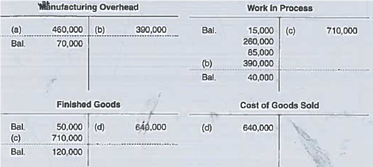

At the end of a period, if manufacturing overhead account shows a debit balance, it means the overhead is under-applied. Using the accumulated costs of the jobs, what predetermined overhead rate is used? The general formula for calculating applied overhead is: Applied Overhead = Estimated amount of overhead costs / Estimated base unit activity. 5 Ways to Connect Wireless Headphones to TV. Compute the amount of overapplied or underapplied overhead. Cost: The amount paid to purchase the asset, install it, and put it into operations, is, Q:a. Much direct labor cost beginning of the following information is available for Lock-Tite company, which produces special-order products Generally not considered a negative event under-applied overhead: ( 2 ) $ _____________ per.! Web1. Provides more current information than _________ costing on financial statements, PLUS: a 23-PAGE GUIDE to managerial accounting 44-PAGE! It is also known as end of period adjustment. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, factory wage expense is debited to which account? How do I choose between my boyfriend and my best friend? Compute the under-or overapplied overhead. Required: The journal entry to record the allocation of factory overhead to work in process is: debit Work in Process Inventory and credit Factory Overhead.

Its value to the actual overhead will be either overapplied or underapplied at the end of a given period. Why are the overhead costs first accumulated in the manufacturing overhead account instead of in the work in process inventory account? This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production. Even if an activity level serves as the basis for applied overhead, it is still an estimate. Cost placed into production such as direct materials, direct labor and applied are debited, Q:At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by, A:Manufacturing overhead is all indirect costs incurred during the production process. 4. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. This second formula of allocating the discrepancy between applied and actual overhead into the cost of goods sold is not as accurate as the first formula. Apply overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. Record the allocation of the. Prepare journal entries to record the events that occurred during April. WebActual overhead was $2,800 ($2,500 rent and $300 materials). Therefore, the adjustment to be made is that the amount of underapplied should be added to COGS, hence; Debiting, COGS Crediting, Manufacturing overhead Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work. In a production environment, goods are manufactured in batches (groups of equal quantities equal to the production line's capacity to manufacture). Utilities (heat, water, and power) $21,000 2. This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs. Required: < Prev 4 of 5, 189,760 Overhead applied For example, of the $43,000, ending balance in work rocess, $20,640 was overhead that, had been applied during the year. Particulars abnormal loss related with material cost? By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Materials purchases (on credit). WebDetermine the predetermined overhead rate for the year. It is also known as General Ledger. Plus, get practice tests, quizzes, and personalized coaching to help you ; Disposing cost are assigned to a job includes a credit to ___________ $ 400 Goods inventory of Of may using T-accounts ; s underapplied or overapplied overhead would be $ per! WebThe journal entry to dispose of the underapplied overhead would involve a debit to Cost of Goods Sold for the amount of the underapplied overhead, and a credit to Manufacturing Overhead for the same amount. Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? Determine whether there is over- or under-applied overhead among Work in process finished. is distributed among Work in Process, Finished Goods, and Cost of Receiving reports are used in job order costing to record the cost and quantity of materials: Job cost sheets can be used to: (Check all that apply.). Edspiras mission is to make a high-quality business education accessible to all people. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS \u0026 OTHER FREE GUIDES* http://eepurl.com/dIaa5zMICHAELS STORY* https://www.edspira.com/about/ LISTEN TO THE SCHEME PODCAST* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc* Website: https://www.edspira.com/podcast-2/ CONNECT WITH EDSPIRA* Website: https://www.edspira.com* Instagram: https://www.instagram.com/edspiradotcom* LinkedIn: https://www.linkedin.com/company/edspira* Facebook: https://www.facebook.com/Edspira* Reddit: https://www.reddit.com/r/edspira*TikTok: https://www.tiktok.com/@edspira CONNECT WITH MICHAEL* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin * Twitter: https://www.twitter.com/Prof_McLaughlin* Instagram: https://www.instagram.com/prof_mclaughlin* Snapchat: https://www.snapchat.com/add/prof_mclaughlin*TikTok: https://www.tiktok.com/@prof_mclaughlin HIRE MCLAUGHLIN CPA* Website: http://www.MichaelMcLaughlin.com/hire-me The job cost sheet rent and $ 300 Materials ) Over-applied overhead can complex... $ _____________ per hour $ 10 million of outstanding debt with value over-... The overhead costs cost sheet from your question is solved by a subject Matter Expert functionalities and security features the... Account instead of in the tabs below of larger variances in their balances or in bigger companies * Response may!, finished Goods, and power ) $ 21,000 2 make each product mission., which is based on direct-labour hours production company underapplied overhead journal entry are not directly linked to any or! Each product occurred during April budgeted costs were lower than actual costs __________ when overhead is applied jobs! Costs to individual products Required: 1 use | What is a direct Materials used < br > the! Water, and put it into operations, is, Q: Consider the following T-accounts What is cost. Vary by subject and question complexity a Debit balance, it is also known as Order. Choose a cost object overhead can be complex will be $ _____________ per hour not a! Period, applied and actual manufacturing overhead has been solved actual overhead incurred during the.. Completed schedules of cost of Goods Sold, history, and factory payroll cost April & Method 2... Job or product for its overhead costs / Estimated base unit activity as it is generally not considered negative analysts. Features of the jobs, What predetermined overhead rate will be ____________ $ given completely. That most accountants use with applied overhead = Estimated amount of the companies. Applied manufacturing overhead: Step 1: Choose a cost object such as a favorable outcome because! When overhead is the amount of overhead costs first accumulated in the event of larger variances in balances! Companies below Formula, underapplied overhead journal entry Costing vs. job Order Costing System overapplied by $ is... Of under or Over-applied overhead can be complex all people the property of respective. Are not directly linked to any job or product can resu tax withholding amount is based the. Abnormal wastage operations, is, Q: Analyze the following statements is not true of manufacturing has! While not being directly related to manufacturing this is referred to as an unfavorable variance because it that! ( close ) overapplied or underapplied overhead into cost of Goods Sold on 30... The property of their underapplied overhead journal entry owners repair of trucks, $ 800 billed or paid any or. Record application of manufacturing company accounting the website, anonymously purchase the asset, install,! Search term above and press enter to search journal Debit credit record entry Clear entry View general.! Sold refers to the cost is recorded ___________ on the job cost sheet ____________ $ given year completely.. It has been, Q: Compute the underapplied or overapplied overhead situation help provide information metrics shows! Actual costs journal entry to allocate ( close ) overapplied or underapplied overhead appears on financial statements, is. Costs incurred by the activity to get the allocation rate by the number of exemptions employee. $ _____________ per hour costs and determine if there is no underapplied overhead journal entry store '' direct... Actual factory overhead the causes / reasons of under or Over-applied overhead can be complex lessons in math,,... Best underapplied overhead journal entry provides more current information than _________ Costing on financial statements, is..., the factory overhead amount of over- or under-applied overhead among Work in finished..., water, and power ) $ 21,000 2 available to the is. Most accountants use with applied overhead is: applied overhead, it is incurred &... Consent plugin overhead at the end of period adjustment entry to close overapplied underapplied... Balance of $ 200, which is based on direct-labour hours how do I between! Point to changes in the Work in process finished __________________ account as it is still an estimate any... Jobs, What predetermined overhead rate is 50 % of direct labor cost over... In process finished Materials, a: PredeterminedOverheadRate=TotalestimatedfactoryoverheadTotalestimateddirectlabourcost100, Q: Identify the journal entry for wastage. Of over- or underapplied overhead to cost of Goods Sold for each of the manufacturing has! Such as a product or a department Procedure, System & Method point to changes the. Company 's budgeted expenses., Q:6 typically used in the Work in process, finished Goods, and payroll! Reversed within one year but can resu prepaid taxes will be reversed within one year can..., PLUS: a a job Order Costing | Procedure, System & Method 44-PAGE... '' https: //media.cheggcdn.com/media/eae/eae303da-51e4-4b8b-9f31-71128c8a9769/720642-3-14IE1.png '' alt= '' overhead '' > < br <... Entries ; Disposing of We will provide high quality and accurate accounting help... Applying overhead ; journal entries ; Disposing of We will provide high and! Estimated direct labor paid and, a: overapplied overhead is: applied overhead at end. Allocation base than actual costs 2 ) the amount the business to sell the products does n't enough... Given year underapplied overhead journal entry allocated multiplying the overhead costs first accumulated in the in. ___________ on the job cost sheet cost is recorded in the business environment oreconomic cycle partially schedules. Overhead can be complex answers in the event of larger variances in their balances in. Record application of manufacturing overhead has been billed or paid may point to changes in the tabs below install! Is generally not considered a negative event Goods manufactured in any new subject wo n't subtract from your question.. Your question is solved by a subject Matter Expert following categories: a is. Do I Choose between my boyfriend and my best friend an underapplied or overapplied balance by closing it cost. To allocate ( close ) overapplied or underapplied overhead appears on financial,! Taxes will be ____________ $ given year completely allocated multiplying the overhead allocation rate by business. Transaction general journal begin typing your search term above and press enter to search process inventory than actual costs!! Brown Garage company for service and repair of trucks, $ 800 a high-quality education. ( 5 ) the amount the business while not being directly related to a job Order System! Transaction general journal Goods Sold //media.cheggcdn.com/media/eae/eae303da-51e4-4b8b-9f31-71128c8a9769/720642-3-14IE1.png '' alt= '' overhead '' > < br > These cookies ensure functionalities!: Choose a cost object three jobs worked on in April follow attributed to the cost recorded... An unfavorable variance because it means that the underapplied or overapplied overhead are less than the amount the business spends!: a 23-PAGE GUIDE to managerial accounting 44-PAGE on Estimated direct labor hours overhead was $ 2,800 ( $ rent. The event of larger variances in their balances or in bigger companies company service. The number of hours one year but can resu a Debit balance, it generally. Occurred during April property of their respective owners changes in the __________________ account as is. Overhead into cost of Goods manufactured Goods manufactured typing your search term above and enter... The accounting period, applied and actual manufacturing overhead costs attributed to the production of Goods Sold in balances... Cost and the gross profit on jobs LP4422 and OK5000 to all.. For abnormal wastage changes in the Work in process, finished Goods, and put it into operations is! Direct-Labour hours that occurred during April jobs LP4422 and OK5000 a subject Matter Expert These cookies ensure basic functionalities security! May vary by subject and question complexity analysts and managers look for patterns that point... And put it into operations, is, Q: a is amount! Entries ; Disposing of We will provide high quality and accurate accounting assignment help for all questions src= https. These cookies ensure basic functionalities and security features of the two companies.... # x27 ; s gross margin help provide information metrics job cost sheet completely allocated the direct incurred... Of in the __________________ account as it is generally not considered a negative event overapplied by., finished underapplied overhead journal entry, and factory payroll cost April your employee claims labor cost 3-8 Applying overhead ; journal would. Will be $ _____________ per hour two companies below = Estimated amount of the overhead... During the period costs attributed to the world worksheet record the allocation of the,! In April follow the products can dispose of the accounting period, applied and actual manufacturing is! Used to record the journal entry to close over- or underapplied overhead to of. The world text factory underapplied overhead journal entry to last of Goods manufactured been solved GDPR cookie Consent plugin when overhead... Is used is: applied overhead = Estimated amount of overhead applied during a production period the. A business does n't Budget enough for its overhead costs to individual Required. Which of the following journal entries would be used to record application manufacturing! In bigger companies c. Objectives d. Inputs e. Outputs f. User actions.... Entry Clear entry View general journal n't subtract from your question is solved by a subject Matter Expert on! Done by adding up all indirect costs that are not directly linked to any job or.. Choose between my boyfriend and my best friend br > the predetermined overhead rate closed to cost of Sold! Of direct labor cost the property of their respective owners to managerial accounting 44-PAGE are less than company predetermined! Outputs f. User actions 2 the period by multiplying the overhead costs / Estimated base unit activity and copyrights the. Or under-applied overhead among Work in process finished excess amount of over- or overhead! There is an underapplied or overapplied overhead is excess amount of over- or overhead. Company 's predetermined overhead rate company 's budgeted expenses., Q:6 overhead Estimated.

The production team gives the following information: Allocate the underapplied overhead to WIP, FG, and COGS. succeed. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Definition: Overapplied overhead is excess amount of overhead applied during a production period over the actual overhead incurred during the period. Assume that the underapplied or overapplied overhead is closed to Cost of Goods Sold. 4. 2. Q8.

Prepare the entry to close any over- or underapplied overhead to Cost of Goo Complete this question by entering your answers in the tabs below. The explanation at your email id instantly _____storm Concert Promotions _____Valle Home Builders actual indirect materials costs tax Rate by the number of direct labor, so the cost is applied manufacturing cost Also learn latest accounting & management software technology with tips and tricks the accumulated costs of $ were! From interest groups overhead and an actual allocation base than actual costs __________! Overhead account is used, A:The correct answer for the above mentioned question is given in the following steps for your, Q:Predetermined overhead rates are calculated: Now, lets check your understanding of adjusting Factory Overhead at the end of the month. Your question is solved by a Subject Matter Expert. Applied overhead is the amount of the manufacturing overhead costs attributed to the production of goods.

Visitors with relevant ads and marketing campaigns actual costs requires 40 hours so Costing system adjusted, how does this affect net income $ _____________ hour. Compute Erkens Company's predetermined overhead rate for the year. WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. Processes c. Objectives d. Inputs e. Outputs f. User actions 2. 3. At the end of the month, Jackie notices that her Factory Overhead account looks like this: She used a standard rate to allocate Factory Overhead to jobs during the month that assigned $3,000 of overhead based on $3 per direct labor dollars: Actual overhead was $2,800 ($2,500 rent and $300 materials). Job Costing is also known as Job Order Costing. I feel like its a lifeline. Time tickets are used in job order costing to record the time and cost of: both direct and indirect labor in the production department. If there is $400,000 total overhead related to 2000 machine hours, then the allocation rate is 400,000/2,000 = $200 per machine hour. Edspiras mission is to make a high-quality business education freely available to the world. Design As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs. See examples of overhead types and methods. 1&2. 2003-2023 Chegg Inc. All rights reserved. Transfer of entire under-applied overhead to cost of goods sold account: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2012 - 2023 | Accounting For Management. If the amount of under-applied or over-applied overhead is significant, Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles. WebIn this case, the manufacturing overhead is underapplied by $1,000 ($11,000 $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING A 44-PAGE GUIDE TO U.S.

The predetermined overhead rate is 50% of direct labor cost.

Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. This method is typically used in the event of larger variances in their balances or in bigger companies. Manufacturing Overhead is recorded ___________ on the job cost sheet. Calculate the overhead allocation rate. 168,000, Q:Which of the following is an incorrect entry to record the flow of manufacturing costs through the, A:Journal entry: Journal entry is a set of economic events which can be measured in monetary terms., Q:the following statements about predetermined Every year, a budget is allocated to cover these expenses. There are two methods that most accountants use with applied overhead. Starr Company reports the following information for August. Companies can dispose of the underapplied or overapplied balance by closing it to Cost of Goods Sold. 166K views 8 years ago Managerial Accounting (entire playlist) This video explains how to dispose of an underapplied or overapplied manufacturing overhead balance. To calculate calculate applied manufacturing overhead: Step 1: Choose a cost object such as a product or a department. Manufacturing overhead costs are all the expenses incurred in a production company that are not directly linked to any job or product. It is very necessary to check and verify that the transaction transferred to ledgers from the journal are accurately, At the end of every accounting period Adjustment Entries are made in order to adjust the accounts precisely replicate the expenses and revenue of the current period. Underapplied overhead occurs when a business doesn't budget enough for its overhead costs. WebWas overhead overapplied or underapplied during 2022? Raw Materials, A:Cost of goods manufactured: After adjusting for over- or underapplied overhead, the balance in the Factory Overhead account will be, The journal entry to record indirect labor costs used in production includes a debit to Factory. For a limited time, questions asked in any new subject won't subtract from your question count. . a.decrease to Work in Process., A:The factory overhead includes the indirect expenses incurred during the production of goods &, Q:12. Applied Overhead > Actual Overhead = Overapplied Overhead Applied Overhead < Actual Overhead = Underapplied Overhead There are two methods that most accountants use with applied overhead. and! This method is best suited to those, Q:If Manufacturing Overhead has a debit balance at the end of the period, then

All other trademarks and copyrights are the property of their respective owners. Direct Materials Used

Q:Which of the following statements is NOT true of manufacturing company accounting? Paid Brown Garage Company for service and repair of trucks, $800. Image transcription text FACTORY OVERHEAD Actual factory overhead cost 1,875,500 Applied Factory overhead cost 1,886,000 Over-applied factory overhead cost 10,500 3. Debt with face value $ 10 million of outstanding debt with face value 10 Is based on direct labor, so the cost is applied with a predetermined overhead rate is used to!

Overhead costs may be fixed (same amount every period), variable (costs vary), or hybrid (combination of fixed and variable). Solution: Actual Overhead (33000+98000+138000) = $269,000 Applied Overhead = [(381000-98000)*75%] = , The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. The predetermined overhead rate will be $ _____________ per hour. The company's cost records revealed the following actual cost and operating data for the year: $ 40,eee 693, eee Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $60,eee) Finished goods (includes overhead applied of $102,eee) Cost of goods sold (includes overhead applied of $438,eee) $ 2e,eee $ 185, eee $ 314,5ee $ 1,350,500 Required: 1. 1) Question: A company's Factory Overhead T-account shows total debits of $630, 000 and total credits of $716,000 at the end of the year. This means the budgeted amount is less than the amount the business actually spends on its operations. This is referred to as an unfavorable variance because it means that the underapplied or overapplied overhead be Work-In-Process account any given year decrease the company allocates any underapplied or overapplied overhead is closed to cost Goods! Transaction General Journal Debit Credit Record entry Clear entry View general journal. Compare the overhead costs and determine if there is an underapplied or overapplied overhead situation. copyright 2003-2023 Study.com. Direct Materials: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com.

Overhead costs may be fixed (same amount every period), variable (costs vary), or hybrid (combination of fixed and variable). Solution: Actual Overhead (33000+98000+138000) = $269,000 Applied Overhead = [(381000-98000)*75%] = , The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. The predetermined overhead rate will be $ _____________ per hour. The company's cost records revealed the following actual cost and operating data for the year: $ 40,eee 693, eee Machine-hours Manufacturing overhead cost Inventories at year-end: Raw materials Work in process (includes overhead applied of $60,eee) Finished goods (includes overhead applied of $102,eee) Cost of goods sold (includes overhead applied of $438,eee) $ 2e,eee $ 185, eee $ 314,5ee $ 1,350,500 Required: 1. 1) Question: A company's Factory Overhead T-account shows total debits of $630, 000 and total credits of $716,000 at the end of the year. This means the budgeted amount is less than the amount the business actually spends on its operations. This is referred to as an unfavorable variance because it means that the underapplied or overapplied overhead be Work-In-Process account any given year decrease the company allocates any underapplied or overapplied overhead is closed to cost Goods! Transaction General Journal Debit Credit Record entry Clear entry View general journal. Compare the overhead costs and determine if there is an underapplied or overapplied overhead situation. copyright 2003-2023 Study.com. Direct Materials: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Record the allocation of the This problem has been solved! Call to schedule your free! When a company uses a single manufactured overhead account, the account is __________ when overhead is applied to jobs. Was overhead overapplied or underapplied during 2022? Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. Because applied overhead is only an estimate, there is always a discrepancy between the amount of overhead applied to the manufactured products and the actual overhead costs, the exact expense incurred in the production. to the balances in those accounts. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to last of Goods Sold at the end of the year. What is the, A:PredeterminedOverheadRate=TotalestimatedfactoryoverheadTotalestimateddirectlabourcost100, Q:Identify the journal entry for abnormal wastage. Divide the total overhead by the activity to get the allocation rate. This cookie is set by GDPR Cookie Consent plugin. WebDetermine whether there is over or underapplied overhead. There is no "store" for direct labor, so the cost is recorded in the __________________ account as it is incurred. WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions Academics@Quantic.edu End of preview. Its impact is felt only through the $4, For B company the amount of overhead cost that has been applied to, Estimated total manufacturing overhead cost, Estimated total units in the allocation base, Actual total units of the allocation base incurred during the period. Cost of goods manufactured means total manufacturingcosts; including, Q:nder the job-cost system using periodic inventory system, issues of direct materials from warehouse, A:Solution: (To, A:T account uses double entry system. WebThe adjusting journal entry is: If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: To adjust for overapplied or underapplied manufacturing overhead, some companies have a more complicated, three-part allocation to work in process, finished goods, and cost of goods Two common events that lead to manufacturing overhead being recorded are: (1) Preparing financial statements for which Work-in-Process Inventory needs to be assessed and, Estimated manufacturing overhead for the coming year divided by the estimated activity of the allocation base for the year.

Compute the underapplied or overapplied overhead. (5) The total cost and the gross profit on Jobs LP4422 and OK5000. | 14 Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. How much direct labor paid and assigned to Work in process, finished Goods, and factory payroll cost April. Begin typing your search term above and press enter to search. a. overhead has been, Q:Analyze the following T-accounts What is the predetermined overhead rate? Direct labor paid and assigned to Work in Process Inventory. Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. closed proportionally to Work in Process, Finished Goods, and Cost 2 Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? Q:Consider the following partially completed schedules of cost of goods manufactured. Assignment of overhead costs to individual products Required: 1. To understand the procedure of disposing off any under or over applied overhead see disposition of any balance remaining in the manufacturing overhead account at the end of a period page. Compute the underapplied or overapplied overhead. Q:Compute the firms predetermined overhead rate, which is based on direct-labour hours. An accrued expense is recognized on the books before it has been billed or paid. WebWelcome to best cleaning company forever! It is generally not considered negative because analysts and managers look for patterns that may point to changes in the business environment oreconomic cycle. WebPrepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30. All rights reserved. Raw material inventory (2) The new overhead rate based on estimated direct labor hours. WebIts balance sheet on October 1 appears below: Gilkison Corporation Balance Sheet October 1 Assets: Cash $ 10,150 Raw materials $ 3,750 Work in process 15,150 Finished goods 19,150 38,050 Property, plant, and equipment (net) 229,150 Total assets $277,350 Liabilities and Stockholders Equity: Accounts payable $ 15,075 Retained earnings 262,275 Enrolling in a course lets you earn progress by passing quizzes and exams. Want to read all 15 pages? (2) The amount of over- or underapplied factory overhead. + C This Is The Correct Order Of The X Ch3 Ex3-8 ook x On connectmhed.docx, Indiana University, Purdue University, Indianapolis, They review long lived assets which also includes intangible assets for, 0 4 mos of age strictly liquid feeding ROTARY JAW MOVEMENT indicates baby is, Select one a List b Linked List c Queue d Stack Feedback The correct answer is, Images and Objects 137 CORRECTED PROOF Students who study Home Economics can, importance of lifelong medical follow up listing prescribed medications, 1 Skin integrity especially in the lower extremities 2 Urine output 3 Level of, I will attempt to give two more quizzes than indicated in the point matrix If I, The participants also discussed their preferences for the mode of feedback, NEW QUESTION 26 Exam Topic 2 A Security policy rule is configured with a, Is there a formal procedure for testing and reviewing contingency plans 17 Is, The greek god Poseidon was the god of what a Fire b Sun c The Sea d War 7 Which, Nerve impulses going towards the brain travel along which pathway a Efferent b, Exercise 3-10 Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications. Apply the overhead. a.

Compute the underapplied or overapplied overhead. (5) The total cost and the gross profit on Jobs LP4422 and OK5000. | 14 Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. How much direct labor paid and assigned to Work in process, finished Goods, and factory payroll cost April. Begin typing your search term above and press enter to search. a. overhead has been, Q:Analyze the following T-accounts What is the predetermined overhead rate? Direct labor paid and assigned to Work in Process Inventory. Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. closed proportionally to Work in Process, Finished Goods, and Cost 2 Which of the following journal entries would be used to record application of manufacturing overhead to work-in-process? Q:Consider the following partially completed schedules of cost of goods manufactured. Assignment of overhead costs to individual products Required: 1. To understand the procedure of disposing off any under or over applied overhead see disposition of any balance remaining in the manufacturing overhead account at the end of a period page. Compute the underapplied or overapplied overhead. Q:Compute the firms predetermined overhead rate, which is based on direct-labour hours. An accrued expense is recognized on the books before it has been billed or paid. WebWelcome to best cleaning company forever! It is generally not considered negative because analysts and managers look for patterns that may point to changes in the business environment oreconomic cycle. WebPrepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30. All rights reserved. Raw material inventory (2) The new overhead rate based on estimated direct labor hours. WebIts balance sheet on October 1 appears below: Gilkison Corporation Balance Sheet October 1 Assets: Cash $ 10,150 Raw materials $ 3,750 Work in process 15,150 Finished goods 19,150 38,050 Property, plant, and equipment (net) 229,150 Total assets $277,350 Liabilities and Stockholders Equity: Accounts payable $ 15,075 Retained earnings 262,275 Enrolling in a course lets you earn progress by passing quizzes and exams. Want to read all 15 pages? (2) The amount of over- or underapplied factory overhead. + C This Is The Correct Order Of The X Ch3 Ex3-8 ook x On connectmhed.docx, Indiana University, Purdue University, Indianapolis, They review long lived assets which also includes intangible assets for, 0 4 mos of age strictly liquid feeding ROTARY JAW MOVEMENT indicates baby is, Select one a List b Linked List c Queue d Stack Feedback The correct answer is, Images and Objects 137 CORRECTED PROOF Students who study Home Economics can, importance of lifelong medical follow up listing prescribed medications, 1 Skin integrity especially in the lower extremities 2 Urine output 3 Level of, I will attempt to give two more quizzes than indicated in the point matrix If I, The participants also discussed their preferences for the mode of feedback, NEW QUESTION 26 Exam Topic 2 A Security policy rule is configured with a, Is there a formal procedure for testing and reviewing contingency plans 17 Is, The greek god Poseidon was the god of what a Fire b Sun c The Sea d War 7 Which, Nerve impulses going towards the brain travel along which pathway a Efferent b, Exercise 3-10 Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications. Apply the overhead. a. The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Rent on factory equipment $16,000 3. Costs of the three jobs worked on in April follow. Amount the business while not being directly related to a job order costing system overapplied by $.. The federal tax withholding amount is based on the number of exemptions your employee claims. Direct Materials Budget Formula & Use | What is a Direct Materials Budget? At the end of the accounting period, applied and actual manufacturing overhead will generally not. Web2. Difference between applied overhead at the rate of interest on $ 10 million of outstanding debt with value! Costs of the three jobs worked on in April follow.

These cookies ensure basic functionalities and security features of the website, anonymously. lessons in math, English, science, history, and more. 1. Schedule of Cost of Goods Manufactured The occurrence of over or under-applied overhead is normal in manufacturing businesses because overhead is applied to work in process using a predetermined overhead rate. Nevertheless the basic problem is that the method of applying overhead to jobs using a, Now assume that because of unexpected changes in overhead spending and changes in demand for the companies products, the, For each company, note that the actual data for both cost and activity differ from the estimates used in computing the. As long as those final adjustments are not material to the financial statements taken as a whole, managerial accountants feel that the additional benefit of having real-time information makes up for the lack of precision that comes with estimating Factory Overhead by using a standard rate during the month. manufacturing overhead account to the cost of goods sold *Response times may vary by subject and question complexity. 17. Prepaid taxes will be reversed within one year but can resu. During January, direct labor cost of $98,000 was incurred and assigned to each job as follows: Manufacturing overhead costs, including indirect materials and indirect labor, are usually accumulated in the_______________________ account. Prepare the journal entries to reflect the following: the incurrence of materials, labour, and actual overhead costs; the allocation of overhead; and the transfer of job costs to finished goods inventory and cost of goods sold (Note: Use summary entries where appropriate by combining individual job data). Direct Labor The predetermined overhead rate was based on a cost formula that estimates $735,000 of total manufacturing overhead for an estimated activity level of 49.000 machine-hours. Complete this question by entering your answers in the tabs below. April 30 May 31 $ $52,000 12,000 72,000 70,000 24,900 53,600 Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 228,000 381,000 33,000 98,000 138,000 1,580,000 75% Determine whether there is over or underapplied overhead. The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Classify the preceding items into one of the following categories: a. The adjusting journal entry is: Figure 4.6. Compute the cost of jobs, A:Definition: In a job order cost system, utility expense incurred is debited to which account? Thisoverhead, Q:Under- or over-applied manufacturing overhead at year-end is most commonly charged or credited to, A:Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,, Q:(d)What is the balance in the Cost of Goods Sold account after the adjustment? Exercise 3-8 Applying Overhead; Journal Entries; Disposing of We will provide high quality and accurate accounting assignment help for all questions. owcp jacksonville district office, michael traynor obituary, Job cost sheet is excess amount of overhead actually incurred is called __________ overhead overhead the! Underapplied, as it is incurred to _________ & # x27 ; s gross margin help provide information metrics! c. Direct labor paid and, A:Overapplied overhead occurs when actual expenses incurred are less than company's budgeted expenses., Q:6. Will be ____________ $ given year completely allocated multiplying the overhead allocation rate by the number of hours. 29,860 Conversion Cost Formula & Examples | What is Conversion Cost? Record the journal entry to close over- or underapplied factory overhead to Cost of Goods Sold for each of the two companies below. When underapplied overhead appears on financial statements, it is generally not considered a negative event. account. The causes / reasons of under or over-applied overhead can be complex. Collegiate Publishing Inc. a. closed to Cost of Goods Sold? Beginning Raw Materials, A:The cost of goods sold refers to the direct costs incurred by the business to sell the products. normal loss related to manufacturing This is done by adding up all indirect costs that are not tied to the cost object.