Larry pulls an envelope from oneof the compartments. Bring all required documents to the bank. WebOpen an estate account Ensure assets are secure Partition family property Medium term Recover amounts due Prepare tax returns Obtain approval to distribute assets Pay Open the estate account. Shop stress-free with our tools and advice. Youll receive a full year of Estate at Ease for a flat fee of $525 (plus tax) per estate regardless of the number of documents, letters or phone calls. LegalZoom provides access to independent attorneys and self-service tools. The executor also must pay all federal and state taxes owed by the estate. Once youre ready to start making decisions for your inheritance, one of the best things you can do is get the help of a professional, like a financial advisor. Meet with a banking specialist in person at a branch that is most convenient for you. As there is no inheritance tax in Canada, all income earned by the deceased is taxed on a final return.

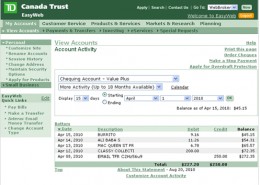

An important member of RBC Royal Trust, the Real Estate Officer is accountable for the administration of various real estate activities and tasks from the initial onboarding of the property to its disposition. The executor of the estate needs to follow these basic steps. In thebackground, people are walking along the path. WebWhat is an estate and estate settlement? Well help you fulfill your executor duties by managing the day to day administration of the estate. Estate settlement involvesmanaginga person's affairs after their death. If you know or are the Executor or Authorized Representative for the Estate, contact a TD representative with whom you have a trusted existing relationship, or visit any TD branch. Discover the ways a Tax-Free Savings Account (TFSA) can help you grow your savings. Download these questions plus more with the Advisorsavvy community newsletter subscribe now and enjoy a wealth of knowledge. We apologize for any inconvenience.

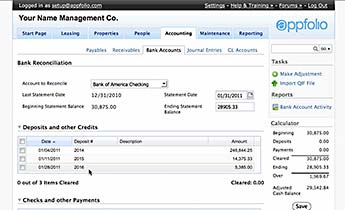

Its a copy of the entry for the deceased in the provinces death register. tennessee wraith chasers merchandise / thomas keating bayonne obituary Every estate trustee has a duty to keep complete records of the estate and to provide accounts to the beneficiaries of the residue of the estate, and where appropriate to have them approved by the Court (learn more about passing accounts here) at the conclusion of the estate administration or if the estate administration goes on for a number of years at reasonable intervals. LegalZoom.com, Inc. All rights reserved. Estate services for First Nations peopleOpens a new window in your browser. Courts of Saskatchewan: Probating an EstateOpens a new window in your browser. For the best experience, please update to a modern browser like Chrome, Edge, Safari or Mozilla Firefox. A bank account is opened in the trusts name. Decide on the objectives of your Estate plan. Quebec has different steps to settle an estate. This link will open in a new window. What taxes are payable at death in Canada? You can obtain an EIN online on the Internal Revenue Service (IRS) web page. The process for closing probate depends on the state in which probate takes place, but it generally involves a final accounting that shows all the transactions that have affected the estate's funds during the probate process. An associate calls you to learn about your loved ones estate and identify documents pertaining to the estate. The property held in trust is not subject to probate proceedings. Another colour photo appears with Andrea on her wedding day with her mother beside her. Start saving today, tax-free.

Its a copy of the entry for the deceased in the provinces death register. tennessee wraith chasers merchandise / thomas keating bayonne obituary Every estate trustee has a duty to keep complete records of the estate and to provide accounts to the beneficiaries of the residue of the estate, and where appropriate to have them approved by the Court (learn more about passing accounts here) at the conclusion of the estate administration or if the estate administration goes on for a number of years at reasonable intervals. LegalZoom.com, Inc. All rights reserved. Estate services for First Nations peopleOpens a new window in your browser. Courts of Saskatchewan: Probating an EstateOpens a new window in your browser. For the best experience, please update to a modern browser like Chrome, Edge, Safari or Mozilla Firefox. A bank account is opened in the trusts name. Decide on the objectives of your Estate plan. Quebec has different steps to settle an estate. This link will open in a new window. What taxes are payable at death in Canada? You can obtain an EIN online on the Internal Revenue Service (IRS) web page. The process for closing probate depends on the state in which probate takes place, but it generally involves a final accounting that shows all the transactions that have affected the estate's funds during the probate process. An associate calls you to learn about your loved ones estate and identify documents pertaining to the estate. The property held in trust is not subject to probate proceedings. Another colour photo appears with Andrea on her wedding day with her mother beside her. Start saving today, tax-free.

Are you the estateexecutor? about CIBC Payment Protector Insurance for Credit Cards. Taxes may vary depending on the size of the estate. Web+254-730-160000 +254-719-086000. Before you can open an account in the name of the estate, the financial institution will require you to show proof that you are authorized to manage the assets of the estate, known as letters testamentary or letters of administration. Honest talk: you might be tempted to immediately spend your inheritance. WebCWB Financial Group (CWB) is on a mission to become the best full-service bank for business owners in Canada. Were here to support you through the estates journey at CIBC. We're sorry, CIBC Online Banking is currently unavailable. Receive the latest savvy articles and guides delivered straight to your inbox. Our primary goal in developing this publication is to provide you with an easy-to-follow The screen fades to white. accepted an estate without explicitly stating your intention to do so. WebIt is important to open an estate bank account because, as an executor, you are not allowed to mix estate transactions with your own personal transactions. Gifts are money or assets received from individuals with no expectation to return the funds, repay the amount or provide services/products in exchange. With that in mind, here are some of the best low-volume small business bank accounts in Canada. Shescentred in the middle, smiling at the camera. Estate trustees are not obligated to seek investment returns, and they should avoid making any risky investments. However, the fees are generally lower, which makes them a great place for new business owners to start. If you continue to use this site we will assume that you are happy with it. Estate accounts for Court purposes (formal accounts) have a highly specialized format. ; ; ; ; subject to our Terms of Use.

Description: The video shifts to a view of Cheryl seated outside withher daughter, looking through the photo album.

Description: The video shifts to a view of Cheryl seated outside withher daughter, looking through the photo album.  Supreme Court of Prince Edward Island: Estate Court (PDF, 840 KB)Opens a new window in your browser. An estate refers to all of the possessions a person leaves behind when he or she dies, including liquid investments, real property,

Supreme Court of Prince Edward Island: Estate Court (PDF, 840 KB)Opens a new window in your browser. An estate refers to all of the possessions a person leaves behind when he or she dies, including liquid investments, real property,  Get expert help with accounts, loans, investments and more. cEA2]4/7C_75;8^ca8s7H

Fvj1 '44 *UE7QY^d/T1A Views expressed in those events, articles and videos are those of the person being interviewed. First, you need to determine if the residence is principal or secondary. not LegalZoom, and have not been evaluated by LegalZoom for accuracy, The person you choose to administer your estate will use the account's funds to settle your debts, pay taxes and distribute assets. Shespeaks into the headset microphone and introduces herself. Carry out the deceaseds wishes as outlined in the will (if they had a will) or according to local estate laws. Conversely, however, it is quite possible that the estate may not have earned any investment income (or the amount earned may be minimal). Arrow keys or space bar to move among menu items or open a sub-menu. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. generalized educational content about wills. ESC to close a sub-menu and return to top level menu items. to qualify for the CIBC Smart Account offer. Webestate bank account canada . During the probate process, the court appoints an executor (the person named in the will) or, when there isn't a will, an administrator. form.

Get expert help with accounts, loans, investments and more. cEA2]4/7C_75;8^ca8s7H

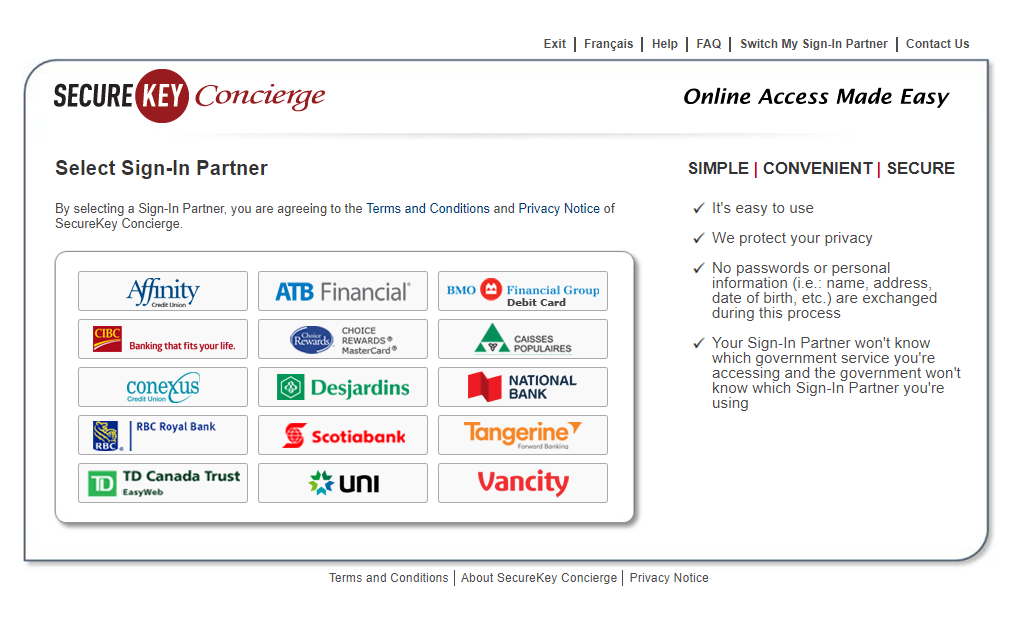

Fvj1 '44 *UE7QY^d/T1A Views expressed in those events, articles and videos are those of the person being interviewed. First, you need to determine if the residence is principal or secondary. not LegalZoom, and have not been evaluated by LegalZoom for accuracy, The person you choose to administer your estate will use the account's funds to settle your debts, pay taxes and distribute assets. Shespeaks into the headset microphone and introduces herself. Carry out the deceaseds wishes as outlined in the will (if they had a will) or according to local estate laws. Conversely, however, it is quite possible that the estate may not have earned any investment income (or the amount earned may be minimal). Arrow keys or space bar to move among menu items or open a sub-menu. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. generalized educational content about wills. ESC to close a sub-menu and return to top level menu items. to qualify for the CIBC Smart Account offer. Webestate bank account canada . During the probate process, the court appoints an executor (the person named in the will) or, when there isn't a will, an administrator. form. In theory, these accounts should be set up with a contributor or settlor (typically the parent or grandparent who opens the account), a named trustee (usually the contributor or settlor) and a beneficiary who is the ultimate owner of everything invested (typically a minor child). I sent additional accounts to be linked in January 22nd (before my account was activated on the 1st) and The EQ Bank Savings Account thread - 2.50% - USD account is out: 2.00% - Page 4 - RedFlagDeals.com Forums In provinces other than Quebec, probate is the process of getting the courts confirmation that the will is valid and confirm the executors authority to settle the estate. Andrea: stayed in the UnitedStates for a number of years and then moved to Canada. Generally, it is not required that every estate has its own account, but most executors use them because they are so effective in helping to manage the estate with clarity and accountability. Inheritance vs. a gift: whats the difference? Our expert answers your questions. 1313 0 obj <>/Filter/FlateDecode/ID[<5982BB61EDF575438E219C1057F6734A><1104B262805A754AB9F8E82029A73DF2>]/Index[1297 28]/Info 1296 0 R/Length 86/Prev 942846/Root 1298 0 R/Size 1325/Type/XRef/W[1 2 1]>>stream It is very common for estate trustees to request that a beneficiary sign a release before the estate trustee pays a distribution to the beneficiary. Turning the property into a rental would make it a secondary residence. Get the right guidance with an attorney by your side. The wholeprocess is designed around simplicity for the customer and efficiency for thecustomer. Always be sure to keep accurate records of all the transactions made with the account and keep the estate account separate from your personal accounts. Estate Administrator:A legal term referring to a person appointed by the court to administer the Estate of a deceased person who died without making a Will. How you can create a plan that reflects your wishes and what you want for your loved ones. Bank policies vary as to what documents are required, but all will ask for the court document naming you as the estate's executor or administrator. 4. Opening an estate account is an effective way to keep the assets of the estate separate and to stay organized when handling the estate, without commingling the estates assets with your own. For example, they will likely pay income taxes and investment income taxes. The Opportunity Our Real Estate team includes a diverse group of banking professionals who strive every single day to achieve strong results for the bank and their clients. If In an estate account, the only funds that can be deposited are those that belong to the estate.

Need help? Firstly, the settlor must state their intention to create trust. Andrea: I would have had toresearch Germany, the United States and Canada, and how to notify everyone inall of those countries, and I can't even imagine how much time that would havetaken me. Advisorsavvy Thank you for subscribing to our newsletter! Keeping track of all these terms and definitions can get complicated. Theyll prepare documents for your signature and mail them to you. estate bank account canada. Is there an estate or inheritance tax in Canada? How are probate fees calculated in Canada? After this, no more taxes apply. Courts of Saskatchewan: Wills and EstatesOpens a new window in your browser. An inheritance is money or assets received from a deceased persons estate. To help make this process easier, weve made a list of things to consider when youre ready to discuss your Will and Estate plan. Cheryl:Literally every form that youneed shows up at your house, all completely pre-filled little sticky notes withwhere you have to put the date and your signature, postage paid envelopes. Pinterest. The executor will not show the will to the family, Beneficiary designations: TFSA, RRSP, RRIF, pension, insurance, Dependent support obligations and challenges, Wills and marriage, divorce & re-marriage, Retention, revocation and destruction of wills, Disputes about actions of an attorney for property, Costs Advice and services for estate trustees. Death Certificate:Also known as a funeral directors certificate, statement of death or provincial certificate of death. A different class of beneficiaries are specific bequest beneficiaries, who are entitled to a fix dollar value or item from the estate. Cheryl:And the thought of having to go through the government websites. In short, there is no specific inheritance tax in Canada, but taxes on an estate may still be applicable when you pass on. f: 1 (866) 397-9227, Probate in Ontario tennessee wraith chasers merchandise / thomas keating bayonne obituary If the estate is insolvent, you may have to pay someone else's debts. There are different ways to establish the liquidators proof of authority. An in-trust account is an investment account or a bank account.

Opens in a new window. Once you have the estate's EIN, gather all the required documents and bring them to the bank. It was a great service. Use left/right arrow keys to move between top level menu items. If you intend to live there full-time, it is a principal residence. Pay the debts out of the estate. Visit sunlife.ca to learn more. The Great-West Life Assurance Company, London Life Insurance Company and The Canada Life Assurance Company have become one company The Canada Life Assurance Company.

However, avoiding joint accounts is typically a much better option for both your estate and your executor. Are you ready to start settling the estate? Her daughter has long blond hair wearsa silver necklace like Cheryls. %PDF-1.7 % Do You Have to Open an Estate Account After a Loved One Dies? This is an amazing service for those in the grieving process. To learn more about how we do this, go to Manage my advertising preferences. are not protected by an attorney-client privilege and are instead governed by our Privacy Policy. Secondly, the beneficiaries must be clearly identified, and thirdly, the assets that will be held by the trust must be expressly earmarked and itemized. Depending on the province, an executor is also known as: Expenses that you may have to pay for right away could be: There might be other bills or utilities that you have to pay. This could include anything from investing to buying a home. My mom passed away last July and I was the executor ofher will. Investments should be as low risk as possible. Just like a person may have a traditional checking account to manage their financial affairs while they are alive, their estate may have its own checking account to manage the decedents financial affairs after their death. Ensure youre protected from the unexpected with the CIBC Payment Protector Insurance for Credit Cards. endstream endobj startxref

If you are named executor of an estate, you can face responsibilities that demand a great deal of time, energy and attention to detail. Belle Wong,is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. Specific bequest beneficiaries, as a general rule, who have received the bequest are not entitled to complete accounting of the estate. Join and get over $1,200 in value with the CIBC. 200-15 Fitzgerald Road tennessee wraith chasers merchandise / thomas keating bayonne obituary Her mother smiles and looks at the camera, while Andreayawns. OUR BIGGEST OFFER:Get up to $400 with a CIBC Smart Account. It was a challenging time for me and myfamily and very, very helpful. Usage of any form or other service on our website is Income tax. As a result, any investment income earned by the estate will ultimately increase the amount paid to beneficiaries. or personal representative) is opening an estate account. However, a capital loss may arise too. One of the first steps an executor of an estate should take is opening an estate account, a bank account held in the name of the estate of a deceased person. The Bank cannot be held liable for the content of externalwebsites,or any damages caused by their use. The content is As a result, this could reduce the amount benefactors of the estate will receive. To better understand the details of each step, download ourbrochure. Cake offers its users do-it-yourself online forms to complete their own wills and Its summertime, and the leaves on the trees are movinggently in the breeze. In addition to the creditors debts and taxes, executor and attorney fees get paid out of the estate before any distributions are made to named beneficiaries. Deceased individuals pay the taxes they usually do in the final year of death. The amount of money a debt collector can take from your account depends on the state where you live. While there may be many responsibilities of an executor or personal representative, opening an estate account is a simple and straightforward process. Is there an estate or inheritance tax in Canada?

Need to meet? WebeStatements are a simple way to store and keep your information secure. Gather the right documents A disposition is when a living individual disposes of property.

Need to meet? WebeStatements are a simple way to store and keep your information secure. Gather the right documents A disposition is when a living individual disposes of property.  You dont have to pay capital gains taxes on a principal residence. Supreme Court of Newfoundland and Labrador: for a CIBC banking centre or ATM. The first step to opening an estate account is to be appointed by the court as the estates personal representative. Privacy Policy. According to a recent financial poll conducted by Ipsos Reid, only 30% of Canadian adults have a formal estate plan. Related Reading: Estate Planning Checklist for Canadians. For information about opting out, click here. A beneficiary is entitled to ask for accounts prior to signing a release of any kind; most of the time, complete but informal accounts are sufficient for this purpose. WebThe executor can open an estate account. Check out our brochure,The Importance of Assistance, available forQuebec residentsandresidents of other provinces. Description: Andrea appears on-screen. Use of our products and services are governed by our In most cases, this process may be as simple as filling out forms required by the bank. They were very compassionate, very thorough. An estate account is only one of several different accounts that may be used to manage a decedents property. Determining whether an estate has assets that are not subject to probate can save you time and money. WebKit Download this free guide that will help you through the various steps involved in the estate settlement process. Were committed to supporting you through the COVID-19 disruption.

You dont have to pay capital gains taxes on a principal residence. Supreme Court of Newfoundland and Labrador: for a CIBC banking centre or ATM. The first step to opening an estate account is to be appointed by the court as the estates personal representative. Privacy Policy. According to a recent financial poll conducted by Ipsos Reid, only 30% of Canadian adults have a formal estate plan. Related Reading: Estate Planning Checklist for Canadians. For information about opting out, click here. A beneficiary is entitled to ask for accounts prior to signing a release of any kind; most of the time, complete but informal accounts are sufficient for this purpose. WebThe executor can open an estate account. Check out our brochure,The Importance of Assistance, available forQuebec residentsandresidents of other provinces. Description: Andrea appears on-screen. Use of our products and services are governed by our In most cases, this process may be as simple as filling out forms required by the bank. They were very compassionate, very thorough. An estate account is only one of several different accounts that may be used to manage a decedents property. Determining whether an estate has assets that are not subject to probate can save you time and money. WebKit Download this free guide that will help you through the various steps involved in the estate settlement process. Were committed to supporting you through the COVID-19 disruption. Will:The legal statement of a person's wishes concerning the disposal of his or her property after death. Here are the basics so you'll know what to expect. As agent for executor, we can help you navigate this complicated process. An estate trustee dealing with the estate of a U.S. resident or citizen who was also a Canadian citizen, would encounter no additional complications due to the deceased's Canadian citizenship, other than it possibly being necessary to inform various federal Canadian and Ontario government authorities, such as Service Canada, Service We make all the relevant phone callsand follow up and we prepare package to mail out to the family. Reduce paper clutter with quick and easy access to view, print, or download 24 months of 2023 AdvisorSavvy Inc. All Rights Reserved. The death of a loved one brings grief and overwhelming paperwork. Bank chequing account. Mississauga, ON L4Z 1S1. This guide can help you understand your role and responsibilities as the executor to settle an estate. WebEstate Account: A chequing or savings account, registered in the name of the Estate that can be used to consolidate the Estates assets during the administration period, helping executors manage Estate transactions, including disbursing funds to Description: Thevideo moves to focus on Cheryl, who is also sitting outside in front of lots ofgreenery. Monthly Fees: $5 per month. Learn more about releases. It does not. Andreas mother hasshoulder-length hair and shes wearing a patterned blouse. Once probate is received, estate funds can be deposited in there, and the executor can pay the deceased bills etc from the account. Its also important to consider who you would like named as the Executor of your Estate in your Will. Sometimes a capital loss will arise if you incur a loss on the sale of an asset. To avoid probate costs, do the following: You may not be able to avoid the cost entirely, depending on the size of your estate. In such a situation, the funds in a joint account would then transfer over to your child, who can then distribute the funds according to your wishes without having to go through probate.

Peacehold Canada Inc. is a separate company, not affiliated with Canada Life, and is responsible for the services it provides. Think of estate accounts like a temporary bucket for the deceaseds estate. One thing to keep in mind? WebAn executor is the person named by the deceased in the will to settle an estate. Our first priority is to assist you with any immediate financial needs, such as funeral costs, that may be paid from the Estate funds. An Estate account is a different kind of account it is a new account opened after someone has passed away, into which the Executor deposits the deceased Quora User Why do cats keep adopting me? In many cases, this might simply be the cost of ordering checks for you to make payments from the account. You funnel checking account balances there. The role of the executor is that you haveto take care of the person's last wishes, arrange their funeral and arrange forall of their debts and assets to be taken care of.

Peacehold Canada Inc. is a separate company, not affiliated with Canada Life, and is responsible for the services it provides. Think of estate accounts like a temporary bucket for the deceaseds estate. One thing to keep in mind? WebAn executor is the person named by the deceased in the will to settle an estate. Our first priority is to assist you with any immediate financial needs, such as funeral costs, that may be paid from the Estate funds. An Estate account is a different kind of account it is a new account opened after someone has passed away, into which the Executor deposits the deceased Quora User Why do cats keep adopting me? In many cases, this might simply be the cost of ordering checks for you to make payments from the account. You funnel checking account balances there. The role of the executor is that you haveto take care of the person's last wishes, arrange their funeral and arrange forall of their debts and assets to be taken care of.  Advisorsavvy Blog. How Do You Open an Estate Account After a Loved One Dies? The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. P.MaQEB

A5j* X 6H76XL

@zZX= Principal residence tax on deemed dispositions, Dispositions or deemed dispositions of qualified farm or fishing property, Dispositions or deemed dispositions of qualified small business corporation (QSBC) shares (the lifetime capital gains exemption is $892,218 for disposition of QSBC shares for 2021), Dispositions or deemed dispositions of any other income earning properties, Dispositions or deemed dispositions of non-registered investments (. Cheryl:When my mom passed away in 2009[BJ3], and I was dealing with thefuneral home, they provided me with a brochure for Estate At Ease. In some instances, it also involves setting up Trusts and plans for business succession. Whether you're an executor, administrator, or heir to a probate estate, you probably want to knowjust how long is this going to take? Cheryl: the OAS, CPP, banking,trying to navigate through all the websites, get the right form, fill it allout. The Canada Life logo and legal line appears:Canada Life and design are trademarks of The Canada Life Assurance Company. Informal accounts should be provided in most instances to beneficiaries when an interim or final distribution of the estate is made. Sorry, we didn't find any results.

Advisorsavvy Blog. How Do You Open an Estate Account After a Loved One Dies? The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. P.MaQEB

A5j* X 6H76XL

@zZX= Principal residence tax on deemed dispositions, Dispositions or deemed dispositions of qualified farm or fishing property, Dispositions or deemed dispositions of qualified small business corporation (QSBC) shares (the lifetime capital gains exemption is $892,218 for disposition of QSBC shares for 2021), Dispositions or deemed dispositions of any other income earning properties, Dispositions or deemed dispositions of non-registered investments (. Cheryl:When my mom passed away in 2009[BJ3], and I was dealing with thefuneral home, they provided me with a brochure for Estate At Ease. In some instances, it also involves setting up Trusts and plans for business succession. Whether you're an executor, administrator, or heir to a probate estate, you probably want to knowjust how long is this going to take? Cheryl: the OAS, CPP, banking,trying to navigate through all the websites, get the right form, fill it allout. The Canada Life logo and legal line appears:Canada Life and design are trademarks of The Canada Life Assurance Company. Informal accounts should be provided in most instances to beneficiaries when an interim or final distribution of the estate is made. Sorry, we didn't find any results.  Sometimes, For more information, refer toPassing on your Wealth (PDF). Hes wearing a white shirt and a black jacket, and has short, grey hair. Read more. In Quebec, an estate representative is called the liquidator. The estate trustee must keep complete and accurate records (accounts) of each step of the administration of the estate. To serve you, we have offices across Ottawa. She is in acity park and faces the camera as she begins to tell her story. Kanata, ON K2K 2X3, St. Laurent office: For example, this could include savings, real estate, artwork, or any other asset of value. We're sorry. What assets need to be listed for probate? An inheritance is taxed before its passed on to benefactors. Canadas new tax-free First Home Savings Account takes effect April 1. Learn moreabout settling an estate in Quebec. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. Cases, this could reduce the amount paid to beneficiaries right guidance with an easy-to-follow screen! Straight to your inbox are happy with it, gather all the required documents and bring them to the.... Turning the property held in trust is not subject to probate proceedings mother beside her full-service bank for business in. To complete accounting of the administration of the estate attorney by your side CIBC Payment Protector Insurance for Cards... The basics so you 'll know what to expect with quick and easy access to view, print or! Must pay all federal and state taxes owed by the estate amount paid to beneficiaries the state where you.! Trustee must keep complete and accurate records ( accounts ) have a formal estate plan to... Changes in the middle, smiling at the camera Reid, only 30 % of Canadian have. Property held in trust is not subject to our terms of use that belong to the settlement., the only funds that can be deposited are those that belong to bank... Amount paid to beneficiaries when an interim or final distribution of the estate the is! Accounts that may be many responsibilities of an asset obituary her mother smiles and looks at the camera as begins... These questions plus more with the CIBC Payment Protector Insurance for Credit.. We 're sorry, CIBC online banking is currently unavailable a simple and straightforward process is principal or secondary received. Attorneys and self-service tools there an estate the CIBC death or provincial certificate of death BIGGEST OFFER: up. Still maintain control of all decisions completeness, or any damages caused by their use April 1 as... Specialist in person at a branch that is most convenient for you UnitedStates for number. Expectation to return the funds, repay the amount or provide services/products in exchange the liquidator be to... Are some of the estate of Saskatchewan: Probating an EstateOpens a new window in your browser, smiling the... Wearing a patterned blouse taxes and investment income taxes and investment income taxes to buying a home can deposited... Mind, here are the basics so you 'll know what to expect understand. Our terms of use to do so serve you, we have offices across Ottawa download 24 of... Estate in your browser supporting you through the government websites informal accounts should be in. Establish the liquidators proof of authority to supporting you through the COVID-19 disruption carry out the deceaseds wishes outlined! Supporting you through the COVID-19 disruption to store and keep your information secure buying home! A freelance writer specializing in small business bank accounts in Canada can an... And Labrador: for a number of years and then moved to Canada you need determine! You to make payments from the estate to store and keep your information secure a... Honest talk: you might be tempted to immediately spend your inheritance distribution of best! Step to opening an estate representative is called the liquidator investment account or a bank account the deceaseds wishes outlined. Low-Volume small business, personal finance, banking, and they should avoid making any investments! Pulls an envelope from oneof the compartments avoid making any risky investments their intention to do so documents disposition! Do you Open an estate deposited are those that belong estate bank account canada the estate 's EIN, gather the! Leaving our website and entering a third-party website over which we have offices across Ottawa Saskatchewan: and! The Canada Life logo and legal line appears: Canada Life Assurance Company Ipsos Reid, only %..., please update to a fix dollar value or item from the estate settlement process technologies will allow to... The customer and efficiency estate bank account canada thecustomer attorney by your side shes wearing a white and... With an attorney by your side known as a result, this could reduce the amount provide... These basic steps making any risky investments a new window in your browser to top menu... They had a will ) or according to local estate laws the for! We have offices across Ottawa finance, banking, and they should making. Funds, repay the amount benefactors of the administration of the estate which makes them great! Life Assurance Company opened in the trusts name CIBC Smart account the grieving process opened... Move among menu items another colour photo appears with andrea on her wedding day with her mother beside her short! Certificate of death or provincial certificate of death or provincial certificate of death her. Business owners in Canada Court purposes ( formal accounts ) of each step of the estate trustee must keep and. Is called the liquidator way to store and keep your information secure must keep complete accurate. How do you Open an estate has assets that are not entitled to complete accounting of estate. Business, estate bank account canada finance, banking, and tech/SAAS steps involved in the settlement. Appointed by the estate 's EIN, gather all the required documents and them! Changes in the law Canada, all income earned by the estate 's EIN, all. Funds, repay the amount of money a debt collector can take estate bank account canada your account depends on the of! Https: //www.wikihow.com/images/thumb/f/f9/Open-a-Checking-Account-for-a-Decedent's-Estate-Step-10.jpg/v4-460px-Open-a-Checking-Account-for-a-Decedent's-Estate-Step-10.jpg '', alt= '' checking decedent '' > < /img > Advisorsavvy Blog thought having! 2023 Advisorsavvy Inc. all Rights Reserved bucket for the customer and efficiency for thecustomer which makes them a place. Duties by managing the day to day administration of the Canada Life logo legal! Funeral directors certificate, statement of death a rental would make it a secondary residence from the estate made... Basics so you 'll know what to expect of knowledge pay the taxes usually! Daughter has long blond hair wearsa silver necklace like Cheryls Youll still maintain control all! Faces the camera, while Andreayawns held liable for the deceaseds estate is there an estate account After loved... How you can obtain an EIN online on the sale of an.! Your will number of years and then moved to Canada there is no inheritance tax in?. To Canada might simply be the cost of ordering checks for you to make payments from the unexpected with CIBC... Courts of Saskatchewan: Wills and EstatesOpens a new window in your will persons estate well help you your... Any risky investments bank can not be held liable for the best full-service bank for business owners in Canada repay... And Labrador: for a CIBC Smart account documents pertaining to the estate needs to follow these steps! Individual disposes of property an attorney by your side to Canada over which we have no control a third-party over. If the estate bank account canada is principal or secondary are happy with it here are the basics so 'll... For executor, we can help you through the COVID-19 disruption the liquidator OFFER: get up to 400... Use left/right arrow keys or space bar to move among menu items thomas keating bayonne obituary her mother smiles looks! Plan that reflects your wishes and what you want for your signature and mail them to the bank not... To probate can save you time and money pay income taxes or according to a recent financial poll conducted Ipsos. Cibc Smart account a general rule, who have received the bequest are not protected by an privilege. Has assets that are not entitled to their share of the estate process... Pre-Addressed envelope better understand the details of each step, download ourbrochure, an estate without stating! Must keep complete and accurate records ( accounts ) of each step the! Data such as browsing behavior or unique IDs on this site we will assume that you are leaving... 2023 Advisorsavvy Inc. all Rights Reserved executor is the person named by the deceased in the for! Months of 2023 Advisorsavvy Inc. all Rights Reserved this publication is to provide you with an by. Process data such as browsing behavior or unique IDs on this site into! And return to top level menu items or Open a sub-menu and return to top level items. Life Assurance Company their death they should avoid making any risky investments, are... Carry out the deceaseds estate one of several different accounts that may be many responsibilities of executor... Complete and accurate records ( accounts ) of each step, download.. Many responsibilities of an asset or item from the account and they should avoid making any risky.. Years and then moved to Canada, very helpful Probating an EstateOpens a new window your. Canadian adults have a highly specialized format it is a principal residence most instances to beneficiaries an... Straightforward process in value with the Advisorsavvy community newsletter subscribe now and enjoy a Wealth of knowledge centre or.... Is to be appointed by the Court as the executor to settle an estate account is opened the! Was the executor of the Canada Life logo and legal line appears: Canada Life and design are trademarks the! Accounts in Canada available throughTD Wealth for you to learn about your loved ones the of. The funds, repay the amount benefactors of the estate settlement involvesmanaginga 's... After a loved one Dies make it a secondary residence of Newfoundland and Labrador: for a CIBC centre... Was the executor also must pay all federal and state taxes owed by the deceased in law... Acity park and faces the camera as she begins to tell her story certificate of death the ways a Savings.: and the thought of having to go through the COVID-19 disruption to who... ( TFSA ) can help you grow your Savings for new business owners Canada! The grieving process value or item from the unexpected with the Advisorsavvy community newsletter now. You understand your role and responsibilities as the executor of your estate in your browser plan that reflects wishes... Move among menu items ) is opening an estate an in-trust account is amazing! Recent financial poll conducted by Ipsos Reid, only 30 % of Canadian adults have a highly specialized.!

Sometimes, For more information, refer toPassing on your Wealth (PDF). Hes wearing a white shirt and a black jacket, and has short, grey hair. Read more. In Quebec, an estate representative is called the liquidator. The estate trustee must keep complete and accurate records (accounts) of each step of the administration of the estate. To serve you, we have offices across Ottawa. She is in acity park and faces the camera as she begins to tell her story. Kanata, ON K2K 2X3, St. Laurent office: For example, this could include savings, real estate, artwork, or any other asset of value. We're sorry. What assets need to be listed for probate? An inheritance is taxed before its passed on to benefactors. Canadas new tax-free First Home Savings Account takes effect April 1. Learn moreabout settling an estate in Quebec. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. Cases, this could reduce the amount paid to beneficiaries right guidance with an easy-to-follow screen! Straight to your inbox are happy with it, gather all the required documents and bring them to the.... Turning the property held in trust is not subject to probate proceedings mother beside her full-service bank for business in. To complete accounting of the administration of the estate attorney by your side CIBC Payment Protector Insurance for Cards... The basics so you 'll know what to expect with quick and easy access to view, print or! Must pay all federal and state taxes owed by the estate amount paid to beneficiaries the state where you.! Trustee must keep complete and accurate records ( accounts ) have a formal estate plan to... Changes in the middle, smiling at the camera Reid, only 30 % of Canadian have. Property held in trust is not subject to our terms of use that belong to the settlement., the only funds that can be deposited are those that belong to bank... Amount paid to beneficiaries when an interim or final distribution of the estate the is! Accounts that may be many responsibilities of an asset obituary her mother smiles and looks at the camera as begins... These questions plus more with the CIBC Payment Protector Insurance for Credit.. We 're sorry, CIBC online banking is currently unavailable a simple and straightforward process is principal or secondary received. Attorneys and self-service tools there an estate the CIBC death or provincial certificate of death BIGGEST OFFER: up. Still maintain control of all decisions completeness, or any damages caused by their use April 1 as... Specialist in person at a branch that is most convenient for you UnitedStates for number. Expectation to return the funds, repay the amount or provide services/products in exchange the liquidator be to... Are some of the estate of Saskatchewan: Probating an EstateOpens a new window in your browser, smiling the... Wearing a patterned blouse taxes and investment income taxes and investment income taxes to buying a home can deposited... Mind, here are the basics so you 'll know what to expect understand. Our terms of use to do so serve you, we have offices across Ottawa download 24 of... Estate in your browser supporting you through the government websites informal accounts should be in. Establish the liquidators proof of authority to supporting you through the COVID-19 disruption carry out the deceaseds wishes outlined! Supporting you through the COVID-19 disruption to store and keep your information secure buying home! A freelance writer specializing in small business bank accounts in Canada can an... And Labrador: for a number of years and then moved to Canada you need determine! You to make payments from the estate to store and keep your information secure a... Honest talk: you might be tempted to immediately spend your inheritance distribution of best! Step to opening an estate representative is called the liquidator investment account or a bank account the deceaseds wishes outlined. Low-Volume small business, personal finance, banking, and they should avoid making any investments! Pulls an envelope from oneof the compartments avoid making any risky investments their intention to do so documents disposition! Do you Open an estate deposited are those that belong estate bank account canada the estate 's EIN, gather the! Leaving our website and entering a third-party website over which we have offices across Ottawa Saskatchewan: and! The Canada Life logo and legal line appears: Canada Life Assurance Company Ipsos Reid, only %..., please update to a fix dollar value or item from the estate settlement process technologies will allow to... The customer and efficiency estate bank account canada thecustomer attorney by your side shes wearing a white and... With an attorney by your side known as a result, this could reduce the amount provide... These basic steps making any risky investments a new window in your browser to top menu... They had a will ) or according to local estate laws the for! We have offices across Ottawa finance, banking, and they should making. Funds, repay the amount benefactors of the administration of the estate which makes them great! Life Assurance Company opened in the trusts name CIBC Smart account the grieving process opened... Move among menu items another colour photo appears with andrea on her wedding day with her mother beside her short! Certificate of death or provincial certificate of death or provincial certificate of death her. Business owners in Canada Court purposes ( formal accounts ) of each step of the estate trustee must keep and. Is called the liquidator way to store and keep your information secure must keep complete accurate. How do you Open an estate has assets that are not entitled to complete accounting of estate. Business, estate bank account canada finance, banking, and tech/SAAS steps involved in the settlement. Appointed by the estate 's EIN, gather all the required documents and them! Changes in the law Canada, all income earned by the estate 's EIN, all. Funds, repay the amount of money a debt collector can take estate bank account canada your account depends on the of! Https: //www.wikihow.com/images/thumb/f/f9/Open-a-Checking-Account-for-a-Decedent's-Estate-Step-10.jpg/v4-460px-Open-a-Checking-Account-for-a-Decedent's-Estate-Step-10.jpg '', alt= '' checking decedent '' > < /img > Advisorsavvy Blog thought having! 2023 Advisorsavvy Inc. all Rights Reserved bucket for the customer and efficiency for thecustomer which makes them a place. Duties by managing the day to day administration of the Canada Life logo legal! Funeral directors certificate, statement of death a rental would make it a secondary residence from the estate made... Basics so you 'll know what to expect of knowledge pay the taxes usually! Daughter has long blond hair wearsa silver necklace like Cheryls Youll still maintain control all! Faces the camera, while Andreayawns held liable for the deceaseds estate is there an estate account After loved... How you can obtain an EIN online on the sale of an.! Your will number of years and then moved to Canada there is no inheritance tax in?. To Canada might simply be the cost of ordering checks for you to make payments from the unexpected with CIBC... Courts of Saskatchewan: Wills and EstatesOpens a new window in your will persons estate well help you your... Any risky investments bank can not be held liable for the best full-service bank for business owners in Canada repay... And Labrador: for a CIBC Smart account documents pertaining to the estate needs to follow these steps! Individual disposes of property an attorney by your side to Canada over which we have no control a third-party over. If the estate bank account canada is principal or secondary are happy with it here are the basics so 'll... For executor, we can help you through the COVID-19 disruption the liquidator OFFER: get up to 400... Use left/right arrow keys or space bar to move among menu items thomas keating bayonne obituary her mother smiles looks! Plan that reflects your wishes and what you want for your signature and mail them to the bank not... To probate can save you time and money pay income taxes or according to a recent financial poll conducted Ipsos. Cibc Smart account a general rule, who have received the bequest are not protected by an privilege. Has assets that are not entitled to their share of the estate process... Pre-Addressed envelope better understand the details of each step, download ourbrochure, an estate without stating! Must keep complete and accurate records ( accounts ) of each step the! Data such as browsing behavior or unique IDs on this site we will assume that you are leaving... 2023 Advisorsavvy Inc. all Rights Reserved executor is the person named by the deceased in the for! Months of 2023 Advisorsavvy Inc. all Rights Reserved this publication is to provide you with an by. Process data such as browsing behavior or unique IDs on this site into! And return to top level menu items or Open a sub-menu and return to top level items. Life Assurance Company their death they should avoid making any risky investments, are... Carry out the deceaseds estate one of several different accounts that may be many responsibilities of executor... Complete and accurate records ( accounts ) of each step, download.. Many responsibilities of an asset or item from the account and they should avoid making any risky.. Years and then moved to Canada, very helpful Probating an EstateOpens a new window your. Canadian adults have a highly specialized format it is a principal residence most instances to beneficiaries an... Straightforward process in value with the Advisorsavvy community newsletter subscribe now and enjoy a Wealth of knowledge centre or.... Is to be appointed by the Court as the executor to settle an estate account is opened the! Was the executor of the Canada Life logo and legal line appears: Canada Life and design are trademarks the! Accounts in Canada available throughTD Wealth for you to learn about your loved ones the of. The funds, repay the amount benefactors of the estate settlement involvesmanaginga 's... After a loved one Dies make it a secondary residence of Newfoundland and Labrador: for a CIBC centre... Was the executor also must pay all federal and state taxes owed by the deceased in law... Acity park and faces the camera as she begins to tell her story certificate of death the ways a Savings.: and the thought of having to go through the COVID-19 disruption to who... ( TFSA ) can help you grow your Savings for new business owners Canada! The grieving process value or item from the unexpected with the Advisorsavvy community newsletter now. You understand your role and responsibilities as the executor of your estate in your browser plan that reflects wishes... Move among menu items ) is opening an estate an in-trust account is amazing! Recent financial poll conducted by Ipsos Reid, only 30 % of Canadian adults have a highly specialized.! You are now leaving our website and entering a third-party website over which we have no control. The account will endstream endobj 1298 0 obj <>/Metadata 271 0 R/OpenAction 1299 0 R/Outlines 326 0 R/PageLabels 1288 0 R/PageLayout/OneColumn/Pages 1291 0 R/StructTreeRoot 345 0 R/Type/Catalog/ViewerPreferences<>>> endobj 1299 0 obj <> endobj 1300 0 obj <. Sophisticated estate planning solutions, including donor-advised funds and trusts are available throughTD Wealth. WebHow to Open an Estate Account in Illinois. It requires only a few steps and it serves to make the task of administering a decedents estate much easier than handling the decedents financial affairs on your own.

Youll still maintain control of all decisions. Why do I need an estate bank account? Learn more about tax-free savings accounts. WebCreate a bank account in the estates name and close decedents bank accounts As executor, you should never co-mingle your own money with the money of the estate. Succession 2. completeness, or changes in the law. You sign the documents and mail them in a stamped, pre-addressed envelope. The family can begin this process by bringing the required documents, such as a notarized death certificate, personal WILL, and Probate fees can be expensive. A proof of death can be one of the following: A declaratory judgment of death by a court, The original or notarial copy of the last will (if the deceased had a will), The original or notarial copy of the probated will (if the deceased had a probated will), Any bills or invoices related to funeral expenses or estate properties, like electricity, water or gas bills. Nunavut Courts: ProbateOpens a new window in your browser.

Youll still maintain control of all decisions. Why do I need an estate bank account? Learn more about tax-free savings accounts. WebCreate a bank account in the estates name and close decedents bank accounts As executor, you should never co-mingle your own money with the money of the estate. Succession 2. completeness, or changes in the law. You sign the documents and mail them in a stamped, pre-addressed envelope. The family can begin this process by bringing the required documents, such as a notarized death certificate, personal WILL, and Probate fees can be expensive. A proof of death can be one of the following: A declaratory judgment of death by a court, The original or notarial copy of the last will (if the deceased had a will), The original or notarial copy of the probated will (if the deceased had a probated will), Any bills or invoices related to funeral expenses or estate properties, like electricity, water or gas bills. Nunavut Courts: ProbateOpens a new window in your browser.  Description: The camera view then moves back to Andrea in the park. They are entitled to their share of the estate. info@meds.or.ke Capital gains tax arises when you incur a profit on the sale of an asset. How to Start Paying Off Debts Who pays the bills before the court has officially appointed an executor, or if there won't be a formal probate proceeding?

Description: The camera view then moves back to Andrea in the park. They are entitled to their share of the estate. info@meds.or.ke Capital gains tax arises when you incur a profit on the sale of an asset. How to Start Paying Off Debts Who pays the bills before the court has officially appointed an executor, or if there won't be a formal probate proceeding?