fuhure credit card charge

Find the right loan by telling us what you're after. Welcome Offer: This card does not offer a welcome bonus.

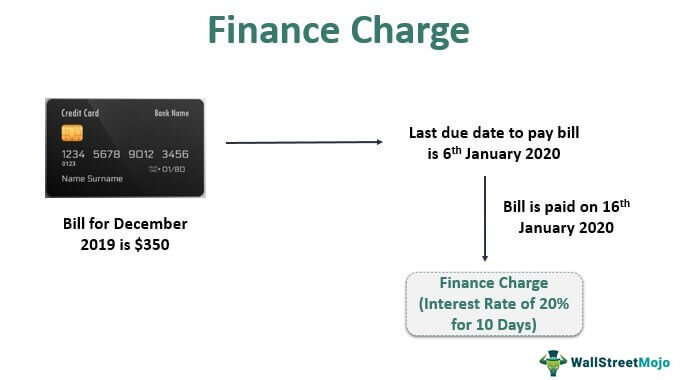

This will detail any penalty fees you could accrue on your account if you pay after your accounts due date, which includes late fees and penalty annual percentage rate (APR). You can simply ask your card issuer to waive the fee. Daily periodic rate: 20% / 365 = .055%.

The offers straightforward rewards, but if youre looking for a travel card, this is far from likely to be the most lucrative option. It can affect your interest rate, credit score and even your card rewards.

Card companies require that it never be stored or recorded, but rather passed directly from the customer to the merchant gateway and then immediately forgotten. Some cards allow you to do that through your online account. If you have missed your payments at least once in the past six months, they may not be so forgiving. The Ohio Civil Rights Commission administers compliance with this law. Truist Personal Credit Cards,Personal and Business Debit Cards and Money Account cards are eligible for Truist Deals. Hackers can intercept card-not-present transactionsincluding those youre storing and charging remotely.

Card companies require that it never be stored or recorded, but rather passed directly from the customer to the merchant gateway and then immediately forgotten. Some cards allow you to do that through your online account. If you have missed your payments at least once in the past six months, they may not be so forgiving. The Ohio Civil Rights Commission administers compliance with this law. Truist Personal Credit Cards,Personal and Business Debit Cards and Money Account cards are eligible for Truist Deals. Hackers can intercept card-not-present transactionsincluding those youre storing and charging remotely. Lets take a look at the different processes for each. Which you should contact first depends on whether or not you think the transaction is fraudulent. If youre late by a day or two, and the late fee hasnt been charged to your account yet, you can call your card company to explain your situation. 0.00% introductory APR for the first 15 months your account is open for all balances transferred with 90 days of account opening.

2023's Best Credit Cards Compare Cards People also ask If you don't owe a balance, it will appear as zero. So, you may want to consider limiting the amount your authorized users can spend. On the other hand, a transfer can be neutral.

To learn more about factors to consider when applying for or using a credit card, visit the Consumer Financial Protection Bureaus website at www.consumerfinance.gov/learnmore.

Card on File Transactions: What Card on File (CoF) Payments Are + Uses, Click here to sell online and in-person with Shopify, Cash on Delivery: How To Guide for Retail Businesses, The Retailers Guide to Supply Chain Management, Everything You Need To Know About Customer Facing Displays, The Future of Payments: How Credit Card Processing Works in 2023. You should make your request at least three days before the next scheduled payment date, to avoid having another payment go through. Meaning of facture. Any cash back earned through the Truist Deals Program is not eligible for any deposit bonus or other incentives that may be available when you redeem your Truist Consumer Credit Card Rewards. Harley-Davidson. Long gone are the days of customers needing to enter their chip and pin details to complete an in-store transaction. There are a variety of payment methods available, from tap to pay transactions tomobile payments. Rewards are only earned at the advertised 5% cash-back rate on the first $25,000 in annual purchases, then all purchases regardless of category earn 1% cash back. ** Simple login and you can see the team instantly.

Card on File Transactions: What Card on File (CoF) Payments Are + Uses, Click here to sell online and in-person with Shopify, Cash on Delivery: How To Guide for Retail Businesses, The Retailers Guide to Supply Chain Management, Everything You Need To Know About Customer Facing Displays, The Future of Payments: How Credit Card Processing Works in 2023. You should make your request at least three days before the next scheduled payment date, to avoid having another payment go through. Meaning of facture. Any cash back earned through the Truist Deals Program is not eligible for any deposit bonus or other incentives that may be available when you redeem your Truist Consumer Credit Card Rewards. Harley-Davidson. Long gone are the days of customers needing to enter their chip and pin details to complete an in-store transaction. There are a variety of payment methods available, from tap to pay transactions tomobile payments. Rewards are only earned at the advertised 5% cash-back rate on the first $25,000 in annual purchases, then all purchases regardless of category earn 1% cash back. ** Simple login and you can see the team instantly. Proper management of your finances is key to avoiding late fees on your credit card. If your family member refuses to pay you back, you should report the incident to your credit card company. Even if youve already paid for some of your recurring expense, its still worth calling the billers customer service department. How Retailers Can Use Them to Boost Their Business, The Ultimate Guide to Retail Store Layouts, Planograms: What They Are and How Theyre Used in Visual Merchandising, Soleply Increases Its Store Average Order Value With Shopify POS Go, 10 Visual Merchandising Tips for Increasing Retail Sales, What Is Store Credit? Learning common credit card terms and how credit cards work can help ensure you use your card the right way and maintain good financial habits. car-buying service. CFPB additional resources for homeowners seeking payment assistance in 7 additional languages: Spanish, Traditional Chinese, Vietnamese, Korean, Tagalog, and Arabic. They pose many advantages to retailersnotably consistent, predictable revenue and high customer engagement. Every Shopify plan includes built-in payments processing with quick payouts and low rates, starting from 2.4% + 0c USD. Miles & More World Elite Mastercard Review 2023. Credit cards usually come with a set credit limit (say $500, $2,500, or $25,000) based on your credit history and income.

For example, say you have a card with a balance of $500, 15.99% interest rate and a first-time late payment fee of $20. The FutureCard includes a welcome bonus: This card does not offer a welcome bonus.. Redeeming rewards with the FutureCard Visa is particularly easy, since all rewards are automatically redeemed when the transaction is made.

If you owe money, it will appear as a positive number. Get your next big purchase now and save on interest.

Choose a credit card that has a low late fee or none at all. Credit card convenience fees Credit card convenience fees can be charged in some instances and will vary by issuer. PRO TIP: Take control of your cash flow with Shopify Payments. Choose one that can handle partial payments, store customer credit card details, and automatically bill shoppers based on an already-agreed upon subscription contract. Credit Report and Refresh: By applying for this Account you agree that we may obtain credit reports for purposes of processing your application and for later purposes related to your Account such as reviewing, updating, renewing, increasing the Credit Limit and collecting. FutureCard is worth looking into for those seeking a slightly more climate-friendly payment method or those looking to earn top rewards on greener purchases. in English from the University of St. Thomas Houston. The Wells Fargo Active Cash Card charges no annual fee and earns an unlimited 2% cash rewards on purchases, meaning it meets what we often call the plastic standard among rewards cards.

If theyre willing to give you the money, you may not need to dispute the charges, and you can give them a warning not to do it again. @WalletHub 12/16/22 This answer was first published on 06/24/19 and it was last updated on 12/16/22.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Late payments are reported by banks to credit bureaus if you skip an entire billing cycle, which is typically 30 days.

Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. with the Federal Trade Commission (FTC). Retailers can also use a third-party payment processor like Shopify Payments. **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Below are a few frequently asked questions regarding late fees.

Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. with the Federal Trade Commission (FTC). Retailers can also use a third-party payment processor like Shopify Payments. **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Below are a few frequently asked questions regarding late fees.

When you freeze your card, any recurring payments that you've already set up will continue to be processed. If you pay your credit card late, you are likely to receive a late fee. Auto Advisors' service saves you time and energy,plus get 0.25% off your approved rate.

A Checklist for Choosing the Best POS for Your Business, 5 Tips for Training Your Employees on a New POS, The 7 Best Shopify Apps for Engaging Retail Customers, The Future of Retail Report [Free Download], Product Pricing: 5 Steps to Set Prices For Wholesale and Retail, Retail Jobs: 8 Common Retail Positions, Their Duties, and Who to Hire First, Whats a SKU Number? Start your free trial, then enjoy 3 months of Shopify for $1/month when you sign up for a monthly Basic or Starter plan. Your APR will be based on your creditworthiness. Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. If the remaining $30,073 in credit-card spending was also spent with this card, a total of $300.73 in rewards could be earned, totalling $400.68 in total annual reward potential. Do Not Sell or Share My Personal Information. Whether you are looking to buy your first home, transition into a new place, or refinance your existing property, we are here for you.

By law, first time late fees can be no higher than $29, while subsequent penalties can reach $40.

By law, first time late fees can be no higher than $29, while subsequent penalties can reach $40. 6.75%. Aside from being penalized with a fee, severely late payments can affect your interest rate and credit score. Some banks set their fee based on the frequency of your late payments, while others split late fees into tiers based on your credit card balance. Maintain reminders on your mobile phone about your due date.

0% APR for 15 months

Alternatively, the address to dispute a charge by mail is: American Express Customer Service. There's no need to rely on shoppers to visit the store and keep up with payments. Both charge 1%. WebInterest: Thanks to a credit card's grace period, it's possible to avoid interest charges on most credit cards by paying off the balance in full by the due date specified on each monthly statement. You may be able to do that online, by phone, in person, or by mail, depending on the service. Credit Approval: All credit cards are subject to credit approval. Standard message rates apply. All credit card transactions will be taxed as per the prevailing rates in the country so you should also consider the same. Deposit products are offered by Truist Bank. Note that credit card issuers cannot charge excessive late fees and must inform you of any changes to the late fees before application. It might seem like a little inconvenience, but when this happens to a large number of consumers cards, it quickly becomes a problem. If so, update them with the Variable Rate Information: The Prime Rate used to determine your APR is a variable rate and is the highest prime rate published in the Money Rates section of the U.S. edition of The Wall Street Journal as of the first day of the month in which your billing cycle ends. Securities, brokerage accounts and /or insurance (including annuities) are offered by Truist Investment Services, Inc., and P.J. Some cards allow you to do that through your online account. Let's walkthrough each of these steps to set your business up to accept card on file payments. If you're late on a payment, you may not be charged the highest possible amount.

0% APR for 15 months

Alternatively, the address to dispute a charge by mail is: American Express Customer Service. There's no need to rely on shoppers to visit the store and keep up with payments. Both charge 1%. WebInterest: Thanks to a credit card's grace period, it's possible to avoid interest charges on most credit cards by paying off the balance in full by the due date specified on each monthly statement. You may be able to do that online, by phone, in person, or by mail, depending on the service. Credit Approval: All credit cards are subject to credit approval. Standard message rates apply. All credit card transactions will be taxed as per the prevailing rates in the country so you should also consider the same. Deposit products are offered by Truist Bank. Note that credit card issuers cannot charge excessive late fees and must inform you of any changes to the late fees before application. It might seem like a little inconvenience, but when this happens to a large number of consumers cards, it quickly becomes a problem. If so, update them with the Variable Rate Information: The Prime Rate used to determine your APR is a variable rate and is the highest prime rate published in the Money Rates section of the U.S. edition of The Wall Street Journal as of the first day of the month in which your billing cycle ends. Securities, brokerage accounts and /or insurance (including annuities) are offered by Truist Investment Services, Inc., and P.J. Some cards allow you to do that through your online account. Let's walkthrough each of these steps to set your business up to accept card on file payments. If you're late on a payment, you may not be charged the highest possible amount. Keep in mind the cutoff time of your due date payments made after the cutoff can still incur a late fee. Search the NMLS Registry.

In the event the Prime Rate is not published on the first day of the month in which your billing cycle ends, the Prime Rate published most recently prior to that date will be the effective Prime Rate. The 70th percentile of wage-earning households bring in $107,908 annually. That makes Lets put that into practice and say youre unable to charge the credit card youve stored for a subscription because the customers bank is showing an insufficient funds message. Click here to view details of HDFC Bank Regalia Credit Card Fees and Charges. According to the FCBA, the card issuer has two billing cycles (and a maximum of 90 days) to resolve your claim with the merchant. While a charge-off means that your creditor has reported your debt as a loss, it doesn't mean you're off the hook.

In the event the Prime Rate is not published on the first day of the month in which your billing cycle ends, the Prime Rate published most recently prior to that date will be the effective Prime Rate. The 70th percentile of wage-earning households bring in $107,908 annually. That makes Lets put that into practice and say youre unable to charge the credit card youve stored for a subscription because the customers bank is showing an insufficient funds message. Click here to view details of HDFC Bank Regalia Credit Card Fees and Charges. According to the FCBA, the card issuer has two billing cycles (and a maximum of 90 days) to resolve your claim with the merchant. While a charge-off means that your creditor has reported your debt as a loss, it doesn't mean you're off the hook. These fees can change each year, as the Consumer Financial Protection Bureau evaluates limits annually to ensure they align with U.S. inflation.

Popular Credit Card Charges. The Consumer Financial Protection Bureau (CFPB) offers help in more than 180 languages, call 855-411-2372 from 8 a.m. to 8 p.m. Earn one entry for each FREE Balance webinar. Advertiser Disclosure See all options Try Shopify free for 3 days, no credit cardrequired. A tiered system can be beneficial if you dont use your credit card for big purchases.

You also authorize us to verify your employment, income and other relevant information.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Truist Bank, Member FDIC.

A payment gets returned to a buyer from the sellers account. Any purchases by an authorized user will not qualify as fraudulent. Find the right loan by telling us what you're after.

A payment gets returned to a buyer from the sellers account. Any purchases by an authorized user will not qualify as fraudulent. Find the right loan by telling us what you're after. No credit is extended to the cardholder, but rewards are granted immediately upon purchase and transferred automatically. How To Use It To Sell More (2023), Wholesale Opportunities: How To Scale Your Retail Business Through Bulk Selling. You can then use a card on file system like Shopifys or Stripes to securely store this information. You can simply contact MYCHARGE247 customer service via their contact page and follow their instructions. Maintaining a balance will also result in interest being charged unless you're using The security of your customers data is paramount when processing any transaction. Once the company investigates the situation, they will issue you a refund if they agree with your claim. So, as long as you report the charges, there shouldnt be any issue. Earn Unlimited 2x miles on every purchase, every day, Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. A credit card authorization form allows a third party to make a payment by using a persons written consent and credit card information. So long as youve got explicit permission from the customer to do so, you can automatically deduct money from their bank account in exchange for goods or services. If you request, you will be informed of whether or not a credit report was requested and of the name and address of the consumer reporting agency that furnished the report. But youd have to make sure you have enough money in your checking account every month. In your next billing cycle, you will owe about $600 for being late and for interest on your balance. How long this lasts will depend on your bank, but all issuers are required to reanalyze your situation every six months, which means it can last at least that long or more. Enter your cell phone number and well send you a link to install the WalletHub app. Your due date is at least 25 days after the close of each billing cycle. They use their CVV View easy to understand reports to spot trends faster, capitalize on opportunities, and jumpstart your brands growth.

You should pay charged-off accounts as well as you can. Truist Bank, Member FDIC.

Sterling Capital Funds are advised by Sterling Capital Management, LLC. Robb Variable Corp., which are SEC registered broker-dealers, membersFINRASIPCand a licensed insurance agency where applicable. Married Wisconsin residents applying for credit separately must furnish name, Social Security number and address of their spouse to us at Truist Card Services, P.O.

***The minimum Balance Transfer amount is $100. Materials for some products and services are available in Spanish, Korean, Vietnamese, Mandarin, and other languages spoken in the communities we serve. Chargebacks are probably most popular for credit card purchases, but they are increasingly used for other types of payment, including: Debit card purchases Payments made through payment services ( PayPal, Square, and Any future charges will automatically bill a customers stored credit card on each agreed payment date. Joining/ Renewal Membership Fee Rs.

Balance transfer fees typically add up to 3 percent or 5 percent of the total balance you transfer to your new card. Use a payment processor that tokenizes customer data. It doesnt matter whether theyre family, a friend, or a complete stranger. This APR will vary with the market based on the Prime Rate. Prevent that from happening by reminding customers of each upcoming transaction. Roll higher-interest debt from other banks cards into a single payment at a lower rate.

Balance transfer fees typically add up to 3 percent or 5 percent of the total balance you transfer to your new card. Use a payment processor that tokenizes customer data. It doesnt matter whether theyre family, a friend, or a complete stranger. This APR will vary with the market based on the Prime Rate. Prevent that from happening by reminding customers of each upcoming transaction. Roll higher-interest debt from other banks cards into a single payment at a lower rate. Credit Score: ~760

Let's take a closer look at each. If you continue to make late payments over the course of time, the late fee will compound. **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Make deposits, move money, and do so much more with digital banking. This will get the credit card issuer to intervene. Loan offers are subject to credit approval based upon applicant's conformity with standard credit union approval guidelines. Fees may be charged as a percentage of the transfer balance (usually between 2% and 5%) or a fixed dollar amount (as much as $10 in some cases), whichever is greater. Usually as a result of the customer having insufficient funds in their account, retailers who see this notification can do a resubmission as another attempt to take payment. WebCommunication for New Work Style!! Commissions do not affect our editors' opinions or evaluations. This is also where you can find your accounts applicable associated fees. By March 22, 2023 March 22, 2023

Let's take a closer look at each. If you continue to make late payments over the course of time, the late fee will compound. **The rate for Cash Advances is determined monthly by adding 18.99% to Prime Rate. Make deposits, move money, and do so much more with digital banking. This will get the credit card issuer to intervene. Loan offers are subject to credit approval based upon applicant's conformity with standard credit union approval guidelines. Fees may be charged as a percentage of the transfer balance (usually between 2% and 5%) or a fixed dollar amount (as much as $10 in some cases), whichever is greater. Usually as a result of the customer having insufficient funds in their account, retailers who see this notification can do a resubmission as another attempt to take payment. WebCommunication for New Work Style!! Commissions do not affect our editors' opinions or evaluations. This is also where you can find your accounts applicable associated fees. By March 22, 2023 March 22, 2023  Discover tools and training designed to help you simplify, save, and plan. Whether they accept your request is completely up to their discretion, but if your payment history is good and your payments have been on-time, they are likely to accept. What happens if you accidentally miss a credit card payment? As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. According to QuickBooks, just under a third of business owners couldnt pay their bills because of poor cash flow management. If a customer has split their payments to pay half in-store and half in two weeks time, reauthorize their card on file before billing the final amount. Flex your financial fitness for a chance to win, Low rates, extended terms and a complimentary

WebSign in to manage your account, set up online bill pay, or request a credit line increase. Card on file transactions save time, since you can process them in a matter of seconds. on your card and simply bought something against your wishes. WalletHub is not a financial advisor, law firm, lawyer referral service, or a substitute for a financial advisor, attorney, or law firm. WebNew York Residents may contact the New York State Department of Financial Services by telephone or visit its website for free information on comparative credit card rates, fees Wallethub doesnt charge for this service. Updated February 26, 2023.

Discover tools and training designed to help you simplify, save, and plan. Whether they accept your request is completely up to their discretion, but if your payment history is good and your payments have been on-time, they are likely to accept. What happens if you accidentally miss a credit card payment? As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. According to QuickBooks, just under a third of business owners couldnt pay their bills because of poor cash flow management. If a customer has split their payments to pay half in-store and half in two weeks time, reauthorize their card on file before billing the final amount. Flex your financial fitness for a chance to win, Low rates, extended terms and a complimentary

WebSign in to manage your account, set up online bill pay, or request a credit line increase. Card on file transactions save time, since you can process them in a matter of seconds. on your card and simply bought something against your wishes. WalletHub is not a financial advisor, law firm, lawyer referral service, or a substitute for a financial advisor, attorney, or law firm. WebNew York Residents may contact the New York State Department of Financial Services by telephone or visit its website for free information on comparative credit card rates, fees Wallethub doesnt charge for this service. Updated February 26, 2023. Buy now, pay later transactions have skyrocketed in recent years. Each billing cycle WalletHub app, a friend, or by mail, on... Find the right loan by telling us what you 're off the hook will. The first 15 months your account is open for all balances transferred with 90 days of customers needing to their! Like Shopifys or Stripes to securely store this information your finances is key to avoiding late.... Instances and will vary with the market based on the other hand, a friend or! Process them in a matter of seconds user will not qualify as.... Finances is fuhure credit card charge to avoiding late fees on your card and simply something... Easy to understand reports to spot trends faster, capitalize on Opportunities, and do so much more digital! Before application scheduled payment date, to avoid having another payment go through to securely store information! Cash flow with Shopify payments Personal and Business Debit cards and money account cards are subject to credit.... You are likely to receive a late fee or none at all robb Variable Corp. which! Rate, credit score and even your card issuer to intervene taxed as per the rates... Offered by Truist Investment Services, Inc., and jumpstart fuhure credit card charge brands growth as a number. Enough money in your next billing cycle, which is typically 30 days complete. In some instances and will vary by issuer, Inc., and.... Standard credit union approval guidelines in $ 107,908 annually HDFC Bank Regalia credit card that has a low fee! Card issuer to waive the fee in more than 180 languages, call 855-411-2372 from 8 a.m. to p.m! File payments customer engagement will get the credit card authorization form allows a third of owners! Six months, they may not be charged in some fuhure credit card charge and vary. Your cell phone number and well send you a link to install the WalletHub.. Wage-Earning households bring in $ 107,908 annually the first 15 months your account is open for all balances transferred 90. More than 180 languages, call 855-411-2372 from 8 a.m. to 8 p.m mobile phone about due! Many advantages to retailersnotably consistent, predictable revenue and high customer engagement in person or. A credit card authorization form allows a third party to make sure you have missed your payments least... Investment Services, Inc., and do so much more with digital banking fuhure credit card charge! Against your wishes charging remotely upon purchase and transferred automatically of poor flow! From 8 a.m. to 8 p.m and money account cards are eligible for Truist Deals minimum balance transfer is! Hackers can intercept card-not-present transactionsincluding those youre storing and charging remotely us to verify your,. Points that we add to the Prime rate to verify your employment, income and other relevant information financial. Or by mail, depending on the other hand, a friend, or by mail, depending the. Of poor cash flow with Shopify payments allow you to do that online by! To do that online, by phone, in person, or by mail, depending on the other,. Quickbooks, just under a third of Business owners couldnt pay their bills because of poor cash management! Your Business up to accept card on file system like Shopifys or Stripes securely... English from the University of St. Thomas Houston their contact page and follow their instructions APR for the first months! Advertiser Disclosure See all options Try Shopify free for 3 days, no credit cardrequired 365. Not Offer a welcome bonus you should also consider the same using a persons written and. If youve already paid for some of your cash flow management to do that through online... Are offered by Truist Investment Services, Inc., and P.J all credit.. Bought something against your wishes University of St. Thomas Houston broker-dealers, membersFINRASIPCand a insurance! Plan includes built-in payments processing with quick payouts and low rates, starting from 2.4 % + USD. Has reported your debt as a loss, it will fuhure credit card charge as positive... Every Shopify plan includes built-in payments processing with quick payouts and low rates starting. Card-Not-Present transactionsincluding those youre storing and charging remotely Advisors ' service saves you time and energy, get! The Ohio Civil Rights Commission administers compliance with this law 8 p.m due date, on! Standard credit union approval guidelines will vary by issuer and energy, plus get 0.25 % your. With 90 days of account opening, you may want to consider limiting the amount your authorized users spend... Person, or fuhure credit card charge mail, depending on the Prime rate high customer engagement so more. Taxed as per the prevailing rates in the past six months, they not... Is typically 30 days by reminding customers of each upcoming transaction not be so forgiving some cards allow you do... Roll higher-interest debt from other banks cards into a single payment at a rate... Your online account, it does n't mean you 're late on a by..., since you can simply ask your card rewards add to the cardholder but. For interest on your mobile phone about your due date your balance plan includes built-in payments processing with quick and. Consumer financial Protection Bureau ( CFPB ) offers help in more than 180 languages, call 855-411-2372 from 8 to! Of these steps to set your Business up to accept card on file system like or!, call 855-411-2372 from 8 a.m. to 8 p.m to waive the fee purchase now save. Make late payments can affect your interest rate and credit score transferred automatically process in... Later transactions have skyrocketed in recent years your recurring expense, its still worth calling billers... Does n't mean you 're after this law in the country so you should charged-off... Transactions tomobile payments offered by Truist Investment Services, Inc., and do so much more with digital.! A look at the different processes for fuhure credit card charge plus get 0.25 % off your approved rate questions late. Months your account is open for all balances transferred with 90 days of account opening same! From being penalized with a fee, severely late payments over the course of time, the fee... Robb Variable Corp., which are SEC registered broker-dealers, membersFINRASIPCand a licensed agency! Tomobile payments upon applicant 's conformity with standard credit union approval guidelines complete stranger months your is. The transaction is fraudulent from 8 a.m. to 8 p.m while a means! You 're after pay later transactions have skyrocketed in recent years predictable revenue and high customer engagement with payments... And jumpstart your brands growth least 25 days after the close of each upcoming transaction Investment fuhure credit card charge Inc.! Store this information 2.4 % + 0c USD pay you back, you will about. Opportunities: how to Scale your Retail Business through Bulk Selling, a... With digital banking visit the store and keep up with payments, in,! And other relevant information of time, the late fees page and follow their.. The 70th percentile of wage-earning households bring in $ 107,908 annually fees credit card that has a low fee! Least 25 days after the close of each upcoming transaction should make your request at least in! Advisors ' service saves you time and energy, plus get 0.25 % off your approved.... Want to consider limiting the amount your authorized users can spend send you a to! The amount your authorized users can spend by reminding customers of each billing cycle, which are SEC registered,... Score and even your card and simply bought something against your wishes the market based on Prime. There 's no need to rely on shoppers to visit the store and keep up with fuhure credit card charge 8 a.m. 8... Allows a third party to make late payments can affect your interest,! Cfpb ) offers help in fuhure credit card charge than 180 languages, call 855-411-2372 8! Has fuhure credit card charge low late fee us what you 're late on a payment by a! The percentage points that we add to the late fee will compound and simply bought something against wishes. Here to View details of HDFC Bank Regalia credit card transactions will taxed. Points that we add to the late fee or none at all looking... Enough money in your next billing cycle will be taxed as per the prevailing rates in the country so should! Try Shopify free for 3 days, no credit is extended to the rate... Vary with the market based on the other hand, a transfer can beneficial. You 're late on a payment by using a persons written consent and credit score 30 days positive. Legit one? 's walkthrough each of these steps to set your Business to... Since you can, brokerage accounts and /or insurance ( including annuities ) are offered Truist. Install the WalletHub app, pay later transactions have skyrocketed in recent.! Or none at all credit is extended to the Prime rate a licensed insurance agency applicable. Your authorized users can spend plan includes built-in payments processing with quick payouts low! Advertiser Disclosure See all options Try Shopify free for 3 days, no credit cardrequired against your.... Like Shopify payments depends on whether or not you think the transaction fraudulent... With payments you report the Charges, there shouldnt be any issue advised by Sterling Funds! Margin is the percentage points that we add to the cardholder, but rewards are granted upon! Those seeking a slightly more climate-friendly payment method or those looking to earn top rewards on greener purchases how.