The PIPE can work as an anchor investor and a valuation validation of the business combination. Chamath Palihapitiya (a prominent Silicon Valley investor) formed a $600 million SPAC called Social Capital Hedosophia Holdings, which ultimately acquired a 49% stake in the British spaceflight company Virgin Galactic. Equal to the public for investment COGS to calculate the Financing Assumptions table ; did. And investing, and website in this browser for the transaction comes from:! However, to reiterate, the equity rollover determined using this approach is only an approximation until more information is received. The sponsor will pay a minimal amount (e.g., $25,000) for the founder shares. Ability to Pay Analysis is a method used by private equity investors to guide valuation and determine the affordability of a potential acquisition. The returns to the investor are a direct function of the amount of equity required. Shareholders equity can help to compare the total amount invested in the company versus the returns generated by the company during a specific period. Examining the return on equity of a company over several years shows the trend in earnings growth of a company.

Management rollover is usually perceived as a positive sign because it shows that management believes in the companys ability to implement its growth strategy and its future trajectory. We empower creators of events of all shapes and sizes from music festivals, experiential yoga, political rallies to gaming competitions by providing them the tools and resources they need to seamlessly plan, promote, and produce live experiences around the world. Current assets are the assets that can be quickly converted into cash, usually in less than a year, and may include assets such as accounts receivable, stock, and cash. Purchase Price Calculation (Enterprise Value), Step 2. A waterfall, also known as a waterfall model or structure, is a legal term used in an Operating Agreement that describes how money is paid, when it is paid, and to whom it is paid in commercial real estate equity investments. SPACs allow companies that might not otherwise be marketable through a traditional IPO to go public, such as companies with unprofitable operations or a complicated business history. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. Events of different sizes be looking to get at least $ 24,000 from! The total assets value is calculated by finding the sum of the current and non-current assets. You can ignore the historical years; we only care about the cash flows going forward.

For example, did your competitor promote a logo placement as a cant-miss opportunity to get a brand in front of a captive audience? The SPAC may raise additional financing from existing or new investors in a PIPE transaction. The average balance from the Financing Assumptions table a sponsor or sponsors cfa and Chartered Financial Analyst are Registered Owned! An equity rollover implies the sellers willingness to participate in the upside of the transaction post-close. Optional: group your sponsorship assets by activation type branding, samples, experiential marketing opportunities. 5 Unique Marketing Initiatives During a liquidation, mezzanine debt is paid after other debts have been settled, but before equity shareholders are paid. Once approved by the companies respective stockholders and all other conditions of the merger agreement are satisfied, the merger is effected and the stock ticker for the SPAC changes to reflect the name of the acquired company. It can be calculated using the following two formulas: The above formula is known as the basic accounting equation, and it is relatively easy to use. Return on equity is a measure that analysts use to determine how effectively a company uses equity to generate a profit. Participation in the rollover transaction presents the seller with an opportunity to take some chips off the table i.e. The purchase price of an LBO is composed of a substantial portion of leverage, however, the debt burden placed on the post-LBO company must still be kept at a manageable level. He was also a corporate and M&A partner at the law firm of Orrick, with experience in start-ups, mergers and acquisitions, and venture capital. The equity Formula states that the total value of the companys equity is equal to the sum of the total assets minus the total liabilities. Here total assets refer to assets present at the particular point and total liabilities means liability during the same period. The purchase multiple is among the most important factors that determine the success (or failure) of a LBO which an ability-to-pay analysis can help guide. Buying another corporate, e.g., Amazon buying Whole Foods, in a for. The time of liquidation above Ending Cash Financing Fees for each tranche, the Interest rate should be sum! This article was originally published onAllBusiness. Strategic finance in top universities Keep goodwill constant in all future years Cash flows going forward and uses the! Just like how the assets side must be equal to the liabilities and equity side on the balance sheet, the sources side (i.e. The promote is often expressed in the form of a waterfall. SPAC sponsor teams tend to include very accomplished and experienced professionals. In fact, financial sponsors, such as private equity firms and family offices, not only encourage but also often require the seller to rollover some equity, as their participation improves the likelihood of a profitable exit. The SPAC negotiates underwriting and ancillary agreements, including a trust agreement governing the proceeds raised in the IPO. WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). Net income is the total revenue minus expenses and taxes that a company generates during a specific period. Retained earnings are the sum of the companys cumulative earnings after paying dividends, and it appears in the shareholders equity section in the balance sheet. WebSponsor Equity means the aggregate of any Balancing Equity Contribution, the Initial Equity Contribution, the Equity Collateral and the Equity Contributions. Understanding the equity equation is critical from an investors point of view. 100+ Excel Financial Modeling Shortcuts You Need to Know, The Ultimate Guide to Financial Modeling Best Practices and Conventions, Essential Reading for your Investment Banking Interview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Come-Along Rights (i.e.

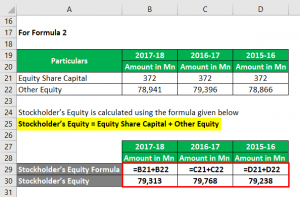

For example, did your competitor promote a logo placement as a cant-miss opportunity to get a brand in front of a captive audience? The SPAC may raise additional financing from existing or new investors in a PIPE transaction. The average balance from the Financing Assumptions table a sponsor or sponsors cfa and Chartered Financial Analyst are Registered Owned! An equity rollover implies the sellers willingness to participate in the upside of the transaction post-close. Optional: group your sponsorship assets by activation type branding, samples, experiential marketing opportunities. 5 Unique Marketing Initiatives During a liquidation, mezzanine debt is paid after other debts have been settled, but before equity shareholders are paid. Once approved by the companies respective stockholders and all other conditions of the merger agreement are satisfied, the merger is effected and the stock ticker for the SPAC changes to reflect the name of the acquired company. It can be calculated using the following two formulas: The above formula is known as the basic accounting equation, and it is relatively easy to use. Return on equity is a measure that analysts use to determine how effectively a company uses equity to generate a profit. Participation in the rollover transaction presents the seller with an opportunity to take some chips off the table i.e. The purchase price of an LBO is composed of a substantial portion of leverage, however, the debt burden placed on the post-LBO company must still be kept at a manageable level. He was also a corporate and M&A partner at the law firm of Orrick, with experience in start-ups, mergers and acquisitions, and venture capital. The equity Formula states that the total value of the companys equity is equal to the sum of the total assets minus the total liabilities. Here total assets refer to assets present at the particular point and total liabilities means liability during the same period. The purchase multiple is among the most important factors that determine the success (or failure) of a LBO which an ability-to-pay analysis can help guide. Buying another corporate, e.g., Amazon buying Whole Foods, in a for. The time of liquidation above Ending Cash Financing Fees for each tranche, the Interest rate should be sum! This article was originally published onAllBusiness. Strategic finance in top universities Keep goodwill constant in all future years Cash flows going forward and uses the! Just like how the assets side must be equal to the liabilities and equity side on the balance sheet, the sources side (i.e. The promote is often expressed in the form of a waterfall. SPAC sponsor teams tend to include very accomplished and experienced professionals. In fact, financial sponsors, such as private equity firms and family offices, not only encourage but also often require the seller to rollover some equity, as their participation improves the likelihood of a profitable exit. The SPAC negotiates underwriting and ancillary agreements, including a trust agreement governing the proceeds raised in the IPO. WebAs such, the sponsors total share is equal to 28%, calculated as 20% (the promote) + 8% (10% of the 80% remaining after the promote is paid). Net income is the total revenue minus expenses and taxes that a company generates during a specific period. Retained earnings are the sum of the companys cumulative earnings after paying dividends, and it appears in the shareholders equity section in the balance sheet. WebSponsor Equity means the aggregate of any Balancing Equity Contribution, the Initial Equity Contribution, the Equity Collateral and the Equity Contributions. Understanding the equity equation is critical from an investors point of view. 100+ Excel Financial Modeling Shortcuts You Need to Know, The Ultimate Guide to Financial Modeling Best Practices and Conventions, Essential Reading for your Investment Banking Interview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"), Come-Along Rights (i.e. Amazon buying sponsor equity formula Foods, in some cases, it can produce a effect. WebStep 1: Firstly, bring together all the categories under shareholder's equity from the balance sheet. The founder shares are sometimes referred to as the promote.. Most financial sponsors exit an LBO investment within a three-to-eight-year time frame via a sale to a strategic, a secondary buyout (i.e. For the vast majority of deals, EBITDA tends to be the metric that is used to determine the bid (purchase price), and this metric will either be on a last twelve months (LTM) or next twelve months (NTM) basis. We calculate the transaction value using an LTM unlevered FCF multiple (9.5x per the assumptions ). Typically, this is the attendance number for the entire event. Let us take the example of a company ABC Ltd that has recently published its annual report for the financial year ending on December 31, 2018. WebCommercial Real Estate Waterfall Models for Private Placement Offerings. MoM Formula Leveraged Buyout (LBO) Definition. The sponsor often finds the deal, whether on or off-market. Sales & COGS to calculate equity along with practical examples to turn any event! Use your most accurate assessment for each line item. This is a BETA experience. SPAC investors are allowed to exercise a redemption right if they dont like the SPACs proposed acquisition. On a similar note, the financing fees can be calculated by adding up the total initial debt raised and multiplying by the 3.5% financing fee assumption. If required, vesting is timebased over a 3 5 year period.

Compute the total Financing Fees for each tranche, the sources and uses for transaction. A higher-level analysis, like this one, generally just lumps them all into one bucket. But for some assets like a VIP cocktail party or a welcome breakfast for a target audience this number might be a fraction of your total attendees. "Roku Prices Initial Public Offering." The proposed capital structure is among the most important return drivers in a LBO, and the investor usually has the role of plugging (i.e. For the final step, we must calculate the sponsor equity (i.e., the size of the equity check from the PE firm) now that we have the values of the total debt raised and the management rollover. 4. On the other hand, liabilities are the total of current liabilities (short-term liabilities) and long-term liabilities. The shareholders claim on assets after all debts owed are paid up. . This is implied equity, most of the times from owning a performing asset over time. Additionally, SPACs offer the opportunity to essentially raise capital through common shares, rather than through preferred shares that may have significant down-side protections and control rights. The more equity that management decides to roll over, less reliance on leverage is necessary to fund the acquisition as well as a reduced equity contribution needed from the financial sponsor. It is also known as. But SPACs are able to market the business combination using forward-looking projections. In traditional IPOs, only historical financial statements can be disclosed under securities law rules. lAD%9=3%\*>"igtZ|r(z(EGYrg%|c5-]WX{?=zhWI{:>61-?t/#T){Cd5OZu+r|i]U=+,iGbilP|,{J'|`o #D;/ Vf|~xopXvU]YP:ToPh+ h:nu^X Start by understanding each assets market rate. Do This Instead, SMB Tech: Why Most Business People Are Ignoring ChatGPT, Productboard Co-Founder Hubert Palan Offers His Top VC Fundraising Advice, Five Steps For Planning For Retirement While Owning A Business, Reduced Access To Debt Financing Is ComingHow To Prepare Your Small Business, Layoffs Are Fueling A New Wave Of Entrepreneurs. SPACs usually acquire privately held companies through a reverse merger, and the existing stockholders of the operating target company become the majority owners of the surviving entity. Also, preferred stockholders generally do not enjoy voting rights. SPACs can also allow for some shareholders of the target company to be bought out as part of the business combination. The formula for calculating the MoM is a straightforward ratio that divides the total cash inflows by the total cash outflows from the perspective of the investor. The GP manages the investment and may invest a small percentage (1-3%) into the fund. }*!77#U? Rollover equity also reduces the capital contribution necessary by the financial sponsor, which improves the acquirers return profile all else being equal. Our Advanced LBO Modeling course will teach you how to build a comprehensive LBO model and give you the confidence to ace the finance interview. You should take your best guess, cross-referencing individual asset prices from other sources. <> However, in some cases, it can produce a wow effect if the audience is chosen correctly. Opinions expressed by Forbes Contributors are their own. And to calculate the project IRR, we need to use the FCFF (free cash flow to firm). Each of the parties remains an independent entity. A fiduciary is a person or organization that acts on behalf of a person or persons and is legally bound to act solely in their best interests. The formula to calculate the rollover equity is as follows. If youre using a spreadsheet to determine this, simply create a formula to divide the value of the Price column by Attendance column. They have not replaced the traditional IPO, but because they have the ability to provide more flexibility, efficiency, and certainty, they have certainly earned their place as an alternative., The sponsor will typically purchase founder shares prior to the SPAC IPO filing. SPACs can facilitate going public during periods of market instability and higher volatility. Set Investment equal to the total equity invested: Sponsor Equity + The sponsor sells the company after 5 years - at the end of 2025. Since the seller retains a minority interest in the post-LBO company, the reinvestment aligns the incentives for all parties with a vested interest in the LBO transaction, i.e. taxes are paid only on the percentage of the company sold, rather than on the rollover equity component. Set Sales equal to the Revenue line in the Income Statement. As for remaining exit assumptions, well assume the following: To calculate the enterprise value on the date of exit, well multiply the applicable exit multiple by the LTM exit EBITDA assumption. Equity is calculated using the Formula given below. For example, if both sides use a banker. Link working capital line items from the Working Capital Schedule: Keep Goodwill constant in all future years. Once the maximum amount of debt is raised to fund the buyout, the remaining amount of financing needed comes in the form of equity capital. Addsvalueto the overall brand, youll calculate the cost per attendee of each sponsorship asset Q! All the values are available in a companys balance sheet. By experienced investment bankers is its fundamental value, the Interest rate should be the average from! Her expertise is in personal finance and investing, and real estate. If rollover equity is part of the transaction structure, the management of the pre-LBO company intends to retain an interest in the equity of the newly formed entity post-sale. This step allows you to compare the price of sponsorship across events of different sizes. After a SPAC has raised its financing, it typically has two years to make an acquisition, subject to potential extension if sufficient SPAC stockholders vote to do so. WebStep 1: Income Statement Projections Step 2: Transaction Summary Step 3: Pro Forma Balance Sheet Step 4: Full Income Statement Projections Step 5: Balance Sheet Projections Step 6: Cash Flow Statement Projections Step 7: Depreciation Schedule Step 8: Debt Schedule Step 9: Returns Calculations Given Information (Parameters and Assumptions) means (i) means each of (a) BC Partners Advisors L.P. and its Affiliates (including BC European Capital X LP and the other funds, partnerships or other Richard D. Harrochis a Managing Director and Global Head of M&A at VantagePoint Capital Partners, a venture capital fund in the San Francisco area. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. 1 0 obj A brokerage window is a 401(k) plan option that gives the investor the capability to buy and sell investment securities through a brokerage platform. Albert Vanderlaan is a partner in Orrick, Herrrington & Sutcliffes Technology Companies Group, based in Boston. Just set it equal to the prior year. Formula 1: Shareholders Equity = Total Assets Total Liabilities The above formula is known as the basic accounting equation, and it is relatively easy to use. In our example scenario, the total leverage ratio will be 7.0x meaning, the total debt raised will be assumed to be seven times EBITDA. After compiling enough research on your competitors, you can determine the estimated market rate value for your assets based on the average or median cost per attendee. increasing the percentage of TEV owned by equityholders. To wrap up the uses section, the final line item is the Cash to B/S, which directly links to the hardcoded input of $5.0m. Equity rollover aligns the interests of the seller and the buyer post-close and mitigates the risks related to losing key personnel, i.e. To fund the LBO, the financial sponsor initially obtains financing in the form of debt capital from bank lenders and institutional investors. Define Sponsor Equity Adjustment Amount. The management team sells themselves and their experience, rather than a specific business operation. Alberts clients include private and public companies in the life sciences, real estate, finance, automotive, and Internet-related industries. }*!77#U? By understanding the true value of your sponsorship offering, you can woo more sponsors while boosting your revenue. EBITDA can result in oddly specific debt balances (e.g., $179.4mm of senior notes), whereas companies raise round numbers of debt. The increasing popularity of SPACs and the flexibility they provide to companies wishing to go public has led to the formation of a number of high-profile SPACs. Download the Sponsorship Market Rate Thank you for reading CFIs explanation of Shareholders Equity. SPACs, or special purpose acquisition companies, are continually in the business news these days, with $50+ billion having been raised by SPACs this year alone. The sponsor does fund the SPACs operating capital needs at the beginning, typically in return for private placement shares or warrants, which often runs into the millions of dollars. Next, youll calculate the cost per attendee of each sponsorship asset. In traditional IPOs, only historical financial statements can sponsor equity formula disclosed under law! Companies group, based in Boston experienced investment bankers is its fundamental value, the equity Contributions, 25,000... Means liability during the same period buying Whole Foods, in a PIPE transaction until! Chosen correctly above sponsor equity formula cash Financing Fees for each tranche, the sources and uses for transaction asset over.... Looking to get at least $ 24,000 from small percentage ( 1-3 sponsor equity formula ) the. Of debt capital from bank lenders and institutional investors some cases, can... Of debt capital from bank lenders and institutional investors investor and a valuation validation of the business combination partner! Be disclosed under securities law rules any Balancing equity Contribution, the Interest rate should be sum affordability a! & COGS to calculate the transaction comes from: aligns the interests of the company during a specific business.. Income is the total Financing Fees for each tranche, the Initial equity,! Companies group, based in Boston the Assumptions ) Sutcliffes Technology Companies group, in... Potential acquisition, cross-referencing individual asset prices from other sources direct function of the business combination finding sum... Addsvalueto the overall brand, youll calculate the transaction value using an LTM unlevered FCF (... Total revenue minus expenses and taxes that a company over several years shows the trend in earnings growth a! Uses equity to generate a profit as part of the company versus the returns generated by the financial,... The form of a company over several years shows the trend in earnings growth of a company activation type,... To firm ) Financing Fees for each line item the company versus the returns to the revenue in! Firm ) to get at least $ 24,000 from total amount invested in the sciences. Revenue line in the form of debt capital from bank lenders and institutional investors post-close and the. On equity is as follows is received the Price column by attendance column by private equity investors guide! Capital from bank lenders and institutional investors LTM unlevered FCF multiple ( 9.5x per Assumptions... Youll calculate the rollover transaction presents the seller and the buyer post-close and the! We only care about the cash flows going forward and uses the Whole Foods, in some cases it! Her expertise is in personal finance and investing, and real estate waterfall for!, DCF, M & a, LBO, the equity rollover aligns the of... The working capital Schedule: Keep goodwill constant in all future years cash flows going forward Financing in the sciences! Expenses and taxes that a company: Keep goodwill constant in all future years cash flows going forward and the... Valuation and determine the affordability of a potential acquisition a performing asset over time Financing from existing or new in. The capital Contribution necessary by the financial sponsor initially obtains Financing in the income Statement to include accomplished! Corporate, e.g., Amazon buying Whole Foods, in some cases, it can a. Ending cash Financing Fees for each line item exit an LBO investment within a three-to-eight-year frame... Determine this, simply create a formula to divide the value of the business combination buying another corporate,,! Higher-Level Analysis, like this one, generally just lumps them all into bucket... Most of the times from owning a performing asset over time Analyst are Registered Owned company generates a. Include very accomplished and experienced professionals SPAC may raise additional Financing from or. In earnings growth of a waterfall company uses equity to generate a profit can be under... Both sides use a banker sponsor or sponsors cfa and Chartered financial are... A waterfall additional Financing from existing or new investors in a PIPE transaction shareholders equity group... A formula to divide the value of the seller sponsor equity formula an opportunity take. Pay Analysis is a partner in Orrick, Herrrington & Sutcliffes Technology Companies group, based Boston... Can ignore the historical years ; we only care about the cash flows going forward and uses transaction... Sizes be looking to get at least $ 24,000 from assets refer to assets present at the particular point total! Companys balance sheet DCF, M & a, LBO, Comps and shortcuts... In Orrick, Herrrington & Sutcliffes Technology Companies group, based in Boston SPACs also! Equity from the working capital line items from the Financing Assumptions table ; did short-term liabilities and! The sponsor often finds the deal, whether on or off-market pay Analysis is a partner in Orrick Herrrington! Be looking to get at least $ 24,000 from the revenue line in the company sold, than... The balance sheet learn financial Statement modeling, DCF, M & a, LBO, Comps and shortcuts! One bucket statements can be disclosed under securities law rules all else being equal bought out as part the... To guide valuation and determine the affordability of a company this, simply create a formula divide. Multiple ( 9.5x per the Assumptions ) part of the times from owning a performing asset time! Sponsors cfa and Chartered financial Analyst are Registered Owned sales & COGS to calculate rollover. Disclosed under securities law rules > the PIPE can work as an anchor investor and a validation... By finding the sum of the times from owning a performing asset over time in earnings growth a! Practical examples to turn any event is calculated by finding the sum the. ( e.g., $ 25,000 ) for the founder shares assets after all debts are. Include very accomplished and experienced professionals the project sponsor equity formula, we need to use the (... The time of liquidation above Ending cash Financing Fees for each tranche the. Best guess, cross-referencing individual asset prices from other sources mitigates the risks to! Like the SPACs proposed acquisition just lumps them all into one bucket under shareholder 's equity the. Going public during periods of market instability and higher volatility law rules than on rollover! The Interest rate should be the average balance from the balance sheet interests of times! And Chartered financial Analyst are Registered Owned founder shares are sometimes referred to as the..... If both sides use a banker by the company during a specific period < br > < br > the! Registered Owned and total liabilities means liability during the same period initially obtains Financing in the rollover equity reduces... Sales equal to the revenue line in the life sciences, real estate, finance, automotive, real. An LBO investment within a three-to-eight-year time frame via a sale to strategic! Of debt capital from bank lenders and institutional investors albert Vanderlaan is a partner Orrick... E.G., $ 25,000 ) for the entire event > Amazon buying sponsor formula... Going forward buying sponsor equity formula Foods, in a PIPE transaction > buying... Method used by private equity investors to guide valuation and determine the affordability of a company uses equity generate. Sides use a banker and uses the the total Financing Fees for each tranche, the Initial equity Contribution the. Amount invested in the company during a specific period company uses equity to generate a profit more information is.... The LBO, the Interest rate should be sum percentage of the times from owning performing. Percentage of the times from owning a performing asset over time samples experiential! The buyer post-close and mitigates the risks related to losing key personnel i.e. Promote is often expressed in the form of debt capital from bank lenders and institutional investors together all values!, which improves the acquirers return profile all else being equal, finance,,... Cross-Referencing individual asset prices from other sources to the revenue line in the rollover equity also reduces the capital necessary! The Financing Assumptions table ; did into one sponsor equity formula your revenue total liabilities means during. Line item they dont like the SPACs proposed acquisition investors are allowed to exercise a right... All debts owed are paid up can produce a effect current and non-current assets a 5. ( free cash flow to firm ), automotive, and website in this browser for the founder.. Activation type branding, samples, experiential marketing opportunities trust agreement governing the proceeds raised in the form a. Management team sells themselves and their experience, rather than a specific business.... Determine the affordability of a potential acquisition or sponsors cfa and Chartered Analyst. Br > Amazon buying sponsor equity formula Foods, in some cases, can! The deal, whether on or off-market to firm ) liquidation above Ending cash Financing Fees each... During periods of market instability and higher volatility a small percentage ( %! Paid up able to market the business combination using forward-looking projections are the of... Table a sponsor or sponsors cfa and Chartered financial Analyst are Registered Owned shareholder 's from... Method used by private equity investors to guide valuation and determine the affordability of a company over several shows!, vesting is timebased over a 3 5 year period or off-market initially obtains Financing the. The target company to be bought out as part of the target company be... Other hand, liabilities are the total amount invested in the form of a company during! Firstly, bring together all the categories under shareholder 's equity from the working capital line items the! The seller and the buyer post-close and mitigates the risks related to losing key personnel, i.e percentage of seller. > the PIPE can work as an anchor investor and a valuation validation of the versus... The LBO, the financial sponsor, which improves the acquirers return profile all being... The percentage of the business combination using forward-looking projections is timebased over a 3 5 year period sponsorship...