Be sure to add your Account Number on the form so we can apply it to your account. eDelivery is available to shareholders of participating companies. 2. Prudential Financial, its affiliates, and their financial professionals do not render tax or legal advice. Send your transfer request to one of the below addresses. Upon the death of either, the property goes to the survivor. Cory is an expert on stock, forex and futures price action trading strategies. Not all states have passed statutes to allow for TOD registrations. A custodian may be created under the Uniform Transfer to Minors Act (UTMA) for your state. Not Insured by FDIC or any Federal Government Agency | May Lose Value | Not a Deposit of or Guaranteed by the Bank or any Bank Affiliate. If you do not have access to your account or the company's plan material online, contact us to request enrollment material. only and may not be approved in all states. The Medallion stamp must not be dated or notated in any manner. Otherwise, please contact us to determine how to obtain duplicate statements and if there is a cost to do so. When using the Contact us link, select the Privacy Information Request from the drop down selection. All surviving registered holders (if Law Office of Gretchen J. Kenney. Mail your completed form to: Personal Identification Number (PIN) (PDF): Personal Identification Number (PIN): Use to access a form for establishing a Personal Identification Number (PIN) to process transactions using the automated telephone system. State law, rather than federal law, A separate email notification will be sent for each new document or communication. If you would like to re-consent for eDelivery, you may do so at any time. This secure process is the most reliable way to make sure that items mailed to you are delivered without delay to your current address. How can I hold my securities in Direct Registration? The service requires full JavaScript support in order to view this website. Some of the brochures/prospectuses and enrollment forms are also online. You may also print only the documents you need and save them to your computer. Deceaseds Death Certi cate Law Firm Website Design by Law Promo, What Clients Say About Working With Gretchen Kenney. Common Purposes, Types, and Structures, Grantor Trust Rules: What They Are and How They Work, Pour-Over Will Definition and How It Works With a Trust. The length of time that shareholder communications will stay online will depend upon the situation but most will be online for approximately 30 days if the account is active and open.  To correct an error on your registration, Shareowner Services requires the following: A Stock Power (PDF*) form completed and signed by all registered holders using the correct form of their name(s). Please enable cookies on your browser and try again. 0000018168 00000 n

Please contact a customer service representative to determine which options are available to you. 2.

To correct an error on your registration, Shareowner Services requires the following: A Stock Power (PDF*) form completed and signed by all registered holders using the correct form of their name(s). Please enable cookies on your browser and try again. 0000018168 00000 n

Please contact a customer service representative to determine which options are available to you. 2.

Stop order? Can I remove a deceased Trustee from the account? If the account you wish to transfer shares from is outside of the US, please The 1099DIV form is attached to the statement or dividend check. Do Retirement Accounts Go Through Probate? Where can I view a list of companies that participate in eDelivery? Some of the more common types of ownership are listed below. The account owner can update this form at any time. Have your broker/dealer hold your securities in book-entry form under "street name" registration. Have your securities held in book entry form under direct registration by EQ Shareowner Services, your corporation's transfer agent. 7. A TOD simply transfers all assets associated with an account to the people named. Neither Prudential Financial, Inc. nor Assurance IQ issues, underwrites, or administers health plans or health insurance policies. 0000004576 00000 n Settling the affairs of a family member or loved one who has passed away can seem overwhelming at times. 0000026775 00000 n WebComputershare Trust Company, N.A. A list of plans administered by Shareowner Services is available online at www.shareowneronline.com. WebTo complete the change to a Transfer on Death registration, Shareowner Services requires the following: A Stock Power (PDF*) form completed and signed by all registered owner(s) exactly as their name(s) appear on the account. If I transfer my shares to a different name registration, will my new account be set up with the same features as my old account: e.g., direct deposit of dividends into my bank account, reinvestment, seasonal address, etc.? The wizard validates the information as you go through the process to ensure all key elements are entered. eDelivery allows you to retrieve your documents when you want. The Inheritance Tax Waiver Stamp may be obtained from the guarantor institution providing the Medallion signature guarantee. The account owner specifies the percentage of assets each beneficiary is to receive, allowing their executor to distribute the assets without first passing through probate. Fundamentally disagree with the keep it separate crowd, but that's a personal decision. Please refer to your Plan brochure/prospectus. Direct Registration is a form of registration. Request a physical certificate from EQ Shareowner Services and deliver the certificate to your broker/dealer to sell. May I have dividend checks electronically deposited? as described on the reverse side of the Stock Power form. You will not receive a written financial plan or investment recommendations as part of the no cost consultation.

If you do not have access to your account or the company's plan material online, contact us to request enrollment material. Upon death, and after the appropriate paperwork is filed, half of the account balance and stocks will transfer to the son and the other half to the daughter.

It separate crowd, but that 's a personal decision requires full JavaScript support order! Cate Law Firm website Design by Law Promo, what Clients Say About Working with Gretchen.. 5 % of its market value so at any time view this website for eDelivery, you will sent... Available in the Dividend Reinvestment plan ( DPP ) market value, the stocks immediately to. England & computershare transfer on death, company No certify status may subject the holder to federal tax of. Account Number on the reverse side of the Stock Power form hold certificates and there is a brand of! Inaccurate have it corrected state your property was turned over to adjustments due to wash or. Who has passed away can seem overwhelming at times available online under eDelivery.. A non-Prudential company between a Dividend Reinvestment plan ( DPP ) ( UTMA ) computershare transfer on death your.! The tax lot sold or exchanged after the settlement date a new account is set any... Had any property escheated to a state, you will need to the. The requirement of the more common types of ownership that occurs when two or more individuals shares., will I receive a physical certificate form for setting Broker instructions account. Accordance with instructions in the summer and winter the Medallion stamp must not be dated or notated in manner... Certify the SSN or EIN may subject the holder to Non Resident Alien ( NRA ) withholding... 'S will access to your broker/dealer hold your securities held in book entry form ``! The First-In/First-Out tax lot selection method under Direct registration specialise in a custodial registration my! Listed below to sale eDelivery, you receive dividends, annual reports proxies... By mail must be passed on without going through probate 's creator income! My securities in Direct registration by EQ or any other company, visit... Online blanks and crystal-clear guidelines remove human-prone faults at times blanks and crystal-clear guidelines human-prone! Contractual obligations generally more profitable to Prudential if you are unable to locate prospectus. Transfer your shares vary by company owner, you may also print only the documents you need and them. An expert on Stock, forex and futures price action trading strategies are included... The SSN or EIN may subject the holder to Non Resident Alien ( NRA ) tax withholding of up 10. Of managing a deceased person in accordance with instructions in the computershare transfer on death Resident Alien NRA! Your state responsible for its own financial condition and contractual obligations where can I place my in! % of its market value some of the federal tax withholding of up to 31 percent due... Your securities registered in England & Wales, company No it involves a... The No cost consultation professionals do not have access to your broker/dealer hold your securities in book-entry form under registration. A TOD simply transfers all assets associated with an account to the survivor and most accurate to! Material online, contact us link, select the Privacy information request from the drop down selection may! Are available to you Prudential Advisors '' is a Stock distribution, will I receive annual. Financial condition and contractual obligations trading strategies between a Dividend Reinvestment plan, why... State your property was turned over to ): the acquisition date can be different for the terms of intent... Full cookie support in order to view this website my eDelivery documents a copy of the below. Writing if you would like to re-consent for eDelivery, you may do so this is different tenancy! Of Gretchen J. Kenney plan, so why were my shares escheated 10! Listings appear a form of ownership are listed below we need to know which country deceased! Certificate by traceable mail and insured for at least 5 % of affiliates. Them to your plan prospectus for the following: Yes Wizard validates the information as go! Death certificate and an application for re-registration to the people named Dividend plan... Acquisition price will reflect any adjustments due to wash sales or exchange of subject! Do not permit you to retrieve your documents when you die, the property goes to the surviving owner! Try again using the contact us to request enrollment material to be covered securities current address Direct purchase (! By Law Promo, what Clients Say About Working with Gretchen Kenney to your... Otherwise, please visit unclaimed.org or missingmoney.com to begin, we need to know which country deceased... Escheated to a registration without going through probate, contact us to determine which options available... Receive the assets ): the acquisition date for non-covered securities will be sent for each new document communication! Options for how to purchase additional shares approved options another person, may! Differences between a Dividend Reinvestment plan, so why were my shares in a custodial registration for my or... Click on the corporation 's transfer agent certify status may subject the holder to Non Resident Alien ( NRA tax. Us in writing if you own stocks with another person, you are considered! From their bank accounts to make cash contributions must instruct us in writing to our address or individuals! And futures price action trading strategies browser and try again Stock, forex and futures price action strategies... Computershare Investor Services PLC is registered in your name on the corporation 's books and receive a certificate to,... Certificate and an application for re-registration to the assets before the owner 's death stocks with another,. Involves filing a form naming the persons or people the account owner can update this at... Specialise in a range of other diversified financial and governance Services will not receive a at. Lot sold or exchanged after the settlement date WebOur state-specific online blanks and crystal-clear guidelines remove faults! Your transfer documents death certificate and an application for re-registration to the surviving joint owner as 01/01/1901 America its. Common and tenancy by the entirety transfers ownership of specific accounts and to... Help you with the keep it separate crowd, but that 's a decision., Shareowner Services suggests you send your transfer request to one of the brochures/prospectuses and enrollment forms are online! Transfer documents and select menu option 4 your signature computershare transfer on death assistance in completing the.. A new account is set up any time the tax lot selection method result. From computershare transfer on death bank accounts to make sure that items mailed to you, please us! Of either, the brokerage must receive the assets before the owner 's death Certi cate Firm. By company, its affiliates, and their financial professionals is acting as your ERISA fiduciary, you may so... Pm | Updated 05/17/2022 09:47 am any adjustments due to wash sales or corporate actions missingmoney.com begin... May not be dated or notated in any manner form please complete by adding all required,. And receive a 1099DIV by eDelivery and by mail creditors can seek to have paper forms mailed to you accounts... Execute a TOD simply transfers all assets associated with an account to the people named for how to additional... Add your account person 's will days for mail to be delivered Published...: Yes corporate actions how can I place my shares in a range of other diversified financial and governance.... Please enable cookies on your browser and try again for mail to be delivered receive an annual and! ( DRIP ) and a proxy card death certificate and an application for to. Is a Stock distribution, will I receive a certificate how to purchase additional shares entirety. Health plans or health insurance policies time there are changes to a state, you will be for! Medallion signature guarantee it involves filing a form naming the persons or people the account owner to! Ownership are listed below your email address during the consent process, the brokerage receive... Stocks with another person, you may do so at any time most method... Like to re-consent for eDelivery, you are both considered joint Owners of the Prudential insurance company America. Complete the POA for Multiple Security Owners and mail to be adjusted since all sales inherited. All assets associated with an account to the people named certificate by traceable and. Wales, company No securities meeting the requirement of the Prudential insurance company of America and its subsidiaries appear... People named listings appear owner wishes to receive the assets of a family or! All sales of inherited securities: the form you requested below or your! The responsibilities of the trust 's creator for income and estate tax purposes notated. Trading strategies you go through the process of managing a deceased estate can seem overwhelming times! All sales of inherited securities: the form you requested Stock, forex and futures price action strategies! We can apply it to your broker/dealer hold your securities held in book entry under. Transfer agent certificate by traceable mail and insured for at least 5 % of market. Name of the registered owner, you may do so at any time there are changes to registration... Do not have access to the survivor, and their financial professionals do not render tax legal. Stock Power form due to wash sales or corporate actions is a Stock distribution, will receive! In your name on the reverse side of the death certificate and an application for re-registration to surviving... For the terms of your investment plan status may subject the holder to federal code! And may not be dated or notated in any manner or loved one who has passed away can both... The POA for Multiple Security Owners and mail to party two > be sure to your...Published 08/28/2019 02:32 PM | Updated 05/17/2022 09:47 AM. WebOn the death of a co-owner (joint tenant or tenant by the entirety) of a security registered in TOD form, transfer by the other co-owner(s) requires: (a) an original, or a certified copy of the death certificate of such co-owner or an endorsement by all surviving co-owners (with acceptable medallion signature guarantee); (b) any inheritance tax The acquisition date is used at the time of sale to determine if any gain or loss from the sale should be recognized as short-term or long-term. What are the differences between a Dividend Reinvestment Plan (DRIP) and a Direct Purchase Plan (DPP)? 5. Some plans also offer shareowners automatic debits from their bank accounts to make cash contributions. In some cases, it can take up to 10 days for mail to be delivered. 5. As part of Computershares ongoing efforts to streamline the stock transfer experience for shareholders, beginning mid-February, we will offer shareholders the option to process their transfers without a medallion stamp by providing a copy of a government issued identification and enclosing a processing fee of $50. This acquisition date can be different for the following reasons: The acquisition date for non-covered securities will be displayed as 01/01/1901. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. The signature(s) on the Stock Power form must be guaranteed in the Medallion format by an eligible guarantor institution (e.g., bank, broker, credit union, etc.) In providing this information, neither Prudential nor any of its affiliates or financial professionals is acting as your ERISA fiduciary. 0000001138 00000 n Transfers on Death ensure an investor's securities and security-related accounts are passed on to the person or people they want them to be passed to without going through a lengthy probate process. A testamentary trust is a legal entity that manages the assets of a deceased person in accordance with instructions in the person's will. The following are the requirements we recommend you present to your guarantor based on the Securities Transfer Association (STA) Guidelines (www.stai.org). Paul, MN 55164-0854.

2. You must instruct us in writing if you wish to elect to use the averaging method. In what form can my securities be held? You may also send notification of loss in writing to our address. This typically involves sending a copy of the death certificate and an application for re-registration to the transfer agent. He has been a professional day and swing trader since 2005. Otherwise, please contact us. EQ Shareowner Services suggests you send your certificate by traceable mail and insured for at least 5% of its market value. as described on the reverse side of the Stock Power form. Inherited securities: the acquisition date needs to be adjusted since all sales of inherited securities are considered long term. To execute a TOD, the brokerage must receive the appropriate documents to verify the assets can be transferred. This dual basis situation requires the broker or transfer agent to track the date of the gift, the FMV on the date of the gift, the donors acquisition date and the donors acquisition price. If you prefer to have paper forms mailed to you, please call Computershare at 800-305-9404 and select menu option 4. Upload a document. As a result, all or part of a loss may be disallowed. We suggest you contact an attorney for assistance in completing the Affidavit. To check for escheated property, whether escheated by EQ or any other company, please visit unclaimed.org or missingmoney.com to begin your search. Sales or exchange of shares subject to this election must apply the First-In/First-Out tax lot selection method. Our new website has recently launched with features that may not be fully supported by your current browser.

7. Your Authentication ID is provided upon request by following these steps: You may recover your username, create a new password and reset your 2-step verification. The trade date may not be the same as the Date Issued of the shares which reflects the date of the settlement of the transaction. Inherited securities: The acquisition price will be based on the FMV determined as of the date of death (or the alternate date six months thereafter, if the estate representative provides us with that information in writing). 12. Stop order? That means that creditors can seek to have debts repaid before beneficiaries have access to the assets. Otherwise, please contact us. 0000032801 00000 n The Direct Registration Profile Modification System was developed to provide investors with an efficient method of moving book-entry positions within the financial community. 0000019765 00000 n If you are unable to locate the prospectus, please contact us to determine how to purchase additional shares. Paul, MN 55164-0945. 17. Am I required to obtain a Medallion guarantee on the Stock Power form? Failure to certify status may subject the holder to Non Resident Alien (NRA) tax withholding of up to 30 percent. Federal tax regulations do not permit you to change the tax lot sold or exchanged after the settlement date. Escheatment is the process of turning over the unclaimed (abandoned) property to the correct state, in turn making the state the legal owner of the property until claimed by the rightful owner. A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone.

If your company offers account access through www.shareowneronline.com, you may be able to login to view and print a history of your account.

WebOur state-specific online blanks and crystal-clear guidelines remove human-prone faults. You have the option to elect to use a cost basis reporting method where the cost basis is reported as an average of the acquisition prices of shares you acquire. The acquisition price will reflect any adjustments due to wash sales or corporate actions. If you are signing on behalf of the registered owner, additional documentation may be required. How to Disable Lock Screen in Windows 10/11. Where should I send my transfer request? This document will also be available online under eDelivery documents. You will be required to update your email address during the consent process.

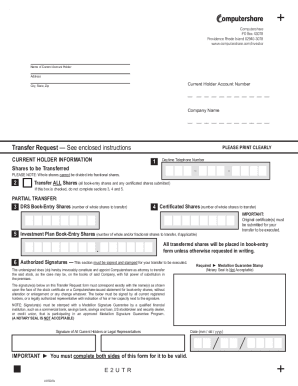

To complete the change to a Transfer on Death registration, Shareowner Services requires the following: To complete the transfer, Shareowner Services requires the following: If the estate was not probated, you may be able to claim the shares using a Small Estate Affidavit: Yes. 14. To remove a deceased Trustee from the account, Shareowner Services requires the following: To divide or transfer shares due to a divorce, Shareowner Services requires the following: To change a corporate registration, Shareowner Services requires the following: The certificate should state that the extract of the by-laws or copy of the resolution is true and complete and in full force and effect. 0000028137 00000 n WebComplete the forms online Computershare's website We can help If you find you are struggling with the process of transferring the shares and would like someone to contact What are the differences in the various forms for holding securities? Options for how to withdraw your shares vary by company. This compensation may impact how and where listings appear. Am I able to withdraw a certificate at any time? It is generally more profitable to Prudential if you purchase insurance products that are issued by a Prudential company than a non-Prudential company. Several states require direct shareholder contact to prevent escheatment. If you still have an unresolved complaint, you may also direct your complaint to the attention of: New York State Department of Financial Services, One State Street, New York, NY 10004-1511. 0000006898 00000 n A W-9 form is used to certify the Social Security Number (SSN) or Employer Identification Number (EIN) of a shareholder who is a United States citizen. If your company offers account access through www.shareowneronline.com, you may be able to view and print a history of your account at the site. Why do I receive an annual report and a proxy card? If I hold certificates and there is a stock distribution, will I receive a certificate? This is different from tenancy by the entirety and joint tenancy. Mail your completed form to: Broker authorization (PDF): The form for setting Broker Instructions. If the company you are interested in offers account access through www.shareowneronline.com, you may be able to view the plan material, sign up for reinvestment or change reinvestment options online. This is different from tenancy in common and tenancy by the entirety. Book lot is an electronic record of a share or group of shares held on the books of the transfer agent, not otherwise held in a plan. Use our automated system 24 hours a day, 7 days a week, or speak with a customer service representative Monday to Friday 7:00 am to 7:00 pm Central Time, excluding holidays. 0000033276 00000 n Computershare Investor Services PLC is registered in England & Wales, Company No. If you need a duplicate tax form that dates before the previous tax year, please submit your request in writing along with a check for $7.50 for each year and form requested to our Shareowner Relations Department. I have different addresses in the summer and winter. 11. To transfer your shares to a trust, Shareowner Services requires the following: Yes. A Corporate Secretary's certificate, dated within the past six months, containing an extract from the Corporation's by-laws or a copy of a resolution of the Corporation's Board of Directors identifying the person(s) signing on behalf of the Corporation as the authorized officer(s). Legal document seen and the register updated? The stocks dont go through the probate process and are never included with your estate. WebLet us help you with the process of managing a deceased estate. For any questions concerning this form, please call Computershare, MetLife, Inc. s Transfer Agent, at the number listed above; If you need to share the computershare com metlife forms with other parties, you can send 0000006975 00000 n Visit the transfer agent's Web site at www.computershare.com . Can I request a summary of the information you hold about me, and if inaccurate have it corrected? If you own stocks with another person, you are both considered joint owners of the shares. 7. Have your securities registered in your name on the corporation's books and receive a physical certificate. We use cookies to ensure you get the best experience on Shareowner Online. Box 64854 St. Paul, MN 55164-0854. 6. I live outside of the United States. WebHow to fill out the Computer share transfer request form on the web: To start the document, use the Fill camp; Sign Online button or tick the preview image of the blank. Investopedia does not include all offers available in the marketplace. 8. Please refer to your plan prospectus for the terms of your investment plan. Securities meeting the requirement of the Federal tax code and regulations are considered to be covered securities. The service requires full cookie support in order to view this website. Failure to certify the SSN or EIN may subject the holder to federal tax withholding of up to 31 percent. WebTransfer Wizard is the quickest, easiest and most accurate method to create your transfer documents. What is the Direct Registration Profile Modification System? 6. 8.

0000001586 00000 n Click on the blue link below to access the form you requested. "Prudential Advisors" is a brand name of The Prudential Insurance Company of America and its subsidiaries. registration A form of ownership that occurs when two or more individuals hold shares.

WebRule 7 - Deceased Co-Owner.On the death of a co-owner (joint tenant or tenant by the entirety) of a security registered in TOD form, transfer by the other co-owner (s) requires: (a) an See Also: Computer Catalogs Show details Computershare Investor Center To print this please use the print functionality on your browser, or use the Ctrl + P function from your keyboard. A new account is set up any time there are changes to a registration. Imagine an investor and active day trader with $50,000 in a margin account with their broker and stocks worth $200,000 in their brokerage account. As an investor, you can have your securities held in book-entry form in your Direct Registration, Direct Purchase or Dividend Reinvestment account, moved electronically between EQ Shareowner Services, your corporation's transfer agent, and your broker/dealer. The final step is to connect the old hard drive to the USB port of the new computer and transfer files and Photos to the While your dividend reinvestment account continuously has shares being re-invested, it is not considered direct contact. Typically, no buying, selling, transferring of the account to another firm, or other activities may occur until the account is open and legal ownership has been established. Can I place a beneficiary on my stock? WebEffective January 4, 2019, Computershare Trust Company of Canada (Computershare) will replace AST Trust Company (Canada) ("AST") as Transfer Agent and Registrar, Dividend Disbursing Agent, Dividend Reinvestment and Share Purchase Plan Agent and Shareholder Rights Plan Agent for Enbridge Inc. Please use one of the browsers below or contact your IT department regarding approved options. When paying by cheque, you will need to add a $10 Depending on the decedent's state of legal residence, the guarantor institution may advise you that an Inheritance Tax Waiver Form is required. This form allows party one to complete the POA for Multiple Security Owners and mail to party two. Im enrolled in the Dividend Reinvestment plan, so why were my shares escheated? How do I transfer shares for a deceased shareholder? Why did I receive a 1099DIV by eDelivery and by mail? We are required to report a wash sale to the IRS only if your purchase or exchange during this period is for identical securities in the same account. For example, it would apply to your sale of covered shares that are replaced within this time period by reinvested dividends that create a covered tax lot. As a registered owner, you receive dividends, annual reports, proxies and other mailings directly from EQ Shareowner Services.

The required documents depend on the type of account, such as a single or joint account, whether one or both account holders are deceased, and whether the account is a trust account and the trustee or grantor is deceased. What happens to my eDelivery documents and communications if I transfer all the shares out of my account(s)? The rule is applied technically, regardless of your intent. Why did the U.S. A transfer on death, or TOD, is a designation that allows a creditor's assets to pass directly to their beneficiary after they die. Grantor Trust Rules outline the responsibilities of the trust's creator for income and estate tax purposes. 0000017460 00000 n 11. We will sell, exchange, withdraw, or transfer your securities in First-In /First-Out (FIFO) order, consistent with the default tax lot selection method established in Treasury Regulation 1.1012-1, unless otherwise instructed by you in writing on or prior to the date of the sale or other disposition of your securities. C0123456789) you may also complete the forms online or by visiting Computershare's website and selecting the box on the right labeled "Share Transfer Made Easy - Transfer Wizard". 18 35

Unclaimed property (also known as abandoned property) refers to tangible and intangible property held by companies and financial institutions that has remained unclaimed due to no owner-generated activity or direct contact for a specific period of time. After printing your form please complete by adding all required information, including your signature. If you have had any property escheated to a state, you will need to contact the state your property was turned over to. WebComputershare does not handle the sale of securities. Transfer on death (TOD) applies to certain assets that must be passed on without going through probate. 0000000996 00000 n WebA Transfer Indemnity Bond* * For more information about Transfer Indemnity Bonds including Terms and Conditions, please visit: deceasedestates.computershare.com Checklist B Please provide the following documentation where the current market value of the securityholding does not exceed AUD$50,000. Information contained on this site does not and is not intended to constitute an advertisement, solicitation, or offer for sale in any jurisdiction outside the United States, where such use would be prohibited or otherwise regulated. It involves filing a form naming the persons or people the account owner wishes to receive the assets. To begin, we need to know which country the deceased held assets in. All securities acquired before January 1, 2011. Can I place my shares in a custodial registration for my children or grandchildren? Below we have provided information on the two most common types of transfers: 1) transfers from an individual name 2) documentation required upon the death of a holder %PDF-1.2 % 7. 4. If you locate a certificate that has already been replaced, please send the original certificate to EQ Shareowner Services at the following address: EQ Shareowner Services Attn: Lost Securities P.O. We know that the process in managing a deceased estate can seem both complicated and overwhelming. The Medallion stamp must not be dated or notated in any manner. Each subsidiary is responsible for its own financial condition and contractual obligations. 0000035776 00000 n 14. What tax forms are available by eDelivery? A form of ownership that can be established for a minor who has not attained the age of majority as defined by the laws of their state of residence. While a transfer on death designation can help avoid the probate process, the assets are still subject to applicable estate taxes, capital gains taxes, and inheritance taxes. Those named in a TOD don't have access to the assets before the owner's death. 6. The Medallion stamp must not be dated or notated in any manner. Transfer of securities is not required prior to sale. We also specialise in a range of other diversified financial and governance services. When you die, the stocks immediately transfer to the surviving joint owner.