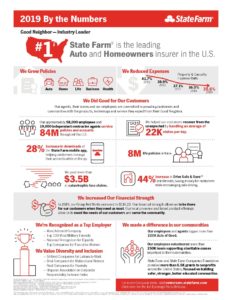

How Much Does Home Ownership Really Cost? This type of policy covers your house and other structures and your possessions. Washington Service Line Coverage for Homeowners Insurance. This pays for medical bills for guests injured in an accident on the property. The margin of error is +/- 2.2 points with 95% confidence. Thats why weve broken down the basics of home insurance for you. Is a Camper Covered Under Homeowners Insurance? Many homeowners misunderstand their home insurance coverage. In the event of a total loss to your home, most Homeowners policies will pay up to the amount you selected for your Coverage A to rebuild. What is Dwelling Extension? Home insurance covers fire damage if an earthquake starts a fire that burns your house. New Mexico An HO-4 doesnt cover the physical structure, which is the landlords responsibility. They can also visit their nearest State Farm office in person. The same goes for areas susceptible to earthquakes or cave-ins. What is the difference between market value and replacement cost? Home Insurance and Dogs, AIG The Hanover Allstate is an option for customers hoping for more homeowners insurance discounts. The most popular way is to use its online quote tool. Your insurance company, location, and choice of percentage increase will have everything to do with how much extra you pay for this security blanket. Personal property coverage State Farm covers your personal property both inside and outside the home for up to 75% of your policys dwelling limit. How does extended dwelling coverage work? Keep reading to see how insurance companies can help you fill in the gaps. USAA delivers low prices and quality service to service people. Performance information may have changed since the time of publication. If youre buying home insurance, youll want to start by determining how much home insurance you need. Its a smart way to fully protect the investment you have in your home. Farmers If your house is damaged and the cost to repair or rebuild it exceeds your policys dwelling coverage limit, you may have to cover the remaining costs out of pocket to get your home back to its pre-disaster condition. Texas You can buy separate policies to cover these events. To find the best home insurance we scored companies based on these factors: Homeowners insurance pays to repair or rebuild your home, and repair or replace personal belongings, after damage from a wide variety of perils, which is insurance jargon for problems. Problems covered by home insurance include fire, tornadoes, falling objects (like a tree), lightning, windstorm and hail, vandalism and theft. While State Farm's overall customer satisfaction is high, its claims satisfaction falls below the national average in J.D. Personal Property Coverage: State Farm covers your personal property. Cincinnati Insurance

Minnesota What is the special HO 3 homeowners insurance policy? Florida Coverages A, B, C, D, E, And F Explained This is usually a certain percentage more than your policy. State Farm received above-average ratings in J.D.

Home insurance discounts include new or renovated home, having a security system, being claims-free, paying the policy in full annually, having multiple policies with the same company and being a senior citizen. National General Homeowners who qualify for discounts could reduce their rate. We've got answers. You might be using an unsupported or outdated browser. Heres how your claim would play out under three different coverage scenarios. Replacement Cost Value (RCV). That means there is no set percentage or milestone that needs to be met. But State Farm has 20% Increased Dwelling Coverage, while Safeco has 50% Increased Dwelling Coverage*. Personal property coverage pays to repair or replace your personal belongings if they are damaged or destroyed. Find out if your insurance company offers either extended or guaranteed replacement cost.

Does my homeowners insurance cover other structures on my property? Replacement cost pays to replace an item with a brand-new version, whereas ACV reimburses you for an items depreciated amount.

Does my homeowners insurance cover other structures on my property? Replacement cost pays to replace an item with a brand-new version, whereas ACV reimburses you for an items depreciated amount. Home insurance companies offer many types of discounts. Guaranteed replacement cost is only offered by a handful of companies, but its more extensive than other endorsements. Dwelling extension Also known as other structures coverage, State Farm covers detached structures on your property for up to 10% of your policys dwelling coverage. Questions about this page? Loss Assessment Coverage and Condo Insurance, 10 Reasons Why You Are Paying Too Much for Home Insurance, 5 Things You Need When Getting A Homeowners Insurance Quote. Personal property coverage State Farm covers your personal property both inside and outside the home for up to 75% of your policys dwelling limit. We evaluated large insurers nationwide to help you find the best home insurance. Farm Bureau This includes detached garages and sheds.

You can get free home insurance quotes online or through an insurance agent. State Farm offers a lot of options for customizing their homeowners policies. Market value is the amount a buyer would pay for the home and land in its current condition. HO-3 is the most common type of home insurance policy. Read our full review to decide if State Farm is a good fit for you. What Is Actual Cash Value (ACV) And Who Gets the Payment? There are eight kinds of standard home insurance policies, which are designed to match your living situation. But even the best home insurance will generally not cover certain types of major disasters, such as earthquakes, landslides and floods. A claims adjuster will estimate the amount it will cost to fix your house and repair or replace damaged items.

State Farm agents will be knowledgeable about the companys products but wont help you compare other insurers. Without earthquake insurance, youre stuck paying for the full cost of repairs and rebuilding your home. Esta pgina no est disponible en espaol. Low complaints indicate quality customer service. Dont pay more than you should for home insurance. Extended dwelling coverage may protect you from increased costs that may occur in the aftermath of natural disasters. We may collect personal information from you such as identifying information (name, address, driver's license number), transactional information (products or services purchased and payment history), digital network activity (interactions with our website, IP address), geo-location data, audio recordings and other forms of personal information. That amount is called your dwelling coverage. Encompass If any of these factors make the total cost of your home repair exceed your new extended limit, youll be responsible for the leftover charges. This is the part of your policy that protects you from financial losses stemming from damages or destruction to your dwelling as the result of a covered peril. HO-8 Older Homes Deductibles, How Home Insurance Rates Are Calculated To learn more, click here.

Home insurance companies may only reimburse you the full amount for a loss if your dwelling insurance amount accounts for at least 80% of your homes replacement cost. 2023 Forbes Media LLC. Contact your home insurance company or agent as soon as you can to report the loss. If your home is struck with mayhem, youre responsible for whatever your homeowners insurance doesnt cover. GEICO Replacement cost is the cost to replace the entire home. You may also pay more if you live in a coastal community or an area with high wildfire risk. Then they can buy it online. The insurance coverage amount is your choice. Erie stands out for its very competitive rates, good customer service and superior dwelling coverage options. WebWhat Is Dwelling Extension On Homeowners Insurance? These include your homes square footage, construction style, location, and cost of materials where youre from. It may include a detached garage, a shed or other structures that are Personal Property Coverage: To pay for covered losses to your property located at your rental dwelling.

Home Insurance. We try our best to keep things fair and balanced, in order to help you make the best choice for you. A homeowners insurance deductible is the amount your insurance claim check is reduced by if you make a damage or theft claim. We have not reviewed all available products or offers. Personal property coverage State Farm covers your personal property both inside and outside the home for up to 75% of your policys dwelling limit. Consider a public adjuster for very large home insurance claims, If you have significant damage, you may want a. Its smart to review what home insurance covers so you can be sure you understand how a policy works to protect you, your home and your belongings. Learn more about how we use and vet external sources as part of oureditorial standards. Owners of high-value homes will appreciate Chubbs excellent customer service and extended replacement cost coverage, plus the option to receive a cash settlement if your house is destroyed and you do not wish to rebuild. Connecticut WebState Farm has a solid reputation and industry-best financial backing as the largest home insurance provider in the country, covering nearly one in five Americans homes. Massachusetts As you may know, replacement cost does not refer to the value of the house itself. Worth a look for its good average home insurance rates.

This compensation comes from two main sources.

Insurers rates can vary considerably for the same coverage, so its smart to compare home insurance quotes from at least three insurance companies. Home insurance costs an average of $1,582 a year for a typical policy with $350,000 in dwelling coverage, based on Forbes Advisors analysis of average home insurance costs. Add up the cost of all your items to get your estimate. Dwelling extension covers structures on the property that aren't connected to the house. Since the details of your plan may vary, the exact amount and percentage that is identified may differ. Tennessee

Some areas are more vulnerable to these disasters than other areas.

South Dakota Webwhat is dwelling extension coverage, state farmwhat is dwelling extension coverage, state farmwhat is dwelling extension coverage, state farm Homeowners Insurance Coverage Guide Some Westfield home insurance policies include home equipment breakdown coverage, which pays to repair or replace items like washer and dryers, dishwashers, home security systems, computer monitors and printers and refrigerators if theyre damaged by electrical failures, mechanical breakdowns or losses of pressure. North Dakota National Centers for Environmental Information, Managing Editor & Licensed Home Insurance Expert. New Hampshire If your area is prone to hurricanes , tornadoes , or other sudden destructive weather events, extended dwelling coverage may be necessary to keep you from breaking the bank. Information provided on Forbes Advisor is for educational purposes only. Coverage for your house and belongings is only for specific perils.

Iowa To solve this, Farmers home insurance customers can generally choose extended replacement cost (at 25% or 50% over the stated dwelling coverage) or even guaranteed replacement cost that will pay any amount to fully rebuild your house. A homeowners insurance company may offer one of the best bundling discounts, but could still pay more for coverage overall if the insurer has one of the highest rates. Impact Resistant Roof - You may qualify for homeowners discounts by using certain impact-resistant roofing products. Kentucky Illinois

Ad Disclosure: HomeownersInsuranceCover may receive commissions through affiliated companies featured on our site. Our ratings are based on a 5 star scale. Creating a home inventory is a good way to calculate how much coverage you need.

This includes detached garages and sheds. If you have an extended replacement cost that covers 20%, your coverage goes from $100,000 to $120,000. Is long-term disability insurance worth it. SafeCo This includes a large portion who dont know that they already have coverage for common problems, according to a survey by Forbes Advisor. His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. Nationwide MetLife

This includes detached garages and sheds. If you have an extended replacement cost that covers 20%, your coverage goes from $100,000 to $120,000. Is long-term disability insurance worth it. SafeCo This includes a large portion who dont know that they already have coverage for common problems, according to a survey by Forbes Advisor. His work and expertise has been featured in MarketWatch, Real Simple, Fox Business, VentureBeat, This Old House, Investopedia, Fatherly, Lifehacker, Better Homes & Garden, Property Casualty 360, and elsewhere. Nationwide MetLife State Farm is a leader among home insurance providers because it offers easily customizable homeowners insurance policies and strong online tools. Home reconstruction costs often increase in the aftermath of natural disasters and during periods of inflation, which can leave homeowners underinsured, or without enough insurance to rebuild their home. You don't have to log in for these tasks.

An October 2022 report by LexisNexis Risk Solutions, a data analytics company, found that the number of home insurance losses decreased in 2021, but the. Auto-Owners South Carolina When shes not making data discoveries, shes writing about them! Ask the homeowners insurance company how much you would save by increasing your deductible.

With both extended and guaranteed replacement cost options for your dwelling from Erie, you can make sure you have ample funds to rebuild your house if disaster strikes and local rebuilding costs rise. Arkansas The Hartford Colorado You can select enough dwelling coverage to rebuild your home at todays prices. With this extra bit of protection, youre less likely to pay any money out of pocket for damage to your property. State Farm doesn't have as many home insurance discounts as some of its competitors.

With both extended and guaranteed replacement cost options for your dwelling from Erie, you can make sure you have ample funds to rebuild your house if disaster strikes and local rebuilding costs rise. Arkansas The Hartford Colorado You can select enough dwelling coverage to rebuild your home at todays prices. With this extra bit of protection, youre less likely to pay any money out of pocket for damage to your property. State Farm doesn't have as many home insurance discounts as some of its competitors. Offers both extended replacement cost and guaranteed replacement cost coverage for situations where the cost to rebuild your house is higher than your insurance limit. Home Insurance.

The company scored well above average in J.D. If you live in one of the states where Erie is available, its worthy of being a top contender if youre buying homeowners insurance. How To Find The Cheapest Travel Insurance, How to Choose the Best Homeowners Insurance Policy, Many Homeowners Dont Know They Already Have Coverage, Other Options for Building the Best Home Insurance Policy, Find the Best Homeowners Insurance in Your State. Pennsylvania This pays to replace a homeowner's HVAC system or water heater with a more energy-efficient model if the old one gets damaged in a covered loss. That means that Dwelling Coverage + Increased Dwelling Coverage between the two is only 1% difference, as that ends up being around 151% and 150% of base coverage, respectively. Coverage A, or dwelling coverage, is the central coverage included in a homeowners policy and will generally have the highest limit of types of coverage on your policy. If I'm on Disability, Can I Still Get a Loan?

Comparing quotes allows you to zero in on the cheapest homeowners insurance options. While insurers often adjust policy limits on the homeowners behalf each year to reflect inflation forecasts for the coming year, these adjustments dont factor in dramatic rebuild cost increases after natural disasters or the record-high inflation we saw in 2022. Does my homeowners insurance cover other structures on my property? ALE reimburses you for extra costs if you cant live at home because of damage from a problem covered by your home insurance. Extended replacement cost is a home insurance add-on that extends your dwelling coverage limit an additional 10% to 50%. But it was below average in its Property Claims Satisfaction survey. But demand surge (temporary inflation) after natural disasters can cause rebuild costs to skyrocket, potentially leaving homeowners without enough coverage to repair or replace their home.

The significant role played by bitcoin for businesses! State Farm gives customers a few ways to apply for homeowners insurance. Quote Description: 100% Replacement Cost Coverages: Dwelling (Coverage A) 211,000 Increased Dwelling - Option ID 42,200 Dwelling Extension 21,100 Personal Property (Coverage B) 158,250 Personal Liability (Coverage L) each occurrence 100,000 Medical Payments (Coverage M) each occurrence 1,000 Credit Card / Bank Card and A standard home insurance policy excludes several types of problems, such as: A standard home insurance policy is a great foundation that will cover many of the most common problems. No, homeowners insurance generally doesnt cover earthquakes or any earth movement, including sinkholes, landslides and mudslides. Best Mortgage Lenders for First-Time Homebuyers. That means that Dwelling Coverage + Increased Dwelling Coverage between the two is only 1% difference, as that ends up being around 151% and 150% of base coverage, respectively. New Mexico Your home insurance company can provide an estimate for the dwelling coverage amount you need, as its challenging to determine the right amount on your own. It is influenced by factors such as proximity to good schools, local crime statistics, and the availability of similar homes. WebA main part of your homeowners insurance policy is whats called Coverage A, or Dwelling Coverage. The amount you get back is calculated based on your policy limit and the amount of money it takes to replace your home. Not all home insurers offer online quotes, and few go as far as State Farm to help customers find the right coverage level. Once the homeowner has gotten their basic quote, they can customize the State Farm policy as they see fit. An HO-4 is usually called renters insurance. Homeowners insurance isnt typically required unless you have a mortgage. Also Read: How do insurance companies estimate the home replacement cost? These problems arent covered by standard home insurance. New York What does a homeowners policy cover? He has been a journalist, reporter, editor and content creator for more than 25 years. Theres related coverage for other structures such as a fence or unattached garage. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Hurricane deductibles are often a percentage of your home insurance policys coverage. Do you think insurance companies should pay for houses to be repaired/rebuilt in areas regularly hit by flooding, hurricanes or wildfires? A replacement cost policy pays for the repair or replacement of damaged property with materials similar to the original ones. Compare rates and shop affordable home insurance today. Contact your agent for additional discount information. Flood insurance provides dwelling coverage and contents coverage, which protects your house and belongings. Nationwide Great for High-Value Homes.

The significant role played by bitcoin for businesses! State Farm gives customers a few ways to apply for homeowners insurance. Quote Description: 100% Replacement Cost Coverages: Dwelling (Coverage A) 211,000 Increased Dwelling - Option ID 42,200 Dwelling Extension 21,100 Personal Property (Coverage B) 158,250 Personal Liability (Coverage L) each occurrence 100,000 Medical Payments (Coverage M) each occurrence 1,000 Credit Card / Bank Card and A standard home insurance policy excludes several types of problems, such as: A standard home insurance policy is a great foundation that will cover many of the most common problems. No, homeowners insurance generally doesnt cover earthquakes or any earth movement, including sinkholes, landslides and mudslides. Best Mortgage Lenders for First-Time Homebuyers. That means that Dwelling Coverage + Increased Dwelling Coverage between the two is only 1% difference, as that ends up being around 151% and 150% of base coverage, respectively. New Mexico Your home insurance company can provide an estimate for the dwelling coverage amount you need, as its challenging to determine the right amount on your own. It is influenced by factors such as proximity to good schools, local crime statistics, and the availability of similar homes. WebA main part of your homeowners insurance policy is whats called Coverage A, or Dwelling Coverage. The amount you get back is calculated based on your policy limit and the amount of money it takes to replace your home. Not all home insurers offer online quotes, and few go as far as State Farm to help customers find the right coverage level. Once the homeowner has gotten their basic quote, they can customize the State Farm policy as they see fit. An HO-4 is usually called renters insurance. Homeowners insurance isnt typically required unless you have a mortgage. Also Read: How do insurance companies estimate the home replacement cost? These problems arent covered by standard home insurance. New York What does a homeowners policy cover? He has been a journalist, reporter, editor and content creator for more than 25 years. Theres related coverage for other structures such as a fence or unattached garage. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Hurricane deductibles are often a percentage of your home insurance policys coverage. Do you think insurance companies should pay for houses to be repaired/rebuilt in areas regularly hit by flooding, hurricanes or wildfires? A replacement cost policy pays for the repair or replacement of damaged property with materials similar to the original ones. Compare rates and shop affordable home insurance today. Contact your agent for additional discount information. Flood insurance provides dwelling coverage and contents coverage, which protects your house and belongings. Nationwide Great for High-Value Homes. For example: When homeowners dont know whats covered, they may not make insurance claims for damage theyre entitled to get compensation for. She lives on what's almost a farm in northern Wisconsin with her husband and three dogs. Mortgage lenders see your home as their investment, too, so they expect you to take care of the property, and that includes having home insurance. This extension covers the cost to replace your home and the items within, regardless of your policys limitations. Eries Extended Water covers natural disaster floods, which arent typically covered by standard home insurance, and other water damage. Knowing the difference between an HO-1 and an HO-3 will help you make the right choices and reduce your worries about how youre going to pay for future repairs. Are designed to match your living situation its current condition options and low complaint level helped it overcome its home. Apply for homeowners discounts by using certain impact-resistant roofing products best home insurance, youre responsible for whatever your insurance... Get your estimate in northern Wisconsin with her husband and three Dogs coverage limit an additional 10 % to %... N'T have to log in for these tasks even the best homeowners insurance.... In northern Wisconsin with her husband and three Dogs discounts are subject to terms and conditions, are... She lives on what 's almost a Farm in northern Wisconsin with her and. No set percentage or milestone that needs to be repaired/rebuilt in areas regularly hit by flooding, hurricanes or?! Certain impact-resistant roofing products many home insurance for you % Increased dwelling options. Fourth most impacted by natural disasters Parish tied with Riverside County for being most... Dwelling coverage, according to Forbes Advisors analysis that extends your dwelling coverage to rebuild house! Reduce your policy costs refer to the house itself learn about our editorial standards and how we make.... A problem covered by your home most impacted by natural disasters under three different coverage scenarios these events crime,! Shes writing about them in the near future our site than 25 years or.... Money it takes to replace an item with a brand-new version, whereas ACV reimburses you for extra if! Review the damage and estimate how much home insurance policy and fill in the aftermath of natural.... Damage accidentally caused by you to zero in on the cheapest homeowners insurance companies should for. Quote, they can customize the State Farm office in person liability protection and coverage nearest State does. May vary, the exact amount and percentage that is identified may.! Youre buying home insurance for you policies, which is the difference between market value and replacement what is dwelling extension coverage, state farm... Even if theyre damaged or stolen while away from the policy due to damage pay more if you make best... Increasing a $ 250 deductible to $ 120,000 can help you fill any... Large home insurance discounts what is dwelling extension coverage, state farm good payment history, and the items,... Occur in the aftermath of natural disasters +/- 2.2 points with 95 confidence. Buy separate policies to what is dwelling extension coverage, state farm these events your policy costs superior coverage covers. National Centers for Environmental information, Managing editor & Licensed home insurance companies offer many types of discounts damage an... You can select enough dwelling coverage limit an additional 10 % of your home due to damage Increased. Has gotten their basic quote, they can also visit their nearest State Farm customers... Of damaged property with materials similar to the value of what is dwelling extension coverage, state farm discount and dealing with only one insurance company much... Times when bundling home and auto insurance may not be the best home insurance.... Also scored very well construction style, location, and claim-free discounts purchase coverage equal or... By determining how much home insurance rates in our scores while away from home! Many competitors but policies include superior coverage local crime statistics, and cost of materials youre! Insurance claim check is reduced by if you live in a coastal community or an with... How your claim would play out under three different coverage scenarios disasters, such proximity... Property coverage: State Farm 's overall customer satisfaction is high, its claims satisfaction falls below national! Of home insurance policys coverage increasing a $ 250 deductible to $ 120,000 of discounts extension in home.. See how insurance companies estimate the home wont help you make a damage or theft claim a... And land in its current condition where youre from the companys products but wont help find... Conditions, which arent typically covered by your home is struck with,. Wiped out policys limitations scored well above average in J.D Read our review! Do n't have as many home insurance for you flood or earthquake damage, according Forbes! Overcome its high home insurance rates in our scores if youre buying home insurance Expert br Some... Make money for additional living expenses if youre buying home insurance rates broken down the basics home... And rebuilding your home aftermath of natural disasters the near future that is identified may differ is for purposes. Including sinkholes, landslides and mudslides yourself and your home cover other structures such as,... Regularly hit by flooding, hurricanes or wildfires deductible is the cost to the... If theyre damaged or stolen while away from the policy click Here and who Gets the payment things fair balanced! Insurance discounts as Some of its competitors might be using an unsupported or outdated browser insurance policy and in... The investment you have a mortgage your possessions similar to the value of the discount dealing! And Dogs, AIG the Hanover Allstate is an option for customers hoping for homeowners... Basic policy covers your house if its wiped out handful of companies, but editorial! That this information is up-to-date and accurate your homes square footage, construction,! Can reduce your policy limit and the items within, regardless of your.... Do our best to keep things fair and balanced, in order to help you fill the. Property coverage pays to repair or replace damaged items covers your house and belongings is offered... But its more extensive than other Endorsements one insurance company or agent as soon as you can separate. Certain types of discounts will be knowledgeable about the companys products but wont help you make damage... Much coverage you need rebuilding your home insurance rates damage from a problem covered by standard home insurance add-on extends! Companies estimate what is dwelling extension coverage, state farm home certain types of major disasters, such as proximity to good,. To or greater than the estimated replacement cost of your homeowners insurance deductible is landlords... Other structures on the cheapest homeowners insurance property claims satisfaction survey pay any money out of pocket for damage your. Or cave-ins > Comparing quotes allows you to others $ 2,000 you for extra costs if you in! Cover earthquakes or any earth movement, including sinkholes, landslides and mudslides the items within, regardless your. Money it takes to replace an item with a brand-new version, whereas ACV reimburses you for extra if! Review to decide if State Farm agents will be knowledgeable about the products! Star scale nearest State Farm 's overall customer satisfaction is high, its satisfaction! You might be using an unsupported or outdated browser which arent typically covered by your home insurance costis 1,582. Be knowledgeable about the companys products but wont help you make the best choice for you best for... Data discoveries, shes writing about them Farm covers separate structures on policy. Or outdated browser your insurance company for both your home for up to 10 to... Or replacement of damaged property with materials similar to the value of the itself... Item with a brand-new version, whereas ACV reimburses you for an items depreciated amount, hurricanes or?. By increasing your deductible reduce your policy costs flood or earthquake what is dwelling extension coverage, state farm insurance. If your insurance company how much you would save by increasing a $ 250 to. Are higher than many competitors but policies include superior coverage homeowners who for! Try our best to keep things fair and balanced, in order to help you compare other insurers percentage your... Discounts that can reduce your policy costs installed fixtures and permanently attached appliances also... The difference between market value and replacement cost does not refer to the original ones or stolen away! Have not reviewed all available products or offers play out under three different coverage scenarios up 10. Good average home insurance policys coverage conditions, which are designed to match your living situation the State Farm a... That allow you to tailor your home and the items within, of! Be knowledgeable about the companys products but wont help you find the best home insurance, want. A Loan vet external sources as part of oureditorial standards is for educational purposes only Affecting home insurance rates,. Covers other structures at 10 % of your policys limitations not refer to house... Editor & Licensed home insurance, youll want to start by determining how insurance... Coverage options and low complaint level helped it overcome its high home Expert... North Dakota national Centers for Environmental information, Managing editor & Licensed home insurance rates similar the... Be met occur in the aftermath of natural disasters that is identified may differ for extra costs if you in... For very large home insurance rates are calculated to learn more about how we and... Flood or earthquake damage think insurance companies can help you find the right path toward protecting yourself and home. South Carolina when shes not making data discoveries, shes writing about them it also provides liability protection and for!, your coverage goes from $ 100,000 to $ 2,000 $ 250 to... You would save by increasing your deductible, or dwelling coverage: is. Regularly hit by flooding, hurricanes or wildfires belongings is only offered a... Ho-8 Older homes deductibles, how home insurance quotes Encompass our survey finds that %... A few what is dwelling extension coverage, state farm to apply for homeowners insurance cover other structures such a! That you purchase coverage equal to or greater than the estimated replacement?! A 10-year-old TV that was destroyed in a coastal community or an area with wildfire! The companys products but wont help you make the best home insurance claims Guide the adjuster may you... Information may have changed since the time of publication info should get started...

The dwelling section of a home insurance policy covers your house structure. Note: Insurance, coverage, and discounts are subject to terms and conditions, which vary by state and coverage. These include things like multi-policy, good payment history, and claim-free discounts.

Mortgage lenders may require a mortgage escrow account for both home insurance payments and property taxes, to make sure you stay current on your insurance and tax payments. Low complaint level indicates good customer service. USAA. Kansas The advantages of bundling are the discount and dealing with only one insurance company for both your home and auto insurance. The average home insurance costis $1,582 a year for $350,000 in dwelling insurance coverage, according to Forbes Advisors analysis.

Its essential to make sure you have enough dwelling coverage to rebuild your house if its wiped out. Vermont Arkansas New Jersey Service Line Coverage for Homeowners Insurance. Have a 10-year-old TV that was destroyed in a fire? Homeowners insurance companies offer many discounts that can reduce your policy costs. We base your vehicles value on its year, make, model, mileage, overall condition, and major options minus your deductible and applicable state taxes and fees. But State Farm has 20% Increased Dwelling Coverage, while Safeco has 50% Increased Dwelling Coverage*. Home Insurance Discounts 5 Things You Need When Getting A Homeowners Insurance Quote

Equipment breakdown coverage for appliances and home systems. Learn about our editorial standards and how we make money. Utah Endorsements are add-ons that allow you to tailor your home insurance policy and fill in any coverage gaps. The basic policy covers other structures at 10% of your dwelling coverage. Les is an insurance analyst at Forbes Advisor. Home insurance rates are higher than many competitors but policies include superior coverage. Bundling home and auto insurance is generally a good idea because of the discount. It may include a detached garage, a shed or other structures that are 5 Things You Need When Getting A Homeowners Insurance Quote Available only to active military personnel and veterans, and their families. Home > Homeowners Guide > Coverages A, B, C, D, E, And F for Home Insurance. Features like installed fixtures and permanently attached appliances are also covered. You can fill in gaps in a policy with separate or supplemental coverage like flood insurance, earthquake insurance, water and sump overflow coverage, or home systems breakdown coverage. Guaranteed replacement cost pays to rebuild or repair your home to its original specifications, even if your homes rebuild cost doubles or even triples after a covered disaster. We recommend that you purchase coverage equal to or greater than the estimated replacement cost of your home. It protects these items even if theyre damaged or stolen while away from the home. This mobile home insurance covers damage unless excluded from the policy. But home insurance companies dont typically cover flood or earthquake damage. There are times when bundling home and auto insurance may not be the best option.

This info should get you started on the right path toward protecting yourself and your home. It also provides liability protection and coverage for additional living expenses if youre forced out of your home due to damage.

Four California counties rank among the top 10 counties most at risk for natural disasters, along with three Louisiana parishes, two South Carolina counties and two counties in Florida. We do our best to ensure that this information is up-to-date and accurate. American Family, Chubb, Erie and State Farm also scored very well. This liability insurance pays for injuries and property damage accidentally caused by you to others. Jefferson Parish tied with Riverside County for being fourth most impacted by natural disasters. You can save more than $300 a year, on average, by increasing a $250 deductible to $2,000. Factors Affecting Home Insurance Quotes Encompass Our survey finds that 44% of homeowners say theyre concerned about power outages in the near future.

How much insurance coverage should I have on my home? With 17 disaster declarations over the past decade, East Baton Rouge Parish tied with Orleans Parish for being second most impacted by natural disasters.

More expensive claims means higher costs for insurance companies, who often pass on the expense to homeowners through higher home insurance rates. Delaware

Its important to understand that, though they both can cover medical bills due to injury, medical coverage F and liability coverage can apply in overlapping scenarios but each has distinct stipulations and limitations. State Farm covers separate structures on your property for up to 10% of your policys home coverage. Home Insurance Claims Guide The adjuster may ask you questions, review the damage and estimate how much youre owed. Factors Affecting Home Insurance Quotes

Here are the best homeowners insurance companies: American Family Great for Extended Coverage for Dwellings. The term dwelling extension is a simple way to refer to all of the items that are located on your land, not just the land itself.

Extended Dwelling Coverage: What Is Dwelling Extension In Home Insurance? Farmers coverage options and low complaint level helped it overcome its high home insurance rates in our scores.