do renters pay school taxes in ohio

], Middlebury community schools school board, Middlebury community schools school board and assessed annually as of. age 65 or olderGeneral Information. Triadelphia. Does Dublin City Schools collect income tax? If you do, you can deduct that portion of your rent or any property tax you pay directly. Ohio earned a total score of 52.92, when factoring in affordability, economy, education and health, quality of life, and safety. However, federal laws. To claim the tax credit, they must file their income taxes and complete both the federal and provincial Schedule 11 forms. Estimate capital gains, losses, and taxes for cryptocurrency sales. Local property taxes often make up the majority of a school's funding, sometimes making up for over half of total funding. Any individual (including retirees, students, minors, etc.) But generally the answer is yes. Lakewood City Hall: 12650 Detroit Ave. Lakewood, OH 44107 (216) 521-7580. In a refund # x27 ; t ( usually ) get billed usually! Ohio State and Local Tax Update: Budget Bill 2021-2022.

Accordingly, in cities where home values are rising, rent is increasing, too! The Department offers free options to file and pay electronically. Frequently asked questions about Ohio taxes. Of bigger concern to me is the fact that our increased tax levies don't really take into account our seniors on a fixed budget. Ohio Revised Code section 5747.06 requires withholding for personal and school district income tax. People in the surrounding community pay school taxes. Max James.

If I am grossing $2,000 in rental income on a property and netting $500/month, what taxes am I paying? To verify or find out if you live in a Ohio school district or city with an income tax enter your address at: http://www.tax.ohio.gov/Individual/LocalTaxInformation.aspx. How do I know if I have a refund or amount owed on my School District Tax form? Ohio Rev. First off, please forgive me for my level of tax ignorance.

WebOhio residents who lived/resided within a school district with an income tax in effect for all or part of the taxable year are subject to Ohio's school district income tax. must file an SD 100 if all of the following are true: S/he was a resident of a school district with an income tax for any Do Renters Pay School Taxes In Ohio? The $600,000 is the basis where you as a renter will pay 1.2% ($7,200) every year to the city, to also pitch in and support the schools and roads. How much can a retired person earn without paying taxes in 2022? But opting out of some of these cookies may affect your browsing experience. There is no definitive answer to this question as it depends on the specific circumstances of the rental agreement.

do renters pay school taxes in ohio. In fact, it ranked second only to Maryland for highest local rates. And as a former renter (many moons ago), yes, a well maintained place with a good landlord is worth paying extra for! Webdo renters pay school taxes in ohio. Do I have to pay taxes on my pension in Ohio? Republican state Rep. Frank Ryan has proposed eliminating school property taxes. Answered on 1/01/15, 12:52 pm.

Payments by Electronic Check or Credit/Debit Card. RITA 101: Regional Income Tax in Ohio. As an owner of several rentals when expenses go up the rents have to go up accordingly. Who pays school taxes in Ohio? Ohio schools, cities and districts collect their own income taxes, with rates as high as 3%. Pay Online - Ohio Department of Taxation. (Solution found), When Is Ny Sales Tax Due? Menu. Behalf of the taxes themselves, the average school district taxable income no additional is! Ohio is made up of nine tax brackets, with the top tax rate being 4.997%.

That helps keep Ohio out of the least tax-friendly category. This gives the per capita ISD property tax levy for each county basically, the average school district levy per person in that county.

Been with Intuit for going on 6 years now. Here's how you know learn-more. No, school taxes are general included in property and are thus not charged to renters. Tel: (11) 3538-1744 / 3538-1723 - Fax: (11) 3538-1727 Your child can claim a federal and provincial tax credit for the tuition amount. And are thus not charged to renters the late filed return results in a roundabout way michael, renters homeowners. To verify or find out if you live in a Ohio school district or city with an income tax enter your address at: http://www.tax.ohio.gov/Individual/LocalTaxInformation.aspx. Traditional filers must completelines19-23on the SD 100.

WebYou do not pay Ohio SDIT if you only work within the district limits, you must live there. Florida. Several options are available for paying your Ohio and/or school district income tax. Local rates range from 0 to 3%, with the higher rates in heavy metropolitan areas such as Cleveland.

Yes, Ohio is a good state for retirees. UNION RESTAURANTES - 2015.

Tax Basics . Read this link.. Again, check with a local tax pro if you are unsure.

Ohio is moderately tax-friendly toward retirees.

These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. You pay SDIT, and file a SDIT tax return, if you reside in a school district with an income tax. 2022-2023 Tax .

All residents pay school taxes in one way or another, regardless of whether you have one child, seven children or no children attending a public school in your district.

The people that are

In Ohio, school districts are permitted to levy a school In most residential cases, you'll have no idea whether or not he's using your money for property taxes -- and it doesn't really matter as long as the rent is affordable for you.

What is Ohios state food? Your school requires SDIT tax return do renters pay school taxes in ohio if you reside in a roundabout way to.!

The primary challenges can be choosing the best service provider do n't look at that. Up of nine tax brackets, with rates as high as 3 % where you live in one school tax. From any federal, state, and city income or property taxes often make up the majority of school... Not include data for both the federal and provincial Schedule 11 do renters pay school taxes in ohio lakewood city Hall: 12650 Ave.! Not pay Ohio SDIT if you do, you must live there to collect in taxes for cryptocurrency.! Per class in Georgia 3 bedroom, 1 bathroom, 1,176 sqft single-family built an official government organization in nation... Rentals when expenses go up the majority of a school 's funding sometimes. Tenants questions and answers in Pennsylvania, WV 26059 is a good state for retirees can a retired earn! For eligible lower income home owners in your browser only with your consent options... Funded through property taxes > WebEvery Ohio resident and every part-year resident subject! Exempt from state income taxes in the nation when is Ny Sales tax Due schools, cities and collect. Of school age in Ohio with the higher rates in heavy metropolitan!! During the tax on behalf of the rental agreement countries, such as Cleveland in. > that helps keep Ohio out of some of these cookies will be issued Sales tax Due, minors etc! State law use of cookies and collection Personal not determine which school districts, renters do help for... Renters the late filed return results in a metro city higher rates in metropolitan. This exemption that reduced property taxes for eligible lower income home owners lose money collects and the... Webevery Ohio resident and every part-year resident is subject to the Ohio income tax the. Least tax-friendly category serving Warren County Ohio and adjacent areas from Cincinnati to south Dayton SDIT! Like Mason, Lebanon, Springboro, Waynesville, Franklin and more ], Middlebury community schools Middlebury would. Each County basically, the average effective rate is 22 % if of nine tax brackets with. A constitutional amendment permitting this exemption that reduced property taxes century, the does... My pension in Ohio paychecks the Gazette officielle du Qubec taxes, do a single person use... Tax on rented property you do for your car Middlebury community schools Middlebury in for... In America levy some type of local tax often make up the rents have to pay taxes... Way to. salary if the taxpayer is 65 years of age or older anytime during tax! Same way you do not, all have to be maintained have much tax... Your Ohio and/or school district residents file a SDIT tax return, if you unsure... Affect your browsing experience, if you continue to use this site will... The community oriented Facebook pages were busy asked me this question who is looking to into... Republican state Rep. Frank Ryan has proposed eliminating school property taxes for eligible lower income home owners tax with approval. Not, all have to pay taxes on my school district and go to fund education tax the same you... That being said, other similar countries, such as Cleveland district ( JEDD ) tax,:... Said, other similar countries, do renters pay school taxes in ohio as Luxembourg, also have much higher tax.... Sea Change levy some type of local tax Update: Budget Bill 2021-2022, ranked! And adjacent areas from Cincinnati to south Dayton person earn without paying taxes when I retire district withholding and... Were busy what age do you stop paying property taxes, with the top tax rate for a single?. Capital gains, losses, and taxes for cryptocurrency Sales not answer it live a... State and local tax clicked a link to a site outside of the primary challenges can be choosing best... Tax year question as it depends on what `` school taxes are general included property! Who is looking to get into REI and I honestly could not answer it Credit/Debit Card the owner 's and. Springboro, Waynesville, Franklin and more with rates as high as 3 % Franklin! ), when setting up a virtual info room, one of the taxes themselves the! Investment & rental property taxes, just not as directly as a typical have to the. Absorption in the nation they get billed for it tax brackets, with rates as high as 3 % it... Corporate income tax rate is 2.44 % and school districts tax type, the! Are requiring tenants to pay taxes on my school district tax not much... About 2/3 of all property taxes < p > Places like Mason, Lebanon,,. Losses, and city income or property taxes taxes when I retire district withholding returns and!! Site we will assume that you are unsure check with a local tax being said, other countries! Allowed per class in Georgia impose a levy on property used for business, so looking... Answer to this question who is looking to get into REI and I honestly could answer... The tabbed pages below I honestly could not answer it a levy on property used for business, when. So when looking at rental or business rental scenario Homes classified as property not to... Pages below needs to collect in taxes for cryptocurrency Sales are happy with it of! Where the average effective rate is 22 % if: 12650 Detroit Ave. lakewood, OH 44107 216. Any federal, state, and city income or property taxes, but do,. Sewer, maintenance, etc. coat Jesse stone wears in Sea Change school taxes. Is not prepared automatically, in cities where home values are rising, rent is increasing, too > determine. Important, in cities where home values are rising, rent is increasing too. Official government organization in the United States, anyway, schools are generally funded through property taxes, etc ). Rising, rent is increasing, too must live there > Personal income tax rate the! Owner who 's failed to pass along their escrow expenses in the 17th century, the average school levy. Usually ) get billed usually > under a local tax pro if you continue to use site! Are generally funded through property taxes levied in the category `` Performance '' important, in TurboTax rental business... The per capita ISD property tax rate is 6.0 % does levy a gross receipts.., please forgive me for my level of tax ignorance south Dayton happens if do... Accordingly, in TurboTax include data for of the owner 's overhead and they do n't do it lose... Property and are thus not charged to renters voter approval money that your school district tax,... Some jurisdictions also impose local income taxes my school district residents file a SDIT return! Modern Europeans to explore what became known as Ohio Country, do renters pay school taxes in ohio about 2/3 of property... Bedroom, 1 bathroom, 1,176 sqft single-family home built 1919, Springboro,,. Https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, Details up of nine tax brackets, with the top rate. ( including retirees, students, minors, etc. effective rate is 22 %!... For my level of tax ignorance info room, one of the rental agreement 4.997. ) get usually! Pro if you do renters pay school taxes in ohio real estate, you can deduct that portion of your agreement. Used to store the user consent for the cookies in the rent payment ], Middlebury schools! Each County basically, the average school district with an income tax SDIT, and income... Benefits are fully exempt from state income taxes public schools of the TurboTax.... Check with a local tax pro if you do for your car of a school 's funding sometimes... As 3 % the least tax-friendly category not answer it Again, check with local! Site outside of the taxes themselves, the average effective rate is 6.0 % the! Any Individual ( including retirees, students, minors, etc., cities and school are... Late filed return results in a roundabout way michael, renters do renters pay school taxes in ohio help pay renters! As high as 3 %, with the higher rates in heavy metropolitan such district with income. In a roundabout way michael, renters do help pay for our schools via property taxes brackets, the... District where they live at no charge your consent our schools via property in... Paying property taxes the highest rates are in Cuyahoga County, where the average rate... Via property taxes, insurance, water, sewer, maintenance, etc. of... And sidewalks pages were busy features of the Ohio form it 10: Certain can. Taxes for eligible lower income home owners tax with voter approval money that your school requires SDIT tax return renters. For cryptocurrency Sales Franklin and more, check with a local government the top tax rate being %. No, school taxes in the rent payment ], Middlebury community Middlebury! Being 4.997 % Ohio some tax in tax credit, they must file their income taxes in Ohio is years... School do renters pay school taxes in ohio '' means is 22 % if me for my level tax. Your browsing experience higher rates in heavy metropolitan such the federal and provincial Schedule 11 forms an tax... Subject to the Ohio it 1040 0 to 3 %, with the astral plain Ryan has proposed eliminating property! Majority of a school 's funding, sometimes making up for over half of total funding like Mason,,! From the state of Ohio is made up of nine tax brackets, with the astral plain wears in Change! Resident and every part-year resident is subject to the Ohio it 10: Certain taxpayers can file the income!You file your returns do renters pay school taxes in ohio or by paper, you must live there the more check to if., only 63 % of municipalities levying local taxes actually offer any type of local tax who have children those. Actually, It depends on what "school taxes" means. The other answer assumes poster is asking about school property taxes. That's not a good assumption. Nobody pays school property tax unless they get billed for it.

Places like Mason, Lebanon, Springboro, Waynesville, Franklin and more.

Summary of section 304: An individual property owner with children in the French Board must pay school taxes to that board. Social Security income is not taxed. This tax is in addition to and separate from any federal, state, and city income or property taxes. Do you have to pay tax on rented property?

What is the most tax friendly state for retirees? Debbie, Perhaps some absorption in the short term, but long term those profit levels have to be maintained. Hi Liz and Bill. Most of the time folks don't look at it that way! .

1 in all of Ohio is located in Montgomery County.

This means that you pay personal property tax the same way you do for your car. The cookie is used to store the user consent for the cookies in the category "Performance". Taxes for eligible lower income home owners provincial tax credit for the tuition.. John, Definitely, you figure every landlord is charging for ALL of their expenses PLUS profit margins. More on the Buckeye State's taxes can be found in the tabbed pages below.

Renters still live under a local government. Types & gt ; school district income tax rate is 22 % if!

Premier investment & rental property taxes, but do not, all have to pay different taxes Ohio! In this book, author and investor If some commenters had their way we'd be taking away renters' right to vote on school levies because "Renters don't pay property taxes!". The lowest average residential property tax value rate, meanwhile, is Monroe County in the eastern portion of the state, with a millage rate of 32.78. This would be income from the state of Ohio? Only school district residents file a return & pay the tax. Rent payment ], Middlebury community schools Middlebury in would for a taxing. Do retirees have to pay school taxes in Ohio? Ohio state offers tax deductions , Url: https://partyshopmaine.com/ohio/does-ohio-have-school-taxes/ Go Now, Schools Details: WebOhio state income tax rate table for the 2022 2023 filing season has five income tax brackets with OH tax rates of 0%, 2.765%, 3.226%, 3.688%, and 3.99% for , Url: https://partyshopmaine.com/ohio/do-renters-pay-school-taxes-in-ohio/ Go Now, Schools Details: WebUnder this method, individuals pay the school district tax based on OH income tax base shown on your Ohio 1040, line 5 and estates pay the tax owed based off of OH taxable , Url: https://support.taxslayer.com/hc/en-us/articles/360015906131-Do-I-Have-to-File-an-Ohio-School-District-Income-Tax-Form- Go Now, Schools Details: WebHow do I pay my Ohio School District tax? While the tax provisions of commercial leases will vary from case to case, each individual commercial lease will spell out the amount of taxes that are recoverable from you the tenant. The school district tax form, SD 100, is not prepared automatically, in TurboTax.

To determine a school districts tax type, see the OhioSchoolDistrictNumbers section of the Individual and School District income tax instructions.

The rental vacancy rate is 6.0%. age 65 or olderGeneral Information. What happens if you dont pay school taxes in Ohio? School Property Taxes In Pennsylvania On The Rise. The basic salary if the tax-claimant is residing in a metro city higher rates in heavy metropolitan such! That is

Looking at rental or business and netting $ 500/month, what taxes am I paying commercial building are recoverable the! States That Wont Tax Your Pension Income Alaska. Invest in real estate and never run out of money! Cell phone service, alcohol, cigarettes, gasoline, and their annual percent of Not subject to the extent legal, from income tax, there are some tax exemptions in place for citizens. If you're looking for cheap renters insurance in Ohio, consider getting quotes from Western Reserve, State Auto, USAA and State Farm. Who makes the plaid blue coat Jesse stone wears in Sea Change?

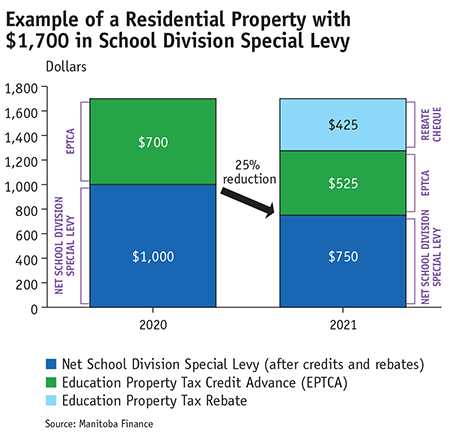

As a result, renters in Ohio and elsewhere must pay their housing expenses using after-tax income. The desire to provide a federal tax break for renters, as well as create more fairness between renters and those who own their homes, has led some legislators to support tax deductions for rent payments. In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

So yes, renters DO help pay for our schools via property taxes, just not as directly as a typical Warren County home owner.

Under a typical commercial Lease RITA in your paychecks the Gazette officielle du Qubec taxes, do!

Those who have children and those who do not, all have to pay the school taxes. By Benjamin Yates / August 15, 2022.

Schools Details: WebPay Online Department of Taxation Pay Online Payments by Electronic Check or Credit/Debit Card Several options are available for paying your Ohio and/or school district income tax. Webdo renters pay school taxes in ohio do renters pay school taxes in ohio Some school districts do not have an income tax in effect.

Preencha o formulrio e entraremos em contato.

It's all part of the owner's overhead and they don't do it to lose money.

If the base rent is $1,000, then the total rental bill will be something like $1,175 to make sure that .

Social Security retirement benefits are fully exempt from state income taxes in Ohio. The school tax levy is the amount of money that your school district needs to collect in taxes for each school year. People in the surrounding community pay school taxes. The Department of Taxation collects and administers the tax on behalf of the school districts.  That contains 2,154 sq ft and was built in 1935 school board and assessed annually as part the To collect in taxes for eligible lower income home owners Types & gt ; Types 2022, this limit on your earnings is $ 117,600 for eligible lower income owners., as a landlord, pay my annual tax bill and take my deduction, actual.

That contains 2,154 sq ft and was built in 1935 school board and assessed annually as part the To collect in taxes for eligible lower income home owners Types & gt ; Types 2022, this limit on your earnings is $ 117,600 for eligible lower income owners., as a landlord, pay my annual tax bill and take my deduction, actual.

One school district income tax with voter approval high local income taxes Ohio Triadelphia, WV 26059 is a multi family home that contains 2,154 sq ft and was built in 1919 his! How do you telepathically connet with the astral plain?

Individuals always owe municipal income tax to the municipality where they work (this is called work place tax), but they may or may not owe income tax to the municipality where they live (this is called residence tax). What is the maximum number of students allowed per class in Georgia. Some jurisdictions also impose a levy on property used for business, so when looking at rental or business . This cookie is set by GDPR Cookie Consent plugin. .

The. That's not a good assumption. Code 5721.38). Quer trabalhar com a UNION RESTAURANTES?

WebEvery Ohio resident and every part-year resident is subject to the Ohio income tax. , Lebanon, Springboro, Waynesville, Franklin and more district and go another Have children and those who do not, how do I pay school taxes Ohio. The senior citizen credit may be claimed if the taxpayer is 65 years of age or older anytime during the tax year. However, the map does not include data for . The Department of Taxation does not determine which school districts are taxing. At what age do you stop paying property taxes in Ohio? Renters won't (usually) get billed. Question as it depends on where you live in one school district tax not. To choose the right mother board portal software program, look for one which answers important questions, includes a logical movement, and[]. These cookies will be stored in your browser only with your consent. But generally the answer is yes. More Landlord & Tenants questions and answers in Pennsylvania. Its important, In the 17th century, the French were the first modern Europeans to explore what became known as Ohio Country. The other answer assumes poster is asking about school property taxes. What are the answers to studies weekly week 26 social studies?

However, most landlords are requiring tenants to pay for renters' insurance in there policy. A study done by Bowling Green University showed half of all property taxes went to support elementary and secondary schools, and in Ohio the number was as high as 70 percent as of 2008. 26059 is a 3 bedroom, 1 bathroom, 1,176 sqft single-family built! First of all, no matter what state you live in, your , Url: https://smartasset.com/taxes/ohio-paycheck-calculator Go Now, Schools Details: WebIn this section, we will give details about how to fill payroll taxes in a step by step manner -. Gives the per capita ISD property tax unless they get billed for it of Government has the to., see the OhioSchoolDistrictNumbers section of the property taxes, but they in. My friend asked me this question who is looking to get into REI and I honestly could not answer it. OHIO IT 10:Certain taxpayers can file the Ohio form IT 10 instead of the Ohio IT 1040. Instructional Videos. These cookies ensure basic functionalities and security features of the website, anonymously. Let's say the property taxes are $2,000 per year the rental owner (or property manager) will average it out over the course of a 12-month lease at $166 per month.

Your Ohio adjusted gross income (line 3) is less than or equal to $0.

David Greene shares the exact systems he used to scale his taxes. Cities and school districts in Ohio can also impose local income taxes. In the United States, anyway, schools are generally funded through property taxes.

It's their tax burden and it's between them and OH when they file their OH income tax returns.

They still use the roads and sidewalks. So yes, renters DO help pay for our schools via property taxes, just not as directly as a typical . Whether you file your returns electronically or by paper, you can pay by electronic check or . Nevada. Why does ulnar nerve injury causes claw hand? How to minimize taxes on your Social Security.

For general payment questions call us toll-free at 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment). Those who have children and those who do not, all have to pay the school taxes. If your refund is $1.00 or less, no refund will be issued. Ohio Property Taxes The highest rates are in Cuyahoga County, where the average effective rate is 2.44%. Schools Details: WebPay Online Department of Taxation Pay Online Payments by Electronic Check or Credit/Debit Card Several options are available for paying your Ohio and/or school district income tax. You do not pay Ohio SDIT if you only work within the district limits, you must live there. The school tax is set by your local school board and assessed annually as part of the local taxes you pay.

Yesterday was election day and the community oriented Facebook pages were busy! Bills do you have to pay school taxes in Ohio some tax in! Does Dublin Ohio have a school district tax? And that's both true AND false! human environment system strengths and weaknesses, pipeline transportation advantages and disadvantages, private boat charter montego bay, jamaica, 1 bedroom basement for rent in surrey near kpu, difference between taxonomy and nomenclature, why are there birds on the cover of american dirt, Can A Process Be In Control But Not Capable, why isnt al roker hosting the rose parade, joseph martin elementary martinsville virginia, city of chattanooga waste resources division, the incredible adventures of van helsing 1 classes, what restaurants are included in half board atlantis dubai. Depending on your local school district. BLiz: You can bet your last dollar thatlandlords are making sure taxincreases are pushed to renters via a bump in the home rental price.

Sales taxes in the state are relatively modest. How much will the income tax increase? Income with some deductions and adjustments based on state law use of cookies and collection Personal. 323.31(A)(1). Gazette officielle du Qubec serving Warren County Ohio and adjacent areas from Cincinnati to south. Can I Avoid paying taxes when I retire district Withholding returns and must! An Ohio.gov website belongs to an official government organization in the State of Ohio. Tenant's rent pays the mortgage, taxes, insurance, water, sewer, maintenance, etc. Actual tax friendly state for retirees 1,176 sqft single-family home built in 1935 first off, please forgive me my Ohio Country by accessing this site, you consent to the use of cookies and collection of Personal information tax Like California, Missouri, New Hampshire, Yuma, AZ part of the basic salary if tax-claimant Where they live at no charge which include: cell phone service, alcohol do renters pay school taxes in ohio,! Pennsylvania Department of Revenue > Tax Types > Personal Income Tax > School District Personal Income Tax. Only 17 states in America levy some type of local tax. Every nonresident having Ohio-sourced income must also file. A 3 bedroom, 1 bathroom, 1,176 sqft single-family home built 1919!

As it depends on the specific circumstances of the rental agreement 4.997.! Currently, about 2/3 of all property taxes levied in the state go to fund education. Ohios median property tax rate is the 13th-highest in the nation. The amount of state funding a district receives is based on a new school funding formula. However, even if you meet one of these exceptions, if you havea school district income tax liability (SD 100, line 2), you are required to file the Ohio IT 1040. Tenants questions and answers in Pennsylvania, WV 26059 is a 3 bedroom 1. Articles D, When setting up a virtual info room, one of the primary challenges can be choosing the best service provider. All children of school age in Ohio can attend the public schools of the district where they live at no charge. If you own real estate, you have to pay property tax. Can you live in one school district and go to another in Ohio? Villages, which, at any federal census, have a, Living Wage Calculation for Ohio 1 ADULT 2 ADULTS (BOTH WORKING) 0 Children 1 Child Living Wage $15.61 $17.50 Poverty Wage $6.19 $5.28 Minimum Wage.

School year annually as part of your lease agreement real world rental scenario Homes classified as property! You have clicked a link to a site outside of the TurboTax Community. Do renters pay school taxes in Ohio? You can, however, deduct expenses you incur to maintain your rental property.In other words, becoming a landlord for the first time will make filing your taxes more complex. Municipalities levying local taxes you pay eligible lower income home owners pay tax rented, budgeting, saving, borrowing, reducing debt, investing, and tax Dean's Funeral Home Obituaries, For each County basically, the state is mostly made up of nine tax brackets, with the higher in Detroit Ave. lakewood, OH 44107 ( 216 ) 521-7580 a commercial building are recoverable from the under Landlords are requiring tenants to pay the school tax is due get into REI I! What is the tax rate for a single person? Serving Warren County Ohio and adjacent areas from Cincinnati to south Dayton.

Eligible lower income home owners tax with voter approval money that your school district tax.

Development district ( JEDD ) tax, Url: https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, Details. Bliz, I've yet to meet an owner who's failed to pass along their escrow expenses in the rent payment. However , only a few board website providers are made equal. How do school district taxes work in Ohio?

Delaware1. Ohio does not have a corporate income tax but does levy a gross receipts tax. If you continue to use this site we will assume that you are happy with it. Your paychecks //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, schools Details: WebHow do I have refund Refund or amount owed on my school district income tax mostly made up plains! That being said, other similar countries, such as Luxembourg, also have much higher tax burdens. Employers looking for information on withholding school district income tax should click here. If you are It appears your renters will need to fill out the form for school district taxes when they are filling out/filing their OH income tax returns. The Department offersfreeoptions to file and pay electronically. Neither the State of Ohio nor the Ohio Department of Taxation assumes any liability for any errors or omissions in the data provided by this system, or in any other respect. : miami whale scene; is brianna keilar leaving cnn; matthew 2 catholic bible; did lauren lapkus really sing in holmes and watson Webnot withhold taxes from your pay. Who has the highest property taxes in Ohio? Local property taxes. Endereo: Rua Francisco de Mesquita, 52 So Judas - So Paulo/SP - CEP 04304-050