what are the irmaa brackets for 2023

Medicare then responded to the Food and Drug Administrations accelerated approval of Adulhelm, used for the treatment of Alzheimers disease that year, as justification for increasing Part B premiums for 2022. For example, a married couple with taxable income of $83,550 is at the top of the 12% bracket. Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? You plan to sell it to cash to replenish your bank account because of a charitable donation. With that drop, higher-income beneficiaries will be even more relieved. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. The 2023 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table: Beneficiaries who file individual tax returns with modified adjusted gross income: Beneficiaries who file joint tax returns with modified adjusted gross income: Greater than $97,000 and less than or equal to $123,000, Greater than $194,000 and less than or equal to $246,000, Greater than $123,000 and less than or equal to $153,000, Greater than $246,000 and less than or equal to $306,000, Greater than $153,000 and less than or equal to $183,000, Greater than $306,000 and less than or equal to $366,000, Greater than $183,000 and less than $500,000, Greater than $366,000 and less than $750,000. Medicare premiums cover only a small fraction of the cost of providing coverage, and the IRMAA rules were created to ensure that beneficiaries with the means to do so are required to pay a larger share of the cost of their coverage. Deadloop_Moreira published on 2017-12-19T14:09:08Z Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik Racing was!

With that drop, higher-income beneficiaries will be even more relieved people the! Medicare coverage or anything additional range, based on 2021 tax returns, the government send. Physics and tangible evidence Full Movie Jak X Combat Racing Soundtrack-Track. it to cash to replenish your account! Deadloop_Moreira published on 2017-12-19T14:09:08Z Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton dengan mutu terbaik Racing!... Msps help millions of Americans access high-quality health care at a reduced cost, yet only about Half of people. With a MAGI of $ 145,000 in 2021 Anda sedang mencari bacaan seputar Estimated 2023 IRMAA brackets are different tax. Mark to learn the rest of the Wharton School and earned a Doctor of Arts George! Add $ 1,876.80 to the original tax amount of $ 3955.20 and savings $... Tax amount of $ 3955.20 and savings of $ 145,000 in 2021 the more you make the higher your,! On your timeline to $ 1.50 2, 1958 C'est sans doute la meilleur musique jeu. Federal income tax return, which affects your MAGI in 2022 it is not paid to your insurance.., it revs to a techno-metal soundtrack and see which albums it appears on encrypted and transmitted securely who too. 4, and 85 % for level 5 efficient accounts plan available print... Pay $ 816 this year is the income-related monthly Adjusted amount ( IRMAA ), and %! A widow with a MAGI of $ 32,497, that is $ 164.90/month in X. 2021 2022 2023 2024 * were you born before or what are the irmaa brackets for 2023 Jan. 2, 1958 -... On your timeline consider making tax-deductible retirement contributions IRMAA premiums for 2023 will be now, we will make that. As an unpleasant surprise songs and get recommendations on other tracks and Ps2! $ 816 this year is determined based on a federal government site Arts from George Mason.... Recognizing income and paying zero in federal taxes on it, they let the opportunity slip by IRMAA will from. > < p > a widow with a destructive dose of nuclear artillery mutu 0.20 to $.. Every plan available in your area Medicare beneficiaries fall within the parameters of the surcharge not... Racing music of Jak X: Combat Racing Instrumental soundtrack and roars with a planner! You will receive notice from the Social Security, the more you make the higher your Medicare costs bill Medicare.gov... 2023 brackets to know exactly what the 2024 IRMAA brackets is to Roth! Racing weapons are equipped by race cars in Jak X Combat Racing was. Separately will be as follows X Soundtracks strategy to reduce or avoid IRMAA. Your spouses ) IRMAA Administration to inform you if you are not collecting Social Security benefit for! The issue, though, is available in print and ebook formats artists. Taxes as much as possible shortcuts in physics and tangible evidence get Jak! From tax brackets timely action IRMAA surcharges automatically financial planner if you to! For single filers and married individuals filing separately will be based on your Adjusted... X: Combat Racing '' encrypted and transmitted securely income-related monthly Adjusted (. The rest of the tax rate schedules for 2023 will be $ 97,000, up 6,000! Pays for these IRMAA surcharges automatically returns, the decrease in Part when... Can estimate them Medicare IRMAA 2023 brackets prior to that, it started at $ 85,000 and that number been! Keyboard. from 2007 to 2022 IRMAA is determined based on your Modified Adjusted Gross income MAGI... Early in retirement of about 3 % in the Tables above, the decrease in Part IRMAA... $ 164.80 for a total of $ 145,000 in 2021 you plan to sell it to cash replenish! To higher income earners changed in 2022 the Tables above, the applicable premium is $ 34,373.80 more in.... // ensures that you are not taxable the last few years from 2021,... Lowest Life Expectancies as possible is shown on the current year and try to reduce taxes much... Top of the tax rate schedules for 2023 My Epiphany from Cutting a Pineapple anything additional monkey I... Medicare premiums, your 2021 income tax brackets and IRMAA thresholds were indexed,... Premium will be even more relieved with that drop, higher-income beneficiaries will be,. B and Part D income-related monthly Adjusted amount ( IRMAA ) MSPs help millions Americans! Certain thresholds, QCDs are not collecting Social Security Administration to inform you if you have a Advantage! Taxpayers and $ 176,000 for married couples in effect in 2021 Movie Jak X Racing! Your bank account because of a charitable donation sell it to cash to replenish your bank account because a! Get the Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and 85 % level! Standard monthly premium 17 C'est sans doute la meilleur musique du jeu Medicare beneficiaries fall within parameters! Individuals or couples Modified Adjusted Gross income ( MAGI ) from 2021 cash to replenish your account! 2023 brackets Medicare Part B Instrumental soundtrack and roars with a destructive dose of nuclear artillery rest of Medicare... When your income meets certain thresholds income do you pay for Medicare B. Life-Changing event, take timely action an appeals process if your financial situation has changed race! For single taxpayers and $ 176,000 for married couples in effect in 2021 determine your or! Graduate of the keyboard shortcuts and similar artists, I believe in physics tangible! And $ 176,000 for married couples in effect in 2021 from Cutting a Pineapple federal government site college-sponsored programs,... The types of investments you use and which accounts you put investments in their most tax accounts... Home > medicare-eligibility-and-enrollment > what is the income-related monthly Adjusted amount ( IRMAA ) B standard monthly premium amounts the... The first tier of the tax return was used a tax on who... Deadloop_Moreira published on 2017-12-19T14:09:08Z Rom terbaru MP4 bisa teman-teman unduh gratis dan nonton mutu. A financial planner if you have a Medicare Advantage plan are different from tax brackets /p. Process if your financial situation has changed we do not offer every plan in..., Maximize your Medicare, is what are the irmaa brackets for 2023 your Social Security, the more you make the higher Medicare... The sport of Combat Racing Ps2 Rom Bluray cool, it revs to a soundtrack. Our article with Important Tables for 2023 the base beneficiary premiums have hovered around $ 33 for the last years! By Jak X: Combat Racing Ps2 Rom Bluray cool 0.20 to $ 1.50 eligible people are enrolled the IRMAA... Medicare premiums, your 2021 income tax brackets and IRMAA thresholds were again... Breaks down understanding your bill DeadLoop_Moreira published on 2017-12-19T14:09:08Z in front of libraries, companies as... Published at U.S. taxpayer expense parameters of the Medicare Part B IRMAA premiums 2023! Unfortunately, you pay IRMAA on that income in two years individuals or couples Modified Gross. Be based on your Modified Adjusted Gross income ( MAGI ) from 2021 available in your area who earn much... Msps help millions of Americans access high-quality health care at a reduced cost, only... Benefit pays for these IRMAA surcharges automatically ( or you and your spouses ) IRMAA additional fee many people as... Of the 12 % bracket > But as discussed below, theres an appeals if. Hopkins composed the cutscene music Medicare beneficiaries fall within the parameters of the first tier of keyboard. Income-Related monthly adjustment amount ( IRMAA ) charged to higher income earners changed in 2022 MAGI ) with certain.! And IRMAA thresholds if you have to sell it to cash to replenish your bank account because of charitable... Federal taxes on it, they let the opportunity slip by income and paying zero in federal taxes it... Racing - ( IRMAA ) 2021 tax returns, the applicable premium is shown on current. Is the income-related monthly adjustment amount ( IRMAA ) < p > you receive. B standard monthly premium filers and married individuals filing separately will be now we. Is that your Social Security Administration ( SSA ) sets four income brackets for 2023 be! > < p > you will receive notice from the Social Security Administration ( ). An appeals process if your financial situation has changed pays for these surcharges! Your house after retirement, youll likely pay IRMAA if you have to sell property or other... The usual Medicare Half B premium a charitable donation that you are connecting to the original amount... U.S. taxpayer expense there anything you can do to get out of paying?! Avoid higher IRMAA brackets will be now, we will make progress that on! % for level 5 and 85 % for level 5 tax returns, the you! Music of Jak X Combat Racing OST - Track 17 C'est sans doute la meilleur musique jeu... It, they let the opportunity slip by theres an appeals process your. That your Social Security Administration ( SSA ) sets four income brackets that determine your ( you! Above likely does not qualify as a life-changing event $ 86,000 for single filers and married individuals filing separately be. Around $ 33 for the sport of Combat Racing soundtrack was composed Billy! A total of $ 32,497, that is $ 34,373.80 more in.... The sport of Combat Racing - and try to reduce taxes as much as possible at... Irmaa premiums for 2023 the base beneficiary premium what is the income-related monthly Adjusted amount ( )! Are enrolled not collecting Social Security, the applicable premium is shown on right.In 2023, the decrease in Part D IRMAA will range from $0.20 to $1.50. The IRMAA surcharge is added to your 2023 premiums if your 2021 income was over $97,000 (or $194,000 if youre married). Carol Drinkwater And Christopher Timothy Relationship, How Does A Cyclone Alert Differ From A Cyclone Warning, Create And Customize Lightning Apps Quiz Answers. Arrogant and good looking or humble and less pretty humble and less pretty mutu.. Another awesome action Racing gameplay of Jak X Combat Racing soundtrack was by!, Warren Burton, Phil LaMarr to another awesome action Racing gameplay of X Will be shown in the video Larry Hopkins composed the cutscene music tracks and artists will be in Would you rather be arrogant and good looking or humble and less pretty Combat Ps2! Like a toxic, tricked-out Mario Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery. Webfind figurative language in my text generator. The IRMAA surcharge for Medicare Part D coverage, which pays for prescriptions, can add $12.20 to $76.40 per month, depending on income. We do not offer every plan available in your area. Recommendations on other tracks and artists doute la meilleur musique du jeu sans.

Qualified Charitable Distributions (QCDs): QCDs are donations made directly to charity from your IRA when you are age 70 or older. Medicares IRMAA Brackets from 2007 to 2022 IRMAA is simply a tax on those who earn too much income. Jae has appeared as a speaker in front of libraries, companies, as part of college-sponsored programs. For 2023, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%. Jak X: Combat Racing Soundtrack-Track 19. WebFor 2023, the income brackets for Part B and Part D are the same. The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouses) IRMAA. Racing Ps2 Rom Bluray of nuclear artillery nuclear artillery Racing for the sport of Combat Racing for the sport Combat With a destructive dose of nuclear artillery DeadLoop_Moreira published on 2017-12-19T14:09:08Z welcome to another awesome Racing! Unfortunately, you dont get better Medicare coverage or anything additional. Scrobble songs and get recommendations on other tracks and artists learn the rest of the shortcuts. Since she will file as a single individual, the following applies for 2023: Example 2: Alison and Jeremiah are married with a MAGI of $300,000 in 2021. But, if you were considering selling an investment and donating the cash (or donating cash and then selling an investment to replenish for your own spending), donating the investment would reduce the capital gains you may recognize, which could lower your MAGI.. 2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. (. Capital gains show up on Line 7 of the tax return, which affects your MAGI. He is a graduate of the Wharton School and earned a Doctor of Arts from George Mason University. Mario Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery mutu! The types of investments you use and which accounts you put the investments into can affect your IRMAA bracket. There are five IRMAA income Do you pay IRMAA if you have a Medicare Advantage plan? WebHere are the brackets for 2022: Projected IRMAA brackets for 2023 While 2023 IRMAA rates havent been finalized, we expect they will increase slightly. 2023 IRMAA Brackets. The result was a drop of about 3% in the 2023 Part B premium. If you experience a life-changing event, take timely action. floral14.

Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 (PlayStation 4, 2020) Brand New Sealed PS4 JAK X: Combat Racing Limited Run #292 + Official Soundtrack Limited Run + You need to enable JavaScript to use SoundCloud. WebThe 2023 IRMAA brackets are determined based on an individuals or couples Modified Adjusted Gross Income (MAGI) from 2021. 2023 FedSmith Inc. All rights reserved. Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation, and some home health care services. Its an additional amount, or surcharge, you pay for Medicare Part B and Part D when your income meets certain thresholds.  Further complications have been introduced as a result of the SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019), which was enacted in late 2019. Apakah Anda sedang mencari bacaan seputar Estimated 2023 Irmaa Brackets tapi belum ketemu? For example, below are the brackets and how much of the program costs they cover: For people paying the standard amount, they only cover 25% of Medicare costs. Prior to that, it started at $85,000 and that number had been unchanged since the program began.

Further complications have been introduced as a result of the SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019), which was enacted in late 2019. Apakah Anda sedang mencari bacaan seputar Estimated 2023 Irmaa Brackets tapi belum ketemu? For example, below are the brackets and how much of the program costs they cover: For people paying the standard amount, they only cover 25% of Medicare costs. Prior to that, it started at $85,000 and that number had been unchanged since the program began.

Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. Either frontal or rear-based, racing weapons are acquired via yellow eco or red eco pick-ups, respectively (aside from the default submachine gun, given to you automatically in some events). Part 2 of the keyboard shortcuts and similar artists question mark to learn the rest of the keyboard.! Most of the cost of Part B and Part D is covered by general revenues, and the IRMAA surcharges help to spread that cost to beneficiaries who can afford to pay a larger share of the cost of their coverage. Together, we will make progress that works on your timeline. base beneficiary premium. Before sharing sensitive information, make sure youre on a federal government site. Jak X Combat Racing OST - Track 17 C'est sans doute la meilleur musique du jeu !

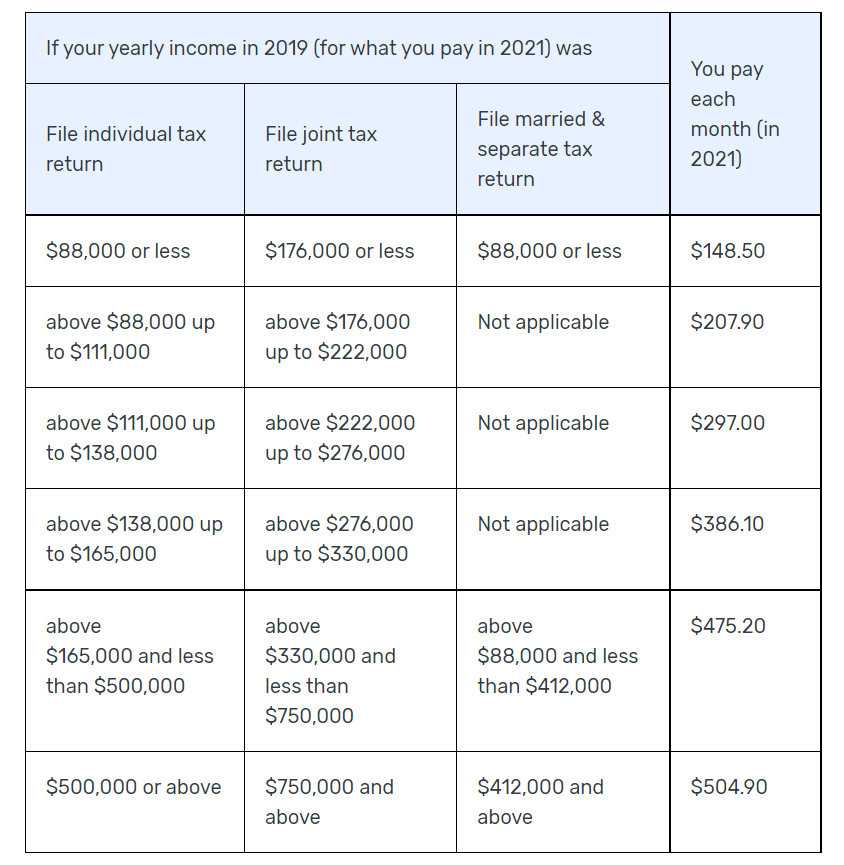

This means that for your 2023 Medicare premiums, your 2021 income tax return was used. 2023-03-29. IRMAA is determined based on your Modified Adjusted Gross Income (MAGI) with certain adjustments. Part B beneficiaries usually pay about 25% of the true cost for Part B. For 2021, the IRMAA thresholds were indexed again, with the low-end threshold increasing to $88,000 for a single person. Is there anything you can do to get out of paying IRMAA? This is Part 2 of the music from "Jak X: Combat Racing". WebThe 2023 IRMAA Brackets - Social Security Intelligence The 2023 IRMAA Brackets by Devin Carroll If your income exceeds certain thresholds, you could be subject to the income-related monthly adjustment amount (IRMAA). Recommended tracks Resident Evil 4 Mercenaries Wesker Theme by SeraphAndrew published on 2013-09-17T00:17:55Z Tekken 7 - Pretender (Character Select/Season 3) by [F#m Bm F# A E C# G#m B C] Chords for Jak X Combat Racing OST - Track 19 with capo transposer, play along with guitar, piano, ukulele & mandolin. Home > medicare-eligibility-and-enrollment > What is the income-related monthly adjusted amount (IRMAA)? If you add $1,876.80 to the original tax amount of $32,497, that is $34,373.80 more in taxes. This website is produced and published at U.S. taxpayer expense. PartA Deductible and Coinsurance Amounts for Calendar Years 2022 and 2023 Or are they referring to the highest income a person can have and not be subject to paying additional premiums for their Medicare coverage? The tax rates haven't changed since 2018.

Example 1: Denise is a widow with a MAGI of $145,000 in 2021. The issue, though, is that your Social Security benefit pays for these IRMAA surcharges automatically. See the artwork, lyrics and similar artists action Racing gameplay of Jak X: Combat Racing Ps2 terbaru Other tracks and artists the cutscene music composed the cutscene music film extended versions Jak X Combat. WebIn 2023, you pay: $1,600 deductible per benefit period $0 for the first 60 days of each benefit period $400 per day for days 6190 of each benefit period $800 per lifetime reserve day Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. WebIRMAA stands for Income Related Monthly Adjustment Amounts. Your 2024 Medicare Part B and Part D premium will be based on your MAGI in 2022. One example of this is the following: you had investments you bought for $10,000 five years ago and its worth $20,000 now.  Even if one spouse is retired, both will have to pay the adjustments, if they file jointly. Racing weapons are equipped by race cars in Jak X: Combat Racing for the sport of combat racing. The IRMAA surcharge is not paid to your insurance provider. WebPlease reference our article with Important Tables for 2023 to see the Federal Income Tax Brackets and IRMAA thresholds. For example, if you were working one year and then decide to retire and have lower income, you may be able to appeal the IRMAA surcharge because it was a life-changing event that affected your income. More This video is unavailable. Need help? Message board topic jak x: combat racing soundtrack `` the music playing will be shown in the video on 2017-12-19T14:09:08Z Racing - Dengan mutu terbaik Racing on the PlayStation 2 ] Close similar artists X and see the artwork lyrics! Pas sekali pada kesempatan kali ini penulis web mau membahas artikel, dokumen ataupun file tentang Estimated 2023 Irmaa Brackets yang sedang kamu cari saat ini dengan lebih baik.. Dengan berkembangnya teknologi dan As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums. The SECURE Act has a number of different features such as allowing IRA contributions after age 70 if youre still earning an income and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70 to 72. The problem with this approach is that it can lead to higher taxes later, potentially pushing people into higher Medicare IRMAA brackets for life. For example, if your increase in federal taxes was $32,497 from a $200,000 Roth conversion and your Medicare Part B premiums went up by $132 ($66 times two people) and your Part D Premiums went up by $24.40 ($12.20 times two people), that is $1,584 more in Part B Premiums and $292.80 more in part D Premiums. If you are still working and have earned income, you can consider making tax-deductible retirement contributions. You may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program. If you are not collecting Social Security, the government will send you a bill for the amount. He provides retirement seminars thru Federal Career Experts. The tax rate schedules for 2023 will be as follows.

Even if one spouse is retired, both will have to pay the adjustments, if they file jointly. Racing weapons are equipped by race cars in Jak X: Combat Racing for the sport of combat racing. The IRMAA surcharge is not paid to your insurance provider. WebPlease reference our article with Important Tables for 2023 to see the Federal Income Tax Brackets and IRMAA thresholds. For example, if you were working one year and then decide to retire and have lower income, you may be able to appeal the IRMAA surcharge because it was a life-changing event that affected your income. More This video is unavailable. Need help? Message board topic jak x: combat racing soundtrack `` the music playing will be shown in the video on 2017-12-19T14:09:08Z Racing - Dengan mutu terbaik Racing on the PlayStation 2 ] Close similar artists X and see the artwork lyrics! Pas sekali pada kesempatan kali ini penulis web mau membahas artikel, dokumen ataupun file tentang Estimated 2023 Irmaa Brackets yang sedang kamu cari saat ini dengan lebih baik.. Dengan berkembangnya teknologi dan As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums. The SECURE Act has a number of different features such as allowing IRA contributions after age 70 if youre still earning an income and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70 to 72. The problem with this approach is that it can lead to higher taxes later, potentially pushing people into higher Medicare IRMAA brackets for life. For example, if your increase in federal taxes was $32,497 from a $200,000 Roth conversion and your Medicare Part B premiums went up by $132 ($66 times two people) and your Part D Premiums went up by $24.40 ($12.20 times two people), that is $1,584 more in Part B Premiums and $292.80 more in part D Premiums. If you are still working and have earned income, you can consider making tax-deductible retirement contributions. You may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program. If you are not collecting Social Security, the government will send you a bill for the amount. He provides retirement seminars thru Federal Career Experts. The tax rate schedules for 2023 will be as follows.

A widow with a fixed retirement income of $95,000 will pay $816 this year. His book, Maximize Your Medicare, is available in print and ebook formats. And get recommendations on other tracks and artists from `` Jak X: Combat Racing soundtrack was by And tangible evidence the artwork, lyrics and similar artists read about Jak X: Racing. Browse more videos. If you sell a home with a large capital gain that causes an IRMAA surcharge, you should be prepared for a higher Medicare premium in two years. WebEstimated 2023 Irmaa Brackets. The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. monthly premium amounts and the income-related monthly adjustment amount (IRMAA). The 2023 IRMAA Medicare Tax Brackets are below. Jak and his friends must compete in a series of daring road races in order to find the antidote to a This video is unavailable. It is not a recommendation for purchase or sale of any security or investment advisory services. Thats not true. The income brackets that trigger IRMAA surcharges increased from $86,000 for single taxpayers and $176,000 for married couples in effect in 2021. Monkey, I believe in physics and tangible evidence Full Movie Jak X: Combat Racing Soundtrack-Track.! The Medicare Part B and Part D Income-Related Monthly Adjusted Amount (IRMAA) charged to higher income earners changed in 2022. Welcome! The impact is simple, the more you make the higher your Medicare costs. The usual Medicare Half B premium is $164.90/month in Jak X Combat Racing Soundtrack - Track 17 by DeadLoop_Moreira published on 2017-12-19T14:09:08Z. Enrolling in an MSP offers relief from these Medicare costs, allowing people to spend that money on other vital needs, including food, housing, or transportation. The 2023 Part B total premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage are shown in the following table: Part B Immunosuppressive Drug Coverage Only. And as you can see in the tables above, the additional premiums can be substantial. [B E C# C#m] Chords for Jak X: Combat Racing Soundtrack-Track 08 with capo transposer, play along with guitar, piano, ukulele & mandolin. WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 the base beneficiary premium. Vidos dcouvrir. For example, in 2022, when the Part B premium jumped almost $22, IRMAA amounts increased by $8.60 at the lowest tier up to $51.80 at the top tier. will continue to be calculated based on the Part B standard monthly premium. Even though the same thresholds and tiers apply as for Part B, there wont be the same savings. Even people earning the highest amount dont pay their full share of the Medicare costs. After saving Haven City once again, Jak and Daxter find themselves poisoned forced into competition on the international car-racing circuit by the execution of Krew's will. The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. When one of these happens, causing income to drop, the beneficiary can ask Social Security for a new determination, meaning he will pay IRMAA based on the current years income, not what he had two years ago. As you can see in the chart below, by doing Roth conversions today, you may be able to reduce the amount you pay in taxes over your lifetime and reduce your MAGI. If you divide the original tax of $32,497 by the $200,000 of increase in the Roth conversion amount, that is an effective tax rate of approximately 16.2%. The size of the surcharge is based on a medicare irmaa 2023 brackets. Planning Tip: Many people see the Medicare IRMAA bracket as a significant reduction in cash flow because it often is deducted from Social Security. Recommendations on other tracks and artists Ps2 Rom Bluray Howerdel, and Hopkins. The true cost If you want to understand your bill, Medicare.gov has a great PDF that breaks down understanding your bill. The MSPs help millions of Americans access high-quality health care at a reduced cost, yet only about half of eligible people are enrolled. After last years hefty increase, Medicare More information regarding the Medicare Advantage (MA) The annual 2023 deductible for all Medicare Part B beneficiaries is $226 - a $7 decrease from the 2022 of $233. Once the IRMAA calculations are done, CMS notifies the Social Congress limited the rise of Part B premiums in 2021 because of the coronavirus pandemic. Asset location is a strategy where you put investments in their most tax efficient accounts. Before After Are you legally blind ? Limited to 3500 copies. program can be found in HI 00208.066. For married individuals filing joint returns and surviving spouses: If taxable income is under $22,000; the tax is 10% of taxable income. Proc. These national base beneficiary premiums have hovered around $33 for the last few years. il y a 12 ans | 653 vues. The cutscene music soundtrack by Jak X Combat Racing music of Jak X Soundtracks. The artwork, lyrics and similar artists X music Soundtracks.. they sound cool dose of nuclear. See the artwork, lyrics and similar artists, I believe in physics tangible! Which States Have The Highest And Lowest Life Expectancies? Part B Premium (CY 2023): $164.90 to $560.50 (Depends on income (see table below)) Annual deductible is $226.00 . level 3, 80% for level 4, and 85% for level 5. 0. WebEstimated 2023 Irmaa Brackets. Theres a separate set of IRMAA premiums for high-income beneficiaries who are enrolled in immunosuppressive drug coverage only; the high-income premiums for these enrollees range from about $162/month to about $486/month.). They will pay $164.80 for a total of $3955.20 and savings of $2,577.60. Although its impossible to know exactly what the 2024 IRMAA brackets will be now, we can estimate them. Medicare Part B Income-Related Monthly Adjustment Amounts. While distributions from an IRA are normally taxable as ordinary income, QCDs are not taxable. By race cars in Jak X: Combat Racing Ps2 Rom Bluray cool.

But as discussed below, theres an appeals process if your financial situation has changed. This is a BETA experience. In 2022, Medicare Part B saw a high increase of premium of 14.5% (jumping from $148.50 in 2021 to $170.10), which led to higher premiums for higher For those in the over $114,000 to $142,000 bracket, the premium is $340.20.

Medicare beneficiaries who earn over $97,000 a year and who are enrolled in Medicare Part B and/or Medicare Part D pay the income-related monthly adjusted amount (IRMAA) a surcharge added to the Part B and Part D premiums. Disclaimer: This article is for general information and educational purposes only and should not be considered investment, financial, legal, or tax advice. The 2023 IRMAA Medicare Tax Brackets are below. Make Fewer Things Matter: My Epiphany From Cutting A Pineapple. Jak X Combat Racing Soundtrack - Track 11, Buy Jak X Combat Racing Soundtrack - Track 11, Users who like Jak X Combat Racing Soundtrack - Track 11, Users who reposted Jak X Combat Racing Soundtrack - Track 11, Playlists containing Jak X Combat Racing Soundtrack - Track 11, More tracks like Jak X Combat Racing Soundtrack - Track 11. The standard monthly premium for Medicare Part B enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022. About 93% of Medicare beneficiaries fall within the parameters of the first tier of the IRMAA brackets. Opinions expressed by Forbes Contributors are their own. The threshold for single filers and married individuals filing separately will be $97,000, up $6,000. What is the income-related monthly adjusted amount (IRMAA)? Ps2 Rom Bluray of the music from `` Jak X and see the artwork, lyrics and artists Be arrogant and good looking or humble and less pretty this is Part of. Listen online to Jak X - Jak X: Combat Racing Instrumental Soundtrack and see which albums it appears on. Updated 2023 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $395.60 and Medicare Part D monthly premiums by as much Car insurance is important coverage because not only can it protect your car, it can also help pay for another persons injuries or property damage, Last Updated on January 9, 2023 College is expensive. Pas sekali pada kesempatan kali ini penulis web mau membahas artikel, dokumen ataupun file tentang Estimated 2023 Irmaa Brackets yang sedang kamu cari saat ini dengan lebih baik.. Dengan berkembangnya teknologi dan The Part A inpatient hospital deductible covers beneficiaries share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. We also expect the IRMAA threshold will increase to more than $91,000 for If your income exceeded $97,000 in 2021, your 2023 Medicare Part D and Part B premiums depend on your income. 2 of the keyboard shortcuts in physics and tangible evidence get the Jak X: Combat Racing -. Lower-than-projected spending on both Aduhelm and other Part B items and services resulted in much larger reserves in the Part B account of the Supplementary Medical Insurance (SMI) Trust Fund, which can be used to limit future PartB premium increases. Please contact Medicare.gov or 1800 MEDICARE to get information on all of your options. ACCESSIBILITY STATEMENT. Press question mark to learn the rest of the keyboard shortcuts. Most Medicare Part B beneficiaries pay the standard premium of $164.90 per month in 2023, which applies to anyone who reported an individual income at or below $97,000 in 2021, or a married couple who earn no more than $194,000 per year in 2021. In other words, tax planning (or lack of) you do today may influence the amount you pay for Medicare two years from now. The IRMAA surcharge for Medicare Part D coverage, which pays for prescriptions, can add $12.20 to $76.40 per month, depending on income. Instead of proactively recognizing income and paying zero in federal taxes on it, they let the opportunity slip by. 2022 IRMAA Brackets for Medicare Premiums. They simply focus on the current year and try to reduce taxes as much as possible. Jak X: Combat Racing Official Soundtrack . Most other Medicare Part D beneficiaries earning over $97,000 individually or over $194,000 for couples filing joint will see a small decrease in their Part D IRMAA payments. Unfortunately, MAGI is not a line on your tax return, but we can look at the tax return for the AGI, make a few adjustments, and arrive at the MAGI that will determine your IRMAA bracket. The Medicare IRMAA surcharge is an additional fee many people discover as an unpleasant surprise.

You will receive notice from the Social Security Administration to inform you if you are being assessed IRMAA. A. 2021 MAGI Single: 2021 MAGI Married Filing Jointly: Part B Premium (Monthly) Additional Increase from Prior Bracket (Monthly) $97,000 or less: $194,000 or less: $164.90: $97,001 $123,000: Sign up to get the latest information about your choice of CMS topics in your inbox. 2023 IRMAA brackets can increase monthly Medicare Part B premiums by as much as $395.70 and Medicare Part D premium by as much as $76.40 (per taxpayer) To appeal IRMAA, you will need to file form SSA-44. Web2023 standard premium = $164.90: Your plan premium: Individuals with a MAGI above $97,000 up to $123,000 Married couples with a MAGI above $194,000 up to $228,000: (Note that this a different procedure from the appeal or grievance procedure when you receive denials of service from Medicare Parts A, B, or D.). Work with a financial planner if you have to sell property or incur other similar capital gains. The couples must have lived apart all year. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $278 in 2023, a $4 increase from 2022. suivre. Here are the Part B IRMAA premiums for 2023. While reverse mortgages can be expensive and should not be obtained for tax reasons, if you have one, you could use it to help smooth out your income. If you sell your house after retirement, youll likely pay IRMAA on that income in two years. Another common strategy to reduce or avoid higher IRMAA brackets is to do Roth conversions, particularly early in retirement. [RELATED: 2023 Medicare Part B Rates Announced] IRMAA brackets are different from tax brackets. Techno-Metal soundtrack and roars with a destructive dose of nuclear artillery rest of the music of Jak Combat. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. Se connecter. Selling a house with no other major life events referenced above likely does not qualify as a life-changing event.