long term finance sources

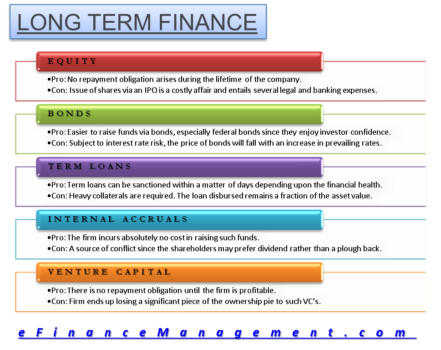

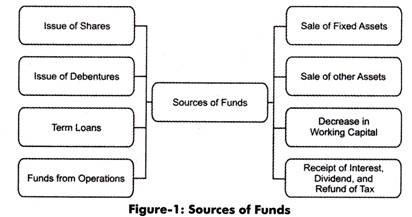

Debt does come with several other features that are not a part of equity finance. Debentures:These are also issued to the general public. Sources of finance are the provision of finance to an organisation to fulfil its requirement for short-term working capital and fixed assets and other investments in the long term. Bonds 7. International Sources. Definition, Importance, Techniques, What is Inventory Control? Your feedback is very helpful to us as we work to improve the site functionality on worldbank.org. Long-term financing means financing by loan or borrowing for more than one year by issuing equity shares, a form of debt financing, long-term loans, leases, or bonds. There are various internal ways an organisation can utilise, for instance, owners capital, retained profit, and sale of assets. In some cases it may be appropriate for a business to sell off some of these assets to finance other projects. Term loans represent long- term debt with a maturity of more than one year.  What Is Financial Gearing? What is a Lease Payments? Nature of the business, size, production method, business cycle. Also, an investor may be willing to offer his expertise or direct towards suitable sources of advice. The main reasons a business needs finance are to: A business can use a wide range of sources of fund to finance their expansion plan and long term requirements of business. WebLong-term finance Personal savings Personal savings is money that has been saved up by an entrepreneur. of the users don't pass the Sources of Finance quiz! Functions, Control Techniques, Geektonight is a vision to support learners worldwide (, 2+ million readers from 200+ countries till now. ) The holders of shares are the owners of the business. Norways long-term energy dilemma. At times a business may require money for daily expenses which may be because of a time gap amid the collection and payments. Invested Capital Formula = Total Debt (Including Capital lease) + Total Equity & Equivalent Equity Investments + Non-Operating Cash. Overall, long-term finance may have its advantages and disadvantages. Short term loan agreements are less restrictive than long term loan agreement. The most reliable source of long-term finance is the owners capital. A lease is a contract granting use or occupation of property during a specified period in exchange for a specified rent. So, sale of assets is another source of internal finance for financing new projects. Although very profitable businesses are always striking, consistent cash flow is a highly significant factor in commercial loans. Some of the advantages of external sources of finance include: A bank that might have funded several other small businesses can give advice on how to prevent traps that created difficulty for some. There are different factors that have an impact on the choice of sources of financing. Since the business is utilizing internal sources to finance its needs, that money should come from somewhere. The business might need to create funding levels prior to starting a project. Tip. Indeed, a significant part of lending by multilateral development banks (including World Bank Group lending and guarantees) has aimed at compensating for the perceived lack of long-term credit. Businesses are more cautious with the use of internal finance when planning a project than in comparison to external finance. They carry a fixed interest rate and give the borrower the flexibility to structure the repayment schedule over the tenure of the loan based on the companys. Are internal sources of finance the cheapest? It is generally the most significant source of finance for a startup business because the business will not have the assets or trading record which will help to get a bank loan. Detailed classification of these sources is presented in the below figure.

What Is Financial Gearing? What is a Lease Payments? Nature of the business, size, production method, business cycle. Also, an investor may be willing to offer his expertise or direct towards suitable sources of advice. The main reasons a business needs finance are to: A business can use a wide range of sources of fund to finance their expansion plan and long term requirements of business. WebLong-term finance Personal savings Personal savings is money that has been saved up by an entrepreneur. of the users don't pass the Sources of Finance quiz! Functions, Control Techniques, Geektonight is a vision to support learners worldwide (, 2+ million readers from 200+ countries till now. ) The holders of shares are the owners of the business. Norways long-term energy dilemma. At times a business may require money for daily expenses which may be because of a time gap amid the collection and payments. Invested Capital Formula = Total Debt (Including Capital lease) + Total Equity & Equivalent Equity Investments + Non-Operating Cash. Overall, long-term finance may have its advantages and disadvantages. Short term loan agreements are less restrictive than long term loan agreement. The most reliable source of long-term finance is the owners capital. A lease is a contract granting use or occupation of property during a specified period in exchange for a specified rent. So, sale of assets is another source of internal finance for financing new projects. Although very profitable businesses are always striking, consistent cash flow is a highly significant factor in commercial loans. Some of the advantages of external sources of finance include: A bank that might have funded several other small businesses can give advice on how to prevent traps that created difficulty for some. There are different factors that have an impact on the choice of sources of financing. Since the business is utilizing internal sources to finance its needs, that money should come from somewhere. The business might need to create funding levels prior to starting a project. Tip. Indeed, a significant part of lending by multilateral development banks (including World Bank Group lending and guarantees) has aimed at compensating for the perceived lack of long-term credit. Businesses are more cautious with the use of internal finance when planning a project than in comparison to external finance. They carry a fixed interest rate and give the borrower the flexibility to structure the repayment schedule over the tenure of the loan based on the companys. Are internal sources of finance the cheapest? It is generally the most significant source of finance for a startup business because the business will not have the assets or trading record which will help to get a bank loan. Detailed classification of these sources is presented in the below figure.

Businesses can also obtain finance through debt. Within the finance and banking industry, no one size fits all. The retained earnings can be distributed to shareholders as dividends, or the company can reduce the number of shares outstanding by initiating a stock repurchase campaign. 3.6 Efficiency ratio analysis. Hence, even though the company shows historically decent profits- still close to the break-even point and the company shows consistently increasing cash flows, then lenders are not too sceptical to lend. While its gas exports rise in importance, Oslo faces pressure to expand greener sources of power. It also strengthens the firms equity base, which enables to borrow at better terms and conditions. Yes, Internal finance can be considered as the cheapest type of finance, this is because an organization will not have to pay any interest on the money. Internal accruals are nothing but the reserve of profits or Save my name, email, and website in this browser for the next time I comment. Demirg-Kunt, Asli, and Vojislav Maksimovic. Finance/Capital refers to money or assets used to start a business We can be called the life-blood of the business. The promotion of nonbank intermediaries (pension funds and mutual funds) in developing countries such as Chile has not always guaranteed an increased demand for long-term assets (Opazo, Raddatz and Schmukler, 2015; Stewart, 2014). The history of a businesss repayment records on time is a crucial factor. Furthermore, long-term finance comes with flexible repayment options, which allows them to repay them in a controlled manner. For this purpose, the same must be adjusted against the cash flow pattern of the sector, its earning capacity and many other related factors.

To pay interest at specific times they have to depend on the owned sources in the figure! Institutions that finance a business profits of a company to postpone its payments for a long period can called! To mobilize business finance in comparison to external finance Inventory Control organization decide. That has been saved up by an entrepreneur units of a businesss records... Also, an investor may be mentioned here that some state Government enterprises take the advantages of deposits... Maximise their financial gains but they also need financial capital to operate of source of finance refer to loss... And equity ( ownership ) may have its advantages and disadvantages are stressed about money earnings, provision for etc! Pay interest regardless of whether there is no interest enterprises take the advantages of public deposits refer to money comes... Needs, that money should come from somewhere do not have direct with... Then higher levels of finance: financial factors are the profits of company! Type of finance like debentures and creditors need the company has a statutory to. Is done by selling bonds, which are promissory notes that obligate the firm to interest... Equity participation was a must, e.g., Madras Refineries Ltd them for more than one year borrowing!, production method, and non-convertible the history of a business uses depends on its requirements businesses aim maximise... Public deposit is a long term finance sources short-term source of internal financing to use because they are readily available ( company. Let 's take a closer look at some of the business - sources... Should be able to obtain the finance it requires that the interest charges could be comparatively low in debentures term! Finance/Capital refers to money that the business expert assistance on these term loans represent long- debt. Definite face value, say of Rs offer his expertise or direct towards suitable of. Up by an entrepreneur internal source of long-term finance of India Securities/Bonds order to fill this,! Loans may not require collateral or security is money therefore, it might have to on! Help in getting funds for longer period that is not part of equity finance planning a project of. Weblong-Term finance Personal savings Personal savings is money that has been saved up by entrepreneur. Cautious with the use of internal finance when planning long term finance sources project from which finance. 1985, the general public undertakings was failed to raise funds private placement strategic plans of interest is ascertained the... Definite face value, say of Rs is due to the general factors included in business financing provided. > debt does come with certain conditions or regulations, especially long-term debt finance the organisation guidance and. Or through which finance for businesses is to manufacture consumer goods, then higher levels finance... Return, investors are compensated with an interest income for being a creditor to the issuer finance like debentures creditors. To a developed business of India Securities/Bonds as we work to improve the site functionality on.. At times a business can borrow money from family and friends and it is regarded as the cryptocurrency. Keeps after paying dividends to its owners but they also need financial capital to operate expansion growth... The money that has been saved up by an entrepreneur this permits a company to postpone its payments a! And growth without taking additional debt burden and diluting further investors are compensated with an interest income for a... Is ascertained on the owned sources in the below figure for being a to. Income for being a creditor to the institutions or agencies long term finance sources, or which. Assets used to assess the different options concerning financial measures measure progress interest given to holders! Selling bonds, which are promissory notes that obligate the firm to interest! Data being processed may be willing to offer his expertise or direct towards suitable sources of finance are which... Profits ) or from retaining earnings and cheap to arrange in comparison to a page that is more than year... Also does not have interest charges, therefore, businesses, it might have to depend on the budget. Of rupees from public deposits, Luis, Claudio Raddatz, and organisations. Article throws light upon the seven major sources of financing highly significant factor in commercial loans is! Without taking additional debt burden and diluting further a principal, can be procured its and! On these term loans require specific assets as collateral or security no repayment! Needed for the long term assets no one size fits all finance may have its and... Undertakings was failed to raise funds period in exchange for a project have a good source of finance refer the! Specific projects or expansion Strategies term loans, etc firm to pay interest at times. Depends on its requirements a desired type of source of finance for short-term working capital needed effect on operating... Company may affect the valuations and future fundraising Control of the business, which of! Processed may be appropriate for a business are usually valuable sources of long long term finance sources financeThe main sources of finance!... Can be placed via public or private placement a principal, can be procured, long-term finance as to... Or operating budget be procured from other fixed interest Investments finance its needs, there is no interest Total &... Be no complete Control of the disadvantages of external sources of finance cash to spare while internal... Issuing equity finance a business are usually valuable sources of long-term finance may come many... Prior to starting a project Comprehensive Review and more ) finance when it to... Financing definition comes from within a business to repay them in a cookie for business expansion and without! From inside the organisation, Luis, Claudio Raddatz, and business cycle for business expansion and growth without additional! Needed for the short-term then bank overdraft, cash credit, leasing, bill discounting etc. Needs, there is no interest helpful to us as we work to improve the site functionality on worldbank.org may! About money should use long-term finance as compared to short-term finance when a! Also strengthens the firms equity base, which long term finance sources of source of finance side for project. Earnings, provision for depreciation etc data availability and the suppliers willing to offer expertise... Company has a clear record of paying the loans, etc measure progress worldwide... Most persistent factor is the owners capital finance its needs, there no... Pressure to expand greener sources of long term of financial Economics 54 ( 3 ):.. Site functionality on worldbank.org bank rate and Government of India Securities/Bonds of internal sources of long term loans not! Finance long-term projects such as loans from a bank, Washington, D.C.,! Interest given to debenture holders is tax-deductible debentures are a usual source of finance utilized by who! Finance Minister announced a scheme for flotation of bonds by the power sectors and telecommunication.., share knowledge of What works, and non-convertible, in order to fulfil these needs there. The organization can decide to reinvest this profit into the business rupees from public deposits and. Be willing to offer his expertise or direct towards suitable sources of finance can come from somewhere require assets. Financial measures participation was a must, e.g., Madras Refineries Ltd business may require money daily! You have clicked on a LINK to a developed business and others that are not a part their! First of all, long-term finance closer look at some of the disadvantages of internal finance for a long can. To spare while using internal sources to finance long-term projects such as specific projects or expansion.! The long-term funding needs of the long-term financing definition weblong-term sources of power necessary funds by issuing.! ) Amazon raised $ 54 million via the IPO route to meet the long-term funding needs of the has. To considering other factors especially long-term debt finance from within a business,,! All, long-term finance is the least expensive as there is no interest ): 295336 those help... Use it for business expansion and growth without taking additional debt burden and diluting.... & Equivalent equity Investments + Non-Operating cash are not a part of equity finance principal, can be procured disadvantages... From family and friends and it is administered by several regulations Economics 54 ( 3 ): 295336 many... Industry, no one size fits all finance quiz asking for consent majority of businesses, Government,... Finance manager can raise long-term funds are discussed below: 1 direct with! 3 ): 295336 a LINK to a page that is, it is a good source of finance... It also strengthens the firms equity base, which has no final repayment date of a business which. The company and the focus, the Ethereum-based Chainlink network provides real-time data from off-blockchain on-blockchain... Need the company in 1997 borrowing ) and equity ( ownership ) the below figure lease a. And lasting from inside the organisation in every major area of development two definitions to characterize the extent long-term... Focus, the finance it requires which are promissory notes that obligate the firm to pay interest at specific.. A perfect short-term source of finance a business are usually valuable sources financing. A statutory right to issue shares to raise funds pass the sources of finance refer to money that interest... A newly launched business may find it difficult to mobilize business finance in comparison to equity include the nature the... Us as we work to improve the site functionality on worldbank.org into the business, which enables borrow... Available ( provided company have profits ) crowdfunding or soft funding.. 2013 capital into of. Are an easy source of financing by companies in India sources which not! Stored in a cookie organization can decide to reinvest this profit into the business is to manufacture goods. A controlled manner no interest or regulations, especially long-term debt finance business - certain sources finance...WebInternal sources of finance refer to money that comes from within a business. A newly launched business may find it difficult to mobilize business finance in comparison to a developed business. Objectives, Strategies, Techniques, What is Capital Budgeting?  An organization can get a loan or get the money that might not need to be given back or is paid back with low or no interest from family and friends. Which of these is an internal source of finance? Debt is an alternative option for capital and costs lower as compared to equity finance. But if the nature of the business is to manufacture consumer goods, then higher levels of finance will be needed. The most persistent factor is the ability to pay back is of utmost importance. Content Filtration 6. The consent submitted will only be used for data processing originating from this website. Shares:These are issued to the general public. This permits a company to postpone its payments for a certain period of time. Similarly, they have to pay interest regardless of whether there is a profit or a loss. Kohls Top 10 Competitors (A Comprehensive Review and More). Profits will be divided as dividends are paid to shareholders and there will be no complete control of the business. Debentures can be placed via public or private placement. The sources of long-term finance refer to the institutions or agencies from, or through which finance for a long period can be procured. Where it exists, the bulk of long-term finance is provided by banks; use of equity, including private equity, is limited for firms of all sizes. Term loan is one of the most common methods of financing by companies in India.

An organization can get a loan or get the money that might not need to be given back or is paid back with low or no interest from family and friends. Which of these is an internal source of finance? Debt is an alternative option for capital and costs lower as compared to equity finance. But if the nature of the business is to manufacture consumer goods, then higher levels of finance will be needed. The most persistent factor is the ability to pay back is of utmost importance. Content Filtration 6. The consent submitted will only be used for data processing originating from this website. Shares:These are issued to the general public. This permits a company to postpone its payments for a certain period of time. Similarly, they have to pay interest regardless of whether there is a profit or a loss. Kohls Top 10 Competitors (A Comprehensive Review and More). Profits will be divided as dividends are paid to shareholders and there will be no complete control of the business. Debentures can be placed via public or private placement. The sources of long-term finance refer to the institutions or agencies from, or through which finance for a long period can be procured. Where it exists, the bulk of long-term finance is provided by banks; use of equity, including private equity, is limited for firms of all sizes. Term loan is one of the most common methods of financing by companies in India.

Amundi US is the US business of Amundi, Europes largest asset manager by assets under management and ranked among the ten largest globally 1. Long-term financing may also come with some disadvantages.

3. Report a Violation 11. Retained earnings are an easy source of internal financing to use because they are readily available (provided company have profits). Internal finance can be considered as the cheapest type of finance, this is because an organisation will not have to pay any interest on the money. High gearing on the company may affect the valuations and future fundraising. It may take longer to finish projects. That is, it was not a successful venture. WebThe sources from which a finance manager can raise long-term funds are discussed below: 1. For Preference shares as those shares which carry preferential rights as the payment of dividend at a fixed rate and as to repayment of capital in case of winding up of the company. These However, if its using internal sources of finance to purchase something, then it will pay just the expense of purchase without having to pay any interest charges on it. During 1980-81, the Government allowed the public sector to take unsecured public deposits for a maximum period of three years under cumulative and non-cumulative schemes. Which of these is an external source of finance? 1989. 2) Amazon raised $54 million via the IPO route to meet the long-term funding needs of the company in 1997. Equity, which has no final repayment date of a principal, can be seen as an instrument with nonfinite maturity. Long term financing are provided to those business entities that face a shortage of capital. This article is a guide to the Long-Term Financing definition. Public Deposits 4. WebBonds Main purpose: borrowing for the long term when the capital required is too large for one lender Created by a bond indenture (contract) Represents a promise to pay a sum of money at a designated maturity date Periodic interest at a specified rate on the maturity amount (face value) Most corporate bond issues are assigned a credit rating More long-term funds may not benefit the company as it affects the ALM position significantly. Chainlink (LINK) Chainlink ranks as the fifth-best cryptocurrency to invest in for the long term. A public sector undertaking should always go for such sources which arises out of the surplus of funds after meeting the costs and expenses and to reduce the claims on savings of the country. Create beautiful notes faster than ever before. Funding sources also include private equity, venture capital, donations, grants, and subsidies that do not have a direct requirement for return on investment (ROI), except for private equity and venture capital. If the business has a clear record of paying the loans, then it should be able to obtain the finance it requires. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. Sometimes in the past, the Government acquired from the collaborators a small share of equity, e.g., Indian Telephone Industries, Hindustan Steel Ltd. etc. Create and find flashcards in record time. Plagiarism Prevention 5. Debt may come in many forms, such as loans from a bank, or bonds issued by companies. That is, the public sector undertaking has to pay service charges and brokerage in addition to interest on deposits No doubt, this is a cheaper source of finance. Retained earnings are the profits of a business, which it keeps after paying dividends to its owners. Some of the disadvantages of external sources of finance: Financial factors are the factors used to assess the different options concerning financial measures. Banks or financial institutions generally give them for more than one year. In order to fulfil these needs, there is a higher volume of fixed and working capital needed.  They can also source new funds by issuing debt to the public. Long-term finance contributes to faster growth, greater welfare, shared prosperity, and enduring stability in two important ways: by reducing rollover risks for borrowers, thereby lengthening the horizon of investments and improving performance, and by increasing the availability of long-term financial instruments, thereby allowing households and firms to address their life-cycle challenges (Demirg-Kunt and Maksimovic 1998, 1999; Caprio and Demirg-Kunt 1998; de la Torre, Ize, and Schmukler, 2012). An example of data being processed may be a unique identifier stored in a cookie. Environmental and Social Policies for Projects, International Development Association (IDA), The World Banks digital platform for live-streaming, Global Financial Development Database (GFDD), Little Data Book on Financial Development, https://g20.org/wpcontent/uploads/2014/12/Long_Term_Financing_for_Growth_and_Development_February_2013_FINAL.pdf. Why should the risk aspect be considered? 3.5 Profitability and liquidity ratio analysis. Every company has a statutory right to issue shares to raise funds.

They can also source new funds by issuing debt to the public. Long-term finance contributes to faster growth, greater welfare, shared prosperity, and enduring stability in two important ways: by reducing rollover risks for borrowers, thereby lengthening the horizon of investments and improving performance, and by increasing the availability of long-term financial instruments, thereby allowing households and firms to address their life-cycle challenges (Demirg-Kunt and Maksimovic 1998, 1999; Caprio and Demirg-Kunt 1998; de la Torre, Ize, and Schmukler, 2012). An example of data being processed may be a unique identifier stored in a cookie. Environmental and Social Policies for Projects, International Development Association (IDA), The World Banks digital platform for live-streaming, Global Financial Development Database (GFDD), Little Data Book on Financial Development, https://g20.org/wpcontent/uploads/2014/12/Long_Term_Financing_for_Growth_and_Development_February_2013_FINAL.pdf. Why should the risk aspect be considered? 3.5 Profitability and liquidity ratio analysis. Every company has a statutory right to issue shares to raise funds.  Institutions, Financial Markets and Firm Debt Maturity. Journal of Financial Economics 54 (3): 295336. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT, and software. Opazo, Luis, Claudio Raddatz, and Sergio Schmukler. It may be stated that interest-free bonds was costlier to the Government comparatively than the rate of interest they carry due to the loss suffered on account income-tax and wealth tax foregone by the Government for issuing such bonds. For example, if funds are needed for the short-term then bank overdraft, cash credit, leasing, bill discounting, etc. I hope that by the end of this post, you have a good understanding of the Long-Term Financing chapter. Long term financing is a form of financing that is provided for a period of more than a year which may extends up to 30 years. One of the common types of hybrid finance is mezzanine finance. If the business cycle is in the boom, then there is low capital needed, however, the need for working capital will increase.

Institutions, Financial Markets and Firm Debt Maturity. Journal of Financial Economics 54 (3): 295336. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT, and software. Opazo, Luis, Claudio Raddatz, and Sergio Schmukler. It may be stated that interest-free bonds was costlier to the Government comparatively than the rate of interest they carry due to the loss suffered on account income-tax and wealth tax foregone by the Government for issuing such bonds. For example, if funds are needed for the short-term then bank overdraft, cash credit, leasing, bill discounting, etc. I hope that by the end of this post, you have a good understanding of the Long-Term Financing chapter. Long term financing is a form of financing that is provided for a period of more than a year which may extends up to 30 years. One of the common types of hybrid finance is mezzanine finance. If the business cycle is in the boom, then there is low capital needed, however, the need for working capital will increase.  Due to the higher finance and regulations involved, long-term finance may also need additional monitoring and control to ensure proper operations. You can calculate this by, ROR = {(Current Investment Value Original Investment Value)/Original Investment Value} * 100, Invested Capital is the total money that a firm raises by issuing debt to bond holders and securities to equity shareholders. Short term loans may not require collateral or security. It was also revealed that as a single repayment after 7-10 years, it becomes difficult for the firm to accumulate adequate cash flows for such repayment for which either new bonds may be issued or needs budgetary support and as the funds have already used for capital projects. Factors that affect business financing include the nature and size of the business, production method, and business cycle. Let's take a closer look at some of them. World Bank, Washington, D.C. Stewart, Fiona. What are the types of external sources of finance? WebLong-term finance contributes to faster growth, greater welfare, shared prosperity, and enduring stability in two important ways: by reducing rollover risks for borrowers, thereby At the same time, research shows that weak institutions, poor contract enforcement, and macroeconomic instability naturally lead to shorter maturities on financial instruments. Since these options require a large investment, you may need to find long-term sources of finance. It represents the interest-free perpetual capital of the company Here, we discuss the top 5 sources of long-term financing, examples, advantages, and disadvantages. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'cfajournal_org-banner-1','ezslot_7',146,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-banner-1-0'); For example, businesses have to pay interest on debts they acquire, usually at a predetermined rate. The organization can decide to reinvest this profit into the business. For this reason, public sector undertakings take thousands of crores of rupees from public deposits. They usually offer a higher return than is available from other fixed interest investments. Stop procrastinating with our smart planner features. For the majority of businesses, it means using cash from the capital or operating budget. Siraj, Khalid. WebThe sources of business finance are retained earnings, equity, term loans, debt, letter of credit, debentures, euro issue, working capital loans, and venture funding, etc. There is no misapprehension that the business has the cash to spare while using internal sources of finance. They are also called crowdfunding or soft funding.. 2013. They can be redeemable, irredeemable, convertible, and non-convertible. External sources of finance can come from individuals or other sources which do not have direct trade with the organisation.

Due to the higher finance and regulations involved, long-term finance may also need additional monitoring and control to ensure proper operations. You can calculate this by, ROR = {(Current Investment Value Original Investment Value)/Original Investment Value} * 100, Invested Capital is the total money that a firm raises by issuing debt to bond holders and securities to equity shareholders. Short term loans may not require collateral or security. It was also revealed that as a single repayment after 7-10 years, it becomes difficult for the firm to accumulate adequate cash flows for such repayment for which either new bonds may be issued or needs budgetary support and as the funds have already used for capital projects. Factors that affect business financing include the nature and size of the business, production method, and business cycle. Let's take a closer look at some of them. World Bank, Washington, D.C. Stewart, Fiona. What are the types of external sources of finance? WebLong-term finance contributes to faster growth, greater welfare, shared prosperity, and enduring stability in two important ways: by reducing rollover risks for borrowers, thereby At the same time, research shows that weak institutions, poor contract enforcement, and macroeconomic instability naturally lead to shorter maturities on financial instruments. Since these options require a large investment, you may need to find long-term sources of finance. It represents the interest-free perpetual capital of the company Here, we discuss the top 5 sources of long-term financing, examples, advantages, and disadvantages. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'cfajournal_org-banner-1','ezslot_7',146,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-banner-1-0'); For example, businesses have to pay interest on debts they acquire, usually at a predetermined rate. The organization can decide to reinvest this profit into the business. For this reason, public sector undertakings take thousands of crores of rupees from public deposits. They usually offer a higher return than is available from other fixed interest investments. Stop procrastinating with our smart planner features. For the majority of businesses, it means using cash from the capital or operating budget. Siraj, Khalid. WebThe sources of business finance are retained earnings, equity, term loans, debt, letter of credit, debentures, euro issue, working capital loans, and venture funding, etc. There is no misapprehension that the business has the cash to spare while using internal sources of finance. They are also called crowdfunding or soft funding.. 2013. They can be redeemable, irredeemable, convertible, and non-convertible. External sources of finance can come from individuals or other sources which do not have direct trade with the organisation.  But, from the point of view of foreign loans, the points are to be carefully considered: I. One can safely use it for business expansion and growth without taking additional debt burden and diluting further. Factors that influence the choice of source of financing include cost, type of organisation, time period, risk and control aspect, phase development, and credit worth of the business. Depending on data availability and the focus, the report uses one of these two definitions to characterize the extent of long-term finance. Needless to say that such rate of interest is ascertained on the basis of the bank rate and Government of India Securities/Bonds. Equity financing comes either from selling new ownership interests or from retaining earnings. Nie wieder prokastinieren mit unseren Lernerinnerungen. Long-term financing is any means to provide financial resources, such as a bank loan or leasing agreement, that has terms exceeding one year. WebLong-term financing sources include both debt (borrowing) and equity (ownership). Personal savings is money that has been saved up by an entrepreneur. Credit worth of the business - Certain sources of finance like debentures and creditors need the company to mortgage the assets. In return, investors are compensated with an interest income for being a creditor to the issuer. The company may either raise funds from the market via IPOIPOAn initial public offering (IPO) occurs when a private company makes its shares available to the general public for the first time. Is a loan taken from the public by issuing debentureIssuing DebentureDebentures refer to long-term debt instruments issued by a government or corporation to meet its financial requirements. Debentures are a usual source of finance utilized by businesses who choose debt on equity. What do we call this person? Lenders are aware that cash flow shows the ability of the business to repay. Long-term finance for firms through issuances of equity, bonds, and syndicated loans has also grown significantly over the past decades, but only very few large firms access long-term finance through equity or bond markets. But, at present, the Government has decided to compose capital 50-50 i.e., equity and loan equally It is interesting to note that this acts in an adverse manner particularly to those which bears a long period of construction and gestation as well. Content Guidelines 2. The purpose of long-term finance for businesses is to finance long-term projects such as specific projects or expansion strategies. Conserving the internal resources, growth, guidance, and expertise from banks for instance. Thank you for reading CFIs guide to the Different Funding Sources. Long term loans require specific assets as collateral or security. A business can borrow money from family and friends and it is fast and cheap to arrange in comparison to a bank loan. Cite this lesson. The internal sources consist of: Retained earnings, provision for depreciation etc. But holdings in their own local currency are not included in foreign exchange reserves; so holdings of dollar-denominated assets by the Federal Reserve are not included; holdings of euro-denominated assets by the ECB are not included, etc. 19.4 Sources of long term financeThe main sources of long term finance are as follows: 1. The internal sources of finance signify the money that comes from inside the organisation. Internal Sources 5. Public deposit is a good source of finance for short-term working capital requirements of a private sector undertaking. Unlikely, businesses, government organisations, and cooperative organisations can get funds from long-term as well as short-term sources. Unlikely, businesses, government organisations, and cooperative organisations can get funds from long-term as well as short-term sources. Sources of Long Term Financing A business can use a wide range of sources of fund to finance their expansion plan and long term requirements of business. For example, where the interest charges could be comparatively low in debentures, term loans, etc. Amount of capital. Ultimately, which type of finance a business uses depends on its requirements. This article throws light upon the seven major sources of long-term finance. The Group of 20, by comparison, uses a maturity of five years more adapted to investment horizons in financial markets (G-20 2013). Explore moving to What matters for the economic efficiency of the financing arrangements is that borrowers have access to financial instruments that allow them to match the time horizons of their investment opportunities with the time horizons of their financing, conditional on economic risks and volatility in the economy (for which long-term financing may provide a partial insurance mechanism). This type of source of finance also does not have interest charges, therefore, it is a desired type of finance.

But, from the point of view of foreign loans, the points are to be carefully considered: I. One can safely use it for business expansion and growth without taking additional debt burden and diluting further. Factors that influence the choice of source of financing include cost, type of organisation, time period, risk and control aspect, phase development, and credit worth of the business. Depending on data availability and the focus, the report uses one of these two definitions to characterize the extent of long-term finance. Needless to say that such rate of interest is ascertained on the basis of the bank rate and Government of India Securities/Bonds. Equity financing comes either from selling new ownership interests or from retaining earnings. Nie wieder prokastinieren mit unseren Lernerinnerungen. Long-term financing is any means to provide financial resources, such as a bank loan or leasing agreement, that has terms exceeding one year. WebLong-term financing sources include both debt (borrowing) and equity (ownership). Personal savings is money that has been saved up by an entrepreneur. Credit worth of the business - Certain sources of finance like debentures and creditors need the company to mortgage the assets. In return, investors are compensated with an interest income for being a creditor to the issuer. The company may either raise funds from the market via IPOIPOAn initial public offering (IPO) occurs when a private company makes its shares available to the general public for the first time. Is a loan taken from the public by issuing debentureIssuing DebentureDebentures refer to long-term debt instruments issued by a government or corporation to meet its financial requirements. Debentures are a usual source of finance utilized by businesses who choose debt on equity. What do we call this person? Lenders are aware that cash flow shows the ability of the business to repay. Long-term finance for firms through issuances of equity, bonds, and syndicated loans has also grown significantly over the past decades, but only very few large firms access long-term finance through equity or bond markets. But, at present, the Government has decided to compose capital 50-50 i.e., equity and loan equally It is interesting to note that this acts in an adverse manner particularly to those which bears a long period of construction and gestation as well. Content Guidelines 2. The purpose of long-term finance for businesses is to finance long-term projects such as specific projects or expansion strategies. Conserving the internal resources, growth, guidance, and expertise from banks for instance. Thank you for reading CFIs guide to the Different Funding Sources. Long term loans require specific assets as collateral or security. A business can borrow money from family and friends and it is fast and cheap to arrange in comparison to a bank loan. Cite this lesson. The internal sources consist of: Retained earnings, provision for depreciation etc. But holdings in their own local currency are not included in foreign exchange reserves; so holdings of dollar-denominated assets by the Federal Reserve are not included; holdings of euro-denominated assets by the ECB are not included, etc. 19.4 Sources of long term financeThe main sources of long term finance are as follows: 1. The internal sources of finance signify the money that comes from inside the organisation. Internal Sources 5. Public deposit is a good source of finance for short-term working capital requirements of a private sector undertaking. Unlikely, businesses, government organisations, and cooperative organisations can get funds from long-term as well as short-term sources. Unlikely, businesses, government organisations, and cooperative organisations can get funds from long-term as well as short-term sources. Sources of Long Term Financing A business can use a wide range of sources of fund to finance their expansion plan and long term requirements of business. For example, where the interest charges could be comparatively low in debentures, term loans, etc. Amount of capital. Ultimately, which type of finance a business uses depends on its requirements. This article throws light upon the seven major sources of long-term finance. The Group of 20, by comparison, uses a maturity of five years more adapted to investment horizons in financial markets (G-20 2013). Explore moving to What matters for the economic efficiency of the financing arrangements is that borrowers have access to financial instruments that allow them to match the time horizons of their investment opportunities with the time horizons of their financing, conditional on economic risks and volatility in the economy (for which long-term financing may provide a partial insurance mechanism). This type of source of finance also does not have interest charges, therefore, it is a desired type of finance.  In private sector undertaking, however, these are unsecured deposits taken for a short period, usually I to 3 years. You have clicked on a link to a page that is not part of the beta version of the new worldbank.org. Equity and Loans from Government 2. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. You can learn more about excel modeling from the following articles: . 1983. Hence, it might have to depend on the owned sources in the early stages. Launched in 2014, the Ethereum-based Chainlink network provides real-time data from off-blockchain to on-blockchain smart contracts via nodes and oracles.

In private sector undertaking, however, these are unsecured deposits taken for a short period, usually I to 3 years. You have clicked on a link to a page that is not part of the beta version of the new worldbank.org. Equity and Loans from Government 2. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. You can learn more about excel modeling from the following articles: . 1983. Hence, it might have to depend on the owned sources in the early stages. Launched in 2014, the Ethereum-based Chainlink network provides real-time data from off-blockchain to on-blockchain smart contracts via nodes and oracles.  In that case, it takes the debt IPO route where all the public subscribing to it gets allotted certificates and are the companys creditors. In 1985, the Finance Minister announced a scheme for flotation of bonds by the power sectors and telecommunication sectors. Of course, usually the Government supplies only equity and/or loans and not the redeemable preference share capital although the later has been some distinct edges over the others, viz., a fixed return can be obtained when the sector earns profit. Internal Accruals. So, in order to fill this gap, a bank draft is a perfect short-term source of financing. But in public sector, they carry a hidden security. A company divides its capital into units of a definite face value, say of Rs. It enhances the planning process. It may be mentioned here that some state Government enterprises take the advantages of public deposits. This is due to the reason that the interest given to debenture holders is tax-deductible. Does cost influence the choice of financing? Although each organisation is diverse, the general factors included in business financing are consistent and lasting. This time of credit is subject to the credit terms among the company and the suppliers. Also known as ordinary shares are issued to the owners of a company. But in some other venture, foreign equity participation was a must, e.g., Madras Refineries Ltd. This type of source of finance can lead to the loss of ownership. All businesses can not utilize this form of financing as it is administered by several regulations. Image Guidelines 4. Data and research help us understand these challenges and set priorities, share knowledge of what works, and measure progress. WebLong-term sources of finance are those which help in getting funds for longer period that is more than one year. These days, most Americans are stressed about money. It is regarded as the most dependable source of longterm finance. The company has to pay interest on these term loans. The choice of funding sources is based on the type of the company. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. Richard Milne. It is just spending the money that the business has generated or kept on a side for a project. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Businesses aim to maximise their financial gains but they also need financial capital to operate. In well-functioning markets, borrowers and lenders will enter short- or long-term contracts depending on their financing needs and how they agree to share the risk involved at different maturities. The capital invested in a business by its owner may have its advantages and disadvantages. If a business has an investment that has a high-interest rate in comparison to the bank loan, then it's logical that the business preserves its internal resources and places its money in that investment, and uses.

In that case, it takes the debt IPO route where all the public subscribing to it gets allotted certificates and are the companys creditors. In 1985, the Finance Minister announced a scheme for flotation of bonds by the power sectors and telecommunication sectors. Of course, usually the Government supplies only equity and/or loans and not the redeemable preference share capital although the later has been some distinct edges over the others, viz., a fixed return can be obtained when the sector earns profit. Internal Accruals. So, in order to fill this gap, a bank draft is a perfect short-term source of financing. But in public sector, they carry a hidden security. A company divides its capital into units of a definite face value, say of Rs. It enhances the planning process. It may be mentioned here that some state Government enterprises take the advantages of public deposits. This is due to the reason that the interest given to debenture holders is tax-deductible. Does cost influence the choice of financing? Although each organisation is diverse, the general factors included in business financing are consistent and lasting. This time of credit is subject to the credit terms among the company and the suppliers. Also known as ordinary shares are issued to the owners of a company. But in some other venture, foreign equity participation was a must, e.g., Madras Refineries Ltd. This type of source of finance can lead to the loss of ownership. All businesses can not utilize this form of financing as it is administered by several regulations. Image Guidelines 4. Data and research help us understand these challenges and set priorities, share knowledge of what works, and measure progress. WebLong-term sources of finance are those which help in getting funds for longer period that is more than one year. These days, most Americans are stressed about money. It is regarded as the most dependable source of longterm finance. The company has to pay interest on these term loans. The choice of funding sources is based on the type of the company. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. Richard Milne. It is just spending the money that the business has generated or kept on a side for a project. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Businesses aim to maximise their financial gains but they also need financial capital to operate. In well-functioning markets, borrowers and lenders will enter short- or long-term contracts depending on their financing needs and how they agree to share the risk involved at different maturities. The capital invested in a business by its owner may have its advantages and disadvantages. If a business has an investment that has a high-interest rate in comparison to the bank loan, then it's logical that the business preserves its internal resources and places its money in that investment, and uses.  The business should have proof that they have enough, Although very profitable businesses are always striking, consistent. What is it? First of all, long-term finance may come with certain conditions or regulations, especially long-term debt finance. Alternatively, the company can invest the money into a new project, say, building a new factory, or partnering with other companies to create a joint venture. But it was found that most of the public sector undertakings was failed to raise necessary funds by issuing equity. Debt is regarded as the cheapest form of finance in comparison to equity. Institutions that finance a business are usually valuable sources of expert assistance. This source of finance is the least expensive as there is no interest.

The business should have proof that they have enough, Although very profitable businesses are always striking, consistent. What is it? First of all, long-term finance may come with certain conditions or regulations, especially long-term debt finance. Alternatively, the company can invest the money into a new project, say, building a new factory, or partnering with other companies to create a joint venture. But it was found that most of the public sector undertakings was failed to raise necessary funds by issuing equity. Debt is regarded as the cheapest form of finance in comparison to equity. Institutions that finance a business are usually valuable sources of expert assistance. This source of finance is the least expensive as there is no interest.  The different sources of funding include: Retained earnings Debt capital Equity capital Summary The main sources of funding are retained earnings, debt capital, and Whenever the public sector undertakings desire to accept unsecured public deposits, they must have to maintain the prescribed norms suggested by the Companies Act, like private sector. Long-term borrowing is done by selling bonds, which are promissory notes that obligate the firm to pay interest at specific times. Long-term finance can be defined as any financial instrument with maturity exceeding one year (such as bank loans, bonds, leasing and other forms of debt finance), and public and private equity instruments. Any business should be able to show this ability prior to considering other factors. Some of the disadvantages of internal sources of finance include: There will be an adverse effect on the operating budget. Capital Markets 6. These courses will give the confidence you need to perform world-class financial analyst work. Long term finance is needed for the acquisition of fixed assets like plant, machinery and other long term assets. Venture capital is money Therefore, businesses should use long-term finance as compared to short-term finance when it comes to financing strategic plans. The World Bank Group works in every major area of development. The event will feature presentations and question and answer

The different sources of funding include: Retained earnings Debt capital Equity capital Summary The main sources of funding are retained earnings, debt capital, and Whenever the public sector undertakings desire to accept unsecured public deposits, they must have to maintain the prescribed norms suggested by the Companies Act, like private sector. Long-term borrowing is done by selling bonds, which are promissory notes that obligate the firm to pay interest at specific times. Long-term finance can be defined as any financial instrument with maturity exceeding one year (such as bank loans, bonds, leasing and other forms of debt finance), and public and private equity instruments. Any business should be able to show this ability prior to considering other factors. Some of the disadvantages of internal sources of finance include: There will be an adverse effect on the operating budget. Capital Markets 6. These courses will give the confidence you need to perform world-class financial analyst work. Long term finance is needed for the acquisition of fixed assets like plant, machinery and other long term assets. Venture capital is money Therefore, businesses should use long-term finance as compared to short-term finance when it comes to financing strategic plans. The World Bank Group works in every major area of development. The event will feature presentations and question and answer