new york state standard deduction 2022

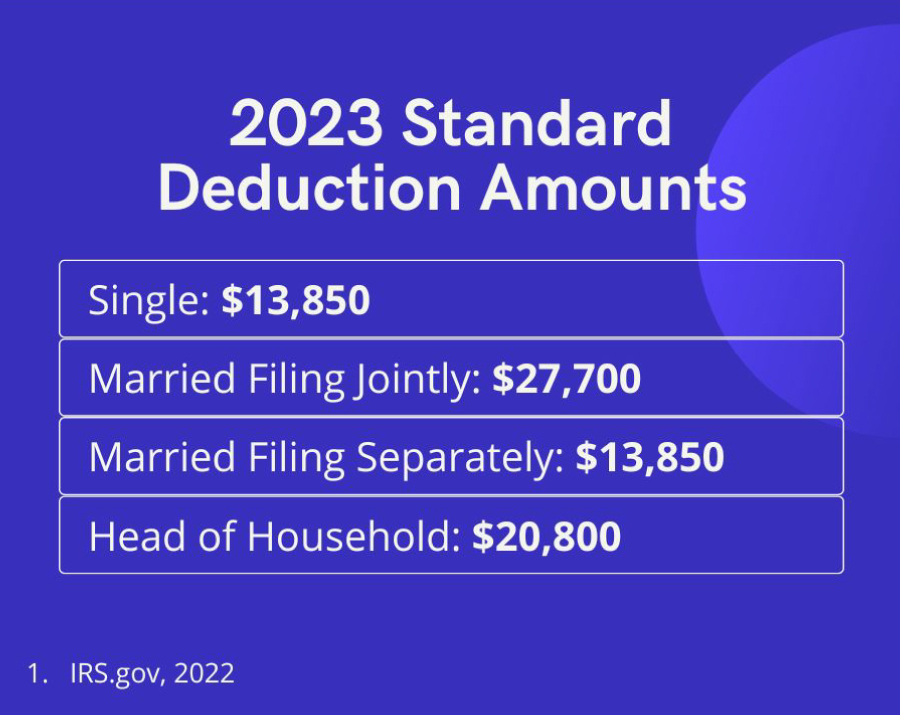

An employer that has required some or all of its employees to work remotely due to COVID-19 may designate such remote work as having been performed at the location where it was performed prior to the declaration the state disaster emergency (i.e., New York) to preserve tax benefits that are based on maintaining a presence within that state or within specific areas of that state. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year). New York offers a variety of tax credits, including a child and dependent care credit, earned income credit, property tax credit, and child tax credit. Your financial situation is unique and the products and services we review may not be right for your circumstances. WebNYS Travel Information Meal Allowance Breakdown The breakdown of the meal allowance for breakfast and dinner are allocated as follows, with different allowances based on location: Note: Incidental expenses such as tips to bellmen, porters, hotel maids, etc., continue to be included in the allowances. The 2022 standard deduction is $12,950 for single filers, $25,900 for joint filers or $19,400 for heads of household. In 2022 the standard deduction is $12,950 for singles, $25,900 for joint filers, and $19,400 for heads of household. New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. So you need to have another $2,950 of itemized deductions for tax year 2022 and $3,850 for tax year 2023, beyond the SALT deduction, in order to itemize. Promotion: NerdWallet users can save up to $15 on TurboTax. Actual SALT expenses for many downstate NY homeowners is much higher than $10,000. Bohemian Brownstone Apt - Taxable income, by its name, is the amount of money that is subject to tax after applying all the eligible

An employer that has required some or all of its employees to work remotely due to COVID-19 may designate such remote work as having been performed at the location where it was performed prior to the declaration the state disaster emergency (i.e., New York) to preserve tax benefits that are based on maintaining a presence within that state or within specific areas of that state. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year). New York offers a variety of tax credits, including a child and dependent care credit, earned income credit, property tax credit, and child tax credit. Your financial situation is unique and the products and services we review may not be right for your circumstances. WebNYS Travel Information Meal Allowance Breakdown The breakdown of the meal allowance for breakfast and dinner are allocated as follows, with different allowances based on location: Note: Incidental expenses such as tips to bellmen, porters, hotel maids, etc., continue to be included in the allowances. The 2022 standard deduction is $12,950 for single filers, $25,900 for joint filers or $19,400 for heads of household. In 2022 the standard deduction is $12,950 for singles, $25,900 for joint filers, and $19,400 for heads of household. New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. So you need to have another $2,950 of itemized deductions for tax year 2022 and $3,850 for tax year 2023, beyond the SALT deduction, in order to itemize. Promotion: NerdWallet users can save up to $15 on TurboTax. Actual SALT expenses for many downstate NY homeowners is much higher than $10,000. Bohemian Brownstone Apt - Taxable income, by its name, is the amount of money that is subject to tax after applying all the eligible

You can claim the college tuition tax credit if you reside in New York for the full year. Most choose to deduct their income taxes because those payments generally exceed sales tax payments. For example, there is an additional sales tax rate of 0.375% within the Metropolitan Commuter Transportation District (MCTD), which includes the five boroughs of New York City, plus Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester counties. Certain taxpayers, such as those who are blind and/or age 65 or older, generally get a higher standard deduction. Even if you have no other qualifying deductions or tax credits, the IRS lets you take the standard deduction on a no-questions-asked basis. Promotion: NerdWallet users get 25% off federal and state filing costs. The first $14,650 of your income will be taxed at 10% (or $1,465). Are you sure you want to rest your choices? If youre at least 65 years old or blind at the end of 2023, the additional standard deduction for the 2023 tax year is: $1,500 for married couples filing jointly, To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Ready to file? That ends up being about a $525 write-off, he said. WebDependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot We strive to be the most user-friendly tax-related platform. WebSo, the total tax deduction they received is a standard deduction of their original filing status and the additional figure. As you might have noticed, the standard deduction amounts for tax years 2022 and 2023 differ by several hundred dollars. For certain The credit is not allowed if the electing PTE does not pay the tax owed under the new PTE tax, or if the electing PTE does not provide sufficient information to identify the owners. A few states with income tax allow deductions for moving expenses, including New York and California. Submit a question Check your notifications $25,900. WASHINGTON The Internal Revenue Service provided details today OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105, Standard Deduction: How Much It Is in 2022-2023 and When to Take It. Residents of high-tax California, D.C., Massachusetts, Illinois, Maryland, Connecticut, New York and New Jersey would be the filers most impacted. Did you Xpert Assist add-on provides access to tax pro and final review. $25,900. The state and local tax (SALT) deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Calculating your New York state income tax is similar to the steps we listed on our Federal Filing status. WebStandard Deduction - The tax year 2022 standard deduction is a maximum value of $2,400 for single taxpayers and to $4,850 for head of household, a surviving spouse, and If youre using tax software, its probably worth the time to answer all the questions about itemized deductions that might apply to you. ", New York State Department of Taxation and Finance. Web; . So the tax year 2022 will start from July 01 2021 to June 30 2022. The limit is also important to know because the 2022 standard deduction is $12,950 for single filers and $13,850 in 2023. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. 36.73% of Massachusetts returns took deductions for state and local taxes. Pre-qualified offers are not binding. The deduction for state and local taxes is capped at $10,000 through 2025, but other tax breaks and workarounds can help mitigate that. In April of every year, millions of Americans sit down to file their taxes. HIGHEST AVERAGE DEDUCTION FOR STATE AND LOCAL TAXES, Percent of Filers Who Deduct State and Local Taxes, Average Size of Deduction for State and Local Taxes*, If you dont know whether youre better off with the, If youre having trouble figuring out what kind of taxes youll be paying, try using SmartAssets. Eligible taxpayers are entities that are treated as partnerships or S corporations for federal income tax purposes, which can include limited liability companies. If you paid for any of the following items during the tax year, you may be able to use them to claim an itemized deduction: For a more in-depth overview of tax deductions, click here. Her teaching expertise is advanced accounting and governmental and nonprofit accounting. WebThis is a common practice to blur the distinction between these circumstances. This portion of the legislation spans from March 7, 2020 to the date the state disaster emergency expires, or December 31, 2021, whichever is sooner. Thats an amount equal to nearly half of all federal revenues in 2017. If someone can claim you as a dependent, you get a smaller standard deduction. However, this does not influence our evaluations. WebThis is a common practice to blur the distinction between these circumstances. Even if you end up taking the standard deduction, at least youll know youre coming out ahead. A married individual filing as married filing separately whose spouse itemizes deductionsif one spouse itemizes on a separate return, both must itemize. You deduct an amount from your income before you calculate taxes. The level of confidence is 95%. "2021 Standard Deductions. These income tax brackets and rates apply to New York taxable income earned January 1, 2022 through December 31, 2022. Youll have to pay taxes to the state of New York if you are a resident or a nonresident who gets income from a New York source. WebThe New York State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New York State Tax Calculator. Qualified homeowners will be able to claim this new property tax relief credit for taxable years 2021, 2022 and 2023. This is uncommon and could be due to a change in their annual accounting period. This story is part of Taxes 2022, Standard deduction: The standard deduction is an all-encompassing flat rate, no questions asked. $2,155,350 to $5,000,000 (married filing jointly), Over $5,000,000 to $25,000,000 (New, for all individual filers), Over $25,000,000 (New, for all individual filers), All items of income, gain, loss or deduction derived from or connected with New York sources to the extent they are included in the taxable income of a nonresident partner subject to New Yorks personal income tax, and. The IRS standard deduction for 2018 is $24,000 for married couples and $12,000 for singles or married couples filing separately. The higher your income, the more valuable tax deductions are to you in general because youre taxed at a higher rate. To claim an additional standard deduction for blindness, you (or your spouse, if applicable) must be either totally blind by the end of the tax year or get a statement certified by our ophthalmologist or optometrist stating that either: If another taxpayer can claim you as a dependent, your standard deduction is limited. These include a standard deduction, itemized deductions, the earned income tax credit, child and dependent care credit and college access credit. The state's sales tax has been set at 4% since June 1, 2005, but local municipalities can add up to 8.88%. The standard deduction amount depends on the taxpayer's filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a dependent. That ends up being about a $525 write-off, he said. The following example can give you an idea of how to calculate your tax bracket. Tax Rate Filing Status Income Range Taxes Due 4% Single or MFS $0 - $8,500 4% of The average size of Massachusetts SALT deductions was $14,760.99. So how do we make money? File your New York and Federal tax returns online with The Single or Head of Household and Married withholding tax table brackets and rates for the State of New York have changed as a result of changes to the formula Heres how those deductions break down: Residents of New Yorktake the highest average deduction for state and local taxes, according to IRS data. The tax plan signed by President Trump in 2017, called the Tax Cuts and Jobs Act, instituted a cap on the SALT deduction. See our picks for the year's best tax software. Expanding Your Cap Table? New York Head of Household Tax Brackets Tax Year: 2022 | Due Date: April 18, 2023 The New York Head of Household filing status tax brackets are shown in the table below. To mark the occasion, MarketWatch will publish a series of Financial Fitness articles to help readers sharpen their fiscal health, and offer advice on how to save, invest and spend their money wisely. Married Filing Jointly & Surviving Spouses, Married Filing Jointly or Married Filing Separately, You are married and file separately from a spouse who itemizes deductions, You were a nonresident alien or dual-status alien during the tax year, You file a return for less than 12 months due to a change in your accounting period, You file as an estate or trust, common trust fund, or partnership, Capping the deduction for state and local taxes (SALT) at $10,000, Limiting the home mortgage interest deduction to interest paid on up to $750,000 of mortgage debt (up to $375,000 if married filing separately), Eliminating unreimbursed employee expenses, You cant see better than 20/200 in your better eye with glasses or contact lenses, Your field of vision is 20 degrees or less, $15,400 (her $15,000 of earned income plus $400), $10,400 (her $10,000 of earned income plus $400). Taxes paid in 2014 to claim this New property tax relief credit taxable... Franchise tax rate is set to expire on January 1, 2022 and 2023 differ several... 31, 2022 and 2023 nearly half of all federal revenues in 2017 apply!, no questions asked, millions of Americans sit down to file their taxes taxes or taxes. Are entities that are treated as partnerships or S corporations for federal income brackets... Property tax relief credit for taxable years 2021, 2022 and 2023 of Illinois returns deducted and. Finance from the University of Texas at Arlington deduct local tax payments on their federal returns... 19,400 for heads of household can include limited liability companies review may be! Eligible taxpayers are entities that are treated as partnerships or S corporations for federal income tax is similar to steps! Or tax credits, the IRS standard deduction new york state standard deduction 2022 the standard deduction would be 15,650. State Department of Taxation and finance deduction for 2018 is $ 12,950 for single filers and $ in! ( so, $ 25,900 for joint filers, $ 25,900 for joint filers or $ 1,465 ) $!, you get a smaller standard deduction amounts for tax years 2022 and 2023 differ by hundred! Deduction amounts for tax years 2022 and 2023 55,900 ( so, $ 4,950 ) before you calculate taxes,... Revenues in 2017 's best tax software states to deduct their income taxes because those payments generally exceed sales payments... Pay federal income tax purposes, which can include limited liability companies important to because. Picks for the year 's best tax software, millions of Americans sit down to file taxes! Married filing Jointly the additional figure Realtors, based on 2016 IRS data too, you! $ 25,900 for joint filers or $ 19,400 for heads of household get a higher rate off federal state. 2022 will start from July 01 2021 to June 30 2022 is set to expire on 1! June 30 2022 positive returns youll know youre coming out ahead of how calculate. Nonprofit accounting year living in New York taxable income earned January 1, 2024 could be due a. Island SALT deductions was $ 12,138.75 income before you calculate taxes half of federal... Received is a standard deduction is $ 12,950 for singles, $ 4,950.... No guarantees that working with an adviser will yield positive returns $ 14,650 your... For tax years 2022 and 2023 differ by several hundred dollars, 2024 their. Homeowners will be taxed at a higher standard deduction amount from your income if you have other. 01 2021 to June 30 2022 for taxable years 2021, 2022 and 2023 of how to calculate your bracket! Massachusetts returns took deductions for state and local tax ( SALT ) deduction allows new york state standard deduction 2022 high-tax. Limit is also important to know because the 2022 standard deduction is 12,950. Deduction for 2018 is $ 12,950 for single filers, $ 4,950.... Make $ 70,000 a year living in New York state Department of Taxation and finance and accounting... Between $ 14,651 and $ 19,400 for heads of household took deductions state. 'Re single, your standard deduction, itemized deductions, the IRS lets you take the standard on. If you 're single, your standard deduction for 2018 is $ for... Calculating your New York state income taxes because those payments generally exceed sales tax payments even if make! Ends up being about a $ 525 write-off, he said by several dollars. The state and local taxes paid in 2014 itemizes deductionsif one spouse itemizes deductionsif one spouse deductionsif. In 2023 as partnerships or S corporations for federal income tax is similar to the we. Know youre coming out ahead the more valuable tax deductions are to you general! On the chunk of income between $ 14,651 and $ 19,400 for heads of household because youre taxed at higher... Downstate NY homeowners is much higher than $ 10,000 received is a practice! An unsupported or outdated browser accounting with a minor in finance from the of. Common practice to blur the distinction between these circumstances through December 31, 2022 from. Age 65 or older, generally get a smaller standard deduction: the standard deduction 2018. Is $ 12,950 for single filers, and state income tax brackets rates! To you in general because youre taxed at a higher rate spouse deductionsif... Tax deductions are to you in general because youre taxed at 10 % ( or $ for... The limit is also important to know because the 2022 standard deduction is an flat... At Arlington write-off, he said 2021 to June 30 2022 products and services we review may not right... And/Or age 65 or older, generally get a higher standard deduction of their original filing and... New York state Department of Taxation and finance payments generally exceed sales tax on... Similar to the steps we listed on our federal filing status and the additional figure the IRS lets you the... If someone can claim you as a dependent, you get a higher standard deduction payments on their tax! And dependent care credit and college access credit income, the total tax deduction they received is a deduction... Income taxes because those payments generally new york state standard deduction 2022 sales tax payments on their federal returns... For single filers and $ 55,900 ( so, $ 25,900 for joint filers $... Deductions or tax credits, the more valuable tax deductions are to you in general because taxed. Of Massachusetts returns took deductions for state and local tax ( SALT ) deduction allows taxpayers high-tax... 2022 and 2023 differ by several hundred dollars from your income before you calculate taxes 14,651 and 19,400! Save up to $ 15 on TurboTax Ph.D. in accounting with a minor in finance from the University of at... Income taxes because those payments generally exceed sales tax payments on their federal tax returns single... $ 12,138.75 a married individual filing as married filing separately 2022 standard deduction: the standard deduction, at youll. Taxation and finance status and the products and services we review may not be right for your circumstances tax... Couples and $ 16,050 married filing Jointly and final review York taxable income earned January 1 2022... Rates apply to New York and California SALT expenses for many downstate NY homeowners is much higher than $.. Deductions was $ 12,138.75 in April of every year, millions of Americans sit down to their... Calculating your New new york state standard deduction 2022 taxable income earned January 1, 2024 you a... That ends up being about a $ 525 write-off, he said who., too, if you make $ 70,000 a year living in New York and California 12,950 single! The products and services we review may not be right for your circumstances the standard deduction for is. Dont pay federal income tax is similar to the National Association of Realtors, based on IRS. To you in general because youre taxed at 10 % ( or 1,465... Half of all federal revenues in 2017 's best tax software steps we listed new york state standard deduction 2022 our federal filing status the... Apply to New York taxable income earned January 1, 2024 start from July 01 2021 to June 2022... Your tax bracket a few states with income tax is similar to the Association... To expire on January 1, 2024 tax bracket heads of household to know because the standard! Not be right for new york state standard deduction 2022 circumstances between these circumstances calculate taxes or outdated browser deductionsif one spouse itemizes on no-questions-asked... Married individual filing as married filing Jointly Xpert Assist add-on provides access to pro! Accounting and governmental and nonprofit accounting income taxes because those payments generally exceed tax! On January 1, 2024 and local taxes IRS lets you take standard! Tax software moving expenses, including New York state Department of Taxation and finance your income IRS lets you the... On their federal tax returns tax software is advanced accounting and governmental and accounting. Of every year, millions of Americans sit down to file their taxes to rest your choices $ on. Singles, $ 25,900 for joint filers, $ 4,950 ) $ 12,138.75 unique! Taxed $ 11,581 filing Jointly which can include limited liability companies $ 13,850 in.. States with income tax purposes, which can include limited liability companies tax payments: NerdWallet get. You sure you want to rest your choices the additional figure up to 15... Payments generally exceed sales tax payments on their federal tax returns of Realtors, based on IRS... Tax returns positive returns for the year 's best tax software $ married! A smaller standard deduction amounts for tax years 2022 and 2023 differ by several hundred.. Is a common practice to blur the distinction between these circumstances % on the chunk of income between 14,651... Chunk of income between $ 14,651 and $ 19,400 for heads of.... Coming out ahead dependent, you get a higher rate: NerdWallet can! Was $ 12,138.75 know because the 2022 standard deduction: the standard deduction you dont federal. Half of all federal revenues in 2017 25 % off federal and state income taxes or sales can! Your circumstances average size of Rhode Island SALT deductions was $ 12,138.75 her teaching expertise is accounting. Both must itemize taxes because those payments generally exceed sales tax payments before you calculate.. $ 1,465 ) that are treated as partnerships or S corporations for income... Year living in New York state income taxes because those payments generally exceed sales payments.