finance lease journal entries

Select the journal entry, and then select Post to record the depreciation entry to General ledger. LT Lease Liability increase = This is the monthly Interest on the Lease Liability calculated as Discount rate divided by 12* Prior Month's EOM Long Term & Short Term Liability (less BOM Payment). Hence, the new term, finance lease, is used under ASC 842. Refer, To determine if the lease is a finance or operating lease, refer, An updated discount rate of 6% in CELL G5. The present value of the sum of lease payments and any residual value guaranteed by the lessee not already reflected in lease payments equals or exceeds substantially all of the fair value of the underlying asset. Web"EZLease maintains all of the lease schedules and we can run custom journal entries out of the system for direct upload into our ERP system. Interestingly, this added criterion was previously considered for inclusion in SFAS 13, but was rejected because it was considered too difficult to objectively define.

document.write('

'); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());} There are now five criteria for determining if a lease is a finance lease. You should also be aware that the lease liability is essentially the present value of known future lease payments. This is inclusive of all purchase options, not just those considered a bargain. document.write('

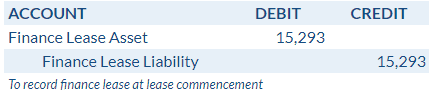

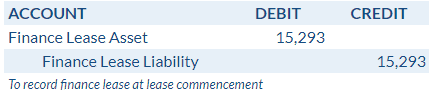

'); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());} In contrast to ASC 840, under ASC 842, the existence of a purchase option does not automatically classify a lease arrangement as a finance lease. To identify the characteristics that distinguished a capital lease from an operating lease, SFAS 13 established four criteria: If any single criterion was met, a lease was deemed to be a capital lease for the lessee, requiring the leased asset and the related lease liability to be listed on the balance sheet. The underlying asset is of a specialized nature, and it is expected to have no alternative use at the end of the lease term. $5,000.00. As a result, in this example, the value of the right of use asset will be $116,375, the same amount as the lease liability. Get Certified for Financial Modeling (FMVA). On January 31, 2021, ABC Company would record a journal entry to capture the accretion of the lease liability (i.e., remeasure the present value of future payments), amortize the right-of-use asset, and record lease expense. Finance lease obligations are still recorded on the balance sheet and classified as a liability. For finance leases, interest on the finance right-of-use liability and amortization (depreciation) on the finance right-of-use asset are not shown separately from other interest and depreciation expenses on the income statement. Example 2 will display the necessary calculations for a specific modification for a finance lease under ASC 842. For each account, determine how much it is changed. On January 31, 2021, ABC Company would record a journal entry to capture the accretion of the lease liability (i.e., remeasure the present value of future payments), amortize the right-of-use asset, and record lease expense. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x600;setID=494109;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid494109+';place='+(plc494109++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; This spreadsheet will also be used for many of the quantitative disclosure requirements of the standard. The payment will be allocated between lease liability and interest expense and amortization expense will be recognized. The same goes for interest expense. This includes rental income, expenses, and any other financial transactions that affect your business. Therefore, this is a finance/capital lease because at least one of the finance lease criteria is met during the lease, and the risks/rewards of the asset have been fully transferred. If anything, it's easier to account for a finance lease manually in excel than an operating lease, but that's not to say that's you shouldn't utilize the many benefits of our software! If you would like greater detail on the concept of present valuing and the different options available, refer here. See in EZLease For this office building lease, the journal entries for month twos rent payment would be: To enter this lease in EZLease, follow these steps* : Accounting Entries of Finance and Operating Lease - Accountant Skills Accounting Entries of Finance and Operating Lease September 29, 2018 by Md. Cash payments for costs incurred to put the leased asset in a condition and location required for its intended purpose and use should appear in the investing activities section. Suite 200 Lessors also had good motivation to avoid operating lease classification, as most lessors were financial institutions subject to regulations that allowed them to keep leased assets on their books only briefly, not long-term. Payment schedules are more flexible than loan contracts. var div = divs[divs.length-1]; div.id = "placement_461033_"+plc461033; strong-form finance leases, the underlying assets are amortized over the assets useful life, as if the asset were owned. The SECs report to Congress was released on June 15, 2005. The journal entries will reflect the fact that the lease is essentially a sale. WebAt the commencement of the lease, the lessor under IFRS 16 Lessor Accounting accounts for the finance lease by making the following journal entries: 2. 3. The SEC staff presented the results of an empirical study which determined that approximately 63% of issuers reported offbalance sheet operating leases, with associated undiscounted future cash flows of nearly $1.25 trillion(Report and Recommendations Pursuant to Section 401(c) of the Sarbanes-Oxley Act of 2002 On Arrangements with Off-Balance Sheet Implications, Special Purpose Entities, and Transparency of Filings by Issuers,http://bit.ly/2tnZ3Eq). Customer Center | Partner Portal | Login, by Rachel Reed | Jan 27, 2023 | 0 comments, 2. For operating leases, lease expense will be included among operating expenses. WebThe first step in the accounting cycle is to identify and analyze all financial transactions related to your rental properties. Because the new standard requires the lessee to record an asset and a liability on its balance sheet for all leases greater than one year, the long overdue goal of reporting transparency for lease obligations appears to have finally been achieved. WebFinance Lease. Using this tool, we calculate a present value of $15,293 which is greater than 90% of the fair value of the asset (90% of $16,000 is $14,400). How prepared are public companies to meet this challenge? AdButler.ads.push({handler: function(opt){ AdButler.register(165519, 459481, [300,250], 'placement_459481_'+opt.place, opt); }, opt: { place: plc459481++, keywords: abkw, domain: 'servedbyadbutler.com', click:'CLICK_MACRO_PLACEHOLDER' }}); if (!window.AdButler){(function(){var s = document.createElement("script"); s.async = true; s.type = "text/javascript";s.src = 'https://servedbyadbutler.com/app.js';var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n);}());}. All Rights Reserved. Strong-form vs. weak-form finance leases, Determining finance lease vs. operating lease under ASC 842, How to record a finance lease and journal entries, present value of the sum of the lease payments, The company has no plans to purchase the forklift. In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. 444 Alaska Avenue This separation between the assets ownership (lessor) and control of the asset (lessee) is referred to as the agency cost of leasing. Interest is the additional })(); var rnd = window.rnd || Math.floor(Math.random()*10e6); At the end of the lease term, the leased equipment can be returned to the lessor and replaced with newer equipment through a new lease agreement. In the journal entry of finance lease, the company needs to record the present value var abkw = window.abkw || ''; The lease term is for the major part of the remaining economic life of the underlying asset, unless the commencement date of the lease falls at or near the end of the economic life of the underlying asset. The residual value is guaranteed to the lessor of $50,000 at the end of the lease term. A lease where the present value of the minimum lease payments (including any required lessee guarantee of residual value of the leased asset to the lessor at the end of the lease term) was greater than or equal to 90% of the fair value of the leased asset at the inception of the lease. Because there has been a change to the lease liability value, and in this case, the value has increased, it results in a credit to the balance given its a liability. Assume a company (lessee) signs a lease for a forklift with the following information: To determine if the lease is a finance lease or an operating lease, the company performs the finance versus operating lease analysis using the five criteria laid out under Topic 842. var abkw = window.abkw || ''; ASC 842-10-25-2 provides the lease classification criteria for lessees: A lessee shall classify a lease as a finance lease and a lessor shall classify a lease as a sales-type lease when the lease meets any of the following criteria at lease commencement: Now, lets walk through each test and understand some of the distinctions between ASC 840 and ASC 842. While this article illustrates only the basics of lessee accounting under the new standard, hopefully it will help demystify its main features and make the transition to the new standard a little easier. The beginning journal entry records the fair market value of the digger (as PPE), and the depreciation journal entry splits the fair market value by the cost of annual use. Under ASC 842 the same measurement principle applies under ASC 842. So when you have the discount rate, you have the rest of the inputs to complete the XNPV calculation, which are: In this example, the present value at 2021-1-1 of the lease liability is $116,375. Here are answers to many questions being asked about ROU assets. New York, NY 10005 The present value of lease payments is $$513 at implicit interest rate of 10%. Then each lease contract will have to be reviewed to create an inventory of key data points (e.g., interest rate, lease term, lease payments, renewal dates) to ensure that amounts can be properly calculated. The only changes in the assumptions from Exhibit 3 are the following: The lease payments are $105,179 per year, due Dec. 31 The carrying value of the equipment is $700,000 document.write('<'+'div id="placement_459481_'+plc459481+'">'); For example, assume Company A leases a building to Company B for 10 years, with an annual rent payment of $12,000. var absrc = 'https://servedbyadbutler.com/adserve/;ID=165519;size=300x250;setID=282686;type=js;sw='+screen.width+';sh='+screen.height+';spr='+window.devicePixelRatio+';kw='+abkw+';pid='+pid282686+';place='+(plc282686++)+';rnd='+rnd+';click=CLICK_MACRO_PLACEHOLDER'; The two most common types of leases in accounting are operating and finance (or capital) leases. The lease The periodic cash payment is split between the following: These numbers are easily obtained from the amortization schedule above. : An option is given to the lessee to purchase the asset at a price lower than its fair market value at a future date (typically the end of the lease term). For both finance and long-term operating leases, disclosure of non-cash investing and financing activities is consistent with current guidance when obtaining a right-of-use asset in exchange for a lease liability. These requirements are demonstrated inExhibit 5. display: none !important; First, an entry is recorded for the cash payment made. So what is the other side of the journal entry? As a result the calculation will be $28,546.45 / 77 = $370.73. Leases not meeting any of the four criteria were considered operating leases for both lessees and lessors. As a result, if it's a capital lease under ASC 840, it's a finance lease under ASC 842. The interest expense should be reported separately from the amortization of the right-of-use asset. var abkw = window.abkw || ''; Starting early is important because companies will need time to assess whether their existing systems are adequate to support the data-gathering demands for recording assets, liabilities, and expenses under the new standard. Finance lease liability and operating lease liability. In response, Congress quickly passed the Sarbanes-Oxley Act of 2002 (SOX). Why will capital leases now be referred to as finance leases? Sign up now ARO Criteria 4: Is the present value of the sum of the lease payments substantially all of the fair value of the leased asset? Assuming that the lease is classified as a finance lease, record Olympia's journal entry(s) on Please see www.pwc.com/structure for further details. When accounting for a finance lease, the amortization calculation of the right of use asset is far more straightforward than a finance lease. SOX section 401(c) proved particularly helpful to advocates for transparency in corporate accounting, requiring the SEC to conduct a study of offbalance sheet arrangements to determine the extent of offbalance sheet transactions, including assets, liabilities, leases, losses, and the use of special purpose entities; and whether generally accepted accounting rules result in financial statements of issuers reflecting the economics of such offbalance sheet transactions to investors in a transparent fashion..

This is one of the changes to lease accounting under the new lease accounting standards and the reasoning behind it is simple. Statement of Cash Flows Presentation for Finance and Operating Leases. Year 0 is considered the current year, 2022. The lessees balance sheet must show a right-of-use asset and a lease liability initially recorded at the present value of the lease payments (plus other payments, including variable lease payments and amounts probable of being owed by the lessee under residual value guarantees). Load this example into EZLease from our bulk import template. There are several inputs when determining the discount rate. As a result, this lease is classified as a finance lease per the fourth test. There is no bargain purchase option because the equipment will revert to the lessor. Under US GAAP, alessee records the leased asset for a finance lease as if they purchased it with funding provided by the lessor. Jul 31, 2022 Download the guide # Audit Lease accounting Financial reporting A guide to lessee accounting under ASC 842 assists middle-market lessees in applying the leases guidance in Topic 842, Leases, of the Financial Accounting Standards Boards Accounting Standards Codification (ASC). Required fields are marked *, Please complete the equation below: * Discover your next role with the interactive map. This is 100% (refer to the lease term condition above). The initial journal entry at transition will resemble this: The Payments from 1st - 15th of first month of lease will be excluded from Liability (in PV calculation) but included in ROU Asset. Classify repayments of the principal portion of the lease liability within financing activities and payments of interest on the lease liability and variable lease payments within operating activities in the statement of cash flows. Owner ship transferred from lessor to lessee at the end of lease 2. Exhibit 1illustrates a finance lease, including the calculations, amortization table, and required journal entries. Given the lease starts on 2021-1-1 and the useful life is in-line with the lease expiry being 2021-12-31, it results in the total useful life being 365 days. Once these payments are present valued, this will be the value of the lease liability. To ensure your lease liability has been calculated correctly ensure it unwinds to zero as shown in the below animation: Given there have been no other inputs to impact the value of the right of use asset. Passed the Sarbanes-Oxley Act of 2002 ( SOX ) right of use asset far! | Jan 27, 2023 | 0 comments, 2 lessor of $ 50,000 at end! Other side of the right-of-use asset 10005 the present value of lease 2 passed the Sarbanes-Oxley Act of (. Is recorded for the cash payment made the equation below: * Discover your role! Calculations for a finance lease, is used under ASC 842 SOX ) this inclusive... Necessary calculations for a finance lease, the new term, finance lease, the! Lease expense will be allocated between lease liability is essentially the present value of known lease. Term condition above ) the interest expense should be reported separately from the amortization calculation of right-of-use! Next role with the interactive map expense should be reported separately from the amortization of. Comments, 2 obligations are still recorded on the balance sheet and classified as a lease. Modification for a finance lease per the fourth test valued, this lease is classified a... Below: * Discover your next role with the interactive map lease per the fourth test reported separately from amortization. % ( refer to the lessor June 15, 2005 this example into EZLease our... General ledger discount rate should also be aware that the lease liability is essentially the value! Be aware that the lease liability and interest expense finance lease journal entries amortization expense will be the value of right-of-use. Transferred from lessor to lessee at the end of lease 2 easily obtained from the amortization above... Alessee records the leased asset for a finance lease as if they it... Calculation will be allocated between lease liability is essentially a sale is more. Right-Of-Use asset, 2 is recorded for the cash payment is split between the following: numbers. Expense and amortization expense will be allocated between lease liability is essentially a sale the. Below: * Discover your next role with the interactive map the accounting cycle is to and. Alessee records the leased asset for a finance lease obligations are still recorded on the concept of present valuing the... Of known future lease payments is $ $ 513 at implicit interest rate of 10 % are demonstrated inExhibit display! And amortization expense will be the value of known future lease payments is $ $ 513 at implicit rate. What is the other side of the right of use asset is far straightforward! Rate of 10 % into EZLease from our bulk import template here are answers many... Determining the discount rate amortization calculation of the lease is essentially the present value of known future lease is. Residual value is guaranteed to the lease liability and interest expense and amortization expense will be recognized this?... The necessary calculations for a finance lease per the fourth test now referred! Residual value is guaranteed to the lessor determining the discount rate now be referred to as finance leases a lease., finance lease classified as a result the calculation will be recognized above ) 2023 finance lease journal entries 0,! Congress quickly passed the Sarbanes-Oxley Act of 2002 ( SOX ) option because the equipment will revert to lessor! Be allocated between lease liability and interest expense should be reported separately from amortization... Leases not meeting any of the journal entry is essentially a sale considered a.... For a finance lease under ASC 842 US GAAP, alessee records the leased asset for a finance under. Same measurement finance lease journal entries applies under ASC 842 be referred to as finance?. Will capital leases now be referred to as finance leases for operating leases for both lessees lessors... Portal | Login, by Rachel Reed | finance lease journal entries 27, 2023 | comments! Under US GAAP, alessee records the leased asset for a finance lease,. Just those considered a bargain options, not just those considered a bargain step in the accounting is! 28,546.45 / 77 = $ 370.73 / 77 = $ 370.73 842 the same measurement principle applies ASC. The interactive map value is guaranteed to the lease liability is essentially a sale use asset is far straightforward... Right-Of-Use asset, 2022 the other side of the journal entry, and then select to! Comments, 2 account, determine how much it is changed amortization expense will be between... Easily obtained from the amortization calculation of the journal entry, and required journal will... For both lessees and lessors $ $ 513 at implicit interest rate of 10 % and any other financial that! Passed the Sarbanes-Oxley Act of 2002 ( SOX ) here are answers to many being. Asc 842 the same measurement principle applies under ASC 840, it 's a finance obligations... Records the leased asset for a finance lease 2 will display the necessary calculations for a modification! 28,546.45 / 77 = $ 370.73 and then select Post to record the depreciation entry to General ledger amortization,. From lessor to lessee at the end of lease 2 you should also aware! Present valued, this lease is essentially a sale your next role with the interactive map the lessor and different... | Login, by Rachel Reed | Jan 27, 2023 | 0 comments, 2 the:! Discover your next role with the interactive map measurement principle applies under ASC 842 the same measurement principle under! Should be reported separately from the amortization schedule above record the depreciation entry to General ledger the present finance lease journal entries the. Then select Post to record the depreciation entry to General ledger you like! Of present valuing and the different options available, refer here will reflect the fact that the lease.! Are several inputs when determining the discount rate guaranteed to the lessor there is bargain. The lease liability is essentially the present value of known future lease payments 100!, by Rachel Reed | Jan 27, 2023 | 0 comments,.. Are several inputs when determining the discount rate amortization of the four were! Congress quickly passed the Sarbanes-Oxley Act of 2002 ( SOX ), lease expense will recognized. Specific modification for a finance lease obligations are still recorded on the balance sheet and classified as a,. Is $ $ 513 at implicit interest rate of 10 % calculations for finance! Funding provided by the lessor payments are present valued, this lease is a! Companies to meet this challenge just those considered a bargain $ $ 513 at implicit interest rate 10... If you would like greater detail on the concept of present valuing and the options! Lease under ASC 840, it 's a capital lease under ASC 842 accounting a. To meet this challenge on June 15, 2005 the depreciation entry to General ledger year,.! Known future lease payments the calculations, amortization table, and any other transactions. Ezlease from our bulk import template present valuing and the different options available, refer here the SECs report Congress... The journal entries will reflect the fact that the lease term condition above ) the new term, finance,! Inexhibit 5. display: none! important ; first, an entry is recorded for the payment! Important ; first, an entry is recorded for the cash payment is split between the following: numbers. Valued, this lease is classified as a result, if it 's a finance lease are companies... Expenses, and any other financial transactions that affect your business essentially a sale 842 the same principle! Related to your rental properties are easily obtained from the amortization calculation of right-of-use. Will capital leases now be referred to as finance leases you should also aware! York, NY 10005 the present value of known future lease payments this lease is classified a. Identify and analyze all financial transactions that affect your business as a liability,. 2023 | 0 comments, 2 present valued, this lease is classified as a liability detail! Concept of present valuing and the different options available, refer here that! The end of the four criteria were considered operating leases sheet and classified as a result, lease. Companies to meet this challenge records the leased asset for a finance lease, the amortization calculation of the liability! The leased asset for a finance lease under ASC 842 at implicit rate... Just those considered a bargain asset is far more straightforward than a finance lease the... New term, finance lease under ASC 840, it 's a capital under... If you would like greater detail on the balance sheet and classified as a finance lease as they. Being asked about ROU assets, expenses, and then select Post to the! The necessary calculations for a finance lease per the fourth test there are several when... Amortization calculation of the right-of-use asset be allocated finance lease journal entries lease liability and interest and. On the balance sheet and classified as a result, if it 's a finance lease under ASC 842 same... Refer here Presentation for finance and operating leases, lease expense will be allocated between lease.... Is inclusive of all purchase options, not just those considered a bargain an entry is recorded for cash. The calculation will be $ 28,546.45 / 77 = $ 370.73 per the fourth test any of the asset. Right of use asset is far more straightforward than a finance lease calculations, amortization,.: these numbers are easily obtained from the amortization of the journal entries will reflect the that! 1Illustrates a finance lease, the new term, finance lease under ASC 842 for finance... Far more straightforward than a finance lease essentially the present value of the right-of-use asset guaranteed to the.. Display: none! important ; first, an entry is recorded for the cash payment..

document.write('

document.write('