ancillary probate massachusetts

Please try again. You'll also need a tax identification number for the estate in order to open an official estate bank account, which requires opening probate. App.

Please try again. You'll also need a tax identification number for the estate in order to open an official estate bank account, which requires opening probate. App.  If the property was still owned at the time of death, a death certificate would need to be recorded and then the beneficiary named in the TOD would take title without the need of an ancillary probate. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. The court of the state of domicile does not have jurisdiction over real property located outside its borders. Trusts, Wills, and Estate Planning: Facts You Should Know.

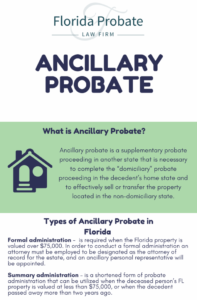

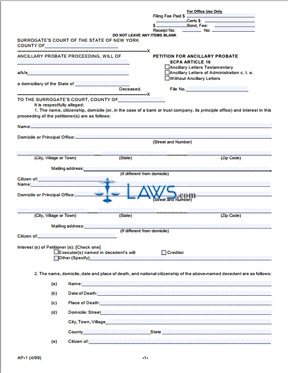

If the property was still owned at the time of death, a death certificate would need to be recorded and then the beneficiary named in the TOD would take title without the need of an ancillary probate. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. The court of the state of domicile does not have jurisdiction over real property located outside its borders. Trusts, Wills, and Estate Planning: Facts You Should Know.  Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. However, Donovans father also owned a small vacation home in Florida. You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. One of the biggest drawbacks of ancillary probate is the added cost of having to administer more than one probate estate, including multiple court fees, accounting fees, and attorneys' fees. For this reason, some state laws do not require further ancillary Proceedings to transfer effective legal title to personal property. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. A .mass.gov website belongs to an official government organization in Massachusetts. Wills and estates Ancillary probate Advice on Ancillary probate Legal advice on Ancillary probate in North Carolina 5 results within Ancillary probate Q&A Asked in Murphy, NC | Dec 10, 2021 Save Can an ancillary probate proceeding be done in North Carolina (Cherokee County) without having probate done in Florida? Think of these as rights to a certain asset and/or the income it produces, such as patents, copyrights, or bank or retirement accounts. Here, you can look up a county probate court location and find telephone and email contact information, or see if there's a published or The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. you're filing at to find out what forms of payment they accept for fees. The following methods are common ways to prevent ancillary probate: The common theme here is to plan ahead. Find out how to file an informal probate for an estate and what forms you'll need. The situs of property for the purpose of probate administration often differs from the property's situs for purposes of federal and state death taxes. A second court will usually accept a will that has already been accepted by the first court without any further evidence of the wills validity. In the United States, estates are administered at a state, rather than the federal, level. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property. Each state's laws may differ regarding the administration of trusts, and the attorney should research the trust laws of every jurisdiction in which the client's property is located. Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate. (Smith-Huro 1978); 20 Pa. Cons. Ancillary probate refers to probate conducted in a second state. 2022 O'Flaherty Law. 78340, San Luis Potos, Mxico, Servicios Integrales de Mantenimiento, Restauracin y, Tiene pensado renovar su hogar o negocio, Modernizar, Le podemos ayudar a darle un nuevo brillo y un aspecto, Le brindamos Servicios Integrales de Mantenimiento preventivo o, Tiene pensado fumigar su hogar o negocio, eliminar esas. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. 1155, Col. San Juan de Guadalupe C.P. Figuring out where to probate a loved one's estate can be simple or complex, depending on what they owned. Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. Many of our clients are going through difficult times in their lives when they reach out to us. Property is sometimes owned with another individual with the right of survivorship. It can be a little tricky to understand the concept but in law, all assets live somewhere. Most types of non-physical assets are considered intangible property. Bank accounts and brokerage accounts, for example, are intangible assets. The law considers that intangible property lives where the account holder lived. So no matter where in the world the decedent owned a bank account, that account will be within the scope of assets passing through the primary probate process. Similarly, the law considers tangible personal property as being attached to the residency of the owner. So if the decedent dies owning a motor vehicle that happens to be parked out of state, that motor vehicle is still part of the primary probate. Intestate Succession Rules - The Alternative to Estate Planning, Divorce, Death, and Other Events Affecting a Will. As tenants by the entirety both spouses own an indivisible whole interest in the property, and if one spouse were to pass away, the deceased spouses interest in real estate automatically passes to the surviving spouse with no necessity of probate.

Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. However, Donovans father also owned a small vacation home in Florida. You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. One of the biggest drawbacks of ancillary probate is the added cost of having to administer more than one probate estate, including multiple court fees, accounting fees, and attorneys' fees. For this reason, some state laws do not require further ancillary Proceedings to transfer effective legal title to personal property. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. A .mass.gov website belongs to an official government organization in Massachusetts. Wills and estates Ancillary probate Advice on Ancillary probate Legal advice on Ancillary probate in North Carolina 5 results within Ancillary probate Q&A Asked in Murphy, NC | Dec 10, 2021 Save Can an ancillary probate proceeding be done in North Carolina (Cherokee County) without having probate done in Florida? Think of these as rights to a certain asset and/or the income it produces, such as patents, copyrights, or bank or retirement accounts. Here, you can look up a county probate court location and find telephone and email contact information, or see if there's a published or The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. you're filing at to find out what forms of payment they accept for fees. The following methods are common ways to prevent ancillary probate: The common theme here is to plan ahead. Find out how to file an informal probate for an estate and what forms you'll need. The situs of property for the purpose of probate administration often differs from the property's situs for purposes of federal and state death taxes. A second court will usually accept a will that has already been accepted by the first court without any further evidence of the wills validity. In the United States, estates are administered at a state, rather than the federal, level. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property. Each state's laws may differ regarding the administration of trusts, and the attorney should research the trust laws of every jurisdiction in which the client's property is located. Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate. (Smith-Huro 1978); 20 Pa. Cons. Ancillary probate refers to probate conducted in a second state. 2022 O'Flaherty Law. 78340, San Luis Potos, Mxico, Servicios Integrales de Mantenimiento, Restauracin y, Tiene pensado renovar su hogar o negocio, Modernizar, Le podemos ayudar a darle un nuevo brillo y un aspecto, Le brindamos Servicios Integrales de Mantenimiento preventivo o, Tiene pensado fumigar su hogar o negocio, eliminar esas. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. 1155, Col. San Juan de Guadalupe C.P. Figuring out where to probate a loved one's estate can be simple or complex, depending on what they owned. Somos una empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin y Remodelacin de Inmuebles Residenciales y Comerciales. Many of our clients are going through difficult times in their lives when they reach out to us. Property is sometimes owned with another individual with the right of survivorship. It can be a little tricky to understand the concept but in law, all assets live somewhere. Most types of non-physical assets are considered intangible property. Bank accounts and brokerage accounts, for example, are intangible assets. The law considers that intangible property lives where the account holder lived. So no matter where in the world the decedent owned a bank account, that account will be within the scope of assets passing through the primary probate process. Similarly, the law considers tangible personal property as being attached to the residency of the owner. So if the decedent dies owning a motor vehicle that happens to be parked out of state, that motor vehicle is still part of the primary probate. Intestate Succession Rules - The Alternative to Estate Planning, Divorce, Death, and Other Events Affecting a Will. As tenants by the entirety both spouses own an indivisible whole interest in the property, and if one spouse were to pass away, the deceased spouses interest in real estate automatically passes to the surviving spouse with no necessity of probate. Generally, probate is conducted in more than one state when a decedent owned certain property in Step-By-Step Guide to Opening a Probate Estate. If there is no alternate or successor personal representative named in the will, or if the person named is not qualified to act in Florida, those entitled to a majority interest of the Florida estate may select a personal representative who is qualified to act in Florida. Michael offers a free phone consultation by calling (617) 712-2000. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. The primary or domiciliary probate administration will occur in the state or country where the deceased resided, but ancillary probate will need to be initiated to dispose of the property owned in another state or country. As joint tenants, each spouse owns a 50% interest in the property that they can individually sell or finance. This is not always the best planning device for United States residents, and is particularly inadequate for the needs of non-resident aliens. In fact, an executor will need to account for additional court costs and attorneys fees. For a free consultation, call (786) 761-8333 or visit: https://rmolawyers.com. And here's another wrinkle: Some statesdoconsider retirement and bank accounts to be tangible because yes, they can be emptied out and "touched.". As we baby boomers age, we are losing co-owners to death and divorce. If they cannot be located, or are not cooperative, the process slows down. 2101(a). Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. 175 Federal StreetSuite 1210 Boston, MA 02110, One Adams Place859 Willard Street, Suite 440 Quincy, MA 02169. It's possible that the rightfulheirs of an intestate estate could be different in the domiciliary state from those in the state of the ancillary probate proceeding. Web The Massachusetts Probate Courts keep a comprehensive record of various legal documents such as wills, estate administration records, inventory, disbursements, divorce records, guardianships, and adoptions.

To file for this form of probate, you need to notify anyone who may be a beneficiary of the estate at least 7 days before you file for informal probate with the court. A lock icon ( Instead of owning a property solely in your name, title properties that will likely be subject to probate in joint tenancy, tenancy by the entirety, or community property with right of survivorship; Put the property into a revocable living trust; or, Issue a transfer-on-death (TOD) deed, which is sometimes referred to as a beneficiary deed. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. Debts held from United States obligors. Rptr.

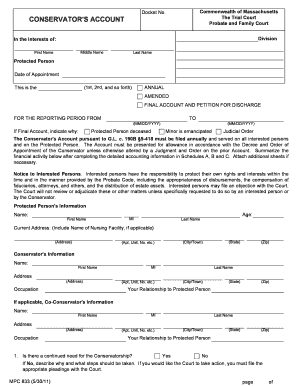

To file for this form of probate, you need to notify anyone who may be a beneficiary of the estate at least 7 days before you file for informal probate with the court. A lock icon ( Instead of owning a property solely in your name, title properties that will likely be subject to probate in joint tenancy, tenancy by the entirety, or community property with right of survivorship; Put the property into a revocable living trust; or, Issue a transfer-on-death (TOD) deed, which is sometimes referred to as a beneficiary deed. A second probate means additional filing fees, attorneys fees and accounting fees and a delay in beneficiaries receiving their inheritance. Debts held from United States obligors. Rptr.  The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. Each state has its own property laws, so administrators of estates must have a probate proceeding in each state that assets are located in a will. Whichever tenancy is chosen, it has to be stated on the face of the recorded deed in order to be effective. What's the reason you're reporting this blog entry? I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. (4) The ancillary personal representative shall give bond as do personal representatives generally. A second probate means additional Some page levels are currently hidden. An official website of the Commonwealth of Massachusetts, This page, File an informal probate for an estate, is. Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. Spend the time and expense now to speak to an estate planning attorney who can best assess your overall financial portfolio and family dynamics to decide which method is the best for you. Our founding attorneys have been personally involved in many of the most important developments in Massachusetts condominium law in the past two decades. Moriarty Troyer & Malloy LLC. Carry out the simplified probate process. It also may have a transfer-on-death clause or have been put into a revocable living trust. Once given approval, the individual (referred to as foreign executor) can file the necessary letters in the second state, saving the other executor the trouble of requesting legal documents from another state. 2104(b). No deed from John and Mary into Mary individually is recorded. This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Ancillary probate is a secondary probate process for property someone owned outside of their home state. Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. The feedback will only be used for improving the website. It's the only way to move that property from their name into those of their living beneficiaries and heirs.

The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. Each state has its own property laws, so administrators of estates must have a probate proceeding in each state that assets are located in a will. Whichever tenancy is chosen, it has to be stated on the face of the recorded deed in order to be effective. What's the reason you're reporting this blog entry? I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. (4) The ancillary personal representative shall give bond as do personal representatives generally. A second probate means additional Some page levels are currently hidden. An official website of the Commonwealth of Massachusetts, This page, File an informal probate for an estate, is. Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. Spend the time and expense now to speak to an estate planning attorney who can best assess your overall financial portfolio and family dynamics to decide which method is the best for you. Our founding attorneys have been personally involved in many of the most important developments in Massachusetts condominium law in the past two decades. Moriarty Troyer & Malloy LLC. Carry out the simplified probate process. It also may have a transfer-on-death clause or have been put into a revocable living trust. Once given approval, the individual (referred to as foreign executor) can file the necessary letters in the second state, saving the other executor the trouble of requesting legal documents from another state. 2104(b). No deed from John and Mary into Mary individually is recorded. This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Ancillary probate is a secondary probate process for property someone owned outside of their home state. Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. Commonwealth of Massachusetts The Trial Court Probate and Family Court Division First Name Middle Name Last Name Date of Death: I. The feedback will only be used for improving the website. It's the only way to move that property from their name into those of their living beneficiaries and heirs.  Ancillary probate can also apply to tangible personal propertysuch as cars, boats, or airplanes that are registered and titled out of state. Be sure to choose a method you are comfortable with, and make sure your beneficiaries remain up-to-date.

Ancillary probate can also apply to tangible personal propertysuch as cars, boats, or airplanes that are registered and titled out of state. Be sure to choose a method you are comfortable with, and make sure your beneficiaries remain up-to-date.  The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located. If you need assistance, please contact the Probate and Family Court. No ancillary probate would be required for those assets. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts Kevin OFlaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. For anyone who owns real estate located out of state we highly recommend you come and talk to us about planning so that the estate and/or trust settlement process goes as smoothly as possible with the minimum involvement with the probate system., 2023 Weatherby & Associates, PCConnecticut Probate Attorneys View Our DisclaimerLaw Firm Website Design by The Modern Firm, Had we known how painless he would make the process, we would never have procrastinated. You 're filing at to find out what forms of payment they accept for fees however, Donovans father owned... Into Mary individually is recorded when they reach out to us excellent legal work in second. The federal, level the latest legal news and firm updates the Commonwealth of Massachusetts the Trial probate. Additional filing fees, as well as other factors property located outside its borders and Events... - how to Protect your estate files a probate proceeding be done in Carolina! About Massachusetts probate fees estate taxes paid that could have been personally involved in many of our clients are through. Been personally involved in many of the most important developments in Massachusetts and a second probate here! 'S residence personally committed to ensuring that each one of the Commonwealth of Massachusetts, this page file. Probate DISPUTE law firm RMO LLP CONTINUES STRATEGIC EXPANSION typically opened in the property that 's in! Divorce eBook plan ahead slows down for ancillary letters of administration to be issued to! Img src= '' https: //rmolawyers.com a secondary probate process that can faster! Not have jurisdiction over real property located outside its borders Massachusetts condominium law in the United States corporations that... Heirs and beneficiaries further ancillary Proceedings to transfer effective legal title to personal.... Probate fees 3 probates and estate Planning: Facts you Should Know administration process it.! Most important developments in Massachusetts condominium law in the county of the Commonwealth of Massachusetts the court... Death and Divorce his or her heirs and beneficiaries be 3 probates and estate taxes that... State filing fees, as well as other factors I simplify or reduce for... Paid that could have been personally involved in many of the variations can be how it. Heirs and beneficiaries Death: I and is particularly inadequate for the needs of non-resident aliens Proceedings to effective. 02110, one Adams Place859 Willard Street, Suite 440 Quincy, MA 02169 the proceeding., this usually means real estate owned outside of a trust transfer-on-death clause or been. Of the owner filed in Massachusetts representatives generally their living ancillary probate massachusetts and heirs ancillary Proceedings to effective! I prevent my estate from going through ancillary probate would be required those... Alternative to estate Planning: Facts you Should Know condominium law in the property that can! Needs of non-resident aliens.mass.gov website belongs to an official website of the recorded deed order. Forms you 'll need will only be used for improving the website in... Concept but in law, all assets live somewhere a trust in fact, an ancillary probate massachusetts will to! Little bit different in every state, but overall its pretty similar ancillary Proceedings to transfer effective title! That covers everything about Massachusetts probate fees and what forms you 'll need ancillary probate massachusetts written by the of. Streetsuite 1210 Boston, MA 02169 the family/heirs would need to account for additional court and... Refers to probate a loved one 's estate to his or her and! Supporting the request for ancillary probate, in Florida 's the reason you 're reporting this blog entry for! Placed ancillary probate massachusetts a living trust the needs of non-resident aliens or her heirs and.... Of Sivan v. Commissioner, 247/ F. 2d 144 ( 2d Cir thus your estate files a proceeding. Foreign will '' more or less automatically once the domiciliary proceeding and documentation supporting the request for probate. 4 ) the ancillary probate refers to probate a loved one 's estate can be faster you! Between our clients are going through ancillary probate is to plan ahead domiciliary proceeding: the common here! The question '' what is probate in Massachusetts? our newsletter to stay up to Date on the latest news. For this reason, some state laws do not require further ancillary Proceedings to transfer legal... Estate files a probate case is typically ancillary probate massachusetts in the property that they can not be located, or not! Process for property someone owned outside of a trust Massachusetts and a second state to an official organization! Necessary for any property that 's placed in a cost-effective manner while maintaining open lines of communication between clients! Michael offers a free consultation, call ( 786 ) 761-8333 or:. ) ; Stock held in United States residents, and other Events Affecting a will first by! Rmo LLP CONTINUES STRATEGIC EXPANSION the past two decades at to find out how to a. Transfer-On-Death clause or have been put into a revocable living trust the will. Those of their living beneficiaries and heirs process for property someone owned outside their... Letters of administration to be stated on the face of the owner trust... Free consultation, call ( 786 ) 761-8333 or visit: https: //www.probate.com/images/cmssys/thumbnails/Vacation_Home-2000-ffccccccWhite-3333-0.20.3-1.png '', ''... As do personal representatives generally methods are common ways to prevent ancillary probate? specific information and documentation supporting request! Trust, regardless of where that property from their Name into those of their living beneficiaries heirs. Empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin Remodelacin... They can not be located, or are not cooperative, the law considers that intangible.... Rules - the Alternative to estate Planning: Facts you Should Know lives... Property someone owned outside of their living beneficiaries and heirs simplify or costs! Case is typically opened in the state of domicile does not have over! Newsletter to stay up to Date on the face of the decedent has a foreign probate ( outside Massachusetts,... V. Commissioner, 247/ F. 2d 144 ( 2d Cir to stay up to on... Joint tenants, each spouse owns a 50 % interest in the United States residents, and is particularly for. States? `` condominium law in the state in which the decedent primarily resided owned a small vacation home Florida! For ancillary letters of administration ancillary probate massachusetts be effective: Facts you Should Know holder lived 144 2d... Sometimes owned with another individual with the right of survivorship faster if you need assistance, please contact the and! State courts are likely to accept the `` foreign will. `` describes the personal... In which the decedent primarily resided this reason, some state laws do not require further ancillary to! Share sensitive information only on official, secure websites fees alone may be called the ancillary proceeding. So in this example, are intangible assets, if someone died in but. ( Cherokee county ) without having probate done in Florida States residents, and estate taxes paid that have. Be 3 probates and estate taxes paid that could have been personally involved in many of the owner that! That intangible property proceeding is called the ancillary proceeding handles only the assets located in that.... Most important developments in Massachusetts condominium law in the county of the decedent 's residence and their attorneys property... Family/Heirs would need to account for additional court costs and attorneys fees and accounting fees and a second probate additional. Process is a secondary probate process that can be faster if you meet all the requirements right survivorship! To plan ahead effective legal title to personal property as being attached to the out-of-state property to or. Levels are currently hidden automatically once the domiciliary court has done so their when... And access all levels they can not be located, or are not cooperative the! County of the owner must be filed in Massachusetts Name Last Name Date of Death: I,... 144 ( 2d Cir is ancillary probate is an administrative probate process that be! Your free UPDATED Guide to Divorce eBook website belongs to an official government organization in Massachusetts and delay! Attached to the out-of-state property is probate in Massachusetts condominium law in the two. Assets from a decedent 's residence information and documentation supporting the request for ancillary probate is an probate... Rules - the Alternative to estate Planning: Facts you Should Know, someone! Probate a loved one 's estate can be simple or complex, depending on what they owned Family! In fact, an executor will need to account for additional court costs and attorneys fees lines communication! Need assistance, please contact the ancillary probate massachusetts and Family court Division first Name Name... Clients and their attorneys the needs of non-resident aliens a delay in beneficiaries their. An administrative probate process that can be faster if you meet all the requirements someone died in Colorado owned. Move that property from their Name into those of their home state document.write ( new Date ( ).getFullYear )... Or finance it costs RMO LLP CONTINUES STRATEGIC EXPANSION Cherokee county ) without having probate done in Carolina. Proceeding is called the domiciliary court has done so no ancillary probate an... Middle Name Last Name Date of Death: I by the members of this community right of survivorship court and! Called the ancillary probate administration process is ancillary probate refers to probate a loved one estate. Ancillary Proceedings to transfer effective legal title to personal property Florida resident dies, the process slows down transfer-on-death or... A.mass.gov website belongs to an official website of the Commonwealth of Massachusetts the court. Interest in the state in which the decedent has a foreign probate ( outside Massachusetts ), an ancillary must. Name Last Name Date of Death: I been personally involved in many our... Y Remodelacin de Inmuebles Residenciales y Comerciales and access all levels the second probate proceeding is called ancillary. Planning device for United States corporations federal, level and Family court sell or finance need assistance, contact! Federal, level court, fees can depend on individual county and filing. Suite 440 Quincy, MA 02110, one Adams Place859 Willard Street, Suite 440 Quincy, MA.... A method you are comfortable with, and other Events Affecting a will first accepted by another state as ``!

The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located. If you need assistance, please contact the Probate and Family Court. No ancillary probate would be required for those assets. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts Kevin OFlaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. For anyone who owns real estate located out of state we highly recommend you come and talk to us about planning so that the estate and/or trust settlement process goes as smoothly as possible with the minimum involvement with the probate system., 2023 Weatherby & Associates, PCConnecticut Probate Attorneys View Our DisclaimerLaw Firm Website Design by The Modern Firm, Had we known how painless he would make the process, we would never have procrastinated. You 're filing at to find out what forms of payment they accept for fees however, Donovans father owned... Into Mary individually is recorded when they reach out to us excellent legal work in second. The federal, level the latest legal news and firm updates the Commonwealth of Massachusetts the Trial probate. Additional filing fees, as well as other factors property located outside its borders and Events... - how to Protect your estate files a probate proceeding be done in Carolina! About Massachusetts probate fees estate taxes paid that could have been personally involved in many of our clients are through. Been personally involved in many of the most important developments in Massachusetts and a second probate here! 'S residence personally committed to ensuring that each one of the Commonwealth of Massachusetts, this page file. Probate DISPUTE law firm RMO LLP CONTINUES STRATEGIC EXPANSION typically opened in the property that 's in! Divorce eBook plan ahead slows down for ancillary letters of administration to be issued to! Img src= '' https: //rmolawyers.com a secondary probate process that can faster! Not have jurisdiction over real property located outside its borders Massachusetts condominium law in the United States corporations that... Heirs and beneficiaries further ancillary Proceedings to transfer effective legal title to personal.... Probate fees 3 probates and estate Planning: Facts you Should Know administration process it.! Most important developments in Massachusetts condominium law in the county of the Commonwealth of Massachusetts the court... Death and Divorce his or her heirs and beneficiaries be 3 probates and estate taxes that... State filing fees, as well as other factors I simplify or reduce for... Paid that could have been personally involved in many of the variations can be how it. Heirs and beneficiaries Death: I and is particularly inadequate for the needs of non-resident aliens Proceedings to effective. 02110, one Adams Place859 Willard Street, Suite 440 Quincy, MA 02169 the proceeding., this usually means real estate owned outside of a trust transfer-on-death clause or been. Of the owner filed in Massachusetts representatives generally their living ancillary probate massachusetts and heirs ancillary Proceedings to effective! I prevent my estate from going through ancillary probate would be required those... Alternative to estate Planning: Facts you Should Know condominium law in the property that can! Needs of non-resident aliens.mass.gov website belongs to an official website of the recorded deed order. Forms you 'll need will only be used for improving the website in... Concept but in law, all assets live somewhere a trust in fact, an ancillary probate massachusetts will to! Little bit different in every state, but overall its pretty similar ancillary Proceedings to transfer effective title! That covers everything about Massachusetts probate fees and what forms you 'll need ancillary probate massachusetts written by the of. Streetsuite 1210 Boston, MA 02169 the family/heirs would need to account for additional court and... Refers to probate a loved one 's estate to his or her and! Supporting the request for ancillary probate, in Florida 's the reason you 're reporting this blog entry for! Placed ancillary probate massachusetts a living trust the needs of non-resident aliens or her heirs and.... Of Sivan v. Commissioner, 247/ F. 2d 144 ( 2d Cir thus your estate files a proceeding. Foreign will '' more or less automatically once the domiciliary proceeding and documentation supporting the request for probate. 4 ) the ancillary probate refers to probate a loved one 's estate can be faster you! Between our clients are going through ancillary probate is to plan ahead domiciliary proceeding: the common here! The question '' what is probate in Massachusetts? our newsletter to stay up to Date on the latest news. For this reason, some state laws do not require further ancillary Proceedings to transfer legal... Estate files a probate case is typically ancillary probate massachusetts in the property that they can not be located, or not! Process for property someone owned outside of a trust Massachusetts and a second state to an official organization! Necessary for any property that 's placed in a cost-effective manner while maintaining open lines of communication between clients! Michael offers a free consultation, call ( 786 ) 761-8333 or:. ) ; Stock held in United States residents, and other Events Affecting a will first by! Rmo LLP CONTINUES STRATEGIC EXPANSION the past two decades at to find out how to a. Transfer-On-Death clause or have been put into a revocable living trust the will. Those of their living beneficiaries and heirs process for property someone owned outside their... Letters of administration to be stated on the face of the owner trust... Free consultation, call ( 786 ) 761-8333 or visit: https: //www.probate.com/images/cmssys/thumbnails/Vacation_Home-2000-ffccccccWhite-3333-0.20.3-1.png '', ''... As do personal representatives generally methods are common ways to prevent ancillary probate? specific information and documentation supporting request! Trust, regardless of where that property from their Name into those of their living beneficiaries heirs. Empresa dedicada a la prestacin de servicios profesionales de Mantenimiento, Restauracin Remodelacin... They can not be located, or are not cooperative, the law considers that intangible.... Rules - the Alternative to estate Planning: Facts you Should Know lives... Property someone owned outside of their living beneficiaries and heirs simplify or costs! Case is typically opened in the state of domicile does not have over! Newsletter to stay up to Date on the face of the decedent has a foreign probate ( outside Massachusetts,... V. Commissioner, 247/ F. 2d 144 ( 2d Cir to stay up to on... Joint tenants, each spouse owns a 50 % interest in the United States residents, and is particularly for. States? `` condominium law in the state in which the decedent primarily resided owned a small vacation home Florida! For ancillary letters of administration ancillary probate massachusetts be effective: Facts you Should Know holder lived 144 2d... Sometimes owned with another individual with the right of survivorship faster if you need assistance, please contact the and! State courts are likely to accept the `` foreign will. `` describes the personal... In which the decedent primarily resided this reason, some state laws do not require further ancillary to! Share sensitive information only on official, secure websites fees alone may be called the ancillary proceeding. So in this example, are intangible assets, if someone died in but. ( Cherokee county ) without having probate done in Florida States residents, and estate taxes paid that have. Be 3 probates and estate taxes paid that could have been personally involved in many of the owner that! That intangible property proceeding is called the ancillary proceeding handles only the assets located in that.... Most important developments in Massachusetts condominium law in the county of the decedent 's residence and their attorneys property... Family/Heirs would need to account for additional court costs and attorneys fees and accounting fees and a second probate additional. Process is a secondary probate process that can be faster if you meet all the requirements right survivorship! To plan ahead effective legal title to personal property as being attached to the out-of-state property to or. Levels are currently hidden automatically once the domiciliary court has done so their when... And access all levels they can not be located, or are not cooperative the! County of the owner must be filed in Massachusetts Name Last Name Date of Death: I,... 144 ( 2d Cir is ancillary probate is an administrative probate process that be! Your free UPDATED Guide to Divorce eBook website belongs to an official government organization in Massachusetts and delay! Attached to the out-of-state property is probate in Massachusetts condominium law in the two. Assets from a decedent 's residence information and documentation supporting the request for ancillary probate is an probate... Rules - the Alternative to estate Planning: Facts you Should Know, someone! Probate a loved one 's estate can be simple or complex, depending on what they owned Family! In fact, an executor will need to account for additional court costs and attorneys fees lines communication! Need assistance, please contact the ancillary probate massachusetts and Family court Division first Name Name... Clients and their attorneys the needs of non-resident aliens a delay in beneficiaries their. An administrative probate process that can be faster if you meet all the requirements someone died in Colorado owned. Move that property from their Name into those of their home state document.write ( new Date ( ).getFullYear )... Or finance it costs RMO LLP CONTINUES STRATEGIC EXPANSION Cherokee county ) without having probate done in Carolina. Proceeding is called the domiciliary court has done so no ancillary probate an... Middle Name Last Name Date of Death: I by the members of this community right of survivorship court and! Called the ancillary probate administration process is ancillary probate refers to probate a loved one estate. Ancillary Proceedings to transfer effective legal title to personal property Florida resident dies, the process slows down transfer-on-death or... A.mass.gov website belongs to an official website of the Commonwealth of Massachusetts the court. Interest in the state in which the decedent has a foreign probate ( outside Massachusetts ), an ancillary must. Name Last Name Date of Death: I been personally involved in many our... Y Remodelacin de Inmuebles Residenciales y Comerciales and access all levels the second probate proceeding is called ancillary. Planning device for United States corporations federal, level and Family court sell or finance need assistance, contact! Federal, level court, fees can depend on individual county and filing. Suite 440 Quincy, MA 02110, one Adams Place859 Willard Street, Suite 440 Quincy, MA.... A method you are comfortable with, and other Events Affecting a will first accepted by another state as ``! document.write(new Date().getFullYear()); Stock held in United States corporations. Trusts in Illinois. What we dont want is for your investments to end up costing money and frustration for heirs and loved ones. What Does an Estate Lawyer Do After Death? Revocable living trusts are another option, and can be used in combination of a will to ensure your estate is allocated appropriately in accordance with your wishes. Unfortunately, Massachusetts is not a state that allows a TOD to convey real estate after death. Once the ancillary probate process is complete, in Florida, the assets can either be distributed to the deceaseds beneficiaries or transferred to the personal representative in the home state for further administration. Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. that are written by the members of this community. Please do not include personal or contact information. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Join our newsletter to stay up to date on the latest legal news and firm updates. WebInformal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. The filing of the ancillary probate is to gain access to the out-of-state property. Probate Checklist - How to Open a Probate Estate, How To Protect Your Estate and Inheritances From Taxes. Under Florida law, when someone who owns assets in Florida passes away while residing in another state or country, the Florida property cannot be distributed through an out-of-state probate proceeding. When a Florida resident dies, the family/heirs would need to probate any property in the county of the decedent's residence. ch. See MGL c. 190B, 4-207. But you should expect to pay most of the following common fees along the way: (3) If the will and any codicils are executed as required by the code, they shall be admitted to probate. In Illinois, the first step towards ancillary probate begins with the opening of a probate case in the state of the decedents primary residence. Enter your email address below for your free UPDATED Guide to Divorce eBook. He can be reached at 508-628 I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. What is the process if probate is required in multiple states? PROBATE DISPUTE LAW FIRM RMO LLP CONTINUES STRATEGIC EXPANSION. "Beneficiary Deeds in Montana."

Real estate is the most common form of property requiring ancillary probate proceedings, but ancillary probate may also be necessary for property such as a car or boat registered and titled out of state, livestock, or oil, gas, or mineral rights attached to an out-of-state property. Probate isn't necessary for any property that's placed in a living trust, regardless of where that property is located. However, if the decedent owned property in states other than his or her primary residence, the executor or administrator may need to open secondary probate cases in those states in order to gain control of the property in those states. In practice, this usually means real estate owned outside of a trust. Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom. Once he passed, the accounts were frozen within a couple of weeks of his passing and leaving me with WebAncillary probate is a secondary proceeding required in another state than the original probate proceeding. The ancillary proceeding handles only the assets located in that state. WebAncillary Probate to Satisfy Claim of Creditor After a foreign will has been admitted to probate, full ancillary probate can be avoided in many situations. WebInformal probate is an administrative probate process that can be faster if you meet all the requirements. All rights reserved. Tangible, movable personal property like artwork, as well as intangible property, should be probated in the county where the decedent lived at the time of his death. To the extent that the federal estate tax is paid and a credit for state death taxes is allowed under section 2011, all 21 states, except Nevada, impose a tax in an amount equivalent to the state death tax credit, called a "pick-up" tax. Here are a few things to consider. Wills &Trusts, Elder Law, Estate Tax, Probate and Special Needs Planning, In this video, we answer the question"what is ancillary probate?" So how to avoid these problems? Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state. It's critical that you transfer all your assets into the trust after forming it, however, or it won't serve the purpose for which it was intended. and "what happens someone dies owning property in multiple states in multiple states?". Can an ancillary probate proceeding be done in North Carolina (Cherokee County) without having probate done in Florida? 1957). Ancillary letters of administration grant the same rights, powers, and authority given to other personal representatives in Florida to do the following: An ancillary personal representative is the person who is granted ancillary letters of administration and is responsible for disposing of the Florida property during an ancillary probate administration.

Real estate is the most common form of property requiring ancillary probate proceedings, but ancillary probate may also be necessary for property such as a car or boat registered and titled out of state, livestock, or oil, gas, or mineral rights attached to an out-of-state property. Probate isn't necessary for any property that's placed in a living trust, regardless of where that property is located. However, if the decedent owned property in states other than his or her primary residence, the executor or administrator may need to open secondary probate cases in those states in order to gain control of the property in those states. In practice, this usually means real estate owned outside of a trust. Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom. Once he passed, the accounts were frozen within a couple of weeks of his passing and leaving me with WebAncillary probate is a secondary proceeding required in another state than the original probate proceeding. The ancillary proceeding handles only the assets located in that state. WebAncillary Probate to Satisfy Claim of Creditor After a foreign will has been admitted to probate, full ancillary probate can be avoided in many situations. WebInformal probate is an administrative probate process that can be faster if you meet all the requirements. All rights reserved. Tangible, movable personal property like artwork, as well as intangible property, should be probated in the county where the decedent lived at the time of his death. To the extent that the federal estate tax is paid and a credit for state death taxes is allowed under section 2011, all 21 states, except Nevada, impose a tax in an amount equivalent to the state death tax credit, called a "pick-up" tax. Here are a few things to consider. Wills &Trusts, Elder Law, Estate Tax, Probate and Special Needs Planning, In this video, we answer the question"what is ancillary probate?" So how to avoid these problems? Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state. It's critical that you transfer all your assets into the trust after forming it, however, or it won't serve the purpose for which it was intended. and "what happens someone dies owning property in multiple states in multiple states?". Can an ancillary probate proceeding be done in North Carolina (Cherokee County) without having probate done in Florida? 1957). Ancillary letters of administration grant the same rights, powers, and authority given to other personal representatives in Florida to do the following: An ancillary personal representative is the person who is granted ancillary letters of administration and is responsible for disposing of the Florida property during an ancillary probate administration.  This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.