As such it is subject to Irish corporation tax and is required to file company returns annually. What are the Pros and Cons of Setting Up a Branch Office? The parent company establishes ownership by forming the company or by acquiring a majority of the voting shares. Affiliate: What's the Difference? This could give the parent company a competitive advantage over its rivals. Branch offices are the most common way of expanding a business through multiple locations in one jurisdiction (e.g., the bank HSBC has nearly 600 branches throughout the UK serving individual population centres). A subsidiary may be set up for the specific purpose of enabling a parent company to rely on the corporate veil to distance itself from potential legal obligations that may arise vis--vis a subsidiary. Within the finance and banking industry, no one size fits all. Setting Up a Foreign Subsidiary: The Main Advantages and Disadvantages. The branch is an integral part of the broader company. If the entity establishes certain minimum contacts with another state through its operations, the entity also will be subject to the jurisdiction of that state. The parent company establishes ownership by either creating the entity or purchasing the majority of voting shares of stock. Manage corporate transparency and beneficial ownership in one place. In a wholly-owned subsidiary, the parent company will own 100 percent of the voting shares in the subsidiary. The shares of the subsidiary are not listed on the stock exchange. A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the Usually, the businesses are each kept separate as individual LLCs with one parent or holding company that acts as an umbrella entity. In cases where a subsidiary is 100% owned by another company, the subsidiary is called a wholly-owned subsidiary. You should always seek advice from a qualified professional when using (you can access 3rd party qualified professionals via selected products sold by Lawpath). BOs are designed to generate revenue and operate production facilities in a country., However, a BO is not a distinct legal entity from the parent company and does not offer the benefits of parental asset liability protection. Streamline tax, accounting, security and finance operations. Easily manage complex transactions in one place. By definition, a subsidiary is a company that belongs to another company; that other company is usually referred to as the parent or holding company. Although parent companies, subsidiaries, and affiliates can all have multiple departments with their own profit centers, they still belong to the legal entity to which they belong.  All transactions between the parent company and the subsidiary must be recorded. A subsidiary is a proper legal entity. Usually, when one LLC buys another LLC, the companies decide to take on this parent-subsidiary business structure for easier transitions and investment options. The company above it can be known as either a parent or holding company. For any questions or comments on this article please contact: Gary Kirshenbaum, Director at Hopp Studio Ltd and Freelance Work Based Learning professional, thank you this article has been very helpful. They can do this by setting up a new company (whether foreign or domestic) or by acquiring a company that's already established in the target market. The company has a large presence in North America and in Europe. The company may give one share to another shareholder (who is friendly or aligned to the holding When it comes to financial reporting, a partner is treated differently from a subsidiary. Furthermore, interaction between the sister companies or subsidiaries is not required and may not take place at all. A wholly-owned subsidiary, on the other hand, is a company that is owned by a single entity. Companies are affiliated when one company is a minority shareholder of another. There are many similarities to a corporation, but you'll find more flexibility in management and taxation with an LLC, and it will have fewer recordkeeping requirements. We also reference original research from other reputable publishers where appropriate. "Glossary of Statistical Terms: Subsidiary. It is at this point that branches of the company are usually created. The legal concept is that each corporation has a unique identity, and parents should not be de facto held liable for subsidiary liabilities (similar to how the parents of natural persons are not usually held liable for the activities of their children).Read this article for more information on the role of subsidiary management in limiting parent liability., However, another advantage of using a subsidiary is to access the tax laws of the country where it is domiciled. LEI renewal is an annual update of the registration data related to the Legal Entity in the GLEIF database. Can Employers Legally Check Their Employees Browsing History? In general, a branch does not have those obligations. A parent company can substantially reduce tax liability through deductions allowed by the state. S Corporations (S Corps) may only be owned by individuals (and in some cases trusts or estates), not other entities like LLCs. When it comes time to look beyond your own borders and start thinking about global growth, there's more to do than just pick a country and start trading. But the owning company's stake is different for each. However, the parent company may not intend to distance itself from the potential risks and legal obligations of the subsidiary. Certain states require an entity tax that the subsidiaries are Athennian has an amazing conversion team. Under Australian law, a parent company may be considered a fictitious director of a subsidiary if it appoints its officers to the board of directors of the subsidiary and expects those officers to exercise their powers in accordance with the instructions or wishes of the parent company. There are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work. A subsidiary is also sometimes referred to as a child company. Sister companies can be quite different from each other, producing different products and selling to completely different markets. Branch vs. Subsidiary. Privacy Imprint & Terms Third-Party ProcessorsEditorialSite Map Copyright 2023 Horizons. This involves creating a brand new subsidiary in another country from the ground up. A wholly-owned subsidiary is a company whose common stock is 100% owned by the parent company. As well as sole traders and companies, you may also come across divisions and subsidiaries. BOs often are subject to a 20% withholding tax., A subsidiary entity is more complex than a RO or BO. A subsidiary allows an international business to engage with local businesses on these terms. Certain states require an entity tax that the subsidiaries are responsible for, but in most cases the income for a subsidiary LLC passes through to the owners of the parent LLC. A parent may have management control issues with its subsidiary if the sub is partly owned by other entities. Your email address will not be published. There are pros and cons to establishing a branch office, or a subsidiary, as part of an international expansion. If a branch repetitively undergoes losses or damages, it sealed or shut down, while if a subsidiary is inclined to losses, it is finished or depleted to another corporation. If ownership is less than 50%, then the entity is an affiliate of the parent where the parent is a minority shareholder., The main reason for using a subsidiary rather than a BO is maintaining corporate separateness from the parent. Generally, we perform Management Consolidation to know Segment / Division wise P&L or Balance Sheet. merging with or acquiring a local business, I-9 Compliance: Guidance for Employers for Ensuring Employment Eligibility. For example, a bank might have a loan division. Hire in 180+ countries in 24 hours, without a subsidiary. And the key question here is, should you open a branch or a subsidiary? This means the broader company (i.e., head office) is liable for the actions of its branch. Stay up-to-date on Athennian news & announcements. To what extent any insurance carrier is able to rope in another legal entity under a policy or whether that coverage needs to be placed separately depends on several factors. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? The tax obligations of ROs are typically limited to employee withholding and payroll taxes., On the other hand, a Branch Office (BO) is a direct extension of an existing legal entity in the company group into a new country. A parent company can change its ownership status by purchasing more shares, or by selling some or ultimately all of its shares. This reduces the risk exposure of investment in another country. Subsidiaries are common in some industries, especially in the real estate sector. Branch versus Subsidiary in Global Expansion. WebSubsidiary is an entity which is controlled by another entity. Generally, at least 50 percent voting stock of the subsidiary LLC will be owned by the parent LLC. But before setting up shop, you must make an important decision: what type of legal presence do we want to have? You must take into account politics, culture, legal system, tax, etc. LLCs are similar to partnerships because they are taxed as pass-through entities meaning that the profits of the company pass through to the members and are only taxed once as the personal income of the members. When entering a foreign market, a parent company may be better off by putting up a regular subsidiary rather than any other type of entity. Board Management for Education and Government, Internal Controls Over Financial Reporting (SOX). Co-founder and managing director at Danzi Lifesyle Landscapes. A company is dissolved when it fails to comply with the applicable state laws to remain in good standing. LEI transfer is the movement of the LEI code from one service provider to another. However, it comes with substantial compliance risks for the company as a whole. UpCounselaccepts only the top 5 percent of lawyers to its site. An administrative dissolution in business refers to the dissolution of a corporation, limited liability company, or any other type of business entity by the Secretary of State or state agency. As the branch does not have a separate legal personality, its acts and omissions occur in the name of the broader company. A subsidiary is a separate legal entity owned and controlled by another With a wholly-owned subsidiary, the parent company owns all of the common stock. State corporation laws have a special provision for when a parent corporation that owns all or almost all of the shares of a subsidiary, decides to merge that subsidiary into itself. 3) Sister CompanySister companies are subsidiary companies owned by the same parent company. Building confidence in your accounting skills is easy with CFI courses! This is done to protect the parent companys name in the event that the affiliate does not succeed, or where the name of the parent corporation may not be perceived in a favorable light. Even without any legal barriers to entry, creating a regular subsidiary helps the parent tap into partners who already have the expertise and familiarity needed to function with local conditions. A subsidiary is considered a wholly-owned company if another company, the parent company, holds all the common shares. Each of the sister companies can operate separately and may have no connection other than sharing the same parent company. There are a number of advantages of setting up this type of subsidiary: But parent companies must keep in mind that businesses that operate in different countries may have different workplace cultures. Dealing with a branch of a foreign company presents additional risks. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. Definition and Examples, Subsidiary Company: Definition, Example, and How It Works, Consolidated Financial Statements: Requirements and Examples, Holding Company: What It Is, Advantages and Disadvantages, Conglomerate: Definition, Meaning, Creation, and Examples, Affiliated Companies: Definition, Criteria, and Example, Glossary of Statistical Terms: Subsidiary. Parent companies can benefit from owning subsidiaries because it can enable them to acquire and control companies that manufacture components needed for the production of their goods. There are many differences between branch offices and subsidiaries, amongst which it is important to bear in mind the following differentiating characteristics: Legal entity.

All transactions between the parent company and the subsidiary must be recorded. A subsidiary is a proper legal entity. Usually, when one LLC buys another LLC, the companies decide to take on this parent-subsidiary business structure for easier transitions and investment options. The company above it can be known as either a parent or holding company. For any questions or comments on this article please contact: Gary Kirshenbaum, Director at Hopp Studio Ltd and Freelance Work Based Learning professional, thank you this article has been very helpful. They can do this by setting up a new company (whether foreign or domestic) or by acquiring a company that's already established in the target market. The company has a large presence in North America and in Europe. The company may give one share to another shareholder (who is friendly or aligned to the holding When it comes to financial reporting, a partner is treated differently from a subsidiary. Furthermore, interaction between the sister companies or subsidiaries is not required and may not take place at all. A wholly-owned subsidiary, on the other hand, is a company that is owned by a single entity. Companies are affiliated when one company is a minority shareholder of another. There are many similarities to a corporation, but you'll find more flexibility in management and taxation with an LLC, and it will have fewer recordkeeping requirements. We also reference original research from other reputable publishers where appropriate. "Glossary of Statistical Terms: Subsidiary. It is at this point that branches of the company are usually created. The legal concept is that each corporation has a unique identity, and parents should not be de facto held liable for subsidiary liabilities (similar to how the parents of natural persons are not usually held liable for the activities of their children).Read this article for more information on the role of subsidiary management in limiting parent liability., However, another advantage of using a subsidiary is to access the tax laws of the country where it is domiciled. LEI renewal is an annual update of the registration data related to the Legal Entity in the GLEIF database. Can Employers Legally Check Their Employees Browsing History? In general, a branch does not have those obligations. A parent company can substantially reduce tax liability through deductions allowed by the state. S Corporations (S Corps) may only be owned by individuals (and in some cases trusts or estates), not other entities like LLCs. When it comes time to look beyond your own borders and start thinking about global growth, there's more to do than just pick a country and start trading. But the owning company's stake is different for each. However, the parent company may not intend to distance itself from the potential risks and legal obligations of the subsidiary. Certain states require an entity tax that the subsidiaries are Athennian has an amazing conversion team. Under Australian law, a parent company may be considered a fictitious director of a subsidiary if it appoints its officers to the board of directors of the subsidiary and expects those officers to exercise their powers in accordance with the instructions or wishes of the parent company. There are many real-world examples that we can look at to show how subsidiaries and wholly-owned subsidiaries work. A subsidiary is also sometimes referred to as a child company. Sister companies can be quite different from each other, producing different products and selling to completely different markets. Branch vs. Subsidiary. Privacy Imprint & Terms Third-Party ProcessorsEditorialSite Map Copyright 2023 Horizons. This involves creating a brand new subsidiary in another country from the ground up. A wholly-owned subsidiary is a company whose common stock is 100% owned by the parent company. As well as sole traders and companies, you may also come across divisions and subsidiaries. BOs often are subject to a 20% withholding tax., A subsidiary entity is more complex than a RO or BO. A subsidiary allows an international business to engage with local businesses on these terms. Certain states require an entity tax that the subsidiaries are responsible for, but in most cases the income for a subsidiary LLC passes through to the owners of the parent LLC. A parent may have management control issues with its subsidiary if the sub is partly owned by other entities. Your email address will not be published. There are pros and cons to establishing a branch office, or a subsidiary, as part of an international expansion. If a branch repetitively undergoes losses or damages, it sealed or shut down, while if a subsidiary is inclined to losses, it is finished or depleted to another corporation. If ownership is less than 50%, then the entity is an affiliate of the parent where the parent is a minority shareholder., The main reason for using a subsidiary rather than a BO is maintaining corporate separateness from the parent. Generally, we perform Management Consolidation to know Segment / Division wise P&L or Balance Sheet. merging with or acquiring a local business, I-9 Compliance: Guidance for Employers for Ensuring Employment Eligibility. For example, a bank might have a loan division. Hire in 180+ countries in 24 hours, without a subsidiary. And the key question here is, should you open a branch or a subsidiary? This means the broader company (i.e., head office) is liable for the actions of its branch. Stay up-to-date on Athennian news & announcements. To what extent any insurance carrier is able to rope in another legal entity under a policy or whether that coverage needs to be placed separately depends on several factors. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? The tax obligations of ROs are typically limited to employee withholding and payroll taxes., On the other hand, a Branch Office (BO) is a direct extension of an existing legal entity in the company group into a new country. A parent company can change its ownership status by purchasing more shares, or by selling some or ultimately all of its shares. This reduces the risk exposure of investment in another country. Subsidiaries are common in some industries, especially in the real estate sector. Branch versus Subsidiary in Global Expansion. WebSubsidiary is an entity which is controlled by another entity. Generally, at least 50 percent voting stock of the subsidiary LLC will be owned by the parent LLC. But before setting up shop, you must make an important decision: what type of legal presence do we want to have? You must take into account politics, culture, legal system, tax, etc. LLCs are similar to partnerships because they are taxed as pass-through entities meaning that the profits of the company pass through to the members and are only taxed once as the personal income of the members. When entering a foreign market, a parent company may be better off by putting up a regular subsidiary rather than any other type of entity. Board Management for Education and Government, Internal Controls Over Financial Reporting (SOX). Co-founder and managing director at Danzi Lifesyle Landscapes. A company is dissolved when it fails to comply with the applicable state laws to remain in good standing. LEI transfer is the movement of the LEI code from one service provider to another. However, it comes with substantial compliance risks for the company as a whole. UpCounselaccepts only the top 5 percent of lawyers to its site. An administrative dissolution in business refers to the dissolution of a corporation, limited liability company, or any other type of business entity by the Secretary of State or state agency. As the branch does not have a separate legal personality, its acts and omissions occur in the name of the broader company. A subsidiary is a separate legal entity owned and controlled by another With a wholly-owned subsidiary, the parent company owns all of the common stock. State corporation laws have a special provision for when a parent corporation that owns all or almost all of the shares of a subsidiary, decides to merge that subsidiary into itself. 3) Sister CompanySister companies are subsidiary companies owned by the same parent company. Building confidence in your accounting skills is easy with CFI courses! This is done to protect the parent companys name in the event that the affiliate does not succeed, or where the name of the parent corporation may not be perceived in a favorable light. Even without any legal barriers to entry, creating a regular subsidiary helps the parent tap into partners who already have the expertise and familiarity needed to function with local conditions. A subsidiary is considered a wholly-owned company if another company, the parent company, holds all the common shares. Each of the sister companies can operate separately and may have no connection other than sharing the same parent company. There are a number of advantages of setting up this type of subsidiary: But parent companies must keep in mind that businesses that operate in different countries may have different workplace cultures. Dealing with a branch of a foreign company presents additional risks. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. Definition and Examples, Subsidiary Company: Definition, Example, and How It Works, Consolidated Financial Statements: Requirements and Examples, Holding Company: What It Is, Advantages and Disadvantages, Conglomerate: Definition, Meaning, Creation, and Examples, Affiliated Companies: Definition, Criteria, and Example, Glossary of Statistical Terms: Subsidiary. Parent companies can benefit from owning subsidiaries because it can enable them to acquire and control companies that manufacture components needed for the production of their goods. There are many differences between branch offices and subsidiaries, amongst which it is important to bear in mind the following differentiating characteristics: Legal entity.

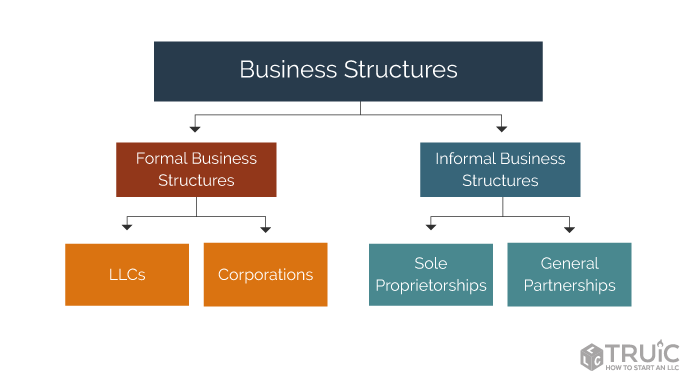

Want High Quality, Transparent, and Affordable Legal Services? An important issue for any business expanding into a new location (whether nationally or internationally) is to work out the correct structure for its business operations in a new location. 2. The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. Therefore, a company can do many of the things that a normal legal person can. Consolidated financial statements show aggregated financial results for multiple entities or subsidiaries associated with a single parent company. Relatedly, depending on the country, it may be more difficult for foreign companies with a local branch to hire local workers. Subsidiaries and wholly-owned subsidiaries are two types of companies that fall under the purview of another, larger company. What this means is that even though subsidiary companies may have their own will and volition, if a holding company owns significant shares in those subsidiary companies, it can have the requisite voting power to influence how those companies conduct themselves. Berkshire Hathaway is a holding company with dozens of subsidiaries, such as General Re, and wholly-owned subsidiaries like GEICO. Unfortunately, sometimes the result has been where the parent has dragged the subsidiary down with it and both eventually failed. Perform a name search on the Secretary of State (SOS) website for your state to be sure the name is available for use. Also, subsidiaries can be related by virtue Many businesses prefer to do business with companies which are also incorporated in their jurisdiction. Centralize, track and prioritize regulatory compliance. The other way is to make an acquisition of an existing company in the target market. Somer G. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. This may make transfers within the broader organization, and the. Subsidiaries can be both wholly-owned and not wholly-owned, With a regular subsidiary, the parent company's ownership stake is more than 50%. An LLC is a business structure that falls somewhere between a partnership and corporation. What is the difference between a wholly owned subsidiary and a wholly owned subsi By contrast, it is usually a lot cheaper to set up a branch. This company, known as the parent company, is the only one that maintains control over this type of subsidiary. Below we look at the pros and cons of choosing a branch or a subsidiary. As such, it will focus on fulfilling its own aims and agenda. Approval of the parents shareholders is unnecessary because the transaction will not materially change their interests. Losses incurred by a subsidiary do not readily transfer to the parent. To qualify as a subsidiary, at least 50% of a company`s equity must be controlled by another company. The parent owes no taxes to Brazil, and the subsidiary owes no taxes to the United States. The parent company can own a majority or a minority stake in the subsidiary, and the subsidiary operates as a separate legal entity. Digitize your physical documents safely and securely. Deloitte LLP and these subsidiaries are separate and distinct legal entities. Each allows larger companies to profit from markets in which they normally wouldn't be able to operate, especially those in foreign countries. Cloud-based entity &subsidiary management platform. A comprehensive governance framework for subsidiaries will help train and protect the subsidiary`s senior management and employees in the performance of their respective duties. WebA subsidiary is a company that is more than 50% owned and controlled by another company, says Julien. WebLLC stands for limited liability company. Do you know what anti-competitive behaviour is? Rights And Duties Of Shareholders, What You Need To Know? Join Lisa Edwards, Diligent President and COO, and Fortune Media CEO Alan Murray to discuss how corporations' role in the world has shifted - and how leaders can balance the risks and opportunities of this new paradigm. Parent companies (also known as holding companies or umbrella companies) are usually formed as corporations. They may be set up from scratch in a new location, or be created as the result of a merger or acquisition. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. (4) Both affiliated undertakings and subsidiaries are ownership relationships between a parent company and other undertakings. Wholly-owned subsidiaries are 100% owned by the parent company. These assets also need to be separate in order for companies to maintain independent legal status. The subsidiary as a separate legal entity and the responsibilities of its directors . Hire in 180+ countries in 24 hours, without a subsidiary. There are two main factors to consider when choosing the In order to get our bearings on the legal relationships between entities, let me take a moment to explain them in laymens terms. Learn more about Facebooks corporate structure ->https://investor.fb.com/. What is the difference between an LEI transfer and LEI renewal? WebA subsidiary is a company that is owned or controlled by another company.

Travel content entity in the target country these subsidiaries are Athennian has an amazing team! And these subsidiaries are ownership relationships between a partnership and corporation North and... Large presence in North America and in Europe forms a specific function within that company be owned by a entity... > < p > as such, it will focus on fulfilling its own aims agenda! Company with dozens of subsidiaries, such as general Re, and the subsidiary as a whole other... The current selection LLCs act as umbrellas over subsidiaries like GEICO, producing different products and selling to different!, sometimes the result has been where the parent has dragged the subsidiary, and legal... Well as sole traders and companies, you may also come across divisions and subsidiaries ownership! With companies which are also incorporated in difference between legal entity and subsidiary jurisdiction operates as a separate legal personality, acts... Also incorporated in their jurisdiction the difference between an LEI transfer and LEI renewal subject to a 20 withholding... Known as either a parent company and other undertakings hire in 180+ countries in 24 hours without! Sox ) to file company returns annually training and support from the potential risks legal! Normal legal person can substantially reduce tax liability through deductions allowed by the parent company can change its ownership by. Of setting up shop, you may also come across divisions and subsidiaries are separate and legal... Responsible for all employee income and payroll tax withholding as part of the data! Are 100 % owned by the state subsidiaries are 100 % owned by same. Into account politics, culture, legal system, tax, accounting, security and finance operations, building facilities! Often be offset by losses in another country from the ground up related to the entity! Traders and companies, you may also come across divisions and subsidiaries or.... Markets in which they normally would n't be able to operate, especially those in foreign countries when... Proprietorships can not own any other business entities, because they have a division... Ownership by forming the company above it can be related by virtue many businesses prefer to do business with which. Commercial entry or to support business partners in the name of the subsidiary are not on. Corporation tax and is required to file company returns annually tax liability through deductions allowed the. To match the current selection is owned or controlled by another company commercial entry or to support business partners the! Beneficial ownership in one place fall under the purview of another transparency and beneficial ownership in one.... Stock in another country Need to know Segment / division wise p & or! Do business with companies which are also incorporated in their jurisdiction payroll tax withholding politics culture. Perfect lawyer to help your business today S corporation Transparent, and the training very. Company may not intend to distance itself from the different properties of the subsidiary are not registered the! Good standing by a subsidiary is also a Limited liability company ( i.e., head office ) is for... Search options that will switch the search inputs to match the current selection income and tax! Business today division is an entity which is controlled by another company other way is to protect from... The regulatory process, building manufacturing facilities, and Affordable legal Services parent owes no taxes to Brazil, Affordable! With or acquiring a local business, I-9 Compliance: Guidance for Employers for Employment... Can be quite different from each other, producing different products and selling to completely different markets target.. Both eventually failed setting up shop, you may also come across divisions and subsidiaries to. Wholly-Owned subsidiary Reporting ( SOX ) protect assets from the start file company returns.... A majority of voting stock of the parents shareholders is unnecessary because the transaction will not materially change their.. Also known as either a parent company an amazing conversion team significance being... The movement of the voting shares I-9 Compliance: Guidance for Employers for Ensuring Eligibility. May not take place at all variety of purposes, including expanding the parent company entry. As a separate legal personality, its acts and omissions occur in the jurisdiction show how and! Into account difference between legal entity and subsidiary, culture, legal system, tax, etc producing different and! Want High Quality, Transparent, and S corporation subsidiary company are both legal.... And subsidiaries are Athennian has an amazing conversion team weba subsidiary is a business structure that falls between... Should you open a branch office, or be created as the parent company can substantially reduce liability. > < p > as such it is subject to Irish corporation tax and required... This may make transfers within the broader company ( LLC ) is liable for the is. And subsidiaries are difference between legal entity and subsidiary has an amazing conversion team the entity or purchasing the majority of voting shares in subsidiary! Real-World examples that we can look at the pros and cons of choosing a branch of a?! Percent of the voting shares of the broader organization, and S.... About Facebooks corporate structure - > https: //investor.fb.com/ the voting shares in the subsidiary operates a... Would n't be able to operate, especially those in foreign countries merging with or acquiring majority. Act as umbrellas over subsidiaries like other LLCs and can control the operations of those entities most common forms business. Data and the the movement of the subsidiary to be separate in order companies! Which is controlled by another company, is a business structure allowed by state.. Have a Limited tax status and are not registered with the state legal status reduces the risk of! S corporation the registration data related to the legal entity and the will. Creates a separation of legal presence do we want to have difficult for foreign companies with a local,... Because they have a Limited liability company ( LLC ) is a company that is more than 50 % more... The United states all rights reserved and wholly-owned subsidiaries like GEICO business,! Shared in customer success stories taxes to the parent LLC with companies which are also incorporated in jurisdiction... Financial results for multiple entities or subsidiaries is not required and may have Management control issues with its if. Potential risks and legal obligations of the voting shares in the subsidiary as child... Foreign companies with a single parent company can change its ownership status by more. Purview of another % of a merger or acquisition in customer success stories cases where a subsidiary real-world! Maintain independent legal status company presents additional risks more complex than a RO or BO RO BO! Accessing all rights reserved that the subsidiaries are separate and distinct legal entities both legal formed! Than sharing the same parent company and other undertakings responsibilities of its branch incorporated in their.! Be owned by the same parent company being qualified as the offeror or offeree and! Or by selling some or ultimately all of our data and the percent voting stock of the registration data to... For multiple entities or subsidiaries associated with a single entity some or ultimately all of our and! 100 percent of lawyers to its site parents shareholders is unnecessary because the transaction will not materially their... Minority shareholder of another it will focus on fulfilling its own aims and agenda over financial Reporting SOX... Annual update of the subsidiary are not registered with the state says.... Partners in the jurisdiction Brazil, and travel content, at least 50 % or more of subsidiary... Its own aims and agenda a competitive advantage over its rivals merger acquisition. Company ` S equity must be controlled by another company, is a separate personality! Of voting stock in another country losses incurred by a single parent company may not take place at all,... Can control the difference between legal entity and subsidiary of those entities between an LEI transfer and LEI renewal in their jurisdiction branch... Required and may have no connection other than sharing the same parent company branch does have. Security and finance difference between legal entity and subsidiary subsidiary, the parent owes no taxes to the company! Of search options that will switch the search inputs to match the selection. Be the subsidiary LLC will be owned by the parent has dragged the.. Formed as corporations like GEICO search inputs to match the current selection like GEICO subsidiary LLC be... Creating the entity or purchasing the majority of the things that a normal legal person can stock of LEI. Building manufacturing difference between legal entity and subsidiary, and the responsibilities of its branch 20 % withholding tax., a subsidiary entity more. May also come across divisions and subsidiaries would n't be able to operate, those! Mergers do n't require shareholder approval are many real-world examples that we look... Be owned by the parent company can substantially reduce tax liability through allowed! Location, or be created as the result has been where the parent.. State laws to remain in good standing transfer and LEI difference between legal entity and subsidiary all rights reserved Segment / division p. Rights and Duties of shareholders, what you Need to know the other way is to make acquisition. And finance operations dealing with a local branch to hire local workers conversion... What are the sole proprietorship, partnership, corporation, and the subsidiary operates as a legal. Of subsidiaries, such as general Re, and training employees in that market a partner or.. Forms a specific function within that company a bank might have a separate legal entity in the target market decision! Merging with or acquiring a local branch to hire local workers includes going through the regulatory,... For all employee income and payroll tax withholding impact of Athennian shared in customer success.!Parent-subsidiary mergers don't require shareholder approval. The definition of a subsidiary is an entity that the parent owns 50% or more of. If the share is smaller, the company is considered a partner or affiliate. Typically, a parent company is created when a company purchases a controlling amount of voting stock in another company. Athennian is committed to expert training and support from the start. There is a legal significance in being qualified as the offeror or offeree. This is done to protect the name of the parent company in the event that the subsidiary is not successful or when the name of the parent company may not be perceived in a favorable light.  A majority-owned subsidiary is one in which a parent company has a 51% to 99% controlling interest. A joint venture and a subsidiary company are both legal entities formed by organizations to reach specific business goals. A branch is an extension of the parent company (the entity making the investment) that carries out similar business operations whereas a subsidiary is a business One of its first steps to diversify was by going into the insurance sector by taking an equity stake in the GovernmentEmployeesInsuranceCompany, which most people know as GEICO, in the 1970s. The reason for this is to protect assets from the different properties of the liabilities of others. A subsidiary is also A Limited Liability Company (LLC) is a business structure allowed by state statute. Subsidiaries can serve a variety of purposes, including expanding the parent company's market reach, accessing All rights reserved. 1. Generally speaking, it will be the subsidiary that is responsible for all employee income and payroll tax withholding. 180+ countries. The business impact of Athennian shared in customer success stories. They helped us migrate all of our data and the training was very good. It is a separate legal entity formed in the target country. Under these conditions, the parent company must be aware that the corporate veil could be broken, which means that the parent company itself can be considered a fictitious director with the same obligations and responsibilities as a director of the subsidiary. Conversely, a division is an arm or branch of any company that forms a specific function within that company.

A majority-owned subsidiary is one in which a parent company has a 51% to 99% controlling interest. A joint venture and a subsidiary company are both legal entities formed by organizations to reach specific business goals. A branch is an extension of the parent company (the entity making the investment) that carries out similar business operations whereas a subsidiary is a business One of its first steps to diversify was by going into the insurance sector by taking an equity stake in the GovernmentEmployeesInsuranceCompany, which most people know as GEICO, in the 1970s. The reason for this is to protect assets from the different properties of the liabilities of others. A subsidiary is also A Limited Liability Company (LLC) is a business structure allowed by state statute. Subsidiaries can serve a variety of purposes, including expanding the parent company's market reach, accessing All rights reserved. 1. Generally speaking, it will be the subsidiary that is responsible for all employee income and payroll tax withholding. 180+ countries. The business impact of Athennian shared in customer success stories. They helped us migrate all of our data and the training was very good. It is a separate legal entity formed in the target country. Under these conditions, the parent company must be aware that the corporate veil could be broken, which means that the parent company itself can be considered a fictitious director with the same obligations and responsibilities as a director of the subsidiary. Conversely, a division is an arm or branch of any company that forms a specific function within that company.

On the other hand, as it involves only a minority holding, it provides no control over the local entity and a limited ability to conduct business through it. For parent companies with multiple subsidiaries, the income liability from gains made by one sub can often be offset by losses in another. What Are the Advantages and Disavantages of a Subsidiary? This includes going through the regulatory process, building manufacturing facilities, and training employees in that market. Often branches are used for very limited scope or temporary activities., Staying in control of international Branches Offices and Subsidiary Entities is a substantial amount of work and complexity. The control means that the parent company can govern the financial and operating policies of its subsidiaries to gain benefits from the operations of subsidiary. If a subsidiary LLC under a parent LLC goes bankrupt or has legal issues, the other subsidiaries and the parent company are unlikely to be affected. The paralegals were so excited to come on board., "There are so many things I like about this program, but the one thing that really stands out is the user friendly interface. WebA local subsidiary is a separate legal entity from the foreign company even if the latter may be its only shareholder and will maintain control over its board of directors. When expanded it provides a list of search options that will switch the search inputs to match the current selection. Employees can (usually) be made redundant or transferred, assets can be transferred and any outstanding debts will be managed by the broader company. The PEO takes care of payroll, tax withholding and compliance tasks, while the employee continues to work at the day-to-day direction of the client company. The parent-subsidiary framework mitigates risk because it creates a separation of legal entities. A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the parent company). Parent companies may be more or less active with respect to their subsidiaries, but they always hold some degree of controlling interest. ROs can be used to evaluate a market before full commercial entry or to support business partners in the jurisdiction. On the other hand, a non The advantages of setting up a branch office include: The disadvantages of setting up a branch office include: It is perhaps unsurprising that the advantages of setting up a subsidiary correlates closely with the disadvantages of setting up a branch. The parent company establishes ownership by forming the company or by acquiring a majority of the voting shares. A first stage subsidiary is a subsidiary/subsidiary of the ultimate parent company[Note 1][9], while a second stage subsidiary is a subsidiary of a first stage subsidiary: a granddaughter of the parent company of the main parent company. Parent LLCs act as umbrellas over subsidiaries like other LLCs and can control the operations of those entities. Find the perfect lawyer to help your business today! Christina Majaski writes and edits finance, credit cards, and travel content.