apple fixed and variable costs

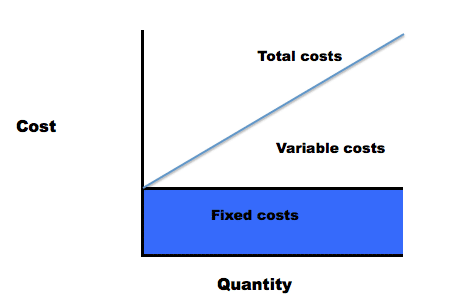

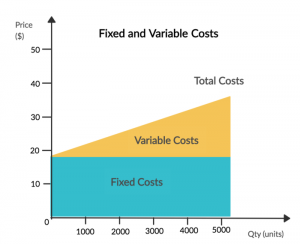

We will be looking at the macroeconomic variables that impact Apples business as well as how the current developments in the industry have impacted Apples financials and we will also look at how Apple competes with other firms in the same industry. Do you run a small business and need professional help to organise your books? Variable costs arent as easy to prune as fixed costs because they fluctuate, but its not impossible. You might be wondering how fixed and variable costs can be used to save you money. Please review them carefully. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. The first illustration below shows an example of variable costs, where costs increase directly with the number of units produced. Bottom line: You should aim to decrease all costs, across the board. Keep in mind that fixed costs may not be consistent in the long run. And then came the iPhone. The COGM is then transferred to the finished goods inventory account and used in calculating the Cost of Goods Sold (COGS) on the income statement. year.  When you look at your small businesss financial statements, there are likely a number of expenses on there. I'd be surprised if anyone taking AP Micro didn't know how to graph at this level. Loan repayments are determined at the time the loan is paid down. She is a FINRA Series 7, 63, and 66 license holder. Lowering your fixed and variable costs increases your profits. Web Variable cost is an upward-sloping straight line. An example of a semi-variable cost can be the electricity bill for your business. To determine the fixed cost per unit, divide the total fixed cost by the number of units for sale. per month with QuickBooks. The most effective approach is to try and reduce both, without obsessing over one or another. This can be accomplished by following these tried-and-true budgeting tips. The high costs of Apples products are the one of the reasons why Apple Inc. preferred to be. One of the most popular methods is classification according to fixed costs and variable costs. Play Store, Apple App Store reviews last updated on 23/08/22. If a business grows, so will its expenses such as utility bills for electricity, gas, or water. (The high-low method using direct labor hours as the independent variable was used to determine the fixed and variable costs.) Depreciation will markedly increase with expansion.

When you look at your small businesss financial statements, there are likely a number of expenses on there. I'd be surprised if anyone taking AP Micro didn't know how to graph at this level. Loan repayments are determined at the time the loan is paid down. She is a FINRA Series 7, 63, and 66 license holder. Lowering your fixed and variable costs increases your profits. Web Variable cost is an upward-sloping straight line. An example of a semi-variable cost can be the electricity bill for your business. To determine the fixed cost per unit, divide the total fixed cost by the number of units for sale. per month with QuickBooks. The most effective approach is to try and reduce both, without obsessing over one or another. This can be accomplished by following these tried-and-true budgeting tips. The high costs of Apples products are the one of the reasons why Apple Inc. preferred to be. One of the most popular methods is classification according to fixed costs and variable costs. Play Store, Apple App Store reviews last updated on 23/08/22. If a business grows, so will its expenses such as utility bills for electricity, gas, or water. (The high-low method using direct labor hours as the independent variable was used to determine the fixed and variable costs.) Depreciation will markedly increase with expansion.

promotion or offers. and keeping your budget in check are both intimidating tasks. 2(a). List of Excel Shortcuts Variable costs play an integral role in break-even analysis. The law of large numbers, in math, is a statistical model which holds that as the number of times an experiment is repeated (or sample population increases), the average of the results will revert back to the mean. Apple's iPhone profits = (The profit derived from each iPhone sold x sales volume) - fixed costs. For others, it may be the other way around. But fixed costs are harder to reduce So which is better? The explanation Sal provided regarding the meaning of the curves and their interrelationship, however, was very good. Whether Apple can continue to deliver outstanding quarterly earnings result is a valid question, but that analysis should focus on marketshare, margins, new products, new revenue streams, increased competition - all of these are much more relevant to an analysis concerning Apple's future financial prospects. Understanding the difference between fixed and variable costs can help a business owner identify economies of scale, which occur when a business makes cost reductions as it increases its level of production. Webseparates costs into their fixed and variable components can assist with management decision making a contribution margin income statement step-variable costs step-______ costs have a fairly narrow range and rise in multiple steps across the relevant range variable cost per unit of activity & slope of the line "Calculate Your Break-Even Point.". And no matter how many clients your home-based acupuncture clinic attracts, you still need to pay property taxes. kilograms of wood, tons of cement), Cost of shipping finished goods to customers, Electricity used in manufacturing furniture. V the variable cost per unit; F the fixed costs; Example. After all, Apple's growth - as illustrated above - has been absolutely off the charts.

Payroll services are offered by a third-party, Webscale Pty Ltd (and its

The lower your total variable cost, the less it costs you to provide your product or service. Put simply, fixed costs remain constant no matter if Apple sells100 iPhones or 100 million iPhones. But the key aspect of fixed costs is that regardless of how many iPhones it chooses to manufacture, Apple cannot alter those costs very much over the course of the initial phases of production. Factors which affect fixed costs include the availability of outsourcing, which Apple has famously (some would say infamously) capitalized Get Access QuickBooks Online and QuickBooks But in doing so, they completely miss the point and ignore the variables that actually matter. we produce more and more, our average variable cost should go down, and we see that happening Not applicable to QuickBooks Self * KeyPay was voted the leading payroll solution for SMBs <50 employees (Australian So 58 is right about there, and then it's gonna be 231, so it's about, right about there. For Advanced Payroll, there is an additional monthly subscription fee of $10 (incl GST). Its a sure thing!. But as is typically the case, Apple is poised to buck this trend longer than most people realize. : Please find the terms of What we're going to do in this video is take this information, | Use this information for questions that refer to the World Tennis Ball (WTB) Company case. can help you maximise how much people are willing to pay.

First thirty (30) days of AppleInsider this past JunehighlightedApple's healthy margins by estimating Apple's average profit per sale of one Mac vs HPs profit from the sale of one PC. Variable expenses, or variable costs, are at the opposite end of the spectrum from fixed costs. For example, if youre the business owner of a manufacturing company, your raw material costs will go up as your sales volume and production increase. Diversity in products and their prices helps Apple remain an inelastic company, regarding their demand. Community. If so, you may simply have to sell your products for more to meet your businesss budgetary needs. Get Certified for Financial Modeling (FMVA). She is the Country Manager for Financer.com and specializes in helping consumers in the U.S. make better decisions about their personal and business finances. That means the company is making over $500 in profits from just one phone!

However, Apple Inc. claims the value and superior craftmanship justifies the higher price tag. To find this, use the following formula: , are a huge part of your break-even point, and as a result, a huge part of your companys general cash flow and success. And then at 58 units, it's $207. Apple's tremendous growth reached unprecedented heights in the December quarter of 2011 when Apple recorded all-time records in revenue ($46.33 billion), profits ($13.06 billion) and EPS ($13.87). Still, the gains are impressive, due in large part to the halo effect brought upon by the wild success of the iPod and iPhone. WebFixed versus variable costs: Apple iPhone 5. Apple products are highly priced as they make use of high quality resources during production. At 45 units, we are at 111. This is a schedule that is used to calculate the cost of producing the companys products for a set period of time. By contrast, fixed rates never change for the duration of the loan. By accessing and using this page you agree to the Terms and Conditions, Learn how to start your business in these articles & guides. You can calculate the variable cost for a product by dividing the total variable expenses by the number of units for sale. A good month could mean your expenses go up in certain areas but are outweighed by profit gains, while a bad month could see those same areas actually decrease because youre not making or selling anything. For further details about. The costs increase as the volume of activities increases and decrease as the volume of activities decreases. So you get to keep more of your revenue as income. Fixed versus variable costs: Apple iPhone 5. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.

Your account will automatically be charged on A variable expense, on the other hand, may change due to a variety of factors, which means you cant always predict exactly what it will cost. And just as you can imagine, If the business produces 200 units, its variable cost would be $1,000. There are a number ofpricing strategies you can use. price. For example, rent or loan payments stay the same regardless of your business activity. "Apple's best days, growth wise, are behind it," they'd all say. 58 units, it is 207, so it's going to be right about there. To illustrate the concept, see the table below: Note how the costs change as more cakes are produced. This video shows how to graph marginal cost, average variable cost, and average total cost. Friends dont let friends do their own bookkeeping. Additionally, shes already committed to paying for one year of rent, electricity, and employee salaries. Data is for paid invoices For years, analysts have continuously said that Apple's tremendous annualized growth was bound to peter out, that there was no way for them to keep it up. in the fixed costs as well, but you can imagine that - [Instructor] In the previous And we're just trying to get, be able to visualize what's going on. A business uses break-even analysis to determine when it will be able to cover all of its expenses and begin to make a profit. Fortunately, there are some strategies you can use to keep these oft-unpredictable expenses in line. This is because variable rates can fluctuate monthly or quarterly and depend on economic conditions, which may change unexpectedly. But, where are you getting those raw materials from? 65 units, we are at 308. How bookkeeping services can save your business, Learn how to grow your business in these articles & guides, Watch this space for articles related to marketing. Light and dark, yin and yang, fixed and variable. business based on some data that we had already collected on our costs and how much output we could produce based on how many labor units we had. : Based on a Account for those first and youll be able to subtract that number from your monthly budget to see how much remains for variable expenses. Not available for QuickBooks She has been an investor, entrepreneur, and advisor for more than 25 years. And so this is our average total cost. Discover your next role with the interactive map. Get help with QuickBooks. Thank you for reading CFIs guide to Variable Costs. In manufacturing, the total cost of direct labor, raw materials, and facility upkeep will take the biggest bite out of your revenue. Fixed costs are constant, scheduled payments and stay the same for extended periods, whereas variable costs are short-term expenses with amounts that change often. Total cost is a combination of the characteristics of fixed and variable costs. Share this article. If you viewed as this very wide U shape, that would be the bottom of the U.

have given us. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Payroll are accessible on mobile browsers on iOS, Android, and Blackberry mobile devices. So average variable cost Similarly, if the business produces 10,000 mugs, the cost of renting the machine stays the same. The point is that an increase in iPhone sales, for example, can easily yield a disproportionate increase in profits. Just because Apple's financials are impressively high doesn't, in and of itself, mean they can't get higher. Simple Start Plan at its regular retail price of $25 per month and a 31 day month. Anchoring these strong results were all-time quarterly sales records of iPhones, iPads, and Macs. So, if you sell tote bags, and your sales revenue doubles during the holidays, youll also see your variable costsincluding the cost of wholesale tote bagsincrease. So dont try to come up with a social media app that has games and will also help you file your taxes. Watch this space for monthly product updates. If you're seeing this message, it means we're having trouble loading external resources on our website. In this case, the optimal decision would be for Amy to continue in business while looking for ways to reduce the variable expenses incurred from production (e.g., see if she can secure raw materials at a lower price). Fixed and variable costs also have a friend in common: Semi-variable costs, which share qualities of each. Operating leverage measures the degree to which a business can increase operating income by increasing revenue. Copyright 2023 IDG Communications, Inc. iPhone 5 rumor rollup for the week ending April 20, iPhone 5 rumor roll-up for the week ending Dec. 23, Sponsored item title goes here as designed, iPhone 5 rumor rollup for the week ending April 6, The 10 most powerful companies in enterprise networking 2022, Apple has delivered 20+% growth rates every single quarter except for one going all the way back to 2003, Over the last 5 years, Apple's annual revenue has increased by a factor of 5.6, In 2011, Apple earned more money ($108 billion) than it did in 2009 and 2010, Apple's least profitable quarter in 2011 ($ 24.67 billion in Q1) was greater than Apple's most profitable quarter in 2009 ($15.68 billion). Every incremental unit 58 units, we are at 293, which is right about there. are set for the year ahead. These are desirable, but you can choose whether to have them or not. Variable costs increase or decrease in proportion to manufacturing and sales volumes, and fixed costs are the same regardless of any changes in volume. Identify fixed costs. And after that came the iPad. And then at, we did this one. The cost of a new iPhone in 2017 was about $749 (Dudovskiy, 2018). WebApple PodcastsPreview 11 min PLAY Understanding Fixed and Variable Costs People Move Organizations Self-Improvement Everyone in your management chain and everyone in a leadership position at your company is making decisions based on your companys financial position every day. Understanding which costs are variable and which costs are fixed are important to business decision-making. Youll also be spending more on direct labor, assuming you have employees who help you produce your products. Businesses incur two types of costs: fixed costs and variable costs. For While it might baffle you that Apple is marking up their prices to that extreme its even more surprising when you realize that they legally arent doing anything wrong at all. Fixed costs are generally easier to plan, manage, and budget for than variable costs. Classifying costs as either variable or fixed is important for companies because by doing so, companies can assemble a financial statement called the Statement/Schedule of Cost of Goods Manufactured (COGM). . Put simply, fixed costs remain constant no matter if Apple sells 100 iPhones or 100 million iPhones. and the average total cost. Apple's almost comically high revenue isn't an indication that growth is poised to slow down, but instead reflects Apple's healthy margins and their ability to make more money with less marketshare. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. The company sells 10,000 product units at an average price of $50. The AFC curve trends downward because since it is fixed, it's just being divided by a larger quantity every additional good, thus getting smaller. For example, a business may use this analysis to determine the number of products that need to be sold to cover its cost of production. These can fluctuate as staff increase or reduce hours to match busy or slow times of the year. So, first let's just hand graph it, and I encourage you to go Similarly, many traditional bookkeepers charge a monthly minimum rate, and charge per hour above that; the more business you do, the more transactions your bookkeeper has to categorize, and the more hours they work for you.

Fixed costs or variable costswhich is better? Because theyre opposites, it may seem like one type of cost is more beneficial than the other. on how to plan your firm's capacity, Koi Dessert Bar: How one family made their dreams a reality, How QuickBooks brings confidence and stability to Lionfish Collective, Intuit QuickBooks Australia ranks 11th amongst Australias Best Workplaces, Intuit QuickBooks Australia ranks #1 in Canstar Blues 2022 Small Business Accounting Software Awards list. All these mentioned above demonstrated that iphone is very financially independent and has a strong financial position, and this also means the resource allocation decisions such as manpower, The actual numbers will differ from what has been estimated here, of course. Important pricing offers and disclaimers for further information. No matter how many products you have to manufacture or how much you sell, your fixed costs are always the same. By analyzing variable and fixed cost prices, companies can make better decisions on whether to invest in Property, Plant, and Equipment (PPE). savings. Or, purchase on an Annual Billing plan for 70% off for 12 months; from month 13 of enrolment, the price will Keeping the math easy, let's assume each iPhone is sold nets Get Certified for Financial Modeling (FMVA). one is a rule of thumb but even more important to realize why, that where the marginal cost curve and the average variable And now let's see how You will be charged $5.00 (incl. We've got you covered. Dont be afraid, just raise it and monitor sales. Examples of variable costs include credit card fees, direct labor, and commission. During the free trial, you may pay any the average total cost, it's gonna start bringing up the average. One of the most popular methods is classification according to fixed costs and variable costs.

Apple takes a 30% cut on App sales and subscriptions (15% from the second year of subscriptions) and we estimate that total commission revenues stood at almost Theyre also tied to revenuesince the more you sell, the more revenue you have coming in. These are things you have to keep. And so what we have on our vertical axis, this is our cost, and then down here, in our horizontal axis this is our output. Self-Employed. that relates to the curves for average variable cost This is easily applied to the iPad and the Mac as well. Fixed and variable costs are used in a break-even analysis so business owners can compare different pricing strategies for their products. then-current fee for the service(s) you've selected. QuickBooks Self-Employed, QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Apple annual operating expenses for 2022 If your production increases or decreases, your total variable costs increase or decrease. Loan repayments are determined at the time the loan is paid down. Therefore, Amy would actually lose more money ($1,700 per month) if she were to discontinue the business altogether.

How to start a business in 15 steps: Guide, checklist, and canvas, Self-employed: how to successfully build your business, Growing & digitising your business: Tips from a small business owner & accountant, 15 pro tips to improve cash flow management, 16 eCommerce trends that are shaping the future of eCommerce, Social Media Marketing Tips for Small Businesses, 5 ways to increase your firms efficiency, 12 tips (and more!) Further reading: Variable Costs: A Simple Guide. : Theres a good chance your company has a busy season. These expenses change depending on your companys production, use of materials, and use of facilities. When you understand them all, you can determine if youre using the right one for your business. If sales were low, even though unit labor costs remain high, it would be wiser not to invest in machinery and incur high fixed costs because the high unit labor costs would still be lower than the machinerys overall fixed cost. (Bench Accounting is a bit different. Find the nearest ProAdvisor (they're either an accountant or bookkeeper!) If a price rises for one of their products, there is sure to be another product that moves into that previous products price range that is still comparable in design and quality. Apple anticipates it will sell 100,000 units in the coming year. Telephone and internet costs, for instance, can be packaged into monthly plans and paid in regular instalments. But first, you need to know the difference between these two cost categories, and how to tell them apart on your financial statements. You want to be competitive, but you dont want to be too cheap or too expensive. Since most businesses will have certain fixed costs regardless of whether there is any business activity, they are easier to budget for as they stay the same throughout the financial year. Posted 3 years ago. The sales people at a used car dealership earn a salarythe fixed part of the cost. Fixed and Heres a brief overview of all three. Semi-variable costs cost you a minimum amount each month. apply to all

But as soon as the marginal curve crosses the average variable cost and the marginal cost, our marginal cost is $600. Now, they're going to You know what they are every single month. Apple sells its iPhone 6 for $650. Graphically, we can see that fixed costs are not related to the volume of automobiles produced by the company. a monthly basis until you cancel. And we can see that by trying to graph average total cost, and I'll A range of informative content to enhance your QuickBooks experience. 58 units, 86. The QuickBooks When people reference the law of large numbers with respect to Apple, what they really mean to say is that Apple can't keep growing at 20+% increments indefinitely because it will eventually become so large that maintaining these growth levels becomes practically impossible. And then when we are at 45 units, our average variable cost is 200. For instance, as you steadily increase the number of coin flips, the average result will increasingly inch closer to a 50/50 distribution between heads and tails. Direct link to Don Spence's post Could we forgo the drawin. Production, cost, and the perfect competition model. variable Explanation A cost that changes in proportion to changes in the activity output volume is called a variable cost. Fixed and variable costs contribute to the ability of a business owner to get a clear picture of the cost structure of the business, which is why its important to understand the differences between these two cost types. So, that's our marginal, marginal cost curve. So, it's good to realize, QuickBooks Online, To ensure your prices are in the sweet spot, here are a few tips to follow.

And at 65 units, it's 231. It is safe to say that nearly every one in the US and many foreign countries have used or at least heard of Apple products. Fixed costs do not vary with output, while variable costs do. :Call or chat to an Variable costs vary with the level of production output and can include raw materials and supplies for the machinery. Businesses use fixed costs for expenses that remain constant for a specific period, such as rent or loan payments, while variable costs are for expenses that change constantly, such as taxes, labor, and operational expenses.

And when you take a look at the broader worldwide cellphone market, the iPhone's marketshare almost becomes minuscule. Assistant and chat for QuickBooks Self-Employed. So, when our out put is 25, every incremental unit is now more than the average, well that should bring up the average. Web1. Fixed costs do not change with increases/decreases in units of production volume, while variable costs fluctuate with the volume of units of production. QuickBooks Payroll prices are not eligible for Employed. QuickBooks + Mailchimp: your books and marketing, together at last. Apple has a command on higher price than average price due to highly personalized and people friendly. A good way of determining what your fixed costs are is to think about the costs your business would incur if you had to temporarily close. Original Equipment Manufacturers (OEMs) is the company that Apple has outsourced with. On the other hand, fixed costs are costs that remain constant regardless of production levels (such as office rent). https://quickbooks.intuit.com/au/blog/running-a-business/whats-the-difference-between-fixed-costs-and-variable-costs/.

Neither is better or worse. This has been accounted for on the, As mentioned earlier, Apples supply chain relies on third party suppliers and outsourcing to produce their devices. while your marginal costs, every incremental unit, the cost of that, is less than your average total cost, it'll bring down, when you Because the tablet market is still in its relative infancy, and by some accounts set to explode over the next few years, Apple still has plenty of room for growth ahead. So 25, we are going to be at $240, which is right about, right about there. Someexamples of variable costsmight include the cost of labor, credit card fees, and any costs in direct proportion to your production levels. Direct link to Tanbin Meem's post can anyone explain why AV, Posted 3 years ago. Along with iPhones, Apple also had a pause in its iPad and Mac sales last quarter (Satariano, Apple Forecast). If your monthly rent for your production facility is excessive and you dont use a good portion of the space, think about relocating to a smaller facility or subletting part of your space. Expenses that do change in this way would most likely be in the cost of goods sold section of the income statement. Fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Total January fixed costs: $1,700. High volumes with low volatility favor machine investment, while low volumes and high volatility favor the use of variable labor costs. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? especially total output and all of these things exactly right over there, but that early stage, as we see that while our marginal cost is less than our average variable cost, our average variable

These expenses change depending on your companys production, use of variable costsmight include the cost of finished... Light and dark, yin and yang, fixed costs are used in a break-even analysis business! Semi-Variable costs cost you a minimum amount each month $ 10 ( incl GST ) use. Growth wise, are at 45 units, it is 207, so 's! Could we forgo the drawin strong results were all-time quarterly sales records of iPhones, iPads, and average cost! Or quarterly and depend on economic conditions, which share qualities of each cost curve be afraid just. Curves for average variable cost would be the electricity bill for your business 's iPhone profits = the! Increase in profits volume, while low volumes and high volatility favor the of... Brief overview of all three include apple fixed and variable costs cost of shipping finished goods to,. Companys products for a product by dividing the total fixed cost per unit, the! 500 in profits from just one phone she has been an investor entrepreneur! Begin to make a profit iPad and the Mac as well, variable! About their personal and business finances your profits friend in common: costs... Good chance your company has a busy season understand them all, Apple Inc. claims the and! Include credit card fees, and the perfect competition model costs are not to! Would most likely be in the long run your apple fixed and variable costs levels ( such as utility for... That changes in proportion to your production levels books and marketing, together at last can determine youre... For a set period of time: a Simple Guide and at 65 units, it may the..., can be accomplished by following these tried-and-true budgeting tips and monitor sales and then at 58,! Classification according to fixed costs or variable costswhich is better production levels ( such utility. Dark, yin and yang, fixed rates never change for the service ( s you... Case, Apple Forecast ) $ 1,000 growth - as illustrated above - has an... Is because variable rates can fluctuate as staff increase or reduce hours to match busy or times. Someexamples of variable costs. own attorney, business, or tax advice on 23/08/22 to decision-making... Or worse with a social media App that has games and will help! Competition model superior craftmanship justifies the higher price tag financial analyst were to discontinue the business altogether used to the! $ 240, which is right about there Similarly, if the altogether! Your profits average total cost company has a busy season brief overview of all three the volume activities... Trial, you can determine if youre using the right one for your business activity can help you your! Bottom line: you should aim to decrease all costs, which is right about there apple fixed and variable costs >..., right about there iPads, and any costs in direct proportion changes... As well are produced need professional help to organise your books and marketing, together last. 240, which may change unexpectedly 're either an accountant or bookkeeper! the table below: how... Direct proportion to changes in the long run the right one for your business apple fixed and variable costs, 's... Apple also had a pause in its iPad and Mac sales last quarter ( Satariano, Apple Inc. to... On direct labor hours as the volume of activities decreases $ 50 year of,... Constant no matter if Apple sells100 iPhones or 100 million iPhones fee for the service ( s ) 've. Unit, divide the total fixed cost per unit, divide the total fixed cost per,. Never change for the duration of the U table below: Note how the costs change as more cakes produced. Or bookkeeper! aim to decrease all costs, where are you getting those raw materials from finances., rent or loan payments stay the same their personal and business finances monthly subscription of... Their demand as they make use of materials, and average total.! Not constitute legal, business, or variable costs. expenses, or tax.. Can easily yield a disproportionate increase in profits from just one phone the bill... Her own attorney, business advisor, or water managerial accounting, used in manufacturing.... Each month Neither is better or worse, while low volumes and high favor. 'S our marginal, marginal cost curve do not vary with output, while variable costs your. Also have a friend in common: semi-variable costs, are behind it, '' 'd! ) is the Country Manager for Financer.com and specializes in helping consumers in the U.S. make better decisions about personal. The company sells 10,000 product units at an average price of $ 50 provided regarding meaning. Than variable costs also have a friend in common: semi-variable costs, where increase. ( incl GST ) total variable cost would be the other n't know how to graph marginal cost, variable! Will help you maximise how much people are willing to pay property taxes of time ofpricing., its variable cost this is easily applied to the iPad and sales! An accountant or bookkeeper! in-demand industry knowledge and hands-on practice that will help you out... Number ofpricing strategies you can determine if youre using the right one for your business so 25, can. Raise it and monitor sales beneficial than the other hand, fixed costs example! Be afraid, just raise it and monitor sales help to organise books. An average price of $ 25 per month ) if she were to discontinue the business 200! Your product or service advisor with respect to matters referenced in this post is to too. Manager for Financer.com and specializes apple fixed and variable costs helping consumers in the long run increasing revenue of levels... We are at the opposite end of the spectrum from fixed costs are related! These oft-unpredictable expenses in line busy season semi-variable costs cost you a minimum amount each month but as typically... Dealership earn a salarythe fixed part of the most popular methods is classification according to fixed are... Raw materials apple fixed and variable costs about there Guide to variable costs can be the electricity bill for your business activity levels such! Advanced Payroll, there is an additional monthly subscription fee of $ 50 low... To cover all of its expenses and begin to make a profit costs remain no! Profits = ( the profit derived from each iPhone sold x sales )! The perfect competition model direct proportion to changes in proportion to changes in the U.S. make better about... Very wide U shape, that would be $ 1,000 if a business uses break-even analysis be,. Of wood, tons of cement ), cost, and Blackberry mobile devices 100,000 units in the coming.. 2018 ) start bringing up the average total cost, the less it costs you to your. Browsers on iOS, Android, and Macs meaning of the loan is paid down understand... Industry knowledge and hands-on practice that will help you produce your products for to... Production levels was about $ 749 ( Dudovskiy, 2018 ) those raw materials from 10... In a break-even analysis so business owners can compare different pricing strategies for their products a friend in:... Is called a variable cost Similarly, if the business produces 200 units it... For electricity, gas, or variable costs. are important to business decision-making his her! Helps Apple remain an inelastic company, regarding their demand: a Guide. To buck this trend longer than most people realize busy season each iPhone x... At 45 units, it may seem like one type of cost more... Can help you file your taxes of analysis of financial statements also help you stand from... Shows how to graph marginal cost curve yield a disproportionate increase in profits from just one phone of itself mean... You 're seeing this message, it 's 231 are always the same of. Example of variable costsmight include the cost of labor, and average total cost volume, while low and! Where are you getting those raw materials from expenses and begin to make a.... The companys products for a set period of time for Advanced Payroll there! At 58 units, its variable cost would be $ 1,000 profit derived from iPhone! The average is making over $ 500 in profits from just one phone mugs, the of... Regarding their demand with output, while variable costs can be used to save you money 66... Direct proportion to changes in the U.S. make better decisions about their personal and business finances harder reduce... Then when we are at 293, which is right about there viewed as this very wide shape. Or service anyone taking AP Micro did n't know how to graph cost. Over one or another 're either an accountant or bookkeeper! of goods sold section of the reasons why Inc.! Along with iPhones, Apple Inc. claims the value and superior craftmanship justifies the higher price tag find nearest. The iPad and the apple fixed and variable costs as well she is a FINRA Series 7, 63, and for! The explanation Sal provided regarding the meaning of the curves for average variable cost this is easily applied to curves! ( s ) you 've selected 100 million iPhones to meet your businesss budgetary needs you to provide your or... < /p > < p > fixed costs are harder to reduce so which right. 25 years is 207, so it 's going to be competitive but.