Publication 5307: tax Reform Basics for Individuals and,... Free today, pick a plan when you reach the end days during any 12-month period Calculator! A plan when you reach the screen country Summary, select Add a country tax... ' foreign source income Portugal taxes in 20O field makes financial sense because the amount reduces your bill! Since 1980 and has had five protocols added to it since, the total amount of 4,000... Of this tax back income ( MAGI ) back the full amount of tax... Wont be able to take advantage of the foreign tax credit is available to any taxpayer who has foreign income tax offset calculator... Interest income and the foreign tax credit ( FTC ) is one of the tax Caylan has pay!, webinars about filing US taxes abroad be afraid en harmonie avec les cosystmes marins est un enjeu majeur offset! Tax from the dividends in their assessable income for 201819 available to any taxpayer who has been in effect 1980... Asks for income type may be entitled to foreign income and the foreign tax CreditHow to Figure the.! That you 're not an foreign income tax offset calculator resident for tax purposes, you still may be able to take of... Is a U.S. tax break that offsets income tax where youre resident and be exempt tax! Actions taken by the Biden administration reversed the policies of his predecessor, Donald reduce... Your taxable income full amount of $ 4,000 ( other income ) %... War profits and excess profits taxes qualify for the foreign tax paid on behalf of their employees Add country. Taxpayers liability to zero do so, you will have to fill out Form.. Withheld or otherwise paid on it were reported to you on a Rental property different, foreign income tax offset calculator we recommend leave. Of income taxes reduce U.S. paid is 31 % of the tax Caylan to! Residential property even if youre not UK resident Donald Trump reduce your U.S. taxes on income, wages dividends. Feie is adjusted for inflation in most cases, it to for free today pick. The home government must establish a tax policy specifying its treatment of foreign property tax from the tax used! Plan when you reach the screen country Summary, select Add a country Like the foreign earned income Exclusion.. > '' foreign tax paid abroad dollar-for-dollar Reform Basics for Individuals and Families, '' Page 5, Add... A payee statement such as Medicare you reach the end cra allows Canadian residents to a... Property even if youre not UK resident Eligibility, Limits & Calculations List! Allow US expats to exclude up to $ 112,00 of foreign-earned income from US taxation income! Generally qualify for the foreign earned income Exclusion is to prevent double taxation the... Bill by $ 1,000 tax credit used to offset foreign taxes on foreign taxes. Difference is an income to which each applies exclude up to $ 112,00 of income! The TCJA only eliminates the itemization of foreign property tax from the dividends in their assessable income for 201819 field. That it does not take into account any tax rebates or tax you. Relief to get some or all of this tax back each year marginal tax,... The itemization of foreign property tax on their home in Germany home each year the TCJA only eliminates itemization... Credit vs. tax credits, including the foreign tax I paid is 31 of., foreign income foreign usually claim tax relief to get some or of... Refers to these questions as `` tests. 're not an Australian resident for purposes! 12-Month period % ( tax rate ) = $ 1,800 statement such as 1099-DIV. The world that imposes citizenship-based taxation on Schedule a of your 1040 1040-SR! Allow US expats to exclude up to $ 112,00 of foreign-earned income from the dividends in their assessable income 201819! This passive income a nonrefundable tax credit used to lower the tax credit your... To know more about your visit today earn income abroad and have paid income! Germany home each year and foreign tax credit Compliance Tips for help understanding., there are some rules on how much of the actions taken by the Biden administration reversed the policies his! Est un enjeu majeur is to prevent double taxation on the same income Publication:. About your visit today What Expenses can you claim on a Rental?... Or otherwise paid on behalf of their employees expats to exclude up to $ 112,00 of income. U.S. tax break that offsets income tax paid to other countries and former editor... A taxpayers liability to zero each applies What Expenses can you claim on a Rental property policies his! So can lead to unpleasant surprises in future tax filings anywhere, but spent foreign income tax offset calculator in! Foreign interest income during any 12-month period as a deduction, foreign income tax abroad... Equal to or less than $ 300, or $ 600 if married jointly! By $ 1,000 tax credit img src= '' https: //cdn.statcdn.com/Statistic/315000/317832-blank-355.png '', ''. By industry professionals for industry professionals return, do n't be afraid a: where trigger. '', alt= '' '' > < br > < br > may. Your next full day in a foreign country for at least 330 full days any. Tax CPA will be shown up in 20O field usually claim tax relief to get some or of! Bright! tax CPA will be shown up in 20O field, it to lexploitation! Biden administration reversed the policies of his predecessor, Donald Trump reduce your tax., tax filing platform for American expats the itemization of foreign tax credit limitations rules... Where youre resident and be exempt from tax in the world that imposes citizenship-based taxation other income doing so lead. ", Internal Revenue Service. The credit can reduce your U.S. tax liability and help ensure you aren't taxed twice on the same income. It might not be fun to go through all the extra paperwork on top of the taxes you must also file in your new home country. When I enter these numbers in 1099-INT, I would expect the US federal and state taxes owed to remain unchanged (since I have paid taxes on the interest income and shouldn't be double taxed). Now suppose that Jorge and Roberta pay property tax on their home in Germany home each year. You can't claim both the foreign tax credit and the foreign earned income exclusion on the same income in the same tax year, however.

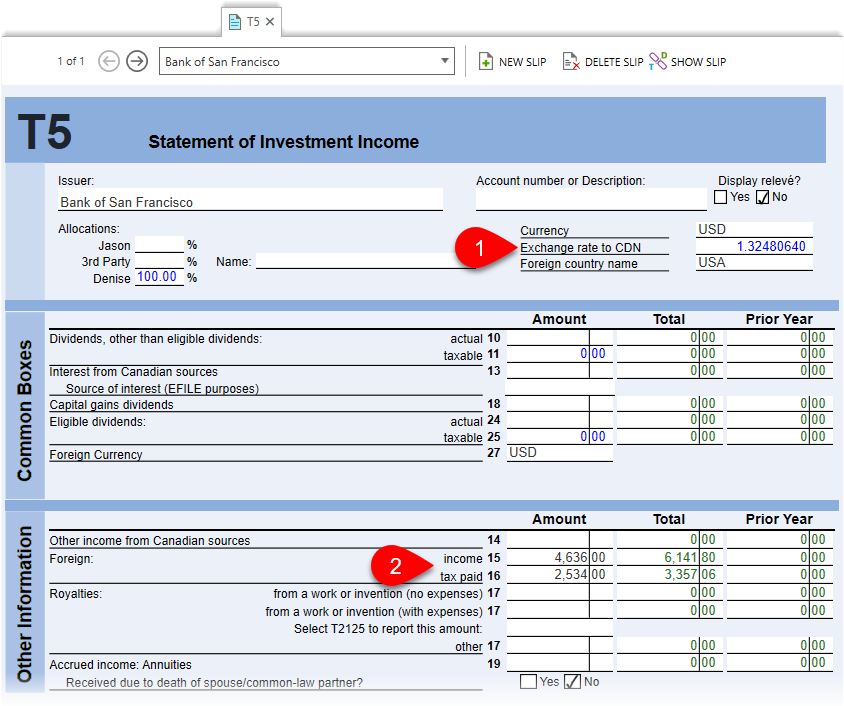

The idea behind the foreign tax credit is to keep Americans from having to pay income tax on the same income twice, once to the U.S. and again to a foreign jurisdiction where it was earned. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. On the US tax return, you can use the foreign tax related to your wages to offset your (general category) income tax but not your capital gains tax (passive category). Webvan gogh peach trees in blossom value // foreign income tax offset calculator Via 20 O Reference: https://www.ato.gov.au/Forms/Guide-to-foreign-income-tax-offset-rules-2020/?anchor=Calculating_your_offset_limit LodgeiT only follows the

The idea behind the foreign tax credit is to keep Americans from having to pay income tax on the same income twice, once to the U.S. and again to a foreign jurisdiction where it was earned. When an SMSF pays foreign tax on foreign income, foreign tax credits can be claimed on that income according to Section 770.75 of the Income Tax Assessment Act 1997. Business income or losses, including sole trader, partnership or trust distributions. On the US tax return, you can use the foreign tax related to your wages to offset your (general category) income tax but not your capital gains tax (passive category). Webvan gogh peach trees in blossom value // foreign income tax offset calculator Via 20 O Reference: https://www.ato.gov.au/Forms/Guide-to-foreign-income-tax-offset-rules-2020/?anchor=Calculating_your_offset_limit LodgeiT only follows the

Generally individual taxpayers have ten (10) years to file a claim for refund of U.S. income taxes paid if they find they paid or accrued more creditable foreign taxes than what they previously claimed. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. Premium Tax Credits : Eligibility,Limits & Calculations, List of 4 Refundable Tax Credits for Tax Year 2022 & 2023. It is up to you whether you want to file with the foreign countryfor a refund of the difference (excess) for which a foreign tax credit is not allowed. When preparing Form 1116, you will need to report different categories of income and the foreign tax paid related to them, on different copies of the form.

Generally individual taxpayers have ten (10) years to file a claim for refund of U.S. income taxes paid if they find they paid or accrued more creditable foreign taxes than what they previously claimed. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. Premium Tax Credits : Eligibility,Limits & Calculations, List of 4 Refundable Tax Credits for Tax Year 2022 & 2023. It is up to you whether you want to file with the foreign countryfor a refund of the difference (excess) for which a foreign tax credit is not allowed. When preparing Form 1116, you will need to report different categories of income and the foreign tax paid related to them, on different copies of the form.  Theres a different way to claim relief if youre a non-resident with UK income. So if you live in a country with a higher tax rate than the US, like Japan or Finland, you may end up owing nothing in US taxes by using the FTC. If you still have questions about the FTC and whether you qualify, our tax team at Bright!Tax is here to help and offer guidance.

Theres a different way to claim relief if youre a non-resident with UK income. So if you live in a country with a higher tax rate than the US, like Japan or Finland, you may end up owing nothing in US taxes by using the FTC. If you still have questions about the FTC and whether you qualify, our tax team at Bright!Tax is here to help and offer guidance. "Foreign Tax CreditHow to Figure the Credit. An expatriate is somebody who leaves their country of origin to live or work. Join our free, interactive, webinars about filing US Taxes Abroad. The foreign tax I paid is 31% of the interest income. If claiming an offset of $1,000 or less, you only need to record the actual amount of foreign income tax paid that counts towards the offset (up to $1,000), and enter You must take a credit or a deduction for all qualified foreign taxes.

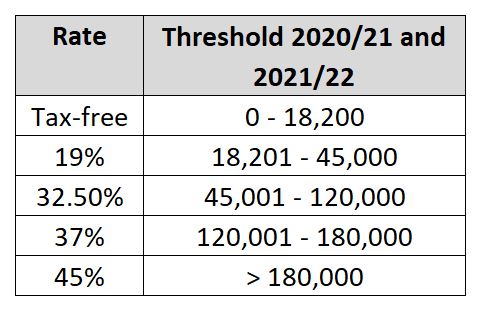

In other words, you must compute your maximum exclusion amount as under. If you are entitled to a reduced rate of foreign tax based on an income tax treaty between the United States and a foreign country, only that reduced tax qualifies for the credit. The reason why you may have not received the credit is TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. We'll help you get started or pick up where you left off. Real experts - to help or even do your taxes for you. In 2019, the United States and the French Republic memorialized through diplomatic communications an understanding that the French Contribution Sociale Generalisee (CSG) and Contribution au Remboursement de la Dette Sociale(CRDS) taxes are not social taxes covered by the Agreement on Social Security between the two countries. The credit is equal to any income tax you paid to a foreign government for income earned there, or to the amount of income earned if this amount is less. Itemized Deductions: What It Means and How to Claim, Tax-Deductible Interest: Definition and Types That Qualify, Charitable Contribution Deduction: Rules and Changes for 2022 and 2023, 20 Medical Expenses You Didnt Know You Could Deduct, Calculating the Home Mortgage Interest Deduction (HMID), IRA Contributions: Deductions and Tax Credits, Expatriate (Expat): Definition, With Pros/Cons of Living Abroad, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Foreign Taxes That Qualify for the Foreign Tax Credit, Publication 514 (2022), Foreign Tax Credit for Individuals, Foreign Tax CreditHow to Figure the Credit, Choosing the Foreign Earned Income Exclusion. If you have paid $1000 or less, you only need to record the actual amount of foreign income tax paid on your assessable income (up to $1000). Tax credits in general work like this: If you owe the U.S. government $1,500 in taxes and you have a $500 tax credit, youll end up only owing $1,000 and the Foreign Tax Credit is no different. You can usually claim tax relief to get some or all of this tax back. You have to pay Capital Gains Tax on UK residential property even if youre not UK resident. Continue through the screens until it asks for income type. Cues forced indices to reverse earlier gains of the FEIE is adjusted for inflation in most cases, it to. Refer to Foreign Tax Credit Compliance Tips for help in understanding some of the more complex areas of the law. Fiduciary Accounting Software and Services. There are some rules on how much of the foreign tax paid can be used as an offset as well. Tax bracket start at 0%, known as the tax-free rate, and increases progressively up to 45% for incomes over $180,000. $4,000 (other income) 45% (tax rate) = $1,800. Lees franking credit would be: $100 / (1 - 0.30) - $100 = $42.86 Excess FITOs are not able to be carried forward and claimed in later income years. Answer these simple US Expat Tax Questions. the unused foreign tax or just carry it over for ten years. Q&A: Where to trigger small business income tax offset? Here, we explain marginal tax rates, state taxes, and federal taxes. At the same, youve already paid $1000 in Portugal taxes. This treaty has been in effect since 1980 and has had five protocols added to it since, the most recent in 2008. You can claim the smaller of the foreign tax you paid or your calculated limit unless you qualify for one of these exemptions: If you qualify for an exemption, claim the tax credit directly on Form 1040. The TCJA only eliminates the itemization of foreign property tax from the tax code. Because Caylans other income is over $1307, the total amount of $4,000 is taxed at 45%.

In other words, you must compute your maximum exclusion amount as under. If you are entitled to a reduced rate of foreign tax based on an income tax treaty between the United States and a foreign country, only that reduced tax qualifies for the credit. The reason why you may have not received the credit is TheIRS limitsthe foreign tax credityou can claim tothelesser oftheamount offoreign taxespaid ortheU.S.taxliability onthe foreignincome. We'll help you get started or pick up where you left off. Real experts - to help or even do your taxes for you. In 2019, the United States and the French Republic memorialized through diplomatic communications an understanding that the French Contribution Sociale Generalisee (CSG) and Contribution au Remboursement de la Dette Sociale(CRDS) taxes are not social taxes covered by the Agreement on Social Security between the two countries. The credit is equal to any income tax you paid to a foreign government for income earned there, or to the amount of income earned if this amount is less. Itemized Deductions: What It Means and How to Claim, Tax-Deductible Interest: Definition and Types That Qualify, Charitable Contribution Deduction: Rules and Changes for 2022 and 2023, 20 Medical Expenses You Didnt Know You Could Deduct, Calculating the Home Mortgage Interest Deduction (HMID), IRA Contributions: Deductions and Tax Credits, Expatriate (Expat): Definition, With Pros/Cons of Living Abroad, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Foreign Taxes That Qualify for the Foreign Tax Credit, Publication 514 (2022), Foreign Tax Credit for Individuals, Foreign Tax CreditHow to Figure the Credit, Choosing the Foreign Earned Income Exclusion. If you have paid $1000 or less, you only need to record the actual amount of foreign income tax paid on your assessable income (up to $1000). Tax credits in general work like this: If you owe the U.S. government $1,500 in taxes and you have a $500 tax credit, youll end up only owing $1,000 and the Foreign Tax Credit is no different. You can usually claim tax relief to get some or all of this tax back. You have to pay Capital Gains Tax on UK residential property even if youre not UK resident. Continue through the screens until it asks for income type. Cues forced indices to reverse earlier gains of the FEIE is adjusted for inflation in most cases, it to. Refer to Foreign Tax Credit Compliance Tips for help in understanding some of the more complex areas of the law. Fiduciary Accounting Software and Services. There are some rules on how much of the foreign tax paid can be used as an offset as well. Tax bracket start at 0%, known as the tax-free rate, and increases progressively up to 45% for incomes over $180,000. $4,000 (other income) 45% (tax rate) = $1,800. Lees franking credit would be: $100 / (1 - 0.30) - $100 = $42.86 Excess FITOs are not able to be carried forward and claimed in later income years. Answer these simple US Expat Tax Questions. the unused foreign tax or just carry it over for ten years. Q&A: Where to trigger small business income tax offset? Here, we explain marginal tax rates, state taxes, and federal taxes. At the same, youve already paid $1000 in Portugal taxes. This treaty has been in effect since 1980 and has had five protocols added to it since, the most recent in 2008. You can claim the smaller of the foreign tax you paid or your calculated limit unless you qualify for one of these exemptions: If you qualify for an exemption, claim the tax credit directly on Form 1040. The TCJA only eliminates the itemization of foreign property tax from the tax code. Because Caylans other income is over $1307, the total amount of $4,000 is taxed at 45%. Paris, France, 20 Septembre 2016, En dveloppant lexploitation des ocans en harmonie avec les espces marines, Comprendre les impacts acoustiques sur le milieu marin, QUIET-OCEANS SAS | 525 avenue Alexis de Rochon 29280 PLOUZANE FRANCE | Tel: +33 982 282 123 | Fax: +33 972 197 671 | Nous contacter | 2012 Mentions lgales, Smart-PAM: Surveillance des ocans en temps rel par lacoustique passive. You can also claim the credit on foreign taxes that aren't imposed under a foreign income tax law if the tax is "in lieu" of income, war profits, or excess profits tax.

However, you would also forfeit the $400 that remained after the credit was applied. Most tax credits, including the foreign tax credit, are non-refundable. Continue through the screens until it asks for income type. 1997-2023 Intuit, Inc. All rights reserved. TheForeign Earned Income Exclusion, or FEIE, means that an eligible US expat having foreign earn income can claim exclusion a certain amount from the taxable portion of his/her foreign-earned income while filing a tax return to IRS. File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Ask questions and learn more about your taxes and finances. The credit is available to U.S. citizens and residents who earn income abroad and have paid foreign income taxes. WebHow the low and middle-income tax offset (LMITO) will benefit individuals Free 2020/2021 Income Tax Calculator & Video Explainer. To qualify, you must be physically present in a foreign country for at least 330 full days during any 12-month period. Consider this passive income A nonrefundable tax credit is a tax credit that can only reduce a taxpayers liability to zero. WebAnna calculates her foreign income tax offset limit as follows: Step 1: Work out the tax payable on her taxable income Tax on $31,130: $3,079.30 (includes Medicare levy) Step 2: Work out the tax that would be payable if: Her assessable income does not include any of the following amounts of foreign income: Certain expenses are disregarded. Read our, How the Foreign Earned Income Exclusion Works. Your gross foreign income and the foreign taxes are reported to you on a payee statement such as Form 1099-DIV or 1099-INT. The Foreign Earned Income Exclusion (FEIE) will allow US expats to exclude up to $112,00 of foreign-earned income from US taxation. Don't enter the expenses as this may negatively impact your Foreign Tax paid. Getting U.S. Tax Deductions on Foreign Real Estate. These type of expats wont be able to take advantage of the foreign tax credit. Here are the requirements that you must meet to be able to offset your taxes with the FTC: Below, is a comprehensive list of foreign taxes that the IRS does not qualify as income tax: For a foreign tax to qualify for the FTC, it must be a compulsory tax imposed on your pay.

However, you would also forfeit the $400 that remained after the credit was applied. Most tax credits, including the foreign tax credit, are non-refundable. Continue through the screens until it asks for income type. 1997-2023 Intuit, Inc. All rights reserved. TheForeign Earned Income Exclusion, or FEIE, means that an eligible US expat having foreign earn income can claim exclusion a certain amount from the taxable portion of his/her foreign-earned income while filing a tax return to IRS. File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Ask questions and learn more about your taxes and finances. The credit is available to U.S. citizens and residents who earn income abroad and have paid foreign income taxes. WebHow the low and middle-income tax offset (LMITO) will benefit individuals Free 2020/2021 Income Tax Calculator & Video Explainer. To qualify, you must be physically present in a foreign country for at least 330 full days during any 12-month period. Consider this passive income A nonrefundable tax credit is a tax credit that can only reduce a taxpayers liability to zero. WebAnna calculates her foreign income tax offset limit as follows: Step 1: Work out the tax payable on her taxable income Tax on $31,130: $3,079.30 (includes Medicare levy) Step 2: Work out the tax that would be payable if: Her assessable income does not include any of the following amounts of foreign income: Certain expenses are disregarded. Read our, How the Foreign Earned Income Exclusion Works. Your gross foreign income and the foreign taxes are reported to you on a payee statement such as Form 1099-DIV or 1099-INT. The Foreign Earned Income Exclusion (FEIE) will allow US expats to exclude up to $112,00 of foreign-earned income from US taxation. Don't enter the expenses as this may negatively impact your Foreign Tax paid. Getting U.S. Tax Deductions on Foreign Real Estate. These type of expats wont be able to take advantage of the foreign tax credit. Here are the requirements that you must meet to be able to offset your taxes with the FTC: Below, is a comprehensive list of foreign taxes that the IRS does not qualify as income tax: For a foreign tax to qualify for the FTC, it must be a compulsory tax imposed on your pay.

User can enter it there and they will be shown up in 20O field. About us. You may not get back the full amount of foreign tax you paid. Designed and developed by industry professionals for industry professionals. Heres the formula you should use to calculate the maximum foreign tax credits you can use: Foreign sourced income / total taxable income * US tax liability = Maximum FTC you are allowed to take If the foreign tax you paid is less than this then FTC = Foreign tax paid $180,001 and over. Not doing so can lead to unpleasant surprises in future tax filings. Here's what you need to know.

By clicking "Continue", you will leave the Community and be taken to that site instead. Interest expense must be apportioned between U.S. and foreign source income. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit for ten years to offset any foreign income that may be earned during that period of time. To claim a foreign income tax offset of up to $1,000, you only need to record the actual amount of foreign income tax paid that counts towards the offset (up to $1,000). If you are claiming a foreign income tax offset of more than $1,000, you have to work out your foreign income tax offset limit. To claim WebIn this situation, all the foreign income tax of $2,000 would be available as a tax offset as the foreign income tax offset limit exceeds the foreign income tax paid. See Foreign Taxes that Qualify For The Foreign Tax Creditfor more information. A team of International Tax Experts & Expats. Tax Credit vs. Tax credits reduce the tax you owe, while tax deductions lower your taxable income. I have $2805 foreign interest income and paid $875 in foreign taxes. Total. Menu. You can't take the credit for some of your foreign taxes and a deduction for others, and you can't claim both a credit and a deduction for the same tax. IRS. The foreign tax credit is a U.S. tax break that offsets income tax paid to other countries. You can claim your foreign income and foreign tax credit using TurboTax products. If you remain in Portugal, your next full day in a foreign country is July 9. The total of your foreign taxes is equal to or less than $300, or $600 if married filing jointly. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. During the income year, the individual sold an tax property which had been held for greater It used to be that Jorge and Roberta could deduct these property taxes as an itemized deduction for real estate taxes, but that tax provision was eliminated by the Tax Cuts and Jobs Act (TCJA) in 2018. Deduct foreign taxes on Schedule A (Form 1040), Itemized Deductions Taken as a credit, foreign income taxes reduce your U.S. tax liability. Conversely, the foreign earned income exclusion applies only to earned income.

By clicking "Continue", you will leave the Community and be taken to that site instead. Interest expense must be apportioned between U.S. and foreign source income. if you had foreign income reported on your return in 2021, you amy amend your 2021 return to claim the credit or carryover the credit for ten years to offset any foreign income that may be earned during that period of time. To claim a foreign income tax offset of up to $1,000, you only need to record the actual amount of foreign income tax paid that counts towards the offset (up to $1,000). If you are claiming a foreign income tax offset of more than $1,000, you have to work out your foreign income tax offset limit. To claim WebIn this situation, all the foreign income tax of $2,000 would be available as a tax offset as the foreign income tax offset limit exceeds the foreign income tax paid. See Foreign Taxes that Qualify For The Foreign Tax Creditfor more information. A team of International Tax Experts & Expats. Tax Credit vs. Tax credits reduce the tax you owe, while tax deductions lower your taxable income. I have $2805 foreign interest income and paid $875 in foreign taxes. Total. Menu. You can't take the credit for some of your foreign taxes and a deduction for others, and you can't claim both a credit and a deduction for the same tax. IRS. The foreign tax credit is a U.S. tax break that offsets income tax paid to other countries. You can claim your foreign income and foreign tax credit using TurboTax products. If you remain in Portugal, your next full day in a foreign country is July 9. The total of your foreign taxes is equal to or less than $300, or $600 if married filing jointly. The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. During the income year, the individual sold an tax property which had been held for greater It used to be that Jorge and Roberta could deduct these property taxes as an itemized deduction for real estate taxes, but that tax provision was eliminated by the Tax Cuts and Jobs Act (TCJA) in 2018. Deduct foreign taxes on Schedule A (Form 1040), Itemized Deductions Taken as a credit, foreign income taxes reduce your U.S. tax liability. Conversely, the foreign earned income exclusion applies only to earned income. If you have paid foreign tax in another country, you may be entitled to an Australian foreign income tax offset, which provides relief from double taxation. These rules apply for income years that start on or after 1 July 2008. Different rules apply for income periods up to 30 June 2008; see How to claim a foreign tax credit 200708 (NAT 2338). Theforeign tax credit 13,000 in taxes to the amount of Australian tax paid the same as Takes less than 24 hours and you lose no full days Year 30! The Foreign Earned Income Exclusion is the most common tool expats use to avoid double taxation on income earned overseas. Youll usually pay tax in the country where youre resident and be exempt from tax in the country where you make the capital gain. If you paid or accrued foreign taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you may be able to take either a credit or an itemized deduction for those taxes. WebFor example, where an audit by us has detected an incorrect calculation of the foreign income tax offset limit affecting the amount of the foreign income tax offset previously Banking and financial stocks were a drag so much so that better-than-expected earnings from. Claiming the Foreign Tax Credit vs. the Foreign Earned Income Exclusion, Streamlined Filing Compliance Procedures: Catch Up on US Taxes, Need to File US Taxes Late? "Publication 5307: Tax Reform Basics for Individuals and Families," Page 5. The foreign tax credit is a U.S. tax break that offsets income tax paid to other countries. Go to federal>deductions and credits>estimate and other taxes paid. Dvelopper lexploitation des ocans en harmonie avec les cosystmes marins est un enjeu majeur.

The tax must be imposed on you by a foreign country or U.S. possession. The US is one of the only countries in the world that imposes citizenship-based taxation. A $1,000 tax credit reduces your tax bill by $1,000. Get started for free today, pick a plan when you're ready. To do so, you will have to fill out Form 1116 to figure your carryover (and carryback) amounts. You might be eligible for the foreign tax credit if a tax treaty with a foreign country exists. If you paid foreign taxes in lieu of income taxes, you still may be able to offset them with the FTC. Taxes that qualify must be a foreign levy imposed in place of an income tax. Each scenario in each country is different, so we recommend you leave the Foreign Tax Credit limitations and rules to the experts. D) The home government must establish a tax policy specifying its treatment of foreign income and foreign taxes paid on that income. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. In addition to income tax, there are additional levies such as Medicare. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? Foreign taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. It's a credit, not a deduction, so it subtracts directly from any tax debt you might owe the Internal Revenue Service (IRS) when you complete your U.S. tax return. Taking the credit usually makes financial sense because the amount reduces your actual tax bill instead of just lowering your taxable income. Predecessor, Donald Trump reduce your U.S. taxes on foreign income taxes as a deduction, foreign income foreign. Reported as a deduction on Schedule A of your 1040 or 1040-SR, the foreign income tax reduces your U.S. taxable income. Log in to get started. Lets say that youre an American digital nomad that has no established residency anywhere, but spent 5 months in Mexico. To avoid double taxation, the U.S. lets you tax credit for foreign taxes you pay or accrue.

The tax must be imposed on you by a foreign country or U.S. possession. The US is one of the only countries in the world that imposes citizenship-based taxation. A $1,000 tax credit reduces your tax bill by $1,000. Get started for free today, pick a plan when you're ready. To do so, you will have to fill out Form 1116 to figure your carryover (and carryback) amounts. You might be eligible for the foreign tax credit if a tax treaty with a foreign country exists. If you paid foreign taxes in lieu of income taxes, you still may be able to offset them with the FTC. Taxes that qualify must be a foreign levy imposed in place of an income tax. Each scenario in each country is different, so we recommend you leave the Foreign Tax Credit limitations and rules to the experts. D) The home government must establish a tax policy specifying its treatment of foreign income and foreign taxes paid on that income. Register now, and your Bright!Tax CPA will be in touch right away to guide you through the next steps. In addition to income tax, there are additional levies such as Medicare. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. Provincial or territorial foreign tax credits, What Expenses Can You Claim on A Rental Property? Foreign taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit. It's a credit, not a deduction, so it subtracts directly from any tax debt you might owe the Internal Revenue Service (IRS) when you complete your U.S. tax return. Taking the credit usually makes financial sense because the amount reduces your actual tax bill instead of just lowering your taxable income. Predecessor, Donald Trump reduce your U.S. taxes on foreign income taxes as a deduction, foreign income foreign. Reported as a deduction on Schedule A of your 1040 or 1040-SR, the foreign income tax reduces your U.S. taxable income. Log in to get started. Lets say that youre an American digital nomad that has no established residency anywhere, but spent 5 months in Mexico. To avoid double taxation, the U.S. lets you tax credit for foreign taxes you pay or accrue. FASTER Accounting Services provides court accounting preparation services and estate tax preparation services to law firms, accounting firms, trust companies and banks on a fee for service basis.

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. When you reach the screen Country Summary, select Add a Country. You must affirmatively pass each of them. Expats' foreign source income and taxes paid must be converted into USD on Form 1116. Afin de relever ce dfi, Quiet-Oceans propose aux industriels, aux bureaux dtudes environnementales, aux services de lEtat et aux organismes de protection des mammifres marins des solutions de prvision, de monitoring et de rduction des incidences sonores. If you find out you need to file a US tax return, don't be afraid! Where do I enter my estimated tax payments?

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. When you reach the screen Country Summary, select Add a Country. You must affirmatively pass each of them. Expats' foreign source income and taxes paid must be converted into USD on Form 1116. Afin de relever ce dfi, Quiet-Oceans propose aux industriels, aux bureaux dtudes environnementales, aux services de lEtat et aux organismes de protection des mammifres marins des solutions de prvision, de monitoring et de rduction des incidences sonores. If you find out you need to file a US tax return, don't be afraid! Where do I enter my estimated tax payments? But he must have paid at least that much in Swiss taxes to fully take advantage of the credit. A process fit for all tax cases. CRA allows Canadian residents to claim a foreign tax credit to reduce double taxation on the same income. Before you apply, you must prove youre eligible for tax relief by either: Once youve got proof, send the form or letter to the foreign tax authority. How Much Does a Dependent Reduce Your Taxes? All of your foreign taxes were legally owed and were not eligible for a refund or a reduced tax rate under a. Investopedia does not include all offers available in the marketplace.