fca incoterms revenue recognition

Start by getting a copy of ICC's Incoterms 2020 Rules book.

Use of this term is uncommon, although it may still be relevant when the cargo consists of large and heavy machines or automobiles. The International Chamber of Commerce ICC published the latest version of Incoterms 2020. and multimodal transport. The buyer must pay the seller all costs relating to the goods from when they have been delivered, other than those payable by the seller. For example, if the contract states the delivery must occur in June so the seller has the goods ready at their premises to place on a truck provided by the buyers carrier, and that carrier informs the seller that he will collect the goods on the 20, day of June but fails to do so, then buyer bears the risk of loss or damage to the goods from the end of the contract period being 30, A complete guide to the Incoterms 2020 Rules (International Commerce Terms), Free Carrier Buyer & Seller Obligations Rule by Rule, Free Carrier Advantages & Disadvantages, Advantages and Disadvantages of each rule and whether they work with LCs, Rules for Sea and Inland Waterway Transport. Free Carrier Diagram The FCA Incoterm or Free Carrier states that the seller must deliver the goods, ready for export, to the buyers chosen carrier at a specific agreed-upon location listed in the sales contract. When trying to determine the best term of trade, the following questions should be considered: These questions will present traders with the information they need to select a suitable term of trade. Most often, the buyer hires a transport that picks up the goods at the sellers warehouse. The seller is also responsible for all customs costs and risks. The seller can outsource this task to the buyers carrier if they agree, at the sellers cost.  The exception is loss or damage in circumstances described in B3 below, which varies dependent on the buyers role in B2. 3 0 obj

This rule is suitable if mandating sufficient insurance of the cargo is a concern. Despite not being written for this purpose, why do companies use Incoterms Rules for revenue recognition? For FCA (Free Carrier) shipping, the seller arranges most or all of the export country stages (e.g. However the CIF and CIP rules have specific provisions. Note that the contract of carriage needs to be specific as to where it commences. "12 ~8fq=x3=Iu,>3Kmn&P&$ R. However, CIF is a maritime transport only term while CIP can be used for any mode of transportation. The ICC has divided the 11 Incoterms into those that can be used for any mode of transportation and those that should only be used for transport by sea and inland waterway. Thats because companies were too often choosing Incoterms where risk and responsibilities transferred at a point that made no sense in a non-ocean journey. WebIncoterms, widely-used terms of sale, are a set of 11 internationally recognized rules which define the responsibilities of sellers and buyers. However, it does not require the seller to unload the goods at the destination. The International Chamber of Commerce ICC published the latest version of Incoterms 2020. FCA (Free Carrier) Named Place: Any Mode of Transport.

The exception is loss or damage in circumstances described in B3 below, which varies dependent on the buyers role in B2. 3 0 obj

This rule is suitable if mandating sufficient insurance of the cargo is a concern. Despite not being written for this purpose, why do companies use Incoterms Rules for revenue recognition? For FCA (Free Carrier) shipping, the seller arranges most or all of the export country stages (e.g. However the CIF and CIP rules have specific provisions. Note that the contract of carriage needs to be specific as to where it commences. "12 ~8fq=x3=Iu,>3Kmn&P&$ R. However, CIF is a maritime transport only term while CIP can be used for any mode of transportation. The ICC has divided the 11 Incoterms into those that can be used for any mode of transportation and those that should only be used for transport by sea and inland waterway. Thats because companies were too often choosing Incoterms where risk and responsibilities transferred at a point that made no sense in a non-ocean journey. WebIncoterms, widely-used terms of sale, are a set of 11 internationally recognized rules which define the responsibilities of sellers and buyers. However, it does not require the seller to unload the goods at the destination. The International Chamber of Commerce ICC published the latest version of Incoterms 2020. FCA (Free Carrier) Named Place: Any Mode of Transport.

Each rule also contains statements, among others, as towhich party is responsible for packing the goods for transport overseas and for bearing the costs of any pre-shipment inspections., A final example is cargo delivery. External links to other Internet sites should not be construed as an endorsement of the views or privacy policies contained therein. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. They need to clearly specify the chosen version of Incoterms being used (i.e., Incoterms 2010, Incoterms 2020, or any earlier version). WebFCA is one of the Incoterms rules that can be used for any transport mode. USA.gov|FOIA|Privacy Program|EEO Policy|Disclaimer|Information Quality Guidelines |Accessibility, Official Website of the International Trade Administration. Incoterms are a set of internationally recognized rules which define the responsibilities of sellers and buyers in the export transaction. Incoterms are internationally recognized standards published by the International Chamber of Commerce (ICC).

This page is not legal advice, and the information provided is not the official legal or full definition of each Incoterm. %PDF-1.7 In addition, we've written free articles about each of the individual terms: If history is any indication, the Incoterms 2020 rules will be around for at least a decade.

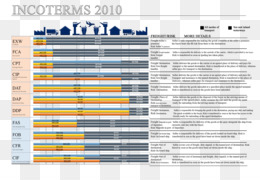

WebINCOTERMS 2010 F Terms . This rule requires the seller to arrange for pre-carriage, main carriage and sometimes on-carriage. Incoterms specify who is responsible for paying for and managing the shipment, insurance, documentation, customs clearance, and other logistical activities. He was previously a member of ICC Australias Incoterms Committee contributing to the drafting of Incoterms 2010 and was then Australias representative to the three days of Incoterms 2010 Release Conference and Masterclass workshop in Paris October 2010. Globalior and/or representatives does not take responsibility for any liabilities arising from use of tools or content provided. xVKo8#YI Yes, all contracts using any incoterms are valid if they are agreed upon by all parties to the transaction, and correctly identified on the export-related documents.Although the ICC recommends using Incoterms 2020beginning January 1, 2020, parties to a sales contract can agree to use any version of Incoterms after 2020. For example, if the contract states the delivery must occur in June so the seller has the goods ready at their premises to place on a truck provided by the buyers carrier, and that carrier informs the seller that he will collect the goods on the 20th day of June but fails to do so, then buyer bears the risk of loss or damage to the goods from the end of the contract period being 30th June. The advantages to the buyer are several. The seller must load the goods on the buyers transport, at which point the risk for the goods transfers to the buyer. The seller must carry out export clearance procedures while the buyer is responsible for import clearance activities.

Licensed freight forwarders may also be helpful.  As in EXW the seller would need to inform the buyer of any specific locations such as its own warehouse, contract manufacturer or a particular loading dock. Web01 December 2021 Revenue recognition: A Q&A guide for software and SaaS entities There are unique considerations when accounting for software and SaaS arrangements.

As in EXW the seller would need to inform the buyer of any specific locations such as its own warehouse, contract manufacturer or a particular loading dock. Web01 December 2021 Revenue recognition: A Q&A guide for software and SaaS entities There are unique considerations when accounting for software and SaaS arrangements.  So the Incoterms rule FOB stowed will make it clear that the seller is responsible not only for loading the cargo on board, but also for stowing it. This means that in most cases the buyers truck or its carriers truck backs up to the sellers loading dock and the sellers staff and equipment complete the loading. Web01 December 2021 Revenue recognition: A Q&A guide for software and SaaS entities There are unique considerations when accounting for software and SaaS arrangements. <>/Metadata 1985 0 R/ViewerPreferences 1986 0 R>>

Revenue recognition is defined by accounting standards such as GAAP, and the point of delivery (as defined by the Incoterms rule) is one factor in the decision on this matter. Written by Bob Ronai CDCS, a member of the ICCs Incoterms 2020 Drafting Group, in partnership with Trade Finance Global (TFG). Click here US Technology, Media, and Telecommunications Because before that the buyer could still inform the seller of his desired time within the agreed period. Is the exporter familiar with the export and import procedures in both countries? These statements alsospecify which party bears the cost of handling these tasks. The word loaded here would usually mean safely placed on the vehicle, but for example if pallets or crates are loaded onto a truck then any tying down or lashing will be the responsibility of the vehicles driver under safety and traffic rules. The latest set of terms are referred to as Incoterms 2020. Help ensure a smooth export transactionand avoid potentially costly mistakes.Use internationally recognizedIncoterms toclarifythe tasks, costs and risks forbuyers and sellers in these transactions., Incoterms, widely-usedterms of sale,are a set of 11 internationally recognized ruleswhich define the responsibilities of sellers and buyers.

So the Incoterms rule FOB stowed will make it clear that the seller is responsible not only for loading the cargo on board, but also for stowing it. This means that in most cases the buyers truck or its carriers truck backs up to the sellers loading dock and the sellers staff and equipment complete the loading. Web01 December 2021 Revenue recognition: A Q&A guide for software and SaaS entities There are unique considerations when accounting for software and SaaS arrangements. <>/Metadata 1985 0 R/ViewerPreferences 1986 0 R>>

Revenue recognition is defined by accounting standards such as GAAP, and the point of delivery (as defined by the Incoterms rule) is one factor in the decision on this matter. Written by Bob Ronai CDCS, a member of the ICCs Incoterms 2020 Drafting Group, in partnership with Trade Finance Global (TFG). Click here US Technology, Media, and Telecommunications Because before that the buyer could still inform the seller of his desired time within the agreed period. Is the exporter familiar with the export and import procedures in both countries? These statements alsospecify which party bears the cost of handling these tasks. The word loaded here would usually mean safely placed on the vehicle, but for example if pallets or crates are loaded onto a truck then any tying down or lashing will be the responsibility of the vehicles driver under safety and traffic rules. The latest set of terms are referred to as Incoterms 2020. Help ensure a smooth export transactionand avoid potentially costly mistakes.Use internationally recognizedIncoterms toclarifythe tasks, costs and risks forbuyers and sellers in these transactions., Incoterms, widely-usedterms of sale,are a set of 11 internationally recognized ruleswhich define the responsibilities of sellers and buyers.  Refer to ICC publication no. Incoterms can be modified in contracts to suit traders preferences. It is not the sellers responsibility to do anything beyond the delivery point, so for example in a container shipment the seller could deliver on the last day of the shipment period meaning the container would not be loaded on board for several days, and sometimes in peak seasons or bad weather, possibly not for two or three weeks after that. WebUsing Incoterms for revenue recognition. The seller will usually need to know from the buyer the name and contact details of its carrier, the freight booking information including reference number/s, and any relevant data such as truck registration, railcar number, the flight details or the vessels details so that it can correctly declare both the date of export and the means of export to its authorities. This means that it can be used for sea freight as well as for various modes of land transport. Any restrictions at the site need to be communicated too. These statements also specify which party bears the cost of handling these tasks., Similarly, each Incoterm rulespecifies which party to the transaction, if any, is obligated to contract for the carriage of the goods. This term may be suitable for bulk non-containerized cargo that the seller wants to arrange main freight for. You can learn more about the CIP term here.

Refer to ICC publication no. Incoterms can be modified in contracts to suit traders preferences. It is not the sellers responsibility to do anything beyond the delivery point, so for example in a container shipment the seller could deliver on the last day of the shipment period meaning the container would not be loaded on board for several days, and sometimes in peak seasons or bad weather, possibly not for two or three weeks after that. WebUsing Incoterms for revenue recognition. The seller will usually need to know from the buyer the name and contact details of its carrier, the freight booking information including reference number/s, and any relevant data such as truck registration, railcar number, the flight details or the vessels details so that it can correctly declare both the date of export and the means of export to its authorities. This means that it can be used for sea freight as well as for various modes of land transport. Any restrictions at the site need to be communicated too. These statements also specify which party bears the cost of handling these tasks., Similarly, each Incoterm rulespecifies which party to the transaction, if any, is obligated to contract for the carriage of the goods. This term may be suitable for bulk non-containerized cargo that the seller wants to arrange main freight for. You can learn more about the CIP term here.  In Case of FOB (Free on Board) it should be recognised when it reaches the port. If you have any questions about Incoterms not addressed on this website, pleaseget in touch. If there is any information which the buyer requests that is not already known to the seller, logically the seller can, and probably would, choose to assist.

In Case of FOB (Free on Board) it should be recognised when it reaches the port. If you have any questions about Incoterms not addressed on this website, pleaseget in touch. If there is any information which the buyer requests that is not already known to the seller, logically the seller can, and probably would, choose to assist.

The Incoterms rules are also applicable to transactions where the buyer and seller are in the same country, or both within a customs union such as the European Union. For some strange reason, in the Incoterms 1990 version FCAs delivery article was expanded to detail specific delivery procedures for rail transport, road transport (not mentioned in any previous versions), inland waterway, sea transport, air transport, unnamed transport (!) This insurance is for the benefit of the buyer, who must claim from the insurer if necessary. This location can be a particular port or a carriers hub. Does the exporter have a legal entity capable of acting as an importing in the destination country? Use this handy chart to quickly identify which fees and potential liabilities you face under each of the 11 international commercial terms. The point of delivery must be specifically tied down in the sales contracts. The documents required will vary depending on the specific terms of the agreement between the buyer and the seller. WebRevenue recognition is defined by accounting standards such as GAAP, and the point of delivery (as defined by the Incoterms rule) is one factor in the decision on this matter. If the seller has been requested by the buyer to provide assistance in obtaining information or documents needed for the buyer to effect carriage, import formalities, insurance and the transport document, then the buyer must reimburse the sellers costs. Namely, the seller is generally also responsible for loading charges, delivery to the port, and export duties and taxes (although the exact terms of the contract can alter these even in a transaction using FCA Incoterms). However, it must be mentioned (again) that Incoterms DO NOT specifically define revenue recognition principles. You can learn more about the CIF term here. Carriage and Insurance Paid To CIP They are a set of rules published by the International Chamber of Commerce (ICC) , which relate to International Commercial Law. 715 for the text. Its one of a gem! FOB (free on board) is an Incoterms rule where the seller is responsible for the shipment up until the point where the goods are loaded onto the vessel. Additionally, and provided the seller has advised that the goods have been clearly identified as the goods under the contract, the buyer pays any additional costs incurred if the buyer fails to nominate who is to take the goods from the seller or that person fails to do so. This is because in such shipments the buyer wants to only take on the risk of damage or loss of the goods when they have actually been exported. if the Incoterms is EXW (Ex-works) then the revenue should be recognised immediately. Revenue recognition available to seller at named point/carrier. Refer to ICC publication no. There is potential for diversion of the goods before they leave the United States, or to another county after they leave the U.S in violation of the Export Administration Regulations (EAR). 1) If the named place is the sellers premises then when the goods have been loaded on the means of transport provided by the buyer. /6}$rH{P]`KYYA7~TbJ}>9krZ_M8\HH-94E*NXlH2+M}#[\My4B6v Official websites use .gov Free Carrier Video We explain this guidance generally in a separate article, Determining the Transfer of Control .