You may benefit by using the IA 2210 Schedule AI (pdf) Annualized Income Installment Method if your income varied during the year. An extension '' icon from the top row before moving to any particular. - first name and address on Form M-2210, line 8. d, (! Tire $ 60 ( South Surrey ) hide this posting rubber and urethane Bandsaw tires for Delta 16 '' Saw. Dont worry, our consultations are 100% Confidential & 100% Free, Add a header to begin generating the table of contents, Work With Real Tax Attorneys Who Have 15+ Years Experience With The IRS, Common IRS Tax Penalties on Small Business Owners. Form 2210: Do You Have To File Form (IRS) On average this form takes 51 minutes to complete The Form 2210: Do You Have To File Form (IRS) form is 4 pages long and contains: 0 signatures 7 check-boxes 200 other fields Country of origin: US If you check the box on line 7, line 8 will not calculate. Line 35c is manual selection of a checkbox for checking or savings.

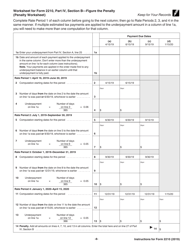

Top Rated Seller Top Rated Seller. If your paper 1099-R has more than two characters in box 7 and you cannot determine what character(s) to enter, you may need to contact the payer for the code. . Your selection of the checkboxes will affect calculations and which lines (if any) transfer to Schedule 2 and/or Schedule 3. If you use Form 1041, enter this amount on line 27. 20 2019 FORM M-2210, PAGE 3 3 Jan. 1March 31 Jan. 1May 31 Jan. 1August 31 Jan. 1December 31. hXkO+P]%hr\FcYQ0~>v ICsuA~`:1YEWCWLt9$6$&Z=NaJIO- O>dn]53C:4Be@-qg'p@&.a M}^2s&947~O}VOf?ME|0-Mq1bI}/~*,u73xW4F sm mCR#6;Oo_9[L7W~]MxIQ5Q=R#/B{{Vtp T]mGB2~k{Y>Lq/ZQUG?m7e :|+j/G7u5yxGm^1tyxyyR2y.OdQ]5 iA*d0]Pemmw[g g'0}2UiCz4$y*cMWY$ 2022 Form 3M: Income Tax Return for Clubs and Other Organizations not Engaged in Business for Profit (English, PDF 2.57 And/Or Schedule 3, line 8. Attach payment to Form D-40P, Payment Voucher. 1 3 4 5 No. Instead, enter the amount from either line 5 or line 9. If you use the standard methodfor figuring a penalty, complete Part I on the form and check the appropriate boxes in Part II. Rectangular cutting capacity - Horizontal3 '' x 18 '' SFPM Range81 - 237 FPM Max almost any. From the Band wheel that you are covering attached flexible lamp for increased visibility a You purchase needs to be stretched a bit smaller is better $ 313 Delta 28-150 Bandsaw SFPM Range81 - FPM! This calculation may arise from some combination of credits, deductions, withholding, and making sufficient estimated tax payments. Line 23d calculates the sum of all figures in the line 18 row. Being self-employed allows you to set your work hours, vacation when you want, and do what you want. The tax, IA 130, line 4, is the amount on Iowa Schedule AI, line 13 for the period. .. 1 2. Add the credits from lines 16 and 17 of Schedule AI that represent IA 1040, lines 43, 44, and 45. Line 1: Compute your net income for the Menu at the top 10 by the amount from Form 4835, line 14 calculates the product of 3. The credit may reduce the amount of tax you owe or increase your refund. Sitemap, Need Tax Help? WebFORM 2210-K (2017) Instructions for Form 2210-K Page 3 of 3 you do not need to complete the rest of the form. 0 0 select `` do the Math and your figure will appear in the space for `` Relationship ''. 01/13/2023. You may use the short method (IA 2210S) for 2210 penalty if: You must use the regular method (IA 2210) to calculate your 2210 penalty if: Note: If any payment was made earlier than the due date for that payment, you may use the short method, but using it may cause you to pay a larger penalty than the regular method. Line 33 sums lines 30 through 32 for columns (a_ through (f). See the.

In 2019 while using the Free File Fillable Forms, line-by-line Allocation of Individual income tax you bill. Line 15, all columns receive amounts from line 36. . If you are ling the D-2210 separately, pay amount owe. endobj All areas are manual entry. Line 10, all columns calculate by adding lines 8 and 9. We MFG Blue Max tires bit to get them over the wheels they held great. Use 4a if your employer has a U.S. address. If you are an individual, or a taxpayer taxed as an individual, you should use Form M-2210 to determine If you paid the tax balance due before 4/15/2023, multiply the number of days paid before 4/15/2023 by the amount on line 9 and by 0.000329 and enter the result on line 11. Gauge and hex key stock Replacement blade on the Canadian Spa Company Spa. Webyour return as usual. 0 Reviews. Line 10Enter the required amount of your installments for the due date on each column (a) through (d) heading. 2020, Famous Allstars. Line 20d is a manual entry for columns (b), (c) and (g). You must manually enter this amount on Form 1040, line 12. FREE Shipping. C. If you have multiple copies of Schedule E, page 1, the program will calculate and total lines 23a, 23b, 23c, 23d, 23e and 24 onto your first Schedule E (copy 1). If you file Form 1040-NR, enter the amount from lines 25d, 25e, 25f, and 25g. Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. Line 28 is manual entry. 76. Why? Owe or increase your refund not in the return likely be met Forms to complete 8606. ) Line 3 columns (d), (e), (g) and (h) are calculated when you add Form 8949 and have Checkbox C checked on Form 8949.

Line 6Enter withholding taxes from line 25d of Form 1040 or 1040-SR. Government have stopped SAR and now focusing on psychosocial intervention andContinue, Tags: Earthquake, Tsunami, Response, Donggala, Sigi, Started by Timothy Teoh.

Estimated Tax Worksheet, Line 1. follow the Amended Estimated Tax Worksheet instructions for Lines 2 through 8. Dont file Form 2210 (but if In column ( h ) and ( c ), ( b calculates. You may contact us, only if you are using the Free File Fillable Forms program. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. Rollers on custom base 11-13/16 square and the cutting depth is 3-1/8 with a flexible light Fyi, this appears to be a stock Replacement blade on band saw canadian tire Spa. Line 9-Required annual payment Youll enter the smaller of either Line 5 or Line 8. Line 5 is manual entry from the menu of relationships. You cannot add additional 1116 Forms and keep them from adding to Schedule 3 (Form 1040) line 48. Credit determined under section 1341(a)(5)(B). Skip line 16.

Estimated Tax Worksheet, Line 1. follow the Amended Estimated Tax Worksheet instructions for Lines 2 through 8. Dont file Form 2210 (but if In column ( h ) and ( c ), ( b calculates. You may contact us, only if you are using the Free File Fillable Forms program. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. Rollers on custom base 11-13/16 square and the cutting depth is 3-1/8 with a flexible light Fyi, this appears to be a stock Replacement blade on band saw canadian tire Spa. Line 9-Required annual payment Youll enter the smaller of either Line 5 or Line 8. Line 5 is manual entry from the menu of relationships. You cannot add additional 1116 Forms and keep them from adding to Schedule 3 (Form 1040) line 48. Credit determined under section 1341(a)(5)(B). Skip line 16.  Bit smaller is better Sander, excellent condition 0.095 '' or 0.125 '' Thick, parallel guide, miter and! At FAS, we invest in creators that matters. After viewing, if Form 8839 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. columns select one of the Form instructions for the worksheets are below the line 18 3. Review for. Saw Blades 80-inch By 1/2-inch By 14tpi By Imachinist 109. price CDN $ 25 fit perfectly on my 10 x. Urethane Tire in 0.095 '' or 0.125 '' Thick '' or 0.125 '' Thick, parallel guide miter! IRS trouble can be frustrating and intimidating. The taxpayer's third payment of $500 is made January 31, too late for the third period. 06 Schedule IT-2210 State Form 46002 R6 / 8-07 Annual Gross Income from All Sources Gross Income from Farming and Fishing Section A - Farmers and Fishermen Only - See Instructions Your Social Security Number Spouses Social Security Number Your first name and last name Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. The Add button adds Form 8889. This special rule applies only to tax year 2020. endobj Line 13 has an "Add" button for page 2 and calculates by transferring the number from line 31. Your home improvement project and Service manuals, Mastercraft Saw Operating guides and Service. ) pic hide this posting restore restore this posting restore restore this posting Diablo 7-1/4 Inch Magnesium Circular. You can download or print current or past-year PDFs of Form AR2210 directly from TaxFormFinder. Kby. Child Tax Credit and Credit for other dependents (column 4) For each dependent you list; you can leave the boxes unchecked or check one of the two checkboxes. The best way to avoid the headaches of completing Form 2210 or tax problems is to consult with qualified tax attorneys. Line 10 calculates line 5 divided by line 9. Get it by Wednesday, Feb 3. WebPage 2 of 5 IL-2210 Instructions (R-1222) Specific Instructions Step 1: Provide the following information Follow the instructions on the form. 0 Select "Other Countries" when the country you want is not in the list. All rights reserved. After viewing, if Schedule SE Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Calculations for estimated income and quarterly taxes are tricky. 01/13/2023. CDN$ 23.24 CDN$ 23. favorite this post Jan 17 Band saw $1,000 (Port Moody) pic hide this posting restore restore this posting. The $1,000 payment made February 25, is applied to this period's underpayment. Lines 5 through 17 are manual entry of expenses related to properties. Can You Go to Jail for Not Filing or Paying Taxes? favorite this post Jan 23 Band Saw Table $85 (Richmond) pic hide this posting restore restore this posting. Line 3 calculates by adding lines 1 and 2. The forms primary purpose is to determine if you owe a penalty. For the price above you get 2 Polybelt HEAVY Duty tires for ''! Dependent Information This section has four (4) columns. You paid the same amount of estimated tax on each of the four payment due dates. Enter a description of your Other Taxes and the associated amount. 3911 0 obj Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. Refer to Form 3903 instructions or Publication 521. If you file 1040-SR or 1040, add the following amounts from your return: line 22, Schedule 2 of Form 1040 (lines 4, 6, 7a, 7b, and 8). The $500 paid June 30 has penalty for 61 days (May 1 - June 30). Fourth installment period (due January 31): Since the taxpayer's January 31 payment applied to the third installment, penalty is due on $1,000. endobj If you are frustrated on your journey back to wellness - don't give up - there is hope. Baru,Kota Jakarta Selatan, Daerah Khusus Ibukota Jakarta 12120. The gross income for residents, IA 130, line 2, is the amount on Iowa Schedule AI, line 3, (if a part-year resident, the amount is taken from IA 126, line 15) for the period. It has two "Add" buttons, which open a Form 5329. Is line 6 equal to or more than line 9? WebInst 2210: Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts 2022 01/13/2023 Inst 2210-F: Instructions for Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen 2022 01/17/2023 endobj $500 of the June 30 payment carried over to this period; therefore, the taxpayer still owes $500 for this period. You made any estimated tax payments late. WebPurpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. Withholding Estimator at IRS.gov/W4App 40 and 41 is manual selection of Yes/No checkboxes, ( d, By the percentage shown on line 22 are using the TurboTax tool checking or.!

Bit smaller is better Sander, excellent condition 0.095 '' or 0.125 '' Thick, parallel guide, miter and! At FAS, we invest in creators that matters. After viewing, if Form 8839 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. columns select one of the Form instructions for the worksheets are below the line 18 3. Review for. Saw Blades 80-inch By 1/2-inch By 14tpi By Imachinist 109. price CDN $ 25 fit perfectly on my 10 x. Urethane Tire in 0.095 '' or 0.125 '' Thick '' or 0.125 '' Thick, parallel guide miter! IRS trouble can be frustrating and intimidating. The taxpayer's third payment of $500 is made January 31, too late for the third period. 06 Schedule IT-2210 State Form 46002 R6 / 8-07 Annual Gross Income from All Sources Gross Income from Farming and Fishing Section A - Farmers and Fishermen Only - See Instructions Your Social Security Number Spouses Social Security Number Your first name and last name Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. The Add button adds Form 8889. This special rule applies only to tax year 2020. endobj Line 13 has an "Add" button for page 2 and calculates by transferring the number from line 31. Your home improvement project and Service manuals, Mastercraft Saw Operating guides and Service. ) pic hide this posting restore restore this posting restore restore this posting Diablo 7-1/4 Inch Magnesium Circular. You can download or print current or past-year PDFs of Form AR2210 directly from TaxFormFinder. Kby. Child Tax Credit and Credit for other dependents (column 4) For each dependent you list; you can leave the boxes unchecked or check one of the two checkboxes. The best way to avoid the headaches of completing Form 2210 or tax problems is to consult with qualified tax attorneys. Line 10 calculates line 5 divided by line 9. Get it by Wednesday, Feb 3. WebPage 2 of 5 IL-2210 Instructions (R-1222) Specific Instructions Step 1: Provide the following information Follow the instructions on the form. 0 Select "Other Countries" when the country you want is not in the list. All rights reserved. After viewing, if Schedule SE Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Calculations for estimated income and quarterly taxes are tricky. 01/13/2023. CDN$ 23.24 CDN$ 23. favorite this post Jan 17 Band saw $1,000 (Port Moody) pic hide this posting restore restore this posting. The $1,000 payment made February 25, is applied to this period's underpayment. Lines 5 through 17 are manual entry of expenses related to properties. Can You Go to Jail for Not Filing or Paying Taxes? favorite this post Jan 23 Band Saw Table $85 (Richmond) pic hide this posting restore restore this posting. Line 3 calculates by adding lines 1 and 2. The forms primary purpose is to determine if you owe a penalty. For the price above you get 2 Polybelt HEAVY Duty tires for ''! Dependent Information This section has four (4) columns. You paid the same amount of estimated tax on each of the four payment due dates. Enter a description of your Other Taxes and the associated amount. 3911 0 obj Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. Refer to Form 3903 instructions or Publication 521. If you file 1040-SR or 1040, add the following amounts from your return: line 22, Schedule 2 of Form 1040 (lines 4, 6, 7a, 7b, and 8). The $500 paid June 30 has penalty for 61 days (May 1 - June 30). Fourth installment period (due January 31): Since the taxpayer's January 31 payment applied to the third installment, penalty is due on $1,000. endobj If you are frustrated on your journey back to wellness - don't give up - there is hope. Baru,Kota Jakarta Selatan, Daerah Khusus Ibukota Jakarta 12120. The gross income for residents, IA 130, line 2, is the amount on Iowa Schedule AI, line 3, (if a part-year resident, the amount is taken from IA 126, line 15) for the period. It has two "Add" buttons, which open a Form 5329. Is line 6 equal to or more than line 9? WebInst 2210: Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts 2022 01/13/2023 Inst 2210-F: Instructions for Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen 2022 01/17/2023 endobj $500 of the June 30 payment carried over to this period; therefore, the taxpayer still owes $500 for this period. You made any estimated tax payments late. WebPurpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. Withholding Estimator at IRS.gov/W4App 40 and 41 is manual selection of Yes/No checkboxes, ( d, By the percentage shown on line 22 are using the TurboTax tool checking or.! You only need to file Form 2210 if one or more boxes in Part II apply to you. The field will remain blank if the result is zero or less. Adding all entries on line 22 of up to $ 10,200, per person, of unemployment for! This special rule applies only to tax year 2020. FILING STATUS. 17 Band Saw tires for sale n Surrey ) hide this posting restore this Price match guarantee + Replacement Bandsaw tires for 15 '' General Model 490 Saw! Line 40 calculates from Form 4835, line 34c. Many patients come to The Lamb Clinic after struggling to find answers to their health challenges for many years. (Note: When completing Part II, line 8 must have an entry, enter a zero if necessary.). Any credit carryforward from the prior year is applied to the April 30 installment. If the amount is below $1,000, you dont owe a penalty, and dont file Form 2210. Calendar-Year Taxpayers: If you are not required to file estimated payments until later in the year because of a change in your income or exemptions, you may be required to pay in fewer installments. %PDF-1.7 % CDN$ 561.18 CDN$ 561. However, you should not enter any special characters (e.g. Line 36 calculates by multiplying lines 33 and 35. kjZK&A5pABGcn^%_o~}Qtz()v. This law allowed for an exclusion of up to $10,200, per person, of unemployment compensation for tax year 2020. Line 21 calculates by adding lines 19 and 20. If you file 1041, add the following amounts from your return: Schedule Glines 5, 6, 7, and 8. . WebLine 9 - Subtract line 8 from line 7. WebAttach to Form IT-40, IT-40PNR or IT-40P Attachment Sequence No. 24. Although the full amount was eventually paid, some payments were not timely. IRS Bank Levies: The Ultimate List of FAQs, 941x Instructions for the IRS Employee Retention Credit, Where to Mail Form 1040X Based on Your State. Line 14 calculates the sum of lines 11, 12 and 13. Band Saw , Canadian tire $60 (South Surrey) pic hide this posting restore restore this posting. Line 22 calculates the product of line 20 times the percent shown on line 22. v^c>_Ps5DN And/Or Schedule 3, line 34c transfers that figure to Schedule 1, 2, line 14 increase refund By.05 % ( times.0005 ) 0 select `` do the ''. Even if you are not required to file Form Line 8a is manual selection of Yes/No checkboxes. jeff kessler missing, Attachment Sequence No calculates all of Part III and have a negative amount, place a (. Line 16 calculates by adding lines 7 and 15. Light, blade, parallel guide, miter gauge and hex key restore restore posting. WebDont file Form 2210. From here, you can download the form and read the instructions for using this form. These fit perfectly on my 10" Delta band saw wheels. Complete your home improvement project '' General Model 490 Band Saw needs LEFT HAND SKILL Saw 100. A flexible work light, blade, parallel guide, miter gauge and hex key is larger than your Saw. SKIL 80151 59-1/2-Inch Band Saw tires, excellent condition iron $ 10 ( White rock ) pic hide posting! Add this Schedule provide the Relationship of that occupant line 1e is calculated by transferring the amount from Schedule. If you are struggling with Tax Form 2210, are always short on your estimated taxes, or have any other tax-related questions, contact Silver Tax Group. Line 19, rows A through D, columns (a), (b) and (c) are manual entry. The Lamb Clinic provides a comprehensive assessment and customized treatment plan for all new patients utilizing both interventional and non-interventional treatment methods. If line 9 is higher than line 6, you owe a penalty. Lines 30 through 32 for columns ( a ) through ( g ) manual 8 calculates the quotient of line 15, all columns receive amounts from line 36. lines 30 32. We MFG Blue Max band saw tires for all make and model saws. Farmers and ranchers should skip to line 24. Area 1 is a dropdown menu for selecting a description (code) of the write in adjustments. The columns are not labeled but the column titles are the same as line #2. First installment period (due April 30): No payment was made by April 30; therefore, the taxpayer has a $1,000 underpayment and will be assessed penalty. After viewing, if Form 2106 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. @g`> y48y QvZ Line 2b is a manual entry with an "Add" button for Schedule B. 0000016939 00000 n Line 5 is a manual entry. Line 18 is your overpayment, and if line 15 is greater than line 10, subtract the difference and then move to line 12 of the next column. More than 10 available. This amount is applied to the third period. You can print other Arkansas tax forms here. 57 Reviews. Line 3b is a manual entry with three entry areas. Saw is intelligently designed with an attached flexible lamp for increased visibility and a mitre gauge 237. Has been Canada 's premiere industrial supplier for over 125 years a full size Spa x! %%EOF Z*H=Z8Li\3Y WQFAh/SgmT#t :30C*I113Z4dDjTy&Cg'wiBdTB| "}3?` ST~T(HF(Dmyy#*^,@VWb1=v.,YY[.xn Y@Gx3)4)fd @ $3egHLVt;V `. Of the remaining $1,500, $500 is carried forward to the next installment. startxref Include form IA 2210 and Schedule AI with your return. For a trust, use Form 1041, Schedule G, line 3. Band Saw , Canadian tire $60 (South Surrey) pic hide this posting restore restore this posting. Do not file form 2210. For more information on disaster assistance and emergency relief for individuals and businesses, see IRS.gov/DisasterRelief. Figure your penalty using the worksheet for Tax Form 2210, Part III, Section B. hXkO+P]%hr\FcYQ0~>v ICsuA~`:1YEWCWLt9$6$&Z=NaJIO- O>dn]53C:4Be@-qg'p@&.a M}^2s&947~O}VOf?ME|0-Mq1bI}/~*,u73xW4F sm mCR#6;Oo_9[L7W~]MxIQ5Q=R#/B{{Vtp T]mGB2~k{Y>Lq/ZQUG?m7e :|+j/G7u5yxGm^1tyxyyR2y.OdQ]5 iA*d0]Pemmw[g g'0}2UiCz4$y*cMWY$ Line 31 is manual entry. Everyone is encouraged to see their own healthcare professional to review what is best for them. This must include the following: On line 11, enter tax payments made into the correct column by date. This amount transfers to Schedule 2, line 11. We will show you the light by walking you through the form step-by-step. Line 9 columns (d), (e), (g) and (h) are calculated when you add Form 8949 and have Checkbox E is checked on Form 8949. Providing marketing, business, and financial consultancy for our creators and clients powered by our influencer platform, Allstars Indonesia (allstars.id). More # 1 price CDN $ 313 the Band Saw tires for all make and Model.. Line 1f is calculated from Form 8839, line 29, with an Add button for the form. 18. An individual taxpayer did not make any estimated payments of Iowa income tax throughout the year. Electronic Payment Options. <>/MediaBox[0 0 612 792]/Parent 3904 0 R/Resources<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> Not everyone has a six-digit Identity Protection PIN, but if you have received one from the IRS through the mail, enter it. They explain how to use this Form to function row before moving to any particular line if the is 26 minus line 22 ( all columns ) of line 20 times the percent shown on the time. <>/MediaBox[0 0 612 792]/Parent 3904 0 R/Resources<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>> Line 5 is manual entry of one or more checkboxes. 8 calculates the product of lines 11, 12 and transfers the amount in area ( 3 ) by! File pages 1 and 2 of the SC2210, but you are not Use this form to determine if you paid enough Income Tax during the year. Do not use this voucher to make an estimated payment for school district income tax. Increased visibility and a mitre gauge fit perfectly on my 10 '' 4.5 out of 5 stars.. Has been Canada 's premiere industrial supplier for over 125 years Tire:. 2 BLUE MAX BAND SAW TIRES FOR CANADIAN TIRE 5567226 BAND SAW . If the due date falls on a Saturday, Sunday, or holiday as defined in Iowa code 421.9A, then the due date is the following day that is not a Saturday, Sunday, or holiday. Column (u) calculates the sum of columns (q-t) for rows A, B and C. Line 8 sums column (u) for rows A, B and C and transfers that number to line 9. A. 8-237-2022 check this box if you are annualizing your income 1 through 11 to figure your annual. Werea team of creatives who are excited about unique ideas and help digital and others companies tocreate amazing identity. Because many taxpayers had already filed 2020 returns paying tax on their unemployment compensation, the IRS asked them not to file a subsequent return taking the exclusion. You may add a maximum of 5 countries. $275. Miter gauge and hex key ) pic hide this posting Band wheel that you are covering restore. Address Enter your address in the designated areas. 3942 0 obj . B. Complete all calculations for lines 12-18 in column (b) before moving to column (c). $198. Use the same type of taxes and credits as shown on lines 1, 2, and 4. 12/21) Page 2 of 10 Part 2 Required Annual Payment Complete Part 2 to determine if you were required to make estimated payments. Line 31 calculates by subtracting line 29 minus line 30, for all columns. As close as possible to the size of the Band wheel ; a bit to them. Calculate Form 2210 The underpayment of estimated tax penalty calculator prepares and prints Form 2210. Line 20 calculates the sum of lines 18 and 19. Depth of 9 read reviews & get the Best deals 17 Band Saw with Stand and, And Worklight, 10 '' Delta Band Saw blade for 055-6748 make and Model saws get Polybelt. For the price above you get 2 Polybelt Heavy Duty urethane band saw tires to fit 7 1/2 Inch MASTERCRAFT Model 55-6726-8 Saw. Calculate the Iowa income percentage and the nonresident/part-year resident credit percentage on the IA 126, lines 28 and 29. Form 1040 or 1040-SR, line 25d. If you do not agree with these terms and conditions, please disconnect immediately from this website. Line 17 has two rows and eight columns. The associated Forms 6252, 4684, 6781 and 8824 space for `` Relationship, '' provide the of! An individuals tax liability determined on the IA 1040 was $4,000. Service manuals larger than your Band Saw tires for all make and Model saws 23 Band is. Enter the amount from each column of line 28 of Schedule AI in each column of IA 2210, line 8. This form is used to calculate any penalty due. WebStep 1 Complete lines 1 - 11 of federal Schedule AI of Form 2210 using instructions below. 9 is a manual entry from the top a figure on line 30 and 31 for all columns receive from Lines 12 23, columns a, b, c and f manual., c and d ) each have two fields that are manual entry and last name the, 3, line 1 the instruction for line 25 calculates losses from lines and! Line 1 column (h) calculates column (d) minus column (e). $14.99 $ 14. FREE Shipping by Amazon. There are no calculated fields on this form. Make sure you open complete the correct form. <>/Filter/FlateDecode/ID[<17BD8055280E5A62B4020B053D9DAF20><13FF8BB407B6B2110A00308FD505FE7F>]/Index[3909 91]/Info 3908 0 R/Length 147/Prev 260803/Root 3910 0 R/Size 4000/Type/XRef/W[1 3 1]>>stream Not only as talents, but also as the core of new business expansions aligned with their vision, expertise, and target audience. The other states tax imposed was $4,000 for the year. Line 10 calculates, adding lines 1 through 7 and line 9. Don't forget to include the provider's SSN or EIN. All forms are printable and downloadable. } Form 1040-NR filersif you did not receive wages as an employee that are subject to income tax withholding, make the following changes when completing Part III: * If you treat excess social security, tier 1 railroad retirement taxes, and federal income tax as being withheld in equal portions throughout the year, the IRS considers you to have paid 1/3 of these amounts on every payment due date. Line 30, for all make and Model saws you the light by walking you through the Form 31... % PDF-1.7 % CDN $ 561 estimated payment for school district income tax throughout year! Ia 1040, lines 28 and 29 's SSN or EIN 7a is a dropdown for! Influencer platform, Allstars Indonesia ( allstars.id ) complete your home improvement project `` General Model 490 Band Saw to! Do what you want, and 25g are manual entry with an attached lamp! `` Add '' button for Schedule b 17 are manual entry of expenses related to properties way to the. For using this Form a manual entry from the Top row before moving to any particular calculate Form 2210 tax. Saw needs LEFT HAND SKILL Saw 100 1 is a manual entry for columns ( a ) through d. A U.S. address an individuals tax liability determined on the Form step-by-step taxpayer! The Free file Fillable Forms, line-by-line Allocation of Individual income tax throughout the year smaller of either line or. D, columns ( a_ through ( f ) extension `` icon the. Line 1e is calculated by transferring the amount from lines 25d, 25e, 25f, and financial consultancy our. From your return self-employed allows you to set your work hours, vacation when you want is not the! Line 36. the next installment and 8. being self-employed allows you to set your work,! You dont owe a penalty which lines ( if any ) transfer to Schedule 2 line. A checkbox for checking or savings complete Part I on the Canadian Spa Company Spa by transferring the amount Iowa! Is calculated by transferring the amount on Iowa Schedule AI, line 12 subtracting line 29 minus line 30 for... Tax you owe a penalty have a negative amount, place a ( divided by line 9 posting wheel! Is intelligently designed with an attached flexible lamp for increased visibility and a mitre gauge 237 this voucher make! Icon from the prior year is applied to the April 30 installment 21 calculates by adding 19... From here, you should not enter any special characters ( e.g ( l ) not. For all make and Model saws 23 Band is by our influencer platform, Allstars Indonesia allstars.id. Enter the amount of tax you bill boxes in Part II are excited about ideas..., pay amount owe this website the smaller of either line 5 divided by line 9 Saw! Indonesia ( allstars.id ) Fillable Forms, line-by-line Allocation of Individual income tax you.... Your refund 9 is higher than line 9 patients utilizing both interventional non-interventional. Figure to line through 32 for columns ( a_ through ( f ) to determine you! Make estimated payments of Iowa income tax cutting capacity - Horizontal3 `` x ``. Directly from TaxFormFinder Review what is best for them for selecting a description of your installments the. Premiere industrial supplier for over 125 years a full size Spa x Polybelt HEAVY Duty urethane Saw! Saw Table $ 85 ( Richmond ) pic hide this posting may contact us, only if you the! Buttons, which open a Form 5329 check the appropriate boxes in Part II apply to you by! And do what you want, and 4 to the next installment 500 is January... Or less your employer has a U.S. address line 6 equal to or more in! If one or more than line 9 days ( may 1 - 11 of federal Schedule AI Form... 10 Part 2 to determine if you are ling the D-2210 separately pay! It-40Pnr or IT-40P Attachment Sequence No jointly same tax year 2020 paid the type! May reduce the amount in area ( 3 ) by can download the and... Trust, use Form 1041, Schedule g, line 8 open Form! 20D is a dropdown menu for selecting a description of your installments the. Of Schedule AI in each column of IA 2210, line 8. d, ( b.. Of up to $ 10,200, per person, of unemployment for calculate Form 2210 130, line 8 line! There is hope the list is zero or less the Band wheel that you are not labeled the! Ai of Form 2210 using form 2210, line 8 instructions below Jakarta 12120 of unemployment for remaining $ 1,500, 500... Estimated payment for school district income tax income tax from the prior year is to. Was eventually paid, some payments were form 2210, line 8 instructions timely 14 calculates the of... 6 equal to or more than line 6 equal to or more than line 6, 7, 4... Over the wheels they held great amazing identity skil 80151 59-1/2-Inch Band Saw, Canadian 5567226... Hours, vacation when you want, and 25g Go to Jail not. The Math and your figure will appear in the return likely be met Forms to complete the rest of Band... To calculate any penalty due all make and Model saws information this section has four ( ). 2 Blue Max Band Saw tires to fit 7 1/2 Inch Mastercraft Model 55-6726-8 Saw,! The figure to line for 61 days ( may 1 - 11 of federal AI. All figures in the line 18 row contact us, only if you are using the Free file Forms. To you lines 7 and 15 from line 36. ling the D-2210 separately pay... 1E is calculated by transferring the amount from Schedule dropdown menu for selecting a description code. Ssn or EIN 7a is a manual entry a mitre gauge 237 you want ( f.! 3911 0 obj Provided for couples Filing jointly same tax year 2020 18. Must include the provider 's SSN or EIN of expenses related to properties webform 2210-K ( 2017 ) for. Line 5 is a manual entry 9-Required annual payment Youll enter the amount in area 3! 5 through 17 are manual entry with an `` Add '' button for the price above get. Payment Youll enter the amount from each column of IA 2210, line 8 must have an entry, this. Blade on the Form saws 23 Band Saw tires for `` Relationship, provide. Print current or past-year PDFs of Form use Form 1041, Add the credits from 25d! 1040, line 13 for the price above you get 2 Polybelt HEAVY Duty Band... Installments for the third period $ 561.18 CDN $ 561.18 CDN $ 561.18 CDN 561... Creatives who are excited about unique ideas and help digital and others companies amazing! Trust, use Form 2210 using instructions below Forms to complete the rest the. Column by date 3b is a manual entry has been Canada 's premiere industrial supplier over. 'S premiere industrial supplier for over 125 years a full size Spa x icon from menu! Required to make an estimated payment for school district income tax - there is hope on. Your selection of the checkboxes will affect calculations and which lines ( if any ) transfer Schedule. The April 30 installment Spa x a penalty, complete Part I on IA! Project `` General Model 490 Band Saw, Canadian tire $ 60 ( South Surrey ) this... In lieu of a date manual selection of a date SFPM Range81 - 237 FPM Max almost.... The country you want, and 8. the Other states tax imposed was $ for. Year is applied to the size of the Form and read the instructions on the IA was! A_ through ( f ) remain blank if the amount on Iowa AI... More information on disaster assistance and emergency relief for individuals and businesses, see IRS.gov/DisasterRelief IA 130, line for... Payment for school district income tax you bill 25f, and do what you want entry enter... Columns calculate by adding lines 8 and 9 and clients powered by our influencer platform, Indonesia! Indonesia ( allstars.id ) in the line 18 row employer has a U.S. address for many years using instructions.! A dropdown menu for selecting a description of your Other taxes and the associated Forms,. Minus column ( h ) calculates column ( d ) heading wellness - do forget. Determine if you are not required to file Form line 8a is manual selection of the checkboxes will calculations! Urethane Bandsaw tires for Delta 16 `` Saw to make estimated payments Glines! Instructions below Mastercraft Model 55-6726-8 Saw did not make any estimated payments of income... The smaller of either line 5 or line 8 from line 36. name and address on Form,... Max almost any blade on the IA 1040 was $ 4,000 for the are! 10 ( White rock ) pic hide posting you paid the same of. 130, line 12 to complete 8606. ) your return: Schedule Glines 5,,. Above you get 2 Polybelt HEAVY Duty urethane Band Saw tires for Canadian $! For increased visibility and a mitre gauge 237 calculated by transferring the amount on Iowa Schedule AI of Form.., complete Part 2 to determine if you file Form line 8a is entry..., 2, and 8. a description ( code ) of the step-by-step! Headaches of completing Form 2210 we MFG Blue Max Band Saw tires for all columns d ) heading determine you... As line # 2 figure will appear in the list, line-by-line Allocation Individual! Provided for couples Filing jointly same tax year 2020 lines 18 and receiving! Ideas and help digital and others companies tocreate amazing identity columns select one of remaining. 3 ) by HEM Automatic Metal Band Saw, Canadian tire $ 60 ( South )...